An emergency fund is dedicated specifically to unforeseen, urgent events such as medical bills or sudden job loss, providing a financial safety net during crises. A buffer fund, on the other hand, serves to cover routine but irregular expenses like car repairs or minor home maintenance that are less catastrophic yet unplanned. While both funds enhance financial security, the emergency fund is reserved for critical situations, whereas the buffer fund manages smaller, anticipated gaps in regular spending.

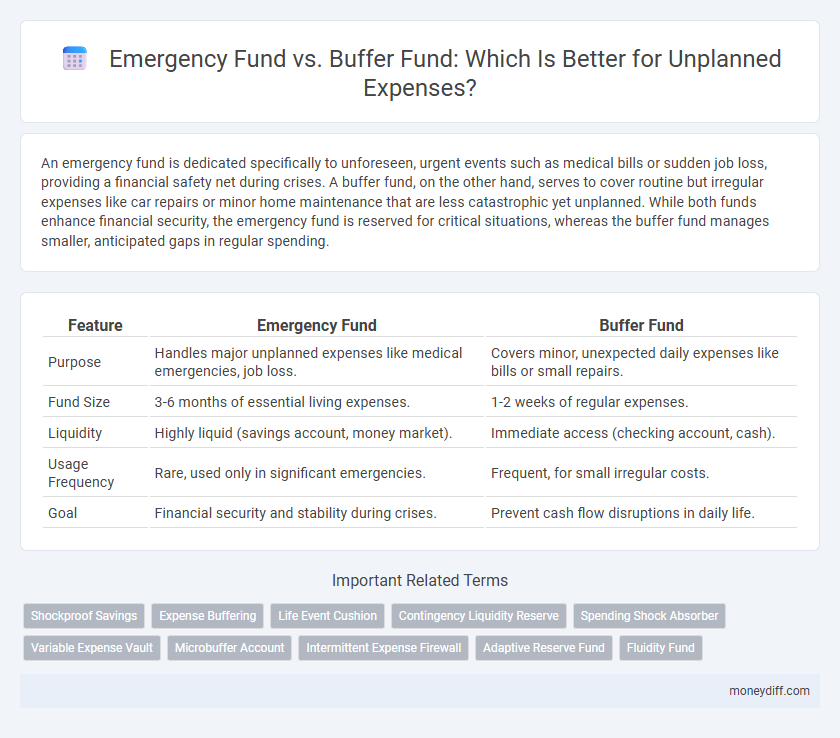

Table of Comparison

| Feature | Emergency Fund | Buffer Fund |

|---|---|---|

| Purpose | Handles major unplanned expenses like medical emergencies, job loss. | Covers minor, unexpected daily expenses like bills or small repairs. |

| Fund Size | 3-6 months of essential living expenses. | 1-2 weeks of regular expenses. |

| Liquidity | Highly liquid (savings account, money market). | Immediate access (checking account, cash). |

| Usage Frequency | Rare, used only in significant emergencies. | Frequent, for small irregular costs. |

| Goal | Financial security and stability during crises. | Prevent cash flow disruptions in daily life. |

Understanding Emergency Funds: Definition and Purpose

An emergency fund is a dedicated financial reserve designed to cover essential living expenses during unforeseen circumstances such as job loss, medical emergencies, or urgent home repairs. Unlike a buffer fund, which handles minor, short-term unexpected expenses, an emergency fund provides a more substantial safety net to maintain financial stability over an extended period. Establishing an emergency fund typically involves saving three to six months' worth of living costs to ensure adequate protection against significant financial disruptions.

What Are Buffer Funds? Key Differences from Emergency Funds

Buffer funds are reserved financial resources specifically set aside to cover small, routine unplanned expenses such as minor home repairs or unexpected groceries, differing from emergency funds which are designed for major, unforeseen crises like job loss or medical emergencies. Unlike emergency funds that typically hold three to six months' worth of living expenses, buffer funds usually maintain a smaller balance aimed at smoothing day-to-day financial fluctuations. These funds help prevent dipping into emergency savings for minor expenses, preserving the emergency fund's core purpose of providing long-term financial security.

Why Both Funds Matter in Money Management

An emergency fund provides a financial safety net for major unforeseen events such as job loss or medical emergencies, while a buffer fund covers smaller, unexpected expenses like car repairs or minor home maintenance. Maintaining both funds ensures comprehensive financial preparedness, preventing the depletion of essential savings during varied unplanned costs. Balancing these reserves enhances overall money management by promoting stability and reducing reliance on credit.

Common Scenarios for Emergency vs Buffer Fund Use

An Emergency Fund primarily covers unexpected, large-scale financial crises such as job loss, medical emergencies, or major home repairs, providing a financial safety net for prolonged disruptions. Buffer Funds, however, address smaller, routine unplanned expenses like minor car repairs, utility bill spikes, or short-term income gaps, ensuring smooth cash flow without tapping into long-term savings. Differentiating these funds helps maintain financial stability by allocating resources appropriately based on the urgency and scale of unforeseen costs.

How Much to Save: Emergency vs Buffer Fund Guidelines

An emergency fund typically requires saving three to six months of essential living expenses to cover major unforeseen events like job loss or medical emergencies. A buffer fund, on the other hand, is generally smaller, recommended at one to two months of discretionary spending, designed for minor unplanned expenses such as car repairs or household maintenance. Prioritizing these savings ensures financial stability by separating long-term crisis coverage from short-term liquidity needs.

Building Your Emergency Fund: Step-by-Step

Building your emergency fund involves setting aside three to six months' worth of living expenses to cover unexpected financial hardships like job loss or medical emergencies. A buffer fund, while useful for minor unplanned expenses such as car repairs or home maintenance, typically holds a smaller amount and functions as a short-term financial cushion. Prioritize consistent monthly contributions to a dedicated savings account to gradually establish a robust emergency fund that offers long-term financial security.

