An Emergency Fund is specifically designed to cover urgent, unexpected expenses such as medical bills or urgent pet care, ensuring financial stability during crises. A Freedom Fund, on the other hand, provides more flexible savings for discretionary spending and lifestyle choices without the pressure of immediate emergencies. Prioritizing an Emergency Fund helps pet owners prepare for sudden costs, while a Freedom Fund supports long-term financial freedom.

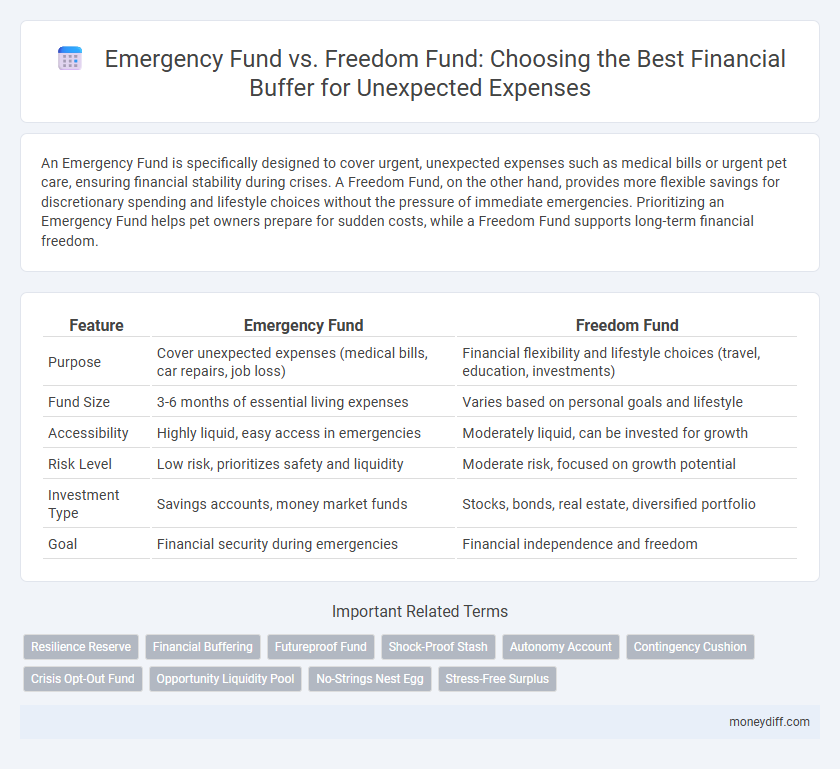

Table of Comparison

| Feature | Emergency Fund | Freedom Fund |

|---|---|---|

| Purpose | Cover unexpected expenses (medical bills, car repairs, job loss) | Financial flexibility and lifestyle choices (travel, education, investments) |

| Fund Size | 3-6 months of essential living expenses | Varies based on personal goals and lifestyle |

| Accessibility | Highly liquid, easy access in emergencies | Moderately liquid, can be invested for growth |

| Risk Level | Low risk, prioritizes safety and liquidity | Moderate risk, focused on growth potential |

| Investment Type | Savings accounts, money market funds | Stocks, bonds, real estate, diversified portfolio |

| Goal | Financial security during emergencies | Financial independence and freedom |

Understanding Emergency Funds vs. Freedom Funds

Emergency funds are specifically designed to cover urgent, unforeseen expenses such as medical emergencies, car repairs, or sudden job loss, ensuring financial stability without debt. In contrast, freedom funds focus on building wealth and long-term financial independence by allowing flexibility in lifestyle choices without the immediate pressure of emergencies. Understanding the distinction helps optimize financial planning by allocating resources appropriately to both short-term security and long-term freedom.

