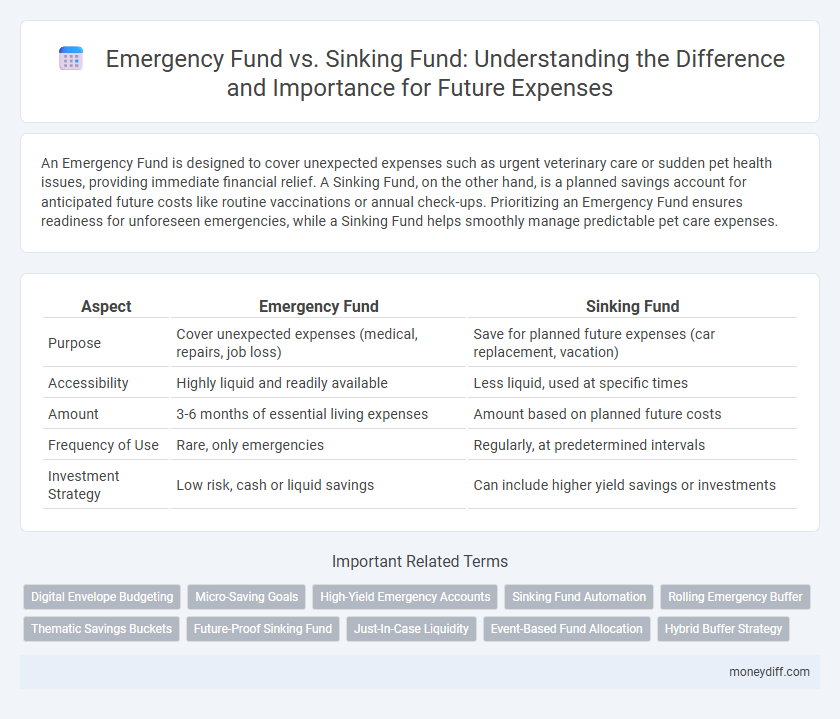

An Emergency Fund is designed to cover unexpected expenses such as urgent veterinary care or sudden pet health issues, providing immediate financial relief. A Sinking Fund, on the other hand, is a planned savings account for anticipated future costs like routine vaccinations or annual check-ups. Prioritizing an Emergency Fund ensures readiness for unforeseen emergencies, while a Sinking Fund helps smoothly manage predictable pet care expenses.

Table of Comparison

| Aspect | Emergency Fund | Sinking Fund |

|---|---|---|

| Purpose | Cover unexpected expenses (medical, repairs, job loss) | Save for planned future expenses (car replacement, vacation) |

| Accessibility | Highly liquid and readily available | Less liquid, used at specific times |

| Amount | 3-6 months of essential living expenses | Amount based on planned future costs |

| Frequency of Use | Rare, only emergencies | Regularly, at predetermined intervals |

| Investment Strategy | Low risk, cash or liquid savings | Can include higher yield savings or investments |

Understanding Emergency Funds: Purpose and Importance

Emergency funds are designed to provide immediate financial support during unexpected situations such as job loss, medical emergencies, or urgent repairs, ensuring liquidity and peace of mind. In contrast, sinking funds are systematically saved over time for planned future expenses like vacations or large purchases, emphasizing foresight and disciplined saving. Understanding the emergency fund's purpose highlights its role as a critical safety net that prioritizes accessibility and financial stability during crises.

What is a Sinking Fund and How Does It Work?

A sinking fund is a financial strategy where money is regularly set aside to cover anticipated future expenses or debt repayments, ensuring funds are available without financial strain. Unlike an emergency fund, which is used for unexpected costs, a sinking fund is planned and allocated for specific goals such as car repairs, home improvements, or vacation savings. Regular contributions to a sinking fund reduce the need for borrowing and provide a disciplined approach to managing upcoming financial obligations.

Key Differences Between Emergency Funds and Sinking Funds

Emergency funds are designed to cover unexpected, urgent expenses such as medical emergencies or job loss, providing immediate financial safety. Sinking funds, on the other hand, are aimed at planned future expenses like car repairs or vacation costs, allowing for systematic saving over time. The primary difference lies in their purpose: emergency funds address unforeseen events, while sinking funds prepare for anticipated expenses.

Common Examples of Emergency Fund Uses

Emergency funds are primarily designed to cover unexpected expenses such as medical emergencies, sudden job loss, or urgent home repairs, ensuring financial stability during unforeseen events. Unlike sinking funds, which are allocated for planned future expenses like vacations or new appliances, emergency funds provide immediate liquidity for crises. Maintaining three to six months of living expenses in an emergency fund is a recommended strategy to safeguard against financial disruptions.

When to Use a Sinking Fund for Planned Expenses

A sinking fund is ideal for planned future expenses such as saving for a new car, home repairs, or vacation, allowing gradual accumulation of money over time without financial stress. Unlike an emergency fund reserved strictly for unexpected events like job loss or medical emergencies, sinking funds help manage predictable costs by setting aside dedicated amounts regularly. This approach prevents dipping into emergency savings while ensuring preparedness for anticipated expenditures.

Building Your Emergency Fund: Best Practices

Building your emergency fund involves setting aside three to six months' worth of living expenses in a high-yield, easily accessible savings account to cover unexpected financial setbacks. Prioritize consistent monthly contributions and avoid tapping into this fund for non-emergencies to ensure it remains intact during true crises. Establish clear criteria for what constitutes an emergency to maintain discipline and prevent depletion, distinguishing this fund from sinking funds designed for planned future expenses.

