An Emergency Fund is a dedicated savings pool designed to cover unexpected, significant expenses such as medical emergencies or major car repairs, providing financial security during crises. In contrast, a Rainy Day Jar is typically a smaller, more accessible stash for minor, day-to-day expenses like small home fixes or casual unexpected costs. Prioritizing an Emergency Fund ensures long-term stability, while the Rainy Day Jar offers quick cash flow for minor financial hiccups.

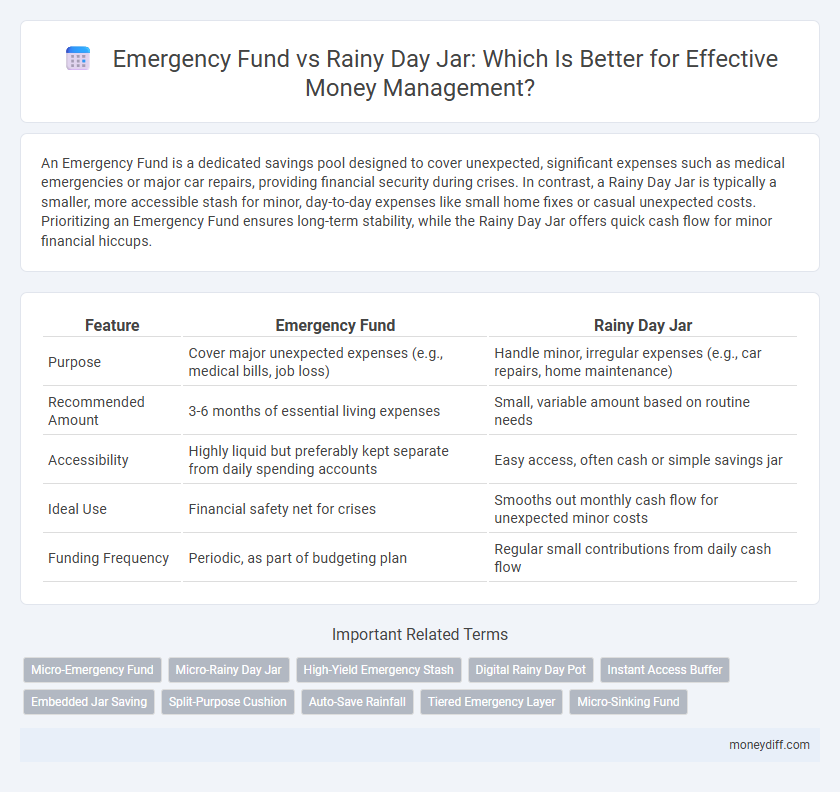

Table of Comparison

| Feature | Emergency Fund | Rainy Day Jar |

|---|---|---|

| Purpose | Cover major unexpected expenses (e.g., medical bills, job loss) | Handle minor, irregular expenses (e.g., car repairs, home maintenance) |

| Recommended Amount | 3-6 months of essential living expenses | Small, variable amount based on routine needs |

| Accessibility | Highly liquid but preferably kept separate from daily spending accounts | Easy access, often cash or simple savings jar |

| Ideal Use | Financial safety net for crises | Smooths out monthly cash flow for unexpected minor costs |

| Funding Frequency | Periodic, as part of budgeting plan | Regular small contributions from daily cash flow |

Understanding Emergency Funds and Rainy Day Jars

Emergency funds and rainy day jars both serve as financial safety nets but differ in purpose and scope. Emergency funds are typically larger savings designed to cover significant unexpected expenses like medical emergencies or job loss, often covering three to six months of living costs. Rainy day jars hold smaller amounts of money intended for minor, everyday financial surprises such as car repairs or home maintenance.

Key Differences Between Emergency Funds and Rainy Day Jars

Emergency funds typically hold three to six months' worth of essential living expenses, providing financial security against major unexpected events like job loss or medical emergencies. Rainy day jars are smaller, easily accessible cash reserves intended for minor, short-term costs such as car repairs or home maintenance. Emergency funds require a higher balance and stricter withdrawal discipline, whereas rainy day jars allow more flexibility for frequent, less critical expenses.

When to Use an Emergency Fund

An Emergency Fund is specifically designed for unexpected, significant financial crises such as medical emergencies, job loss, or major home repairs, whereas a Rainy Day Jar covers smaller, routine expenses like minor car maintenance or occasional bills. Use an Emergency Fund only when expenses are urgent and unavoidable, ensuring you maintain financial stability without resorting to high-interest debt. This fund typically holds three to six months' worth of living expenses to provide sufficient coverage during prolonged financial disruptions.

Ideal Uses for a Rainy Day Jar

A Rainy Day Jar is ideal for covering small, unexpected expenses such as minor car repairs, medical co-pays, or household supplies, providing quick access to cash without disrupting long-term savings goals. Unlike a comprehensive Emergency Fund designed for major financial crises, this jar supports everyday contingencies that can prevent larger financial setbacks. Maintaining a Rainy Day Jar enhances overall money management by promoting disciplined, incremental savings for routine, unplanned costs.

Building Your Emergency Fund: Step-by-Step Guide

Building your emergency fund begins by setting a clear savings goal, ideally covering three to six months of essential expenses to ensure financial security during unexpected events. Prioritize automatic transfers into a high-yield savings account to steadily grow the fund, distinguishing it from a rainy day jar, which is typically smaller and meant for minor, short-term expenses. Regularly reassess your budget and fund status to adjust contributions, ensuring your emergency reserve remains adequate for true financial emergencies.

Simple Strategies to Grow a Rainy Day Jar

A Rainy Day Jar serves as a flexible, easily accessible cash reserve for minor unexpected expenses, complementing a more comprehensive Emergency Fund designed for significant financial crises. Simple strategies to grow a Rainy Day Jar include setting aside small, consistent amounts from paychecks, adding spare change daily, and redirecting small windfalls like cashback or refunds. Keeping the jar in a visible place encourages regular contributions and helps maintain a steady accumulation of funds for short-term needs.

