An Emergency Fund is specifically designed to cover unexpected, urgent expenses such as medical bills or urgent home repairs, providing immediate financial security. In contrast, a Life Buffer Fund serves as a broader financial cushion that supports ongoing living expenses during periods of income disruption or major life changes. Effective money management involves maintaining both funds to ensure short-term emergencies are addressed without compromising long-term financial stability.

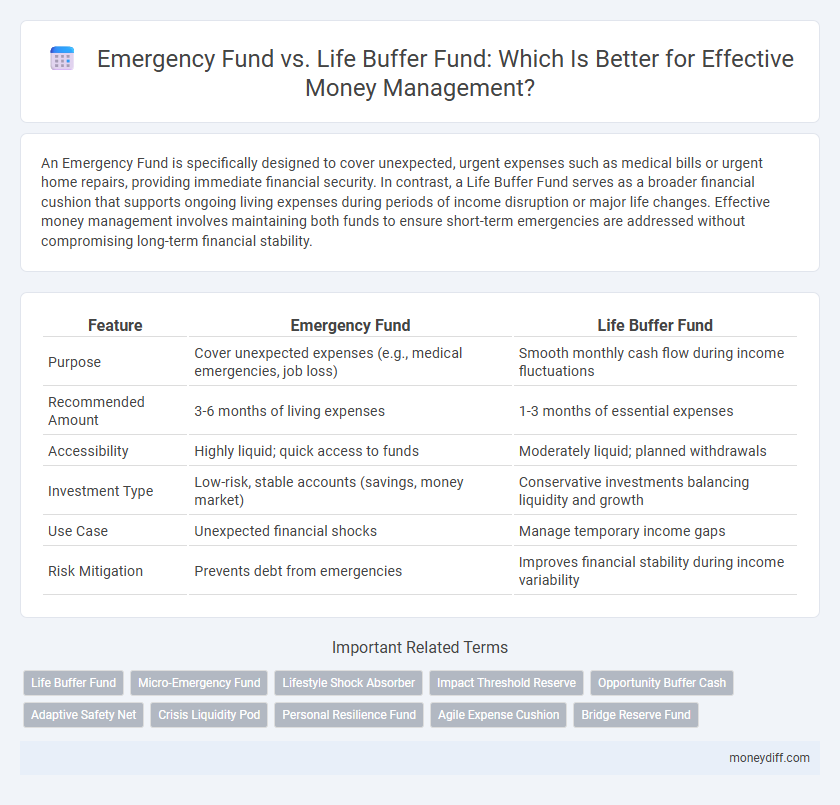

Table of Comparison

| Feature | Emergency Fund | Life Buffer Fund |

|---|---|---|

| Purpose | Cover unexpected expenses (e.g., medical emergencies, job loss) | Smooth monthly cash flow during income fluctuations |

| Recommended Amount | 3-6 months of living expenses | 1-3 months of essential expenses |

| Accessibility | Highly liquid; quick access to funds | Moderately liquid; planned withdrawals |

| Investment Type | Low-risk, stable accounts (savings, money market) | Conservative investments balancing liquidity and growth |

| Use Case | Unexpected financial shocks | Manage temporary income gaps |

| Risk Mitigation | Prevents debt from emergencies | Improves financial stability during income variability |

Understanding Emergency Funds: Definition and Purpose

Emergency funds are specifically designed to cover unexpected expenses such as medical emergencies, car repairs, or job loss, providing a financial safety net that helps maintain stability without incurring debt. In contrast, a life buffer fund is generally larger and intended to support ongoing living expenses and long-term financial goals during extended periods of income disruption. Understanding the distinct roles of an emergency fund versus a life buffer fund is crucial for effective money management and financial resilience.

What Is a Life Buffer Fund?

A Life Buffer Fund is a financial reserve designed to cover lifestyle expenses during periods of reduced income, such as career transitions or unexpected life changes. Unlike an Emergency Fund, which primarily addresses urgent, unforeseen costs like medical bills or car repairs, the Life Buffer Fund provides a more flexible cushion for maintaining day-to-day living standards. This fund ensures stability by bridging financial gaps without disrupting long-term savings or investments.