Setting Up Effective Sinking Funds for Big Purchases

Setting up effective sinking funds for big purchases requires clearly defining the target amount and timeline to ensure consistent monthly contributions. Allocating a separate savings account exclusively for sinking funds prevents accidental spending and provides tangible progress toward expensive future expenses like home renovations or vehicle replacements. Unlike emergency funds reserved for unexpected financial crises, sinking funds are purpose-driven, fostering disciplined saving habits and reducing the reliance on credit when major costs arise.

Emergency Fund vs. Sinking Fund: Which Comes First?

Emergency funds prioritize immediate, unexpected expenses such as medical emergencies or job loss, providing essential financial security. Sinking funds are designated for planned future expenses like vacations or car repairs, allowing for cost distribution over time without incurring debt. Establishing an emergency fund typically comes first to ensure foundational financial stability before allocating money towards sinking funds.

Pros and Cons of Emergency and Sinking Funds

Emergency funds provide immediate liquidity for unforeseen expenses, ensuring financial stability during crises, but they often yield lower returns due to conservative investment choices. Sinking funds, designed for planned future expenses, allow systematic saving with potentially higher returns but lack the flexibility to cover unexpected emergencies. Balancing both funds optimizes financial preparedness by combining the emergency fund's accessibility with the sinking fund's goal-specific growth.

Combining Emergency and Sinking Funds in Your Money Management Strategy

Combining emergency and sinking funds in your money management strategy enhances financial resilience by ensuring liquidity for unexpected expenses while systematically saving for planned future costs like vacations or home repairs. An emergency fund typically covers 3-6 months of essential living expenses, providing a safety net for unforeseen events, whereas a sinking fund allocates specific amounts for predictable expenditures over time. This integrated approach optimizes cash flow management, reduces reliance on credit, and supports disciplined saving habits aligned with both short-term emergencies and long-term financial goals.

Related Important Terms

Digital Envelope Budgeting

An emergency fund is a liquid reserve designed for unexpected expenses like medical emergencies or urgent repairs, while a sinking fund allocates money gradually for planned future expenses such as vacations or car replacements within a digital envelope budgeting system. Digital envelope budgeting facilitates precise fund separation and management by creating virtual envelopes dedicated to each financial goal, enhancing fiscal discipline and ensuring readiness for both unforeseen and anticipated costs.

Micro-Saving Goals

Emergency funds provide immediate financial safety for unexpected expenses, while sinking funds allocate money over time for planned future costs. Micro-saving goals leverage small, consistent deposits to build both funds, enhancing financial discipline and ensuring preparedness for unforeseen emergencies and scheduled expenses alike.

High-Yield Emergency Accounts

High-yield emergency accounts offer liquidity and higher interest rates, making them ideal for emergency funds, which provide immediate access to cash during unexpected situations. Sinking funds, designed for planned future expenses, typically invest in lower-yield, less liquid options to preserve capital until specific goals are met.

Sinking Fund Automation

Automating sinking fund contributions ensures consistent savings for planned future expenses, reducing the risk of financial shortfalls while keeping emergency funds reserved solely for unexpected events. This systematic approach optimizes cash flow management, providing targeted preparedness and enhancing overall financial stability.

Rolling Emergency Buffer

A Rolling Emergency Buffer maintains a flexible, replenishing fund designed to cover unexpected expenses without depleting financial stability, contrasting with a Sinking Fund that accumulates money for predetermined future costs. This dynamic approach ensures continuous liquidity, adapting to emergencies by replenishing as funds are utilized, promoting resilience in personal finance management.

Thematic Savings Buckets

Emergency funds cover unexpected financial emergencies, providing immediate liquidity for unforeseen expenses, while sinking funds are thematic savings buckets designed for planned future expenses, such as vacations or home repairs. Utilizing distinct savings buckets enhances financial organization and ensures dedicated funds are available without compromising emergency reserves.

Future-Proof Sinking Fund

A Future-Proof Sinking Fund strategically allocates savings for anticipated large expenses, ensuring funds grow over time and minimize financial shock. Unlike an Emergency Fund designed for unpredictable crises, the sinking fund is optimized for planned costs like home repairs or vehicle replacement, offering targeted financial readiness and enhanced budget management.

Just-In-Case Liquidity

An emergency fund provides immediate, just-in-case liquidity to cover unexpected financial shocks like medical emergencies or sudden job loss, ensuring quick access to cash without penalties. In contrast, a sinking fund is a planned savings strategy for future expenses, lacking the instant availability that makes an emergency fund crucial for urgent monetary needs.

Event-Based Fund Allocation

Emergency funds provide immediate liquidity for unexpected financial crises like medical emergencies or job loss, while sinking funds allocate money gradually to planned future expenses such as vacations, home repairs, or car replacements. Event-based fund allocation distinguishes these by targeting emergency funds for unforeseen events and sinking funds for predictable, non-urgent costs.

Hybrid Buffer Strategy

An Emergency Fund is designed to cover unexpected expenses like medical emergencies or job loss, while a Sinking Fund allocates money for planned future expenses such as car repairs or vacations. Implementing a Hybrid Buffer Strategy combines both funds, ensuring immediate liquidity for emergencies and systematic savings for anticipated costs, optimizing financial stability and cash flow management.

Emergency Fund vs Sinking Fund for future expenses. Infographic

moneydiff.com

moneydiff.com