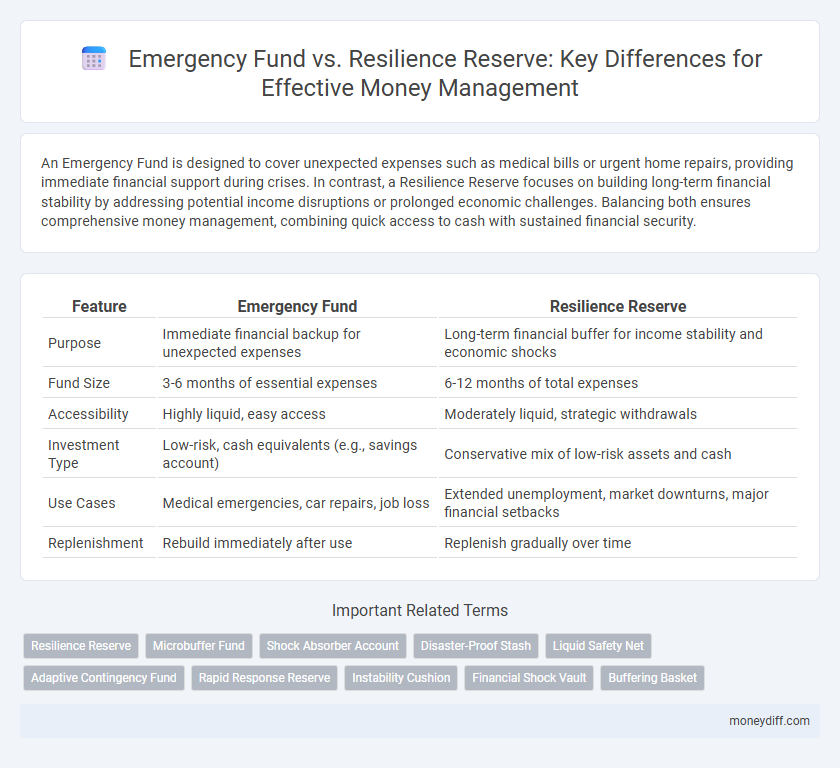

An Emergency Fund is designed to cover unexpected expenses such as medical bills or urgent home repairs, providing immediate financial support during crises. In contrast, a Resilience Reserve focuses on building long-term financial stability by addressing potential income disruptions or prolonged economic challenges. Balancing both ensures comprehensive money management, combining quick access to cash with sustained financial security.

Table of Comparison

| Feature | Emergency Fund | Resilience Reserve |

|---|---|---|

| Purpose | Immediate financial backup for unexpected expenses | Long-term financial buffer for income stability and economic shocks |

| Fund Size | 3-6 months of essential expenses | 6-12 months of total expenses |

| Accessibility | Highly liquid, easy access | Moderately liquid, strategic withdrawals |

| Investment Type | Low-risk, cash equivalents (e.g., savings account) | Conservative mix of low-risk assets and cash |

| Use Cases | Medical emergencies, car repairs, job loss | Extended unemployment, market downturns, major financial setbacks |

| Replenishment | Rebuild immediately after use | Replenish gradually over time |

Understanding Emergency Funds and Resilience Reserves

Emergency funds serve as readily accessible cash pools designed to cover unexpected expenses such as medical emergencies or sudden job loss, typically amounting to three to six months of essential living costs. Resilience reserves complement emergency funds by acting as a secondary financial buffer intended for longer-term stability and recovery, often invested in more liquid assets with modest risk. Understanding the distinct roles of emergency funds and resilience reserves enhances effective money management, ensuring both immediate protection and sustained financial resilience.

Key Differences Between Emergency Funds and Resilience Reserves

Emergency funds typically cover 3 to 6 months of essential living expenses, providing a financial buffer for unexpected job loss or urgent medical costs, whereas resilience reserves focus on long-term financial stability and flexibility beyond immediate crises. Emergency funds are liquid, easily accessible savings specifically earmarked for sudden expenses, while resilience reserves may include diversified assets or investments to sustain income over extended periods of economic hardship. The key difference lies in purpose and scope: emergency funds address short-term emergencies, whereas resilience reserves enhance overall financial adaptability and security.

Core Purposes: Emergency Fund vs Resilience Reserve

An Emergency Fund is designed to cover urgent, unforeseen expenses like medical emergencies or car repairs, ensuring immediate financial stability. A Resilience Reserve, however, serves as a broader safety net, sustaining long-term financial health during extended crises such as job loss or economic downturns. Prioritizing an adequately funded Emergency Fund before building a Resilience Reserve optimizes overall money management by balancing short-term liquidity with long-term security.

Financial Benefits of Maintaining Both Funds

Maintaining both an Emergency Fund and a Resilience Reserve enhances financial stability by addressing immediate crises and long-term uncertainties separately. The Emergency Fund provides quick access to liquid cash for sudden expenses such as medical emergencies or job loss, while the Resilience Reserve supports sustained financial health during prolonged stress like economic downturns or unexpected major repairs. This dual-fund strategy optimizes liquidity and safeguards against depletion of retirement or investment accounts, promoting greater economic security and peace of mind.

How to Determine Your Ideal Emergency Fund Size

To determine your ideal emergency fund size, evaluate essential monthly expenses such as housing, utilities, food, healthcare, and debt payments, then multiply by a safety factor between three to six months, depending on job stability and income sources. Assess personal risk factors like employment volatility, presence of dependents, and existing financial assets to fine-tune the reserve amount. Comparing this figure to your resilience reserve, which covers unforeseen expenditures beyond basic needs, helps clarify the distinct purpose and appropriate magnitude of each fund in your overall money management strategy.

