An Emergency Fund is designed to cover immediate, unexpected expenses such as sudden pet medical bills or urgent supplies replacement. A Resilience Fund goes beyond short-term needs by providing financial stability for ongoing or prolonged crises, helping pet owners manage extended disruptions without compromising care. Both funds are essential in crisis planning, but a Resilience Fund ensures long-term preparedness and peace of mind for pet-related emergencies.

Table of Comparison

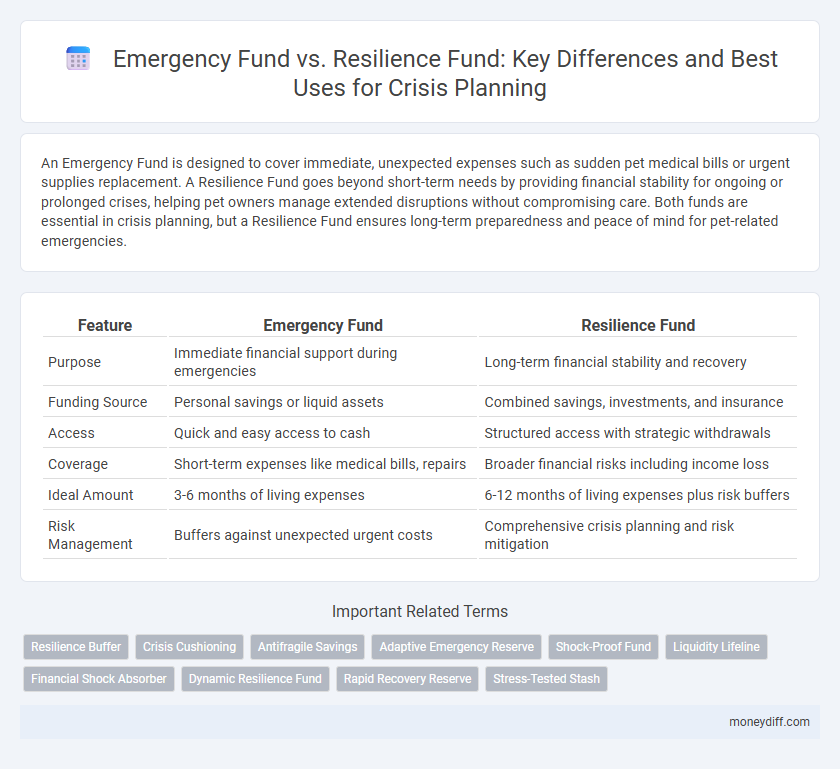

| Feature | Emergency Fund | Resilience Fund |

|---|---|---|

| Purpose | Immediate financial support during emergencies | Long-term financial stability and recovery |

| Funding Source | Personal savings or liquid assets | Combined savings, investments, and insurance |

| Access | Quick and easy access to cash | Structured access with strategic withdrawals |

| Coverage | Short-term expenses like medical bills, repairs | Broader financial risks including income loss |

| Ideal Amount | 3-6 months of living expenses | 6-12 months of living expenses plus risk buffers |

| Risk Management | Buffers against unexpected urgent costs | Comprehensive crisis planning and risk mitigation |

Understanding Emergency Funds: Definition and Purpose

An Emergency Fund is a financial reserve specifically set aside to cover unexpected expenses such as medical emergencies, job loss, or urgent repairs, ensuring immediate liquidity. In contrast, a Resilience Fund focuses on long-term recovery and adaptation strategies during prolonged crises, including community rebuilding or business continuity. Understanding the distinct purpose of an Emergency Fund is crucial for effective crisis planning, as it provides quick access to cash and financial stability in sudden hardship.

What Is a Resilience Fund? Key Differences Explained

A resilience fund is designed to provide long-term financial stability by addressing a broad range of potential risks, including economic downturns, natural disasters, and unexpected disruptions beyond immediate emergencies. Unlike a traditional emergency fund that typically covers short-term expenses such as medical bills or car repairs, a resilience fund focuses on sustainable recovery and adaptive capacity for future crises. Key differences include the size of the fund, the scope of coverage, and strategic planning to ensure readiness against complex, multifaceted challenges.

Emergency Fund vs Resilience Fund: Core Functions Compared

An Emergency Fund primarily serves as immediate financial support to cover unexpected expenses such as medical emergencies, job loss, or urgent repairs, ensuring liquidity during crises. In contrast, a Resilience Fund is designed to strengthen long-term stability by addressing systemic risks and enabling recovery through strategic investments in resources, infrastructure, or community support. While Emergency Funds emphasize short-term cash availability, Resilience Funds focus on sustainable capacity building to mitigate future disruptions.

Building Your Emergency Fund: Best Practices

Building your emergency fund requires setting a clear savings goal of three to six months' worth of essential expenses to ensure financial stability during unexpected crises. Prioritize liquid assets like high-yield savings accounts or money market funds to maintain quick access without penalties. Regularly reassess contributions and adjust your fund size based on changing income, expenses, and potential risks to enhance financial resilience effectively.

Strengthening Financial Resilience with a Resilience Fund

A Resilience Fund enhances financial preparedness by covering a broader range of risks and prolonged crises, unlike a traditional Emergency Fund that targets immediate, short-term needs. It incorporates flexible funding strategies to address fluctuations in income and unexpected long-term expenses, thereby strengthening overall financial stability. Establishing a Resilience Fund is crucial for sustaining economic well-being during extended periods of uncertainty.

Crisis Planning: Which Fund Should You Prioritize?