Key Differences Between Emergency Funds and Life Buffer Funds

Emergency funds consist of liquid savings set aside specifically for unforeseen expenses like medical emergencies or car repairs, typically covering three to six months of essential living costs. Life buffer funds, in contrast, provide a financial cushion for planned life transitions or non-emergency setbacks, such as career changes or education expenses, often involving larger, less liquid amounts. The key differences lie in accessibility, purpose, and timing, with emergency funds prioritizing immediate availability and life buffer funds focusing on strategic financial stability over longer periods.

Why You Need Both: Complementary Roles in Money Management

An Emergency Fund provides immediate cash for unexpected expenses like medical bills or car repairs, ensuring financial stability during crises. A Life Buffer Fund helps smooth irregular income and manage planned but inconsistent expenses such as taxes or insurance, preventing cash flow interruptions. Together, these funds create a comprehensive money management system that addresses both sudden emergencies and predictable financial fluctuations.

Funding Priorities: Which to Build First?

Emergency Fund should be the priority to build first as it provides immediate financial security against unexpected expenses like medical emergencies or job loss. Life Buffer Fund, designed for longer-term goals and lifestyle stability, becomes relevant only after securing the essential Emergency Fund of 3 to 6 months' living expenses. Prioritizing the Emergency Fund ensures a solid financial foundation before allocating resources to the Life Buffer Fund.

How Much Should You Save in Each Fund?

Emergency funds typically require saving three to six months' worth of essential living expenses to cover unexpected situations, while a life buffer fund is designed to hold a larger amount--often six to twelve months of total income--to provide greater financial security for longer-term uncertainties. The emergency fund prioritizes liquidity and immediate availability, making it crucial to tailor the savings amount based on monthly fixed costs such as rent, utilities, and groceries. Determining the precise allocation depends on individual risk tolerance, income stability, and overall financial goals, ensuring both funds complement each other for comprehensive money management.

Access and Liquidity: Rules for Withdrawing from Each Fund

Emergency Funds prioritize immediate access and liquidity, allowing withdrawals without penalties to cover unexpected expenses like medical emergencies or urgent repairs. Life Buffer Funds, while also accessible, often have more flexible withdrawal rules designed to support planned but non-urgent life events such as career changes or extended education, balancing accessibility with strategic financial stability. Clear guidelines for each fund ensure that emergency reserves remain liquid and readily available, while Life Buffer Funds maintain enough flexibility to support longer-term financial goals.

Common Money Mistakes: Mixing Emergency and Life Buffer Funds

Confusing an emergency fund with a life buffer fund often leads to depleted savings during true emergencies and insufficient coverage for lifestyle adjustments. Emergency funds should strictly cover unexpected expenses like medical bills or urgent repairs, while life buffer funds manage planned financial transitions such as career changes or relocations. Maintaining clear boundaries between these funds improves financial resilience and prevents common money management mistakes.

Practical Steps for Building Both Funds

Establishing an Emergency Fund requires setting aside three to six months' worth of essential expenses in a highly liquid account to cover unforeseen financial crises. In contrast, a Life Buffer Fund focuses on cushioning longer-term lifestyle adjustments and typically involves saving an additional three to twelve months' discretionary spending. Practical steps to build both funds include automating monthly transfers, prioritizing high-interest savings accounts, and regularly reviewing budget allocations to accelerate growth and maintain adequate coverage.

Long-term Financial Benefits of Maintaining Separate Funds

Maintaining separate Emergency Fund and Life Buffer Fund enhances long-term financial stability by clearly distinguishing between immediate liquidity needs and ongoing lifestyle expenses. An Emergency Fund provides quick access to cash for unforeseen crises without derailing long-term financial goals, while the Life Buffer Fund supports sustained financial security during extended income disruptions. This segregation optimizes cash flow management, reduces reliance on debt, and preserves investment growth over time.