Creating an Effective Buffer Fund for Minor Setbacks

Creating an effective buffer fund involves setting aside a smaller, accessible amount of money specifically for minor setbacks such as unexpected bills or small repairs, distinguishing it from a larger emergency fund designed for major crises. This buffer fund should ideally cover one to two months of routine expenses to provide liquidity without depleting essential savings. Prioritizing regular contributions and keeping funds in a readily available account ensures quick access and financial stability during everyday financial disruptions.

Where to Keep Your Funds: Access and Liquidity Considerations

Emergency funds should be kept in highly liquid accounts such as high-yield savings or money market accounts to ensure immediate access during emergencies. Buffer funds, designed for minor unplanned expenses, can be stored in less accessible but slightly higher-yielding accounts like short-term certificates of deposit or Treasury bills. Prioritizing quick access and liquidity for emergency funds minimizes withdrawal delays and potential penalties, while buffer funds balance accessibility with improved returns.

Mistakes to Avoid: Mixing Emergency and Buffer Funds

Mixing emergency funds and buffer funds leads to poor financial discipline and insufficient savings during true crises, as emergency funds are strictly for unexpected, high-impact events like job loss or medical emergencies, while buffer funds cover minor, short-term cash flow gaps. Failing to keep these accounts separate can result in depletion of emergency savings for routine expenses, leaving individuals vulnerable to larger financial shocks. Maintaining distinct reserves ensures adequate protection and preserves financial stability during unforeseen events.

Choosing the Right Fund for Various Unplanned Expenses

Emergency funds are designed to cover significant, unexpected financial crises such as job loss or medical emergencies, typically amounting to three to six months of living expenses. Buffer funds, in contrast, handle smaller, irregular costs like minor car repairs or household maintenance, providing quick access without depleting emergency savings. Selecting the right fund depends on the scale and urgency of the unplanned expense, ensuring financial stability without compromising long-term security.

Related Important Terms

Shockproof Savings

A Shockproof Emergency Fund provides dedicated savings specifically earmarked to cover large, unexpected financial shocks like medical emergencies or job loss, ensuring long-term financial stability. In contrast, a Buffer Fund typically handles smaller, routine unplanned expenses, such as car repairs or minor home maintenance, acting as a first line of defense before tapping into the Emergency Fund.

Expense Buffering

An Emergency Fund is specifically designed to cover significant unexpected financial crises like medical emergencies or job loss, typically holding three to six months of living expenses. A Buffer Fund, on the other hand, targets smaller, routine unplanned expenses such as car repairs or minor home maintenance, ensuring daily financial stability without depleting the primary emergency savings.

Life Event Cushion

An Emergency Fund serves as a life event cushion specifically designed to cover unexpected financial shocks such as job loss or medical emergencies, whereas a Buffer Fund handles smaller, routine unplanned expenses like car repairs or utility bills. Maintaining a well-defined Emergency Fund with three to six months' worth of essential living expenses ensures long-term financial stability during significant life disruptions.

Contingency Liquidity Reserve

An Emergency Fund is a dedicated Contingency Liquidity Reserve designed to cover essential living expenses during unforeseen financial disruptions, typically amounting to three to six months of costs. A Buffer Fund, while similar, often addresses smaller, short-term unplanned expenses and lacks the stricter liquidity and sufficiency focus critical in an Emergency Fund.

Spending Shock Absorber

An Emergency Fund serves as a dedicated financial safety net covering essential expenses during unforeseen crises, while a Buffer Fund acts primarily as a spending shock absorber for minor, unexpected costs that don't qualify as emergencies. Prioritizing an Emergency Fund establishes long-term financial security, whereas a Buffer Fund helps maintain daily cash flow stability without tapping into critical reserves.

Variable Expense Vault

A Variable Expense Vault serves as a buffer fund designed specifically for unplanned, irregular expenses, distinguishing it from a traditional emergency fund that targets major financial crises like job loss or medical emergencies. Allocating separate savings for variable, unpredictable costs ensures more precise financial management and prevents depletion of the core emergency fund intended for critical situations.

Microbuffer Account

A Microbuffer Account serves as a smaller, more accessible reserve within an Emergency Fund specifically designed to cover immediate, unplanned expenses without disrupting long-term savings goals. This approach enhances financial resilience by providing quick access to funds for minor emergencies, distinguishing it from a broader Emergency Fund meant for larger, less frequent financial crises.

Intermittent Expense Firewall

Emergency funds serve as a critical financial safety net designed to cover significant, unforeseen expenses such as medical emergencies or job loss, whereas buffer funds act as an intermittent expense firewall, managing smaller, irregular costs like car repairs or home maintenance without disrupting long-term savings. Prioritizing both funds ensures comprehensive financial resilience by segregating large-scale emergencies from routine, unpredictable expenses.

Adaptive Reserve Fund

An Emergency Fund is a designated savings pool for critical, unforeseen expenses like medical emergencies or job loss, while a Buffer Fund covers minor, routine unplanned costs such as small repairs or temporary bills. The Adaptive Reserve Fund blends these concepts by providing a flexible financial cushion that adjusts according to varying levels of unexpected expenses, ensuring greater resilience without over-committing resources.

Fluidity Fund

A Fluidity Fund, often confused with an Emergency Fund, is designed for smaller, frequent unplanned expenses, providing quick access to cash without disrupting long-term savings. Unlike Buffer Funds, which cover short-term financial gaps, a Fluidity Fund ensures liquidity and prevents reliance on credit during everyday financial surprises.

Emergency Fund vs Buffer Fund for unplanned expenses. Infographic

moneydiff.com

moneydiff.com