Crisis planning demands prioritizing funds that offer the most immediate financial security, making an emergency fund essential for covering unexpected expenses like medical bills or urgent repairs. A resilience fund, while valuable for long-term recovery and business continuity, typically focuses on broader risks and recovery strategies beyond immediate cash needs. Allocating resources first to an emergency fund ensures liquidity during crises, forming the foundation upon which resilience funds can build sustained recovery and adaptation.

Emergency Fund Limitations in Prolonged Crises

Emergency funds typically cover 3 to 6 months of essential expenses but often fall short during prolonged crises lasting beyond a year or involving multiple financial shocks. Such limitations highlight the need for resilience funds, which are larger, diversified reserves designed to sustain households or organizations through extended periods of economic instability. Emergency funds prioritize immediate liquidity, whereas resilience funds focus on long-term financial stability and adaptive capacity.

Resilience Fund Advantages for Long-Term Security

A Resilience Fund offers sustainable financial stability by addressing both immediate emergencies and ongoing challenges, unlike a traditional Emergency Fund which is designed primarily for short-term crises. It enhances long-term security through diversified investments and strategic resource allocation, reducing vulnerability to future economic shocks. Establishing a Resilience Fund promotes proactive financial planning, supporting continuous recovery and adaptability during extended periods of uncertainty.

How Much to Save: Emergency vs Resilience Fund Goals

Emergency funds typically target saving three to six months' worth of essential living expenses to cover unexpected financial shocks such as job loss or medical emergencies. Resilience funds, by contrast, focus on a broader scope, aiming to accumulate a larger buffer that supports long-term stability, including recovery from prolonged crises or multiple disruptions. Determining how much to save depends on individual risk tolerance and crisis planning goals, with emergency funds providing immediate liquidity and resilience funds ensuring sustained financial security.

Integrating Both Funds into Your Financial Strategy

Integrating an emergency fund and a resilience fund into your financial strategy ensures comprehensive crisis preparedness by covering immediate expenses and long-term recovery needs. Allocating resources to a liquid emergency fund with three to six months of living expenses provides quick access during urgent situations, while a resilience fund supports rebuilding and adaptation post-crisis. Combining both funds enhances financial stability, reduces vulnerability, and promotes sustained economic security during unforeseen events.

Related Important Terms

Resilience Buffer

A Resilience Buffer serves as a strategic extension of an Emergency Fund, designed to cover prolonged or recurring crises by addressing both immediate expenses and long-term financial stability. Unlike traditional Emergency Funds that focus on short-term shocks, a Resilience Buffer emphasizes liquidity and adaptability to ensure sustained crisis management and recovery.

Crisis Cushioning

An Emergency Fund provides immediate liquidity to cover unexpected personal expenses such as medical bills or car repairs, acting as a financial safety net during short-term disruptions. In contrast, a Resilience Fund is designed to support long-term crisis cushioning by enabling sustained recovery and adaptation through investments in skills, resources, and strategic planning.

Antifragile Savings

Emergency Funds provide essential liquidity for immediate financial shocks, while Resilience Funds emphasize building antifragile savings that grow stronger through stress and uncertainty. Integrating antifragile strategies in crisis planning enhances long-term financial adaptability beyond traditional emergency reserves.

Adaptive Emergency Reserve

An Adaptive Emergency Reserve diverges from a traditional Emergency Fund by emphasizing flexibility and scalability to address varying crisis intensity and duration, allowing for dynamic resource allocation based on real-time needs. This resilience-focused approach ensures preparedness not only for immediate financial shocks but also for prolonged or evolving emergencies, enhancing overall crisis planning effectiveness.

Shock-Proof Fund

A Shock-Proof Fund differs from a traditional Emergency Fund by emphasizing long-term financial resilience through diversified assets that can withstand various economic shocks, rather than just covering immediate expenses. This approach enhances crisis planning by ensuring access to liquidity and sustaining financial stability across unexpected events.

Liquidity Lifeline

An Emergency Fund provides immediate liquidity lifeline for unforeseen expenses, ensuring quick access to cash during crises, while a Resilience Fund focuses on longer-term financial stability and recovery. Prioritizing an Emergency Fund enhances financial security by maintaining readily available liquid assets essential for urgent crisis planning.

Financial Shock Absorber

An Emergency Fund serves as a financial shock absorber by providing immediate access to liquid cash for unexpected expenses, while a Resilience Fund is designed to support long-term recovery and stability during prolonged crises. Prioritizing an Emergency Fund ensures short-term financial security, cushioning the impact of sudden shocks, whereas Resilience Funds build capacity for sustained crisis management and adaptation.

Dynamic Resilience Fund

A Dynamic Resilience Fund enhances traditional Emergency Fund strategies by incorporating flexible, real-time allocation of resources tailored to evolving crisis scenarios, ensuring not only immediate financial relief but also long-term adaptive capacity. This approach leverages predictive analytics and scenario planning to maintain liquidity while supporting recovery efforts across multiple phases of a crisis.

Rapid Recovery Reserve

A Rapid Recovery Reserve differs from a traditional Emergency Fund by emphasizing quick access to liquid assets that enable businesses to resume operations immediately after a crisis, minimizing downtime and financial losses. While Emergency Funds cover unexpected expenses, Resilience Funds focus on sustaining long-term stability and adaptability, making Rapid Recovery Reserves essential for agile crisis response and rapid financial recovery.

Stress-Tested Stash

A Stress-Tested Stash in an Emergency Fund is designed to cover essential expenses for at least three to six months, ensuring liquidity during unexpected financial shocks. A Resilience Fund extends this by incorporating long-term crisis planning, focusing on adaptive savings to maintain stability beyond immediate emergencies.

Emergency Fund vs Resilience Fund for crisis planning. Infographic

moneydiff.com

moneydiff.com