An emergency fund is designed to cover significant, unexpected expenses such as medical bills or car repairs, providing a financial safety net in crisis situations. A rainy day stash, on the other hand, is intended for smaller, less urgent expenses like minor home maintenance or occasional car servicing. Prioritizing an emergency fund ensures long-term financial stability, while a rainy day stash helps manage everyday irregular costs without disrupting your budget.

Table of Comparison

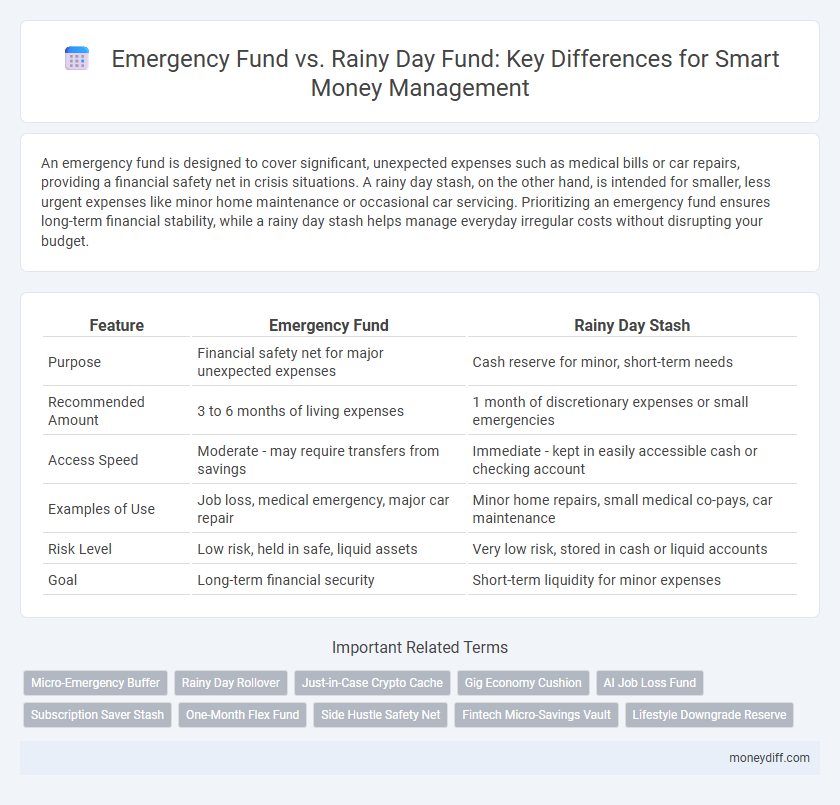

| Feature | Emergency Fund | Rainy Day Stash |

|---|---|---|

| Purpose | Financial safety net for major unexpected expenses | Cash reserve for minor, short-term needs |

| Recommended Amount | 3 to 6 months of living expenses | 1 month of discretionary expenses or small emergencies |

| Access Speed | Moderate - may require transfers from savings | Immediate - kept in easily accessible cash or checking account |

| Examples of Use | Job loss, medical emergency, major car repair | Minor home repairs, small medical co-pays, car maintenance |

| Risk Level | Low risk, held in safe, liquid assets | Very low risk, stored in cash or liquid accounts |

| Goal | Long-term financial security | Short-term liquidity for minor expenses |

Understanding Emergency Funds vs. Rainy Day Stash

Emergency funds are designed to cover significant, unexpected expenses such as medical emergencies, job loss, or major home repairs, typically recommended to have three to six months' worth of living expenses saved. In contrast, a rainy day stash is a smaller reserve intended for minor, non-recurring expenses like car repairs, minor medical bills, or occasional home maintenance. Understanding the distinct purposes and appropriate funding levels of each helps optimize money management by ensuring preparedness for both substantial financial crises and smaller everyday surprises.