Related Important Terms

Life Buffer Fund

A Life Buffer Fund serves as an extended financial cushion beyond the traditional Emergency Fund, covering long-term lifestyle expenses and unforeseen life events rather than just immediate crises. This fund prioritizes maintaining financial stability during prolonged income interruptions, providing a more flexible and comprehensive safety net for sustainable money management.

Micro-Emergency Fund

A Micro-Emergency Fund provides quick access to small amounts of cash for immediate, minor financial disruptions like car repairs or medical co-pays, distinct from a broader Life Buffer Fund designed to cover several months of essential expenses during long-term income loss. Prioritizing a Micro-Emergency Fund enhances financial resilience by addressing everyday unexpected costs without depleting larger savings reserved for major emergencies or life changes.

Lifestyle Shock Absorber

An Emergency Fund serves as a critical financial safety net designed to cover unexpected expenses like medical emergencies or urgent home repairs, typically holding three to six months of living expenses. In contrast, a Life Buffer Fund acts as a broader lifestyle shock absorber, providing additional liquidity to manage temporary income disruptions or lifestyle adjustments without compromising long-term financial goals.

Impact Threshold Reserve

An Emergency Fund typically covers 3 to 6 months of essential expenses, serving as an immediate safety net for unexpected financial shocks, while a Life Buffer Fund includes a higher Impact Threshold Reserve designed to absorb larger, long-term financial disruptions and lifestyle changes. Prioritizing the Impact Threshold Reserve within a Life Buffer Fund ensures greater resilience by accommodating severe income loss or significant emergencies beyond daily unforeseen expenses.

Opportunity Buffer Cash

An Emergency Fund covers unforeseen expenses like medical bills or car repairs, while a Life Buffer Fund, often held as Opportunity Buffer Cash, maintains liquidity to seize investment or business opportunities without disrupting financial stability. Prioritizing Opportunity Buffer Cash ensures readiness for growth prospects alongside traditional emergency preparedness, enhancing overall money management strategies.

Adaptive Safety Net

An Emergency Fund acts as an Immediate Safety Net, covering unexpected expenses like medical bills or urgent repairs, while a Life Buffer Fund provides ongoing financial stability by cushioning variable monthly income or living costs, enhancing Adaptive Safety Net strategies. Prioritizing both funds ensures comprehensive money management by balancing short-term liquidity with long-term financial resilience.

Crisis Liquidity Pod

A Crisis Liquidity Pod within an Emergency Fund provides immediate access to cash specifically for unforeseen financial emergencies, while a Life Buffer Fund serves as a broader financial cushion for ongoing expenses during life transitions. Prioritizing a well-funded Crisis Liquidity Pod ensures rapid response liquidity, minimizing reliance on high-interest debt during crises.

Personal Resilience Fund

A Personal Resilience Fund emphasizes long-term financial stability by covering unexpected life events beyond immediate emergencies, whereas an Emergency Fund primarily targets short-term crises like medical bills or urgent repairs. Integrating both funds enhances overall financial security by addressing diverse risks with tailored liquidity reserves.

Agile Expense Cushion

An Emergency Fund is designed to cover unexpected, urgent expenses like medical emergencies or job loss, while a Life Buffer Fund provides a flexible financial cushion for managing regular cash flow fluctuations and planned lifestyle changes. Agile Expense Cushion emphasizes maintaining liquidity and adaptability, ensuring quick access to funds for both sudden emergencies and variable monthly expenses without disrupting long-term savings goals.

Bridge Reserve Fund

An Emergency Fund is specifically designed to cover unexpected expenses such as medical emergencies or urgent home repairs, typically holding three to six months' worth of living expenses. In contrast, a Bridge Reserve Fund, part of a Life Buffer Fund strategy, acts as a temporary financial cushion to maintain cash flow during periods between income sources or transitional phases, providing short-term stability without depleting long-term savings.

Emergency Fund vs Life Buffer Fund for money management Infographic

moneydiff.com

moneydiff.com