Pros and Cons: Emergency Fund vs Rainy Day Jar

An emergency fund provides a dedicated, larger cash reserve to cover unexpected, significant expenses like medical bills or job loss, ensuring long-term financial security; however, it may require more time to build. A rainy day jar is a smaller, more accessible stash intended for minor, short-term expenses such as car repairs or household fixes, offering convenience but limited protection against major financial crises. Balancing both methods allows for comprehensive money management by addressing both immediate small costs and unforeseen, substantial emergencies.

How Much Should You Save in Each Fund?

Emergency funds typically require saving three to six months' worth of essential living expenses, ensuring financial stability during extended income disruptions, while a rainy day jar is designed to cover smaller, unexpected costs like car repairs or minor medical bills, usually amounting to a few hundred dollars. Prioritize building the emergency fund first to safeguard against significant financial crises, then allocate additional savings to the rainy day jar for short-term, unpredictable expenses. Maintaining clear distinctions between these funds improves money management and prevents premature depletion of critical savings.

Common Mistakes in Managing Your Funds

Mixing emergency funds with a rainy day jar causes confusion and weakens financial preparedness by blurring short-term urgent needs with less critical expenses. Common mistakes include underfunding the emergency fund due to over-allocating money to minor discretionary expenses tracked in a rainy day jar. Overlooking clear distinctions leads to inadequate liquidity during true emergencies, resulting in reliance on high-interest debt or financial stress.

Choosing the Right Option for Your Financial Security

Emergency funds provide a financial safety net with at least three to six months' worth of living expenses, offering robust protection during significant life disruptions such as job loss or medical emergencies. Rainy day jars, in contrast, target smaller, short-term expenses like car repairs or minor home maintenance, promoting accessible and immediate cash reserves. Selecting between an emergency fund and a rainy day jar depends on your financial stability, monthly income variability, and risk tolerance to ensure long-term security and short-term liquidity.

Related Important Terms

Micro-Emergency Fund

A Micro-Emergency Fund is a small, easily accessible cash reserve designed to cover immediate, minor unexpected expenses, differing from a larger Emergency Fund which targets more significant financial crises. Unlike a Rainy Day Jar, which often holds money for irregular but planned non-emergency costs, a Micro-Emergency Fund prioritizes quick liquidity to maintain financial stability during sudden small-scale disruptions.

Micro-Rainy Day Jar

A Micro-Rainy Day Jar is a small, easily accessible savings fund designed to cover minor unexpected expenses, complementing a larger Emergency Fund that safeguards against significant financial crises. This dual approach enhances money management by addressing both everyday financial hiccups and major emergencies, ensuring continuous financial stability.

High-Yield Emergency Stash

A High-Yield Emergency Fund offers superior interest rates compared to a traditional Rainy Day Jar, maximizing growth while ensuring liquidity for unexpected expenses. Unlike low-yield cash jars, these funds are typically held in high-yield savings accounts or money market funds, balancing quick access with optimized returns.

Digital Rainy Day Pot

A Digital Rainy Day Pot offers a flexible, easily accessible solution for short-term unexpected expenses, complementing a traditional Emergency Fund designed for major financial crises. Integrating automated savings features and instant transfers, Digital Rainy Day Pots enhance money management by encouraging regular contributions and immediate access without disrupting long-term emergency reserves.

Instant Access Buffer

An Emergency Fund provides a larger financial safety net for unforeseen major expenses, typically held in a high-yield savings account for quick access during crises. The Rainy Day Jar serves as an instant access buffer for smaller, everyday unexpected costs, ensuring immediate liquidity without compromising the main Emergency Fund's stability.

Embedded Jar Saving

Emergency funds prioritize covering essential expenses for extended financial crises, while rainy day jars target minor, unexpected costs; embedded jar saving integrates these concepts by automatically allocating money into segmented virtual jars, enhancing disciplined and goal-specific money management. This method leverages digital tools to optimize savings behavior, ensuring readiness for both short-term disruptions and long-term emergencies.

Split-Purpose Cushion

An Emergency Fund is designed to cover significant, unexpected expenses like medical bills or job loss, whereas a Rainy Day Jar handles smaller, routine surprises such as car repairs or home maintenance. Splitting funds between these two cushions enhances financial stability by ensuring liquidity for both major crises and minor setbacks.

Auto-Save Rainfall

Emergency Fund typically involves a larger, long-term financial buffer for unexpected expenses, while a Rainy Day Jar serves as a smaller, short-term savings tool for minor emergencies. Auto-Save Rainfall enhances both methods by automatically transferring spare change or small amounts into designated accounts, optimizing consistent savings without manual effort.

Tiered Emergency Layer

A Tiered Emergency Layer structure divides funds into multiple categories based on urgency and amount, distinguishing between a highly liquid Rainy Day Jar for minor, short-term emergencies and a larger, more comprehensive Emergency Fund for significant, unexpected financial crises. This approach optimizes money management by ensuring immediate access to small cash reserves while building a robust financial safety net for prolonged income disruptions or major expenses.

Micro-Sinking Fund

A Micro-Sinking Fund is a targeted savings approach within the broader Emergency Fund strategy, allowing individuals to allocate small, specific amounts for anticipated minor expenses without depleting the main emergency savings. Unlike a Rainy Day Jar, which often serves for unexpected small costs, Micro-Sinking Funds enhance financial discipline by categorizing and earmarking funds for precise short-term financial goals.

Emergency Fund vs Rainy Day Jar for money management Infographic

moneydiff.com

moneydiff.com