Key Differences Between Emergency and Rainy Day Funds

Emergency funds typically cover significant, unexpected expenses like job loss or major medical bills, requiring a larger financial cushion often equating to three to six months of living expenses. Rainy day funds address smaller, more predictable setbacks such as car repairs or minor home maintenance, generally holding a few hundred to a couple thousand dollars. The key difference lies in their purpose and scale: emergency funds safeguard long-term financial stability, while rainy day stashes manage short-term, less severe financial disruptions.

When to Use an Emergency Fund

An emergency fund is designed for significant, unexpected financial crises such as job loss, medical emergencies, or major home repairs, providing a safety net that prevents debt accumulation. In contrast, a rainy day stash covers smaller, less urgent expenses like car maintenance or minor appliance replacements, which can be planned within a monthly budget. Use an emergency fund only when facing critical situations that impact your financial stability for an extended period.

Typical Uses for a Rainy Day Stash

A Rainy Day Stash is typically used for small, unexpected expenses such as minor car repairs, home maintenance, or temporary utility bill increases, providing quick access to cash without disrupting long-term savings. Unlike an Emergency Fund, which covers significant financial crises like job loss or medical emergencies, a Rainy Day Stash helps manage everyday financial bumps that do not jeopardize overall financial stability. This approach ensures flexibility and prevents dipping into more substantial reserves meant for severe emergencies.

How Much Should You Save in Each Fund?

Emergency funds typically require saving three to six months' worth of essential living expenses to cover major financial crises like job loss or medical emergencies, while a rainy day stash usually holds a smaller amount, around one month's expenses, designated for minor, unexpected costs such as car repairs or household fixes. Financial advisors suggest prioritizing the emergency fund first due to its critical role in long-term financial stability, gradually building the rainy day stash for more immediate, less severe needs. The exact amount to save in each fund depends on individual income, monthly expenses, job security, and risk tolerance, but maintaining distinct savings goals ensures better cash flow management and preparedness.

Setting Financial Priorities: Emergency First or Rainy Day?

Setting financial priorities requires distinguishing between an emergency fund and a rainy day stash, where the emergency fund is critical for unforeseen, high-impact events like medical emergencies or job loss, typically covering three to six months of expenses. The rainy day stash addresses smaller, less urgent expenses such as minor home repairs or car maintenance, usually funded with one to two months of living costs. Prioritizing the emergency fund ensures financial stability during major crises before allocating resources to less critical, short-term needs.

Where to Keep Your Emergency and Rainy Day Funds

Emergency funds should be kept in high-yield savings accounts or money market accounts to ensure liquidity and steady interest growth, enabling quick access during unforeseen financial crises. Rainy day stashes, intended for smaller, less urgent expenses, can be stored in easily accessible checking accounts or lower-yield savings accounts, balancing convenience and minimal interest. Separating these funds promotes disciplined money management and optimizes financial readiness for both minor and major unexpected costs.

Building Your Funds: Strategies for Effective Saving

Building your emergency fund requires setting clear financial goals and automating regular savings to ensure consistent growth, while a rainy day stash focuses on smaller, more frequent contributions for unexpected minor expenses. Prioritizing high-yield savings accounts maximizes returns on both funds, allowing quicker access to cash without risking principal. Tracking expenses and reviewing your fund sizes quarterly helps maintain appropriate balances aligned with evolving financial needs and potential emergencies.

Common Mistakes in Managing Emergency and Rainy Day Funds

Confusing the purposes of an emergency fund and a rainy day stash often leads to mismanagement, such as using emergency savings for minor expenses instead of true emergencies. Another common mistake is inadequately funding the emergency fund, resulting in insufficient coverage during significant financial crises. Failing to regularly review and adjust fund amounts according to changing life circumstances can also undermine the effectiveness of both funds.

Integrating Both Funds Into Your Money Management Plan

Integrating an emergency fund and a rainy day stash into your money management plan strengthens financial resilience by covering both major unexpected expenses and smaller, irregular costs. Allocating specific amounts to each fund ensures readiness for significant crises while maintaining liquidity for minor disruptions, optimizing overall financial stability. Regularly reviewing and adjusting contributions based on lifestyle and income changes helps maintain an effective balance between these two critical financial safety nets.

