An emergency fund is a specific reserve of liquid cash set aside to cover unexpected expenses like medical emergencies or urgent home repairs, ensuring immediate financial access. In contrast, a financial safety net comprises broader resources such as insurance policies, credit lines, and investments that provide long-term protection and support during financial crises. Allocating funds between an emergency fund and a financial safety net enhances overall resilience by balancing short-term liquidity with sustained financial stability.

Table of Comparison

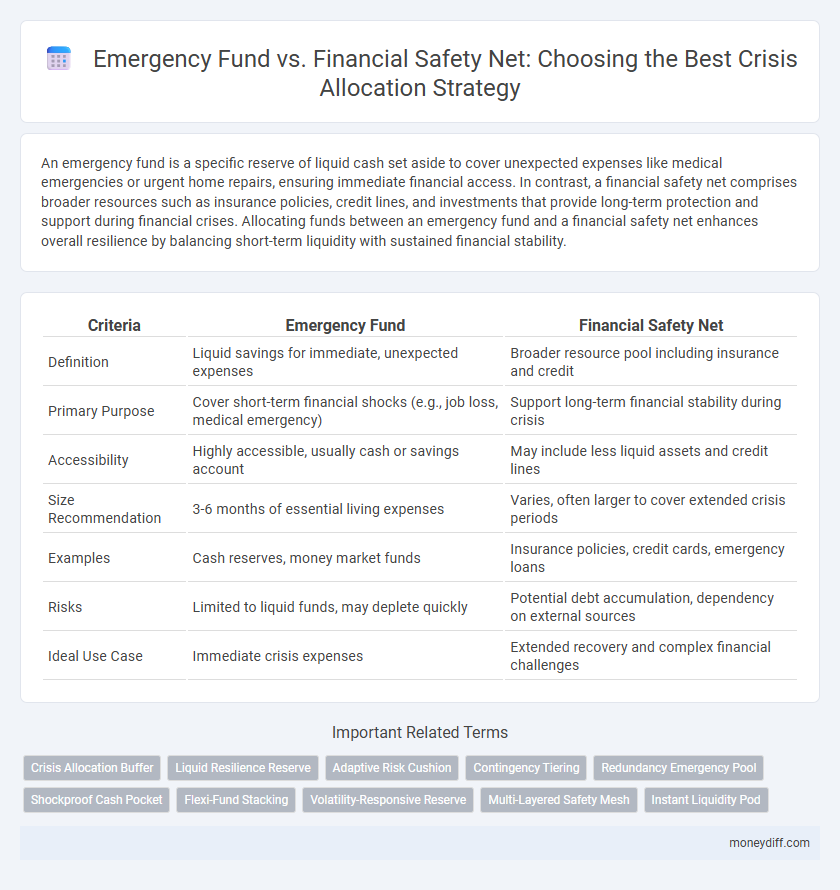

| Criteria | Emergency Fund | Financial Safety Net |

|---|---|---|

| Definition | Liquid savings for immediate, unexpected expenses | Broader resource pool including insurance and credit |

| Primary Purpose | Cover short-term financial shocks (e.g., job loss, medical emergency) | Support long-term financial stability during crisis |

| Accessibility | Highly accessible, usually cash or savings account | May include less liquid assets and credit lines |

| Size Recommendation | 3-6 months of essential living expenses | Varies, often larger to cover extended crisis periods |

| Examples | Cash reserves, money market funds | Insurance policies, credit cards, emergency loans |

| Risks | Limited to liquid funds, may deplete quickly | Potential debt accumulation, dependency on external sources |

| Ideal Use Case | Immediate crisis expenses | Extended recovery and complex financial challenges |

Understanding Emergency Funds: Purpose and Importance

Emergency funds are designated savings that cover 3 to 6 months of essential expenses, providing immediate liquidity during unexpected financial crises such as job loss or medical emergencies. Unlike broader financial safety nets, which may include insurance policies, investments, or credit lines, emergency funds are specifically liquid and accessible without penalty. Understanding their purpose is crucial for financial resilience, ensuring short-term stability and preventing debt accumulation during unforeseen disruptions.

