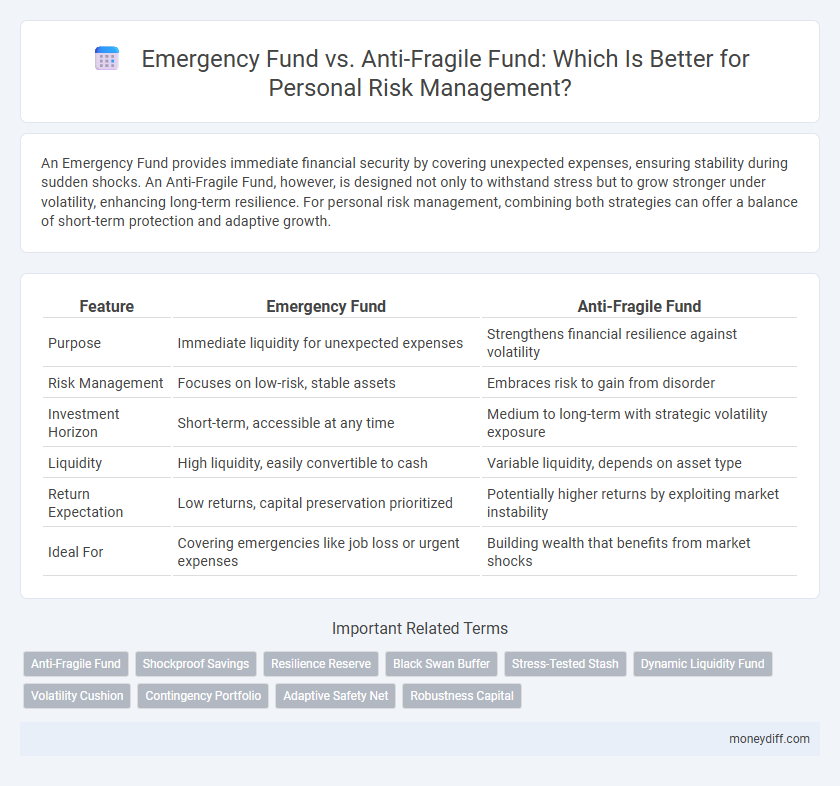

An Emergency Fund provides immediate financial security by covering unexpected expenses, ensuring stability during sudden shocks. An Anti-Fragile Fund, however, is designed not only to withstand stress but to grow stronger under volatility, enhancing long-term resilience. For personal risk management, combining both strategies can offer a balance of short-term protection and adaptive growth.

Table of Comparison

| Feature | Emergency Fund | Anti-Fragile Fund |

|---|---|---|

| Purpose | Immediate liquidity for unexpected expenses | Strengthens financial resilience against volatility |

| Risk Management | Focuses on low-risk, stable assets | Embraces risk to gain from disorder |

| Investment Horizon | Short-term, accessible at any time | Medium to long-term with strategic volatility exposure |

| Liquidity | High liquidity, easily convertible to cash | Variable liquidity, depends on asset type |

| Return Expectation | Low returns, capital preservation prioritized | Potentially higher returns by exploiting market instability |

| Ideal For | Covering emergencies like job loss or urgent expenses | Building wealth that benefits from market shocks |

Understanding Emergency Funds: Core Principles

Emergency funds serve as liquid cash reserves designed to cover unexpected personal expenses, typically recommended to hold three to six months' worth of living costs. Core principles emphasize accessibility, safety, and minimal risk, ensuring funds can be used immediately without market volatility impact. Unlike anti-fragile funds, which aim to grow and benefit from stressors, emergency funds prioritize stability and preservation of capital for true financial security.

What is an Anti-Fragile Fund? Key Differences

An Anti-Fragile Fund is designed to benefit and grow stronger from volatility and unexpected adverse events, unlike a traditional Emergency Fund that primarily serves as a financial safety net for unforeseen expenses. Key differences include that Emergency Funds prioritize liquidity and capital preservation, while Anti-Fragile Funds incorporate diversified assets that can gain value during market disruptions. This approach enhances personal risk management by not only protecting against losses but also capitalizing on economic stressors.

