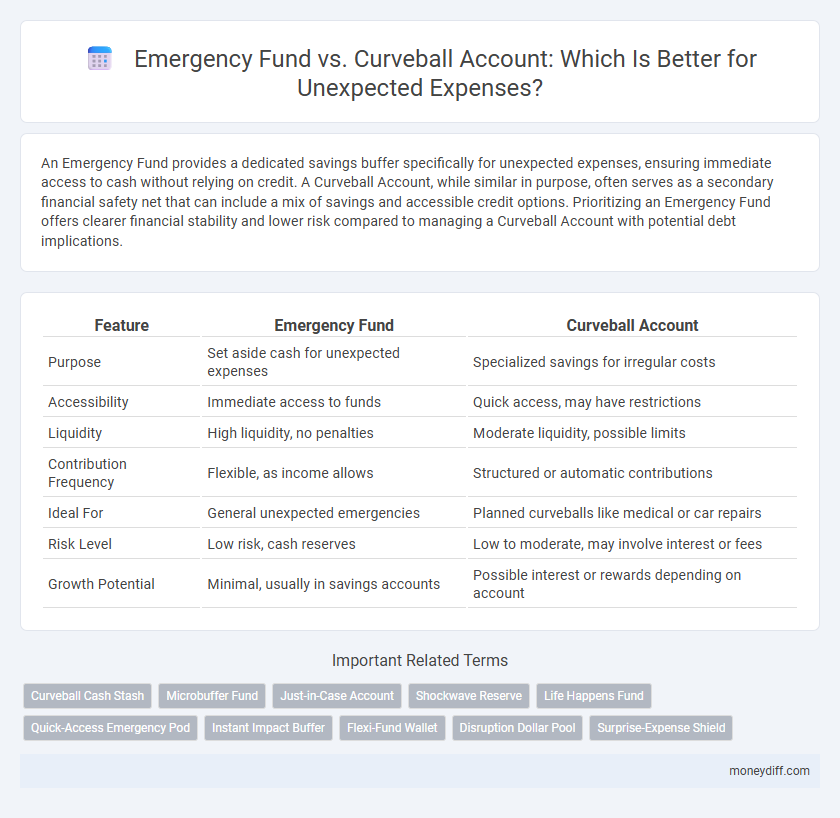

An Emergency Fund provides a dedicated savings buffer specifically for unexpected expenses, ensuring immediate access to cash without relying on credit. A Curveball Account, while similar in purpose, often serves as a secondary financial safety net that can include a mix of savings and accessible credit options. Prioritizing an Emergency Fund offers clearer financial stability and lower risk compared to managing a Curveball Account with potential debt implications.

Table of Comparison

| Feature | Emergency Fund | Curveball Account |

|---|---|---|

| Purpose | Set aside cash for unexpected expenses | Specialized savings for irregular costs |

| Accessibility | Immediate access to funds | Quick access, may have restrictions |

| Liquidity | High liquidity, no penalties | Moderate liquidity, possible limits |

| Contribution Frequency | Flexible, as income allows | Structured or automatic contributions |

| Ideal For | General unexpected emergencies | Planned curveballs like medical or car repairs |

| Risk Level | Low risk, cash reserves | Low to moderate, may involve interest or fees |

| Growth Potential | Minimal, usually in savings accounts | Possible interest or rewards depending on account |

Understanding Emergency Funds: Purpose and Importance

Emergency funds are specifically designed to cover unexpected expenses such as medical emergencies, car repairs, or sudden job loss, providing financial stability and peace of mind. Unlike a Curveball Account, which often serves as a flexible savings tool for irregular expenses, an emergency fund prioritizes liquidity and accessibility in true crisis situations. Maintaining an emergency fund with three to six months' worth of living expenses ensures preparedness for financial disruptions without incurring debt.

What is a Curveball Account?

A Curveball Account is a dedicated savings fund designed specifically for unexpected expenses that fall outside the scope of a traditional emergency fund, such as last-minute travel or unique medical costs. Unlike an emergency fund which covers essential and urgent financial needs, a Curveball Account provides flexibility for irregular, surprise expenses that don't qualify as true emergencies but can still disrupt your budget. This account helps maintain financial stability by preventing non-critical surprises from depleting essential emergency savings.

Key Differences Between Emergency Funds and Curveball Accounts

Emergency funds are liquid savings set aside specifically for major unexpected expenses, typically covering three to six months of essential living costs, while curveball accounts are more flexible funds designed for minor, unpredictable financial surprises. Emergency funds prioritize stability and quick access to cash, ensuring financial security during significant crises, whereas curveball accounts allow for discretionary spending on smaller, less urgent incidents. The key difference lies in their intended use and funding strategy: emergency funds target critical emergencies with strict guidelines, while curveball accounts accommodate irregular, lower-impact expenses with more relaxed parameters.

When to Use an Emergency Fund vs. a Curveball Account

An Emergency Fund is designed for true crises like job loss or major medical bills, providing a financial safety net for high-impact, unforeseen events. A Curveball Account serves smaller, irregular expenses such as car repairs or home maintenance, preventing disruption to your primary budget. Use the Emergency Fund for rare, significant financial shocks and the Curveball Account for routine but unexpected costs to maintain overall financial stability.

Pros and Cons of Emergency Funds

Emergency funds provide immediate liquidity, typically covering three to six months of essential expenses, which ensures financial stability during unexpected events and protects against high-interest debt. However, these funds can lose value over time due to inflation and often offer lower returns compared to other savings vehicles, limiting long-term growth potential. Managing an emergency fund requires discipline to avoid dipping into it for non-urgent expenses, maintaining its purpose solely for true financial emergencies.