Building a Resilience Reserve for Long-Term Stability

Building a Resilience Reserve focuses on accumulating financial resources that extend beyond immediate emergencies to support long-term stability during prolonged disruptions. This reserve typically includes diversified assets and alternative income streams designed to absorb extended economic shocks. Prioritizing a resilience reserve enhances money management by promoting sustained financial security rather than short-term crisis response.

When to Use an Emergency Fund vs a Resilience Reserve

An Emergency Fund should be used for immediate, unexpected expenses such as medical emergencies, car repairs, or job loss, providing quick access to cash without disrupting long-term investments. A Resilience Reserve, on the other hand, is designed for longer-term financial stability, covering multiple months of living expenses to sustain resilience during prolonged economic challenges or income reduction. Understanding the distinction helps optimize money management by allocating funds appropriately for short-term crises versus extended financial disruptions.

Common Mistakes in Managing Financial Buffers

A common mistake in managing financial buffers is confusing an emergency fund with a resilience reserve, where the former is intended for immediate, unexpected expenses while the latter covers longer-term financial stability. Many individuals underestimate the importance of maintaining both separately, leading to inadequate liquidity when urgent needs arise or diminished long-term security. Properly distinguishing these funds ensures effective cash flow management and stronger financial resilience against diverse risks.

Steps to Transition from Emergency Fund to Resilience Reserve

Start by assessing your current Emergency Fund to ensure it covers three to six months of essential expenses as a financial safety net. Gradually allocate surplus savings into a Resilience Reserve, designed to address broader risks like income loss, unexpected health costs, or major repairs beyond immediate emergencies. Regularly review and adjust both funds to maintain liquidity and long-term financial stability, prioritizing diversified asset allocation within the Resilience Reserve for enhanced protection.

Incorporating Both Funds Into Your Money Management Plan

Incorporating both an Emergency Fund and a Resilience Reserve into your money management plan enhances financial stability by addressing immediate crises and long-term uncertainties. An Emergency Fund typically covers three to six months of essential expenses for sudden events like medical emergencies or job loss, while a Resilience Reserve prepares for broader challenges such as major economic downturns or extended unemployment. Balancing contributions to both funds ensures comprehensive protection and fosters sustained financial resilience.

Related Important Terms

Resilience Reserve

A Resilience Reserve goes beyond a traditional Emergency Fund by not only covering unforeseen expenses but also ensuring financial stability during prolonged income disruptions and economic downturns. By maintaining a higher balance and diversified liquidity, a Resilience Reserve enhances long-term money management and provides a stronger buffer against financial shocks.

Microbuffer Fund

A Microbuffer Fund functions as a smaller, highly liquid component of an Emergency Fund designed to cover minor unexpected expenses without eroding the primary Resilience Reserve. This strategic separation enhances overall money management by preserving long-term financial stability while addressing immediate cash flow fluctuations.

Shock Absorber Account

An Emergency Fund acts as a dedicated Shock Absorber Account, providing immediate liquidity to cover unexpected expenses such as medical bills or car repairs, ensuring financial stability without incurring debt. In contrast, a Resilience Reserve supports long-term financial durability by bolstering overall savings and investment goals rather than addressing sudden cash flow disruptions.

Disaster-Proof Stash

An Emergency Fund serves as a readily accessible cash reserve for immediate financial crises, while a Resilience Reserve is a broader, strategically diversified portfolio designed to withstand prolonged economic disruptions. Building a Disaster-Proof Stash involves maintaining liquid assets within your Emergency Fund and supplementing it with resilient investments in your Resilience Reserve to ensure long-term financial stability during unforeseen disasters.

Liquid Safety Net

An Emergency Fund serves as a liquid safety net designed for immediate access to cover unexpected expenses, ensuring financial stability without incurring debt. In contrast, a Resilience Reserve is a broader financial buffer aimed at long-term stability, often including less liquid assets that support recovery from prolonged disruptions.

Adaptive Contingency Fund

An Emergency Fund primarily covers unexpected personal expenses like medical bills or car repairs, while a Resilience Reserve, also known as an Adaptive Contingency Fund, is designed to provide financial flexibility during prolonged income disruptions or economic downturns by adjusting reserve levels based on changing risk factors. This adaptive approach ensures sustained liquidity and financial stability by dynamically reallocating resources to meet evolving financial challenges.

Rapid Response Reserve

A Rapid Response Reserve, distinct from a traditional Emergency Fund, is specifically designed for immediate access to cash during unexpected financial crises, ensuring liquidity without disrupting long-term savings. This component of money management enhances financial resilience by providing a quick cash buffer, reducing reliance on credit and mitigating stress during urgent situations.

Instability Cushion

An Emergency Fund provides immediate liquidity to cover unexpected expenses, serving as a vital instability cushion that prevents financial disruption. In contrast, a Resilience Reserve focuses on long-term financial stability by addressing income fluctuations and economic setbacks, enhancing overall money management strategies.

Financial Shock Vault

The Emergency Fund serves as an immediate access pool of liquid assets to cover unexpected expenses, while the Resilience Reserve, often termed the Financial Shock Vault, provides a larger buffer designed to sustain financial stability during prolonged crises. Prioritizing the Financial Shock Vault ensures deeper financial resilience by safeguarding income sources and enabling long-term recovery from severe economic disruptions.

Buffering Basket

An Emergency Fund serves as a liquid safety net specifically designed to cover unforeseen expenses, while a Resilience Reserve functions as a broader financial buffer supporting long-term stability during extended disruptions. The Buffering Basket concept strategically allocates funds between immediate accessibility and sustainable resources, optimizing money management by balancing short-term liquidity with resilience against economic challenges.

Emergency Fund vs Resilience Reserve for money management. Infographic

moneydiff.com

moneydiff.com