Emergency Fund vs Anti-Fragile Fund: A Side-by-Side Comparison

An Emergency Fund provides a financial safety net by covering essential expenses during unforeseen events, typically held in liquid, low-risk accounts for immediate access. An Anti-Fragile Fund, in contrast, is designed to benefit from volatility and stress by incorporating diversified, high-risk assets that grow stronger under adverse conditions. Comparing the two, Emergency Funds prioritize stability and immediate liquidity, while Anti-Fragile Funds emphasize long-term growth and resilience through exposure to uncertainty and market fluctuations.

Situational Uses: When Each Fund Offers Maximum Protection

Emergency Funds provide immediate financial security during unexpected expenses like medical emergencies, job loss, or urgent home repairs, ensuring liquidity and peace of mind. Anti-Fragile Funds, designed to grow stronger during market volatility and economic downturns, offer long-term resilience by leveraging uncertainty through diversified and adaptive investment strategies. Situationally, Emergency Funds are optimal for short-term crises requiring quick access to cash, whereas Anti-Fragile Funds excel in protecting against prolonged economic stress and enhancing wealth stability over time.

Liquidity Needs: Comparing Accessibility and Flexibility

Emergency funds prioritize immediate liquidity, providing quick access to cash for unforeseen expenses without penalties or delays, ensuring financial stability during crises. In contrast, anti-fragile funds balance liquidity with strategic risk exposure, offering some accessibility but potentially involving longer withdrawal periods or market-dependent valuations. Understanding these differences helps individuals tailor their risk management strategies to prioritize either rapid availability or long-term growth resilience.

Risk Mitigation: Which Fund Prepares You for the Unexpected?

An emergency fund provides immediate financial liquidity to cover unforeseen expenses, minimizing short-term risk by preserving cash flow during crises. In contrast, an anti-fragile fund not only withstands shocks but grows stronger under volatility by strategically investing in assets designed to benefit from market turbulence. For personal risk management, an emergency fund offers essential risk mitigation through stability and accessibility, while an anti-fragile fund enhances resilience by capitalizing on uncertainty and adverse conditions.

Building an Emergency Fund: Essential Steps

Building an emergency fund requires setting a clear savings goal, typically three to six months of essential living expenses, to ensure financial stability during unforeseen events. Prioritize liquid, low-risk accounts such as high-yield savings or money market accounts to maintain quick access to funds. Regularly contributing a fixed portion of income strengthens the fund's resilience, providing a critical safety net before considering more complex strategies like anti-fragile funds.

Constructing an Anti-Fragile Fund: Strategies for Growth

Constructing an Anti-Fragile Fund involves allocating resources to investments that not only withstand shocks but also benefit from volatility, such as diversified equities, real assets, and options strategies. Unlike traditional Emergency Funds that prioritize liquidity and safety, Anti-Fragile Funds emphasize growth through adaptive risk exposure and incremental capital deployment during market downturns. This approach enhances personal risk management by converting uncertainty and stressors into opportunities for wealth accumulation and financial resilience.

Integrating Both Funds into a Comprehensive Financial Plan

Integrating an Emergency Fund with an Anti-Fragile Fund enhances personal risk management by providing liquidity for immediate needs while simultaneously building resilience against unexpected shocks. An Emergency Fund offers quick access to cash for short-term crises, whereas an Anti-Fragile Fund invests in assets that gain value from volatility and disruption, creating long-term financial stability. Combining these funds in a comprehensive financial plan ensures balanced protection and growth, aligning with diverse risk tolerance and financial goals.

Choosing the Right Approach: Customizing Funds for Personal Risk

Choosing between an Emergency Fund and an Anti-Fragile Fund depends on individual risk tolerance and financial goals. An Emergency Fund offers immediate liquidity for unforeseen expenses, typically covering three to six months of living costs, while an Anti-Fragile Fund focuses on growth through volatility by investing in assets that perform well under stress. Customizing these funds requires assessing personal financial stability, risk exposure, and the ability to withstand market fluctuations, ensuring optimal protection and resilience during economic uncertainty.