Key Differences Between Emergency and Freedom Funds

Emergency funds are specifically designed to cover urgent, unforeseen expenses such as medical emergencies, car repairs, or job loss, typically holding three to six months' worth of living expenses in highly liquid accounts. Freedom funds, by contrast, aim to provide financial flexibility and empower lifestyle choices by supporting less urgent but unexpected opportunities or transitions, usually involving larger sums invested for growth or longer-term security. The key difference lies in their purpose and liquidity: emergency funds prioritize immediate access and risk aversion, while freedom funds focus on financial independence and strategic resource allocation.

Purpose and Importance of an Emergency Fund

An Emergency Fund is specifically designed to cover unexpected expenses such as medical emergencies, car repairs, or sudden job loss, ensuring immediate financial stability. Unlike a Freedom Fund, which focuses on long-term financial independence and personal goals, the Emergency Fund's primary purpose is to provide a safety net that prevents debt accumulation during crises. Maintaining an adequately funded Emergency Fund is crucial to avoid high-interest borrowing and protect overall financial health.

Freedom Fund: Definition and Financial Goals

A Freedom Fund is a dedicated savings account designed to cover unexpected expenses while promoting financial independence and long-term security. Unlike a traditional Emergency Fund, which prioritizes immediate crisis management, a Freedom Fund aims to provide greater flexibility by supporting lifestyle choices and reducing financial stress over time. Key financial goals of a Freedom Fund include ensuring sufficient liquidity, fostering personal empowerment, and enabling proactive financial planning beyond mere emergency preparedness.

When to Use Your Emergency Fund

Use your emergency fund strictly for urgent, unplanned expenses like medical emergencies, car repairs, or job loss to maintain financial stability. The freedom fund, in contrast, supports lifestyle choices and non-essential goals without jeopardizing your basic security. Accessing the emergency fund only for genuine crises ensures long-term protection against financial setbacks.

Situations Suited for a Freedom Fund

A Freedom Fund is designed for unexpected expenses that offer opportunities for personal growth or lifestyle enhancement rather than strictly financial emergencies. Situations suited for a Freedom Fund include spontaneous travel, pursuing a new hobby, or investing in professional development, where the goal is to enrich life experiences without compromising essential financial security. Unlike an Emergency Fund, which covers urgent needs like medical bills or car repairs, the Freedom Fund supports discretionary spending that promotes freedom and flexibility.

Building an Emergency vs. Freedom Fund: Steps and Strategies

Building an emergency fund involves setting aside three to six months' worth of essential living expenses to cover unexpected costs like medical bills or car repairs, ensuring financial stability during crises. A freedom fund goes beyond basic emergencies by targeting financial independence, enabling individuals to pursue opportunities or lifestyle changes without income pressure. Strategic steps include budgeting rigorously, automating savings, and prioritizing liquidity for emergency funds, while investing and increasing income streams support the growth of a freedom fund.

How Much Should You Save in Each Fund?

An emergency fund typically requires three to six months' worth of essential living expenses to cover urgent financial setbacks like job loss or medical emergencies. In contrast, a freedom fund is more flexible, often targeting a smaller amount--such as one to two months' worth of discretionary spending--to provide quick access to opportunities or unexpected lifestyle expenses. Allocating the right balance between these funds depends on individual risk tolerance, monthly costs, and financial stability goals.

Common Mistakes: Mixing Emergency and Freedom Funds

Mixing emergency funds with freedom funds often leads to inadequate financial preparedness, as emergencies require immediate access to liquid savings while freedom funds target long-term goals like travel or personal projects. This confusion can result in overspending or depletion of emergency cash, leaving individuals vulnerable during genuine crises. Maintaining clear distinctions between these funds ensures both immediate financial security and the ability to pursue discretionary goals without compromising stability.

Choosing the Right Fund for Unexpected Expenses

An Emergency Fund is designed specifically for urgent, unforeseen expenses like medical bills or car repairs, providing quick financial relief without disrupting long-term savings. In contrast, a Freedom Fund offers more flexibility for personal growth opportunities and lifestyle changes but may lack the immediate accessibility needed during crises. Selecting the right fund depends on prioritizing liquidity and risk tolerance, ensuring immediate needs are met without sacrificing future financial goals.

