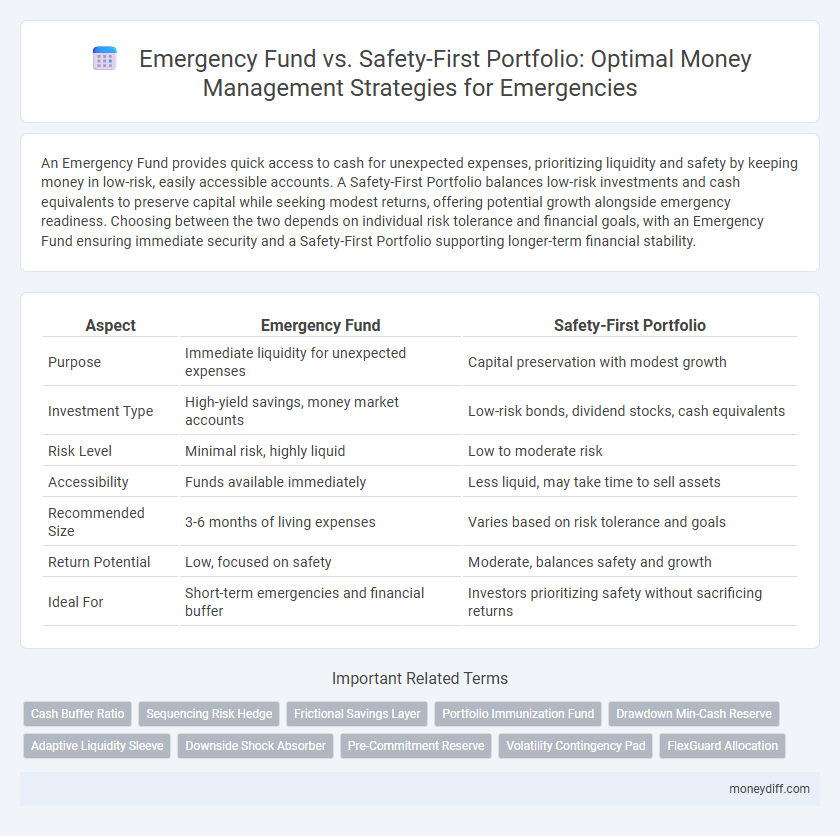

An Emergency Fund provides quick access to cash for unexpected expenses, prioritizing liquidity and safety by keeping money in low-risk, easily accessible accounts. A Safety-First Portfolio balances low-risk investments and cash equivalents to preserve capital while seeking modest returns, offering potential growth alongside emergency readiness. Choosing between the two depends on individual risk tolerance and financial goals, with an Emergency Fund ensuring immediate security and a Safety-First Portfolio supporting longer-term financial stability.

Table of Comparison

| Aspect | Emergency Fund | Safety-First Portfolio |

|---|---|---|

| Purpose | Immediate liquidity for unexpected expenses | Capital preservation with modest growth |

| Investment Type | High-yield savings, money market accounts | Low-risk bonds, dividend stocks, cash equivalents |

| Risk Level | Minimal risk, highly liquid | Low to moderate risk |

| Accessibility | Funds available immediately | Less liquid, may take time to sell assets |

| Recommended Size | 3-6 months of living expenses | Varies based on risk tolerance and goals |

| Return Potential | Low, focused on safety | Moderate, balances safety and growth |

| Ideal For | Short-term emergencies and financial buffer | Investors prioritizing safety without sacrificing returns |

Understanding Emergency Funds: The Basics

An emergency fund is a dedicated cash reserve aimed at covering unexpected expenses like medical bills, car repairs, or job loss, ensuring financial stability without incurring debt. A safety-first portfolio emphasizes low-risk, highly liquid investments prioritizing capital preservation and easy access, whereas an emergency fund stays primarily in ultra-liquid savings accounts or money market funds for immediate availability. Understanding these basics highlights that an emergency fund is a foundational step in money management, distinct from investment strategies that seek growth but may involve market risk.

What Is a Safety-First Portfolio?