Related Important Terms

Anti-Fragile Fund

An Anti-Fragile Fund enhances personal risk management by not only protecting against financial shocks like a traditional Emergency Fund but also by benefiting from volatility and adversity, thus growing stronger in unpredictable environments. This dynamic approach leverages diversified assets and strategic opportunities to build resilience and wealth beyond mere preservation.

Shockproof Savings

An Emergency Fund provides a shockproof savings buffer to cover unexpected expenses and maintain financial stability during crises, while an Anti-Fragile Fund is designed not only to withstand shocks but also to grow stronger from volatility by leveraging adaptive investment strategies. Prioritizing a robust emergency fund ensures immediate liquidity and security, forming the foundation of personal risk management before exploring more complex, growth-oriented anti-fragile approaches.

Resilience Reserve

An Emergency Fund serves as a short-term financial buffer designed to cover unexpected expenses, ensuring immediate liquidity and stability during crises. In contrast, an Anti-Fragile Fund functions as a Resilience Reserve that not only absorbs shocks but also leverages volatility to grow stronger, enhancing long-term personal risk management and financial adaptability.

Black Swan Buffer

An Emergency Fund provides immediate liquidity for predictable financial shocks, whereas an Anti-Fragile Fund, such as a Black Swan Buffer, is designed to grow stronger during extreme, unpredictable market events by leveraging volatility and uncertainty. Incorporating a Black Swan Buffer enhances personal risk management by protecting against rare but catastrophic financial crises, ensuring resilience beyond traditional emergency savings.

Stress-Tested Stash

An Emergency Fund serves as a liquidity reservoir to cover unforeseen expenses and provides immediate financial relief during crises, whereas an Anti-Fragile Fund is designed to grow stronger under volatility by strategically leveraging market fluctuations. Stress-Tested Stash methodology emphasizes maintaining a robust Emergency Fund calibrated to withstand multiple months of essential expenses, ensuring resilience against prolonged economic disruptions and personal financial shocks.

Dynamic Liquidity Fund

A Dynamic Liquidity Fund offers a flexible alternative to traditional Emergency Funds by providing both immediate access to cash and opportunities for growth, adapting to fluctuating personal risk management needs. Unlike static Emergency Funds, these funds optimize liquidity and resilience, aligning with the principles of an Anti-Fragile Fund to better withstand financial shocks.

Volatility Cushion

An Emergency Fund provides immediate liquidity to cover unexpected expenses, whereas an Anti-Fragile Fund acts as a volatility cushion by benefiting from market fluctuations to enhance financial resilience. Incorporating an Anti-Fragile Fund into personal risk management strategies improves long-term stability by mitigating the impact of economic shocks beyond the static backup of traditional emergency savings.

Contingency Portfolio

An Emergency Fund provides liquid assets to cover immediate, unforeseen expenses, ensuring short-term financial stability, while an Anti-Fragile Fund is designed to grow stronger from shocks by incorporating diversified, adaptive investments within a Contingency Portfolio. Prioritizing a Contingency Portfolio that balances liquidity and resilience enhances personal risk management by protecting against both sudden financial crises and long-term volatility.

Adaptive Safety Net

An Emergency Fund provides a static financial buffer covering 3 to 6 months of essential expenses to manage sudden income loss, while an Anti-Fragile Fund adapts dynamically to changing risks by investing in diversified assets that grow stronger under volatility. Emphasizing an Adaptive Safety Net, combining these approaches ensures both immediate liquidity and long-term resilience against unpredictable personal financial shocks.

Robustness Capital

Emergency Funds provide immediate liquidity to cover unexpected expenses, whereas Anti-Fragile Funds focus on growing stronger through volatility and stress, emphasizing Robustness Capital that not only safeguards assets but enhances financial resilience under adverse conditions. Prioritizing Robustness Capital in personal risk management ensures stability while leveraging market fluctuations for long-term wealth accumulation.

Emergency Fund vs Anti-Fragile Fund for personal risk management. Infographic

moneydiff.com

moneydiff.com