Related Important Terms

Resilience Reserve

An Emergency Fund serves as a Resilience Reserve, specifically allocated for sudden financial shocks such as medical emergencies or job loss, ensuring immediate liquidity without disrupting long-term investments. In contrast, a Freedom Fund targets broader financial independence goals by covering unexpected expenses with a flexible, less restricted approach that supports lifestyle choices beyond urgent crises.

Financial Buffering

An Emergency Fund provides a dedicated financial buffer specifically designed to cover immediate and unforeseen expenses such as medical emergencies or urgent repairs, ensuring liquidity without disrupting long-term investments. In contrast, a Freedom Fund offers a broader financial safety net aimed at sustaining lifestyle choices during extended periods of income loss, emphasizing flexibility alongside security.

Futureproof Fund

An Emergency Fund covers immediate unexpected expenses like medical bills or car repairs, while a Freedom Fund, often referred to as a Futureproof Fund, is designed to support long-term financial independence by addressing larger-scale disruptions such as career changes or prolonged unemployment. Prioritizing a Futureproof Fund ensures resilience against future uncertainties, providing a strategic buffer beyond short-term emergencies.

Shock-Proof Stash

A Shock-Proof Stash in an Emergency Fund provides immediate liquidity for unexpected expenses, ensuring financial stability without resorting to debt, whereas a Freedom Fund focuses on long-term financial independence. Prioritizing a Shock-Proof Stash builds a robust safety net that covers urgent needs like medical bills, car repairs, or sudden job loss.

Autonomy Account

The Emergency Fund prioritizes immediate financial stability by covering urgent, unplanned expenses, while the Freedom Fund, often managed through an Autonomy Account, enhances long-term financial independence by empowering individuals to allocate resources flexibly for unexpected opportunities or challenges. Maintaining a robust Autonomy Account fosters resilience and control, bridging the gap between short-term crisis management and sustained economic freedom.

Contingency Cushion

An emergency fund acts as a contingency cushion specifically designed to cover immediate, unexpected expenses such as medical emergencies or urgent home repairs, ensuring financial stability without accruing debt. In contrast, a freedom fund provides broader financial flexibility for lifestyle choices or opportunities, not limited to unforeseen contingencies.

Crisis Opt-Out Fund

A Crisis Opt-Out Fund differs from a traditional Emergency Fund by offering immediate financial flexibility for unexpected expenses without the constraints of repaying or accruing interest, providing a true freedom buffer during crises. This approach emphasizes maintaining liquidity and psychological security, empowering individuals to opt out of high-stress financial scenarios and avoid debt accumulation.

Opportunity Liquidity Pool

An Emergency Fund acts as a liquidity reserve for immediate, unforeseen expenses, ensuring financial stability without disrupting long-term investments. In contrast, a Freedom Fund serves as an Opportunity Liquidity Pool, providing readily accessible capital to seize investment opportunities or cover unexpected costs while maintaining growth potential.

No-Strings Nest Egg

An Emergency Fund serves as a no-strings nest egg strictly reserved for urgent, unexpected expenses like medical bills or car repairs, ensuring financial stability without obligations or penalties. In contrast, a Freedom Fund offers flexible access to cash for opportunities or discretionary spending, but may lack the dedicated security that defines a true emergency reserve.

Stress-Free Surplus

An Emergency Fund provides a stress-free surplus by covering unexpected expenses without disrupting daily finances, while a Freedom Fund offers additional financial flexibility for opportunities beyond just emergencies. Maintaining both funds ensures comprehensive protection and peace of mind, minimizing financial stress during unforeseen events.

Emergency Fund vs Freedom Fund for unexpected expenses. Infographic

moneydiff.com

moneydiff.com