Defining a Financial Safety Net: Beyond Emergency Funds

A financial safety net extends beyond a traditional emergency fund by encompassing multiple resources such as insurance policies, accessible credit lines, and liquid assets designed to cover unexpected expenses during a crisis. Unlike a basic emergency fund, which typically consists of three to six months' worth of living expenses in cash savings, a financial safety net integrates diverse financial tools to ensure broader protection and recovery capacity. This integrated approach reduces vulnerability by providing flexible, layered support for various financial disruptions, including job loss, medical emergencies, or sudden major repairs.

Key Differences Between Emergency Funds and Financial Safety Nets

Emergency funds are liquid savings explicitly set aside to cover unexpected expenses such as medical emergencies or job loss, typically recommended to cover three to six months of living expenses. Financial safety nets encompass a broader range of resources, including insurance policies, access to credit, and social support systems, designed to provide financial stability during larger crises. Key differences include the immediacy and accessibility of emergency funds versus the diverse, sometimes less liquid, components that form a comprehensive financial safety net.

Crisis Allocation: How Emergency Funds Serve Immediate Needs

Emergency funds provide a critical financial safety net by ensuring quick access to cash for immediate crisis allocation, such as unexpected medical bills or urgent home repairs. Unlike broader financial safety nets, which include insurance and credit lines, emergency funds offer liquidity without additional costs or delays. This immediate availability enables individuals to address emergencies promptly, reducing financial stress and preventing debt accumulation.

Building a Robust Financial Safety Net for Long-Term Security

Building a robust financial safety net involves allocating funds beyond an emergency fund to cover extended crises, ensuring long-term security and stability. This approach includes diversifying resources across liquid savings, insurance policies, and investment portfolios tailored to withstand economic downturns and unforeseen expenses. Prioritizing a comprehensive safety net supports sustained financial resilience and mitigates risks associated with prolonged emergencies.

Emergency Fund vs. Financial Safety Net: Which Comes First?

An emergency fund should be prioritized before building a broader financial safety net, as it provides immediate liquidity to cover unexpected expenses like medical bills or car repairs. This fund typically consists of three to six months' worth of essential living expenses, ensuring quick access to cash without incurring debt. A financial safety net, which may include insurance policies and diversified investments, serves as a long-term strategy to protect against larger financial shocks after establishing the emergency fund.

Ideal Fund Size: Emergency Reserve or Comprehensive Safety Net?

An ideal emergency fund typically covers three to six months of essential living expenses, ensuring immediate liquidity for unexpected costs like medical emergencies or job loss. A comprehensive financial safety net extends beyond this reserve, including additional assets or insurance to mitigate broader risks such as long-term unemployment or major property damage. Prioritizing the right fund size depends on individual risk tolerance, income stability, and the availability of other financial resources.

Strategic Allocation: Balancing Both for Maximum Protection

Strategic allocation between an emergency fund and a financial safety net enhances crisis resilience by diversifying access to liquidity. Emergency funds typically cover immediate, short-term expenses, while financial safety nets provide broader support, such as insurance or credit lines, for larger or prolonged crises. Balancing both ensures maximum protection by addressing various financial risks with tailored resources.

Common Mistakes in Crisis Fund Planning and How to Avoid Them

Common mistakes in emergency fund planning include underestimating necessary fund size and confusing it with a broader financial safety net, leading to insufficient crisis allocation. Many individuals overlook regular fund replenishment, leaving them vulnerable during unexpected events. To avoid these pitfalls, calculate emergency fund needs based on actual living expenses and maintain clear separation between immediate emergency reserves and long-term financial safety nets.

Steps to Transition From Emergency Fund to Full Financial Safety Net

Establish a targeted emergency fund covering three to six months of essential expenses before expanding it into a comprehensive financial safety net that includes insurance policies, diversified investments, and accessible credit lines. Prioritize building liquidity by gradually allocating surplus income into broader financial instruments such as retirement accounts and health savings accounts. Regularly review and adjust your financial plan to ensure alignment with evolving personal needs and potential crisis scenarios.