Pros and Cons of Curveball Accounts

Curveball Accounts offer a flexible approach to handling unexpected expenses by allowing users to set aside funds specifically for unplanned costs, often with fewer restrictions than traditional savings accounts. They provide quick access and can help avoid high-interest debt, but may lack the interest benefits and formal structure of dedicated emergency funds. However, their less regulated nature can lead to inconsistent savings discipline and potential difficulty in covering major emergencies fully.

How Much to Save: Emergency Fund vs. Curveball Account

Emergency funds typically recommend saving three to six months' worth of essential living expenses to cover significant emergencies like job loss or medical crises. In contrast, a curveball account is designed for smaller, unpredictable expenses and usually requires a smaller balance, often one to two months' expenses or a fixed amount like $1,000. Allocating funds accordingly ensures both major emergencies and minor financial surprises are managed without disrupting daily finances.

Common Unexpected Expenses: Which Account to Tap Into?

Common unexpected expenses such as medical bills, car repairs, and urgent home maintenance require immediate financial attention and are best managed through an emergency fund due to its liquidity and safety. Curveball accounts, designed for less predictable or unusual financial surprises, often carry higher risk or limited access compared to emergency funds. Prioritizing emergency fund withdrawals for routine urgent costs preserves curveball accounts for rare, high-impact financial challenges.

Steps to Set Up Emergency Funds and Curveball Accounts

To set up an emergency fund, start by calculating three to six months of essential living expenses and open a high-yield savings account dedicated to this purpose. For a Curveball Account, identify potential irregular or unexpected costs outside standard emergencies, allocate a separate savings pool, and regularly contribute to maintain its balance. Automate transfers for both accounts to ensure consistent growth and readiness for unforeseen financial challenges.

Choosing the Right Strategy for Financial Resilience

An Emergency Fund provides immediate access to liquid cash, essential for urgent expenses without incurring debt, while a Curveball Account offers a more flexible, variable reserve tailored for unpredictable financial disruptions. Prioritizing the Emergency Fund ensures a fixed, reliable safety net, whereas the Curveball Account enhances adaptability by accommodating fluctuating needs. Strategically combining both can optimize financial resilience, balancing stability with flexibility for comprehensive protection.

Related Important Terms

Curveball Cash Stash

Curveball Cash Stash offers a specialized emergency fund solution designed to cover unexpected expenses with flexible access and tailored saving goals. Unlike traditional emergency funds, Curveball Cash Stash provides automated contributions and instant withdrawal options, ensuring quick financial support during unforeseen situations.

Microbuffer Fund

A Microbuffer Fund within an Emergency Fund offers targeted financial security for small, unexpected expenses, enhancing cash flow management without disrupting long-term savings. Unlike a Curveball Account, which covers larger or unpredictable costs, the Microbuffer Fund ensures immediate access to minor emergency cash, reducing reliance on credit or loans.

Just-in-Case Account

A Just-in-Case Account, also known as a Curveball Account, is a dedicated savings fund meant specifically for unexpected expenses, providing more flexibility than a traditional Emergency Fund by allowing access to funds for a wider range of unplanned financial situations. Unlike a strict Emergency Fund, this account prioritizes readiness for any curveballs life throws, ensuring financial stability without the constraints of rigid withdrawal rules.

Shockwave Reserve

Shockwave Reserve offers a specialized approach to managing unexpected expenses by providing immediate liquidity tailored for sudden financial shocks, unlike traditional Emergency Funds which may be broader but less accessible. Its design prioritizes quick fund availability and higher flexibility, making it a more efficient tool for handling curveball financial emergencies.

Life Happens Fund

Life Happens Fund provides a flexible alternative to traditional Emergency Funds by allowing withdrawals for unexpected expenses without penalties, unlike a Curveball Account which often restricts access or imposes fees. Its semantic optimization targets practical financial resilience, emphasizing immediate liquidity and ease of use during unforeseen life events.

Quick-Access Emergency Pod

A Quick-Access Emergency Pod within an Emergency Fund offers immediate liquidity for unforeseen expenses, ensuring funds are available without penalties or delays. Unlike a Curveball Account, which may have restrictions or longer access times, this pod prioritizes speed and ease of withdrawal to cover urgent financial needs effectively.

Instant Impact Buffer

An Emergency Fund provides a secured financial cushion with immediate liquidity for unplanned expenses, while a Curveball Account offers more flexible access but may involve delayed availability. The Instant Impact Buffer within an Emergency Fund ensures rapid deployment of cash to handle urgent costs without disrupting long-term savings or incurring debt.

Flexi-Fund Wallet

The Flexi-Fund Wallet combines the reliability of an Emergency Fund with the adaptability of a Curveball Account, offering instant access and flexible use for unexpected expenses. Its seamless digital platform ensures funds are readily available without penalties, optimizing financial preparedness and peace of mind.

Disruption Dollar Pool

An Emergency Fund provides immediate liquidity for unexpected expenses, serving as a reliable Disruption Dollar Pool to cover urgent financial disruptions without incurring debt. In contrast, a Curveball Account is a specialized reserve designed for irregular, less predictable disruptions, complementing but not replacing the steady availability of an Emergency Fund.

Surprise-Expense Shield

An Emergency Fund serves as a reliable Surprise-Expense Shield by providing immediate cash reserves for unforeseen costs, ensuring financial stability during emergencies. In contrast, a Curveball Account, often a specialized savings account, targets unpredictable expenses but may lack the liquidity and accessibility that an Emergency Fund offers.

Emergency Fund vs Curveball Account for unexpected expenses. Infographic

moneydiff.com

moneydiff.com