A Safety-First Portfolio is a money management strategy designed to prioritize the preservation of capital and minimize financial risk, often by allocating funds into low-volatility, high-liquidity assets such as Treasury bills, money market funds, and short-term bonds. Unlike a traditional emergency fund, which is typically held in cash or savings accounts for immediate accessibility, a Safety-First Portfolio balances safety with potential for modest returns while ensuring funds remain readily available for unexpected expenses. This approach helps investors maintain financial security by protecting principal and providing liquidity without sacrificing growth opportunities.

Key Differences Between Emergency Funds and Safety-First Portfolios

Emergency funds are liquid assets set aside to cover unexpected expenses, typically stored in savings accounts for immediate access and stability, emphasizing short-term financial security. Safety-first portfolios prioritize preserving capital by investing in low-risk assets like Treasury bills and high-grade bonds, aiming for a balance between safety and modest returns. Key differences include liquidity, risk tolerance, and investment horizon, with emergency funds favoring quick access and safety-first portfolios focusing on capital preservation with some growth potential.

Purpose and Goals: Emergency Fund vs Safety-First Portfolio

An Emergency Fund is designed to provide immediate liquidity for unexpected expenses, typically covering three to six months of essential living costs to ensure financial stability during crises. The Safety-First Portfolio aims to prioritize the preservation of capital by investing in low-risk, liquid assets while maintaining a modest return, balancing safety with growth potential. Both focus on risk mitigation but differ as the Emergency Fund emphasizes short-term accessibility, whereas the Safety-First Portfolio seeks long-term financial security through conservative investment strategies.

Liquidity Considerations for Effective Money Management

The Emergency Fund prioritizes immediate liquidity by holding cash or cash equivalents that can be accessed instantly for unforeseen expenses, minimizing risk and ensuring financial stability. In contrast, a Safety-First Portfolio balances liquidity with growth by incorporating low-volatility assets like short-term bonds, providing a buffer while maintaining some return potential. Effective money management requires assessing liquidity needs to optimize fund accessibility without sacrificing financial security during emergencies.

Risk Tolerance: Comparing Emergency Funds and Portfolios

Emergency funds prioritize liquidity and immediate access to cash, minimizing risk by focusing on low-volatility assets such as savings accounts or money market funds. Safety-first portfolios balance risk by incorporating low-risk investments like high-grade bonds alongside emergency cash reserves to accommodate moderate risk tolerance and longer time horizons. Comparing these approaches hinges on individual risk tolerance, where emergency funds suit conservative strategies, while safety-first portfolios appeal to those tolerating mild market fluctuations for potentially higher returns.

How Much Should You Allocate? Fund vs Portfolio

An emergency fund typically requires 3 to 6 months' worth of living expenses set aside in highly liquid, low-risk accounts to ensure immediate access during financial crises. In contrast, a safety-first portfolio balances liquidity with higher returns by combining emergency savings with conservative investments, often allocating around 10-20% of total assets to cash or cash equivalents. Choosing the right allocation depends on individual risk tolerance, financial goals, and the need for quick access to funds without sacrificing potential growth.

Return Potential: Weighing Growth Against Security

An Emergency Fund offers immediate liquidity and low risk but limited return potential, prioritizing safety over growth. In contrast, a Safety-First Portfolio balances secure assets like bonds with modest equity exposure to enhance return potential while maintaining relatively low volatility. Choosing between the two depends on individual risk tolerance, financial goals, and the need for quick access versus long-term growth.

When to Choose an Emergency Fund or a Safety-First Portfolio

An Emergency Fund is ideal for immediate liquidity needs, covering three to six months of essential expenses to protect against unexpected financial shocks. A Safety-First Portfolio, comprising low-risk investments like Treasury bonds and money market funds, offers higher returns while maintaining capital preservation and accessibility. Choose an Emergency Fund for short-term security and quick access, and a Safety-First Portfolio when seeking modest growth alongside safety over a medium-term horizon.

Integrating Both Approaches for Optimal Financial Security

Integrating an emergency fund with a safety-first portfolio enhances financial resilience by combining immediate liquidity with conservative, low-risk investments. Maintaining three to six months' worth of living expenses in a liquid emergency fund ensures quick access to cash during unforeseen events, while allocating additional assets to Treasury bonds, high-quality municipal bonds, or stable dividend stocks within a safety-first portfolio provides steady income and capital preservation. This dual strategy balances accessibility with growth potential, optimizing financial security in both short-term crises and long-term stability.