Related Important Terms

Crisis Allocation Buffer

A Crisis Allocation Buffer serves as a dedicated financial safety net designed specifically to cover unexpected, high-impact expenses during emergencies, distinct from a general Emergency Fund which primarily addresses routine financial disruptions. Prioritizing a Crisis Allocation Buffer ensures liquidity for immediate crisis-related costs, enhancing financial resilience and minimizing reliance on high-interest debt or asset liquidation.

Liquid Resilience Reserve

An Emergency Fund represents a dedicated, highly liquid cash reserve designed to cover essential expenses for three to six months, providing immediate financial stability during unforeseen crises. In contrast, a Financial Safety Net encompasses a broader portfolio of assets, including liquid and semi-liquid investments, creating a Liquid Resilience Reserve that balances accessibility with growth potential to support long-term crisis allocation.

Adaptive Risk Cushion

An Emergency Fund serves as an immediate liquidity reserve designed to cover unexpected expenses, while a Financial Safety Net encompasses broader financial protections like insurance and access to credit lines. The Adaptive Risk Cushion strategy dynamically adjusts the Emergency Fund's size based on evolving risk factors and personal financial volatility, enhancing resilience during crises.

Contingency Tiering

Emergency funds provide immediate liquidity for short-term needs, while financial safety nets offer broader support during prolonged crises through contingency tiering that allocates resources based on urgency and impact severity. Contingency tiering strategically prioritizes access to funds, ensuring essential expenses are covered first, followed by secondary needs to optimize crisis allocation efficiency and financial resilience.

Redundancy Emergency Pool

The Emergency Fund serves as a primary financial buffer specifically designated for immediate crisis expenses, while the Financial Safety Net, including the Redundancy Emergency Pool, provides an extended layer of protection to cover prolonged income disruptions or multiple unforeseen events. Allocating resources to both ensures comprehensive crisis readiness by balancing short-term liquidity with long-term financial resilience.

Shockproof Cash Pocket

An Emergency Fund serves as a dedicated Shockproof Cash Pocket, providing immediate liquidity to cover unexpected expenses without disrupting long-term investments, whereas a Financial Safety Net encompasses broader resources such as insurance and credit lines for comprehensive crisis allocation. Maintaining a well-funded Emergency Fund ensures quick access to cash and minimizes financial stress during emergencies, distinguishing it as the first line of defense in personal financial resilience.

Flexi-Fund Stacking

Emergency Fund and Financial Safety Net differ in scope and flexibility, with Flexi-Fund Stacking enhancing crisis allocation by allowing layered reserves tailored to specific emergencies. This approach optimizes liquidity management, ensuring immediate access to funds while maintaining long-term financial stability through diversified resource allocation.

Volatility-Responsive Reserve

An Emergency Fund serves as a readily accessible cash reserve to cover unexpected expenses, while a Financial Safety Net for crisis allocation often includes diversified assets designed to respond to market volatility and provide broader financial stability. A Volatility-Responsive Reserve strategically adjusts its allocation based on market fluctuations, enhancing liquidity and preserving capital during economic downturns.

Multi-Layered Safety Mesh

An Emergency Fund provides immediate access to liquid cash reserves designed to cover short-term expenses during financial crises, while a Financial Safety Net encompasses a multi-layered safety mesh including insurance policies, credit lines, and community support systems that offer extended protection and resources. Combining these elements creates a robust crisis allocation strategy that mitigates risks and enhances financial resilience across various emergency scenarios.

Instant Liquidity Pod

An Emergency Fund serves as an immediate source of cash, offering instant liquidity to cover unexpected expenses during a crisis, whereas a Financial Safety Net encompasses broader resources like insurance, credit lines, and investments that provide long-term stability. Prioritizing an Instant Liquidity Pod ensures rapid access to funds, minimizing financial disruption and enhancing resilience in emergency situations.

Emergency Fund vs Financial Safety Net for crisis allocation. Infographic

moneydiff.com

moneydiff.com