Related Important Terms

Micro-Emergency Buffer

A Micro-Emergency Buffer is a small, easily accessible portion of money within an Emergency Fund designed to cover immediate, minor unexpected expenses such as car repairs or short-term medical costs. Unlike a broader Rainy Day Stash, which addresses larger or less urgent financial disruptions, the Micro-Emergency Buffer ensures quick financial stability without compromising long-term savings goals.

Rainy Day Rollover

A Rainy Day Stash typically covers smaller, unexpected expenses and allows for a Rainy Day Rollover, where unused funds carry over to future months, maintaining liquidity without dipping into an Emergency Fund. This rollover feature ensures consistent money management by preserving cash flow for ongoing minor financial disruptions, contrasting with the fixed-capacity Emergency Fund reserved for major crises.

Just-in-Case Crypto Cache

An Emergency Fund provides accessible cash set aside for significant, unexpected expenses, while a Rainy Day Stash covers smaller, occasional costs; a Just-in-Case Crypto Cache merges liquidity with digital assets, offering quick access to crypto holdings for urgent financial needs. Maintaining a balanced Emergency Fund alongside a crypto-backed cache enhances financial resilience by combining traditional cash security with the potential growth of cryptocurrency.

Gig Economy Cushion

An Emergency Fund in the gig economy offers a robust financial cushion designed to cover extended income gaps and unexpected major expenses, ensuring stability during periods of irregular work or significant emergencies. In contrast, a Rainy Day Stash serves as a smaller, more accessible reserve for minor, short-term costs, providing immediate liquidity without depleting the primary emergency savings.

AI Job Loss Fund

An Emergency Fund serves as a critical financial safety net specifically designed to cover prolonged income disruptions such as AI job loss, typically offering three to six months of living expenses. In contrast, a Rainy Day Stash is a smaller, more flexible reserve for unexpected minor expenses, making it insufficient for the extended financial challenges posed by technology-driven unemployment.

Subscription Saver Stash

Emergency Fund and Rainy Day Stash serve distinct purposes in money management, with the Subscription Saver Stash specifically designed to cover recurring expenses like subscriptions during financial disruptions. This targeted stash ensures uninterrupted access to essential services, complementing broader emergency funds that address unexpected major costs.

One-Month Flex Fund

A One-Month Flex Fund serves as a strategic middle ground between an Emergency Fund and a Rainy Day Stash, providing liquidity to cover unexpected expenses for a full month without dipping into long-term savings. This fund enhances money management by ensuring financial flexibility and reducing reliance on high-interest credit during short-term cash flow disruptions.

Side Hustle Safety Net

An Emergency Fund typically covers three to six months of essential expenses, providing a robust financial buffer against major crises, while a Rainy Day Stash is smaller, aimed at managing minor unexpected costs like car repairs or medical copays. Leveraging a Side Hustle Safety Net enhances financial resilience by generating supplementary income streams that can replenish or supplement these funds, ensuring greater stability during both short-term disruptions and prolonged emergencies.

Fintech Micro-Savings Vault

Fintech micro-savings vaults provide a more structured and automated approach to building an emergency fund compared to a traditional rainy day stash, ensuring consistent contributions and easy access during financial crises. These digital tools optimize money management by leveraging algorithms to allocate small amounts into dedicated emergency fund buckets, enhancing liquidity and financial resilience.

Lifestyle Downgrade Reserve

An Emergency Fund serves as a Lifestyle Downgrade Reserve, specifically designed to cover essential expenses during significant financial disruptions, whereas a Rainy Day Stash addresses smaller, unexpected costs without drastically affecting your living standards. Prioritizing an adequately funded Emergency Fund ensures long-term financial stability and cushions against major income loss or emergencies.

Emergency Fund vs Rainy Day Stash for money management. Infographic

moneydiff.com

moneydiff.com