Related Important Terms

Cash Buffer Ratio

The Emergency Fund primarily emphasizes liquidity with a recommended Cash Buffer Ratio of three to six months' worth of essential expenses to cover unexpected financial setbacks. In contrast, the Safety-First Portfolio balances risk and return by integrating cash reserves with low-volatility investments, aiming to maintain a Cash Buffer Ratio that supports both immediate liquidity and long-term capital preservation.

Sequencing Risk Hedge

Emergency funds provide immediate liquidity to cover unexpected expenses, effectively reducing sequencing risk by preventing forced withdrawals during market downturns. In contrast, a safety-first portfolio strategically allocates conservative assets to hedge sequencing risk over time, balancing growth potential with downside protection.

Frictional Savings Layer

The Frictional Savings Layer within an Emergency Fund serves as immediate liquidity to cover unexpected expenses, contrasting with the Safety-First Portfolio which emphasizes long-term capital preservation and growth through diversified, lower-risk investments. Prioritizing a Frictional Savings Layer enhances financial resilience by ensuring quick access to cash without market risk, whereas the Safety-First approach balances risk tolerance with the goal of sustaining purchasing power over time.

Portfolio Immunization Fund

Emergency Fund provides immediate liquidity for unexpected expenses, whereas the Safety-First Portfolio emphasizes long-term capital preservation through Portfolio Immunization Fund strategies that match asset durations with liabilities to minimize interest rate risk. Portfolio Immunization Fund targets stable returns by aligning bond maturities and cash flows, offering a structured approach to financial security beyond the flexibility of a traditional Emergency Fund.

Drawdown Min-Cash Reserve

An Emergency Fund typically holds three to six months' worth of living expenses in liquid assets to cover immediate financial needs, while a Safety-First Portfolio integrates low-volatility investments with a defined Drawdown Min-Cash Reserve to minimize risk and ensure capital preservation during market downturns. Emphasizing a Drawdown Min-Cash Reserve within a Safety-First Portfolio prioritizes maintaining sufficient cash buffers to avoid forced asset liquidation, enhancing long-term financial stability compared to traditional Emergency Fund strategies.

Adaptive Liquidity Sleeve

Emergency Fund provides immediate access to cash for unforeseen expenses, while the Safety-First Portfolio integrates an Adaptive Liquidity Sleeve to dynamically balance liquidity and growth by adjusting asset allocation based on market conditions and personal risk tolerance. This adaptive approach ensures optimal liquidity without sacrificing long-term returns, enhancing financial resilience during emergencies.

Downside Shock Absorber

An emergency fund serves as a dedicated cash reserve designed to absorb immediate financial shocks such as job loss or unexpected medical expenses, ensuring liquidity without market risk. In contrast, a safety-first portfolio balances risk and return by combining low-volatility investments with cash, aiming to provide downside protection while preserving long-term growth potential.

Pre-Commitment Reserve

A Pre-Commitment Reserve in an Emergency Fund provides immediate access to cash for unforeseen expenses without compromising investment returns, whereas a Safety-First Portfolio prioritizes capital preservation through low-risk securities but may lack liquidity. Integrating a Pre-Commitment Reserve ensures financial stability during emergencies by balancing ready cash availability with prudent asset allocation.

Volatility Contingency Pad

An Emergency Fund provides immediate liquidity for unexpected expenses, typically held in low-volatility, highly liquid accounts, whereas a Safety-First Portfolio integrates a Volatility Contingency Pad designed to buffer against market fluctuations by combining liquid assets with conservative investments. This approach balances risk management with potential growth, ensuring funds are accessible while mitigating the impact of market volatility on financial stability.

FlexGuard Allocation

FlexGuard Allocation balances liquidity and growth by integrating a Safety-First Portfolio with a strategic Emergency Fund, optimizing access to cash while targeting long-term returns. This approach mitigates financial risk through diversified assets, ensuring funds are available for emergencies without sacrificing investment potential.

Emergency Fund vs Safety-First Portfolio for money management Infographic

moneydiff.com

moneydiff.com