An Emergency Fund provides a financial safety net for unexpected expenses, ensuring immediate access to cash during crises such as sudden pet medical emergencies. A Freedom Fund, on the other hand, is a choice-driven reserve aimed at enhancing lifestyle flexibility and opportunities, like planned pet care upgrades or future pet-related adventures. Prioritizing an Emergency Fund establishes security, while a Freedom Fund supports intentional spending, making both essential for balanced financial planning.

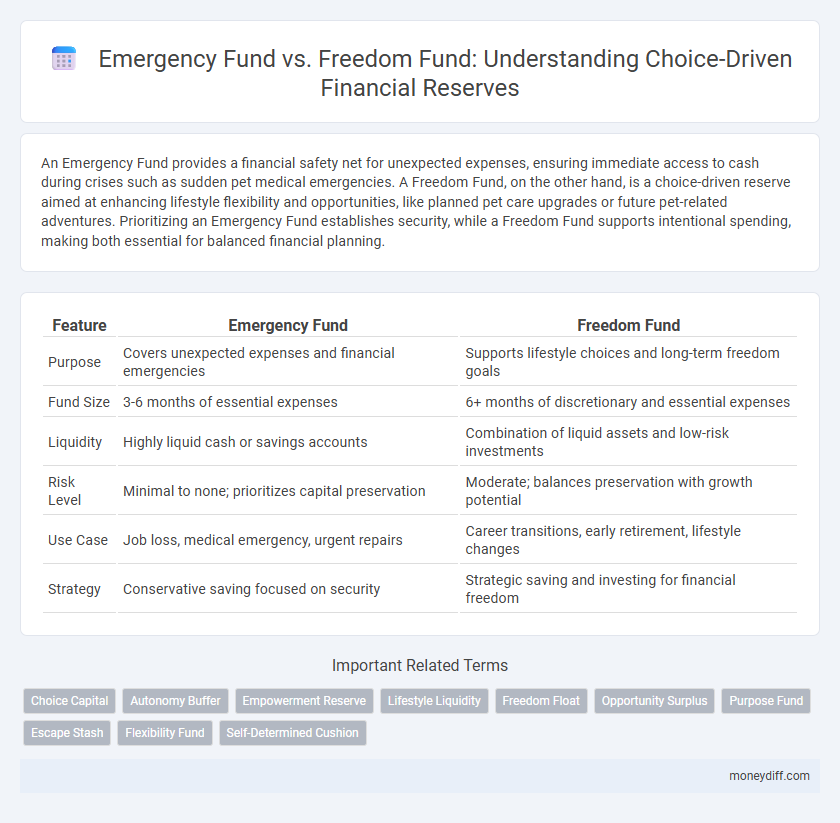

Table of Comparison

| Feature | Emergency Fund | Freedom Fund |

|---|---|---|

| Purpose | Covers unexpected expenses and financial emergencies | Supports lifestyle choices and long-term freedom goals |

| Fund Size | 3-6 months of essential expenses | 6+ months of discretionary and essential expenses |

| Liquidity | Highly liquid cash or savings accounts | Combination of liquid assets and low-risk investments |

| Risk Level | Minimal to none; prioritizes capital preservation | Moderate; balances preservation with growth potential |

| Use Case | Job loss, medical emergency, urgent repairs | Career transitions, early retirement, lifestyle changes |

| Strategy | Conservative saving focused on security | Strategic saving and investing for financial freedom |

Understanding Emergency Funds: Safety Nets for Life’s Uncertainties

Emergency funds serve as crucial safety nets designed to cover unexpected expenses such as medical emergencies, car repairs, or sudden job loss, typically recommended to hold three to six months' worth of living expenses. In contrast, freedom funds focus on providing financial independence and lifestyle choices, enabling individuals to pursue personal goals without immediate income concerns. Prioritizing an emergency fund establishes a secure financial foundation that supports stability during life's uncertainties before allocating resources toward a freedom fund.

What Is a Freedom Fund? Empowering Financial Choices

A Freedom Fund is a financial reserve designed to empower individuals with the flexibility to pursue choices without being constrained by immediate financial pressures, unlike a traditional Emergency Fund that primarily covers unexpected expenses. This fund supports proactive decisions such as changing careers, starting a business, or taking sabbaticals by providing a cushion that enables calculated risks and personal growth. Building a Freedom Fund emphasizes intentional saving aimed at long-term freedom rather than just safety, enhancing financial empowerment and life autonomy.

Emergency Fund vs Freedom Fund: Key Differences Explained

An Emergency Fund is designed to cover unexpected expenses like medical bills or car repairs, typically amounting to three to six months of living expenses to ensure financial stability during crises. In contrast, a Freedom Fund aims to provide long-term financial independence, supporting lifestyle choices or career changes without immediate income, often requiring a larger savings target based on personal goals. Understanding these key differences helps individuals tailor their savings strategy to balance immediate security with future flexibility.

The Purpose of an Emergency Fund: Security and Stability

An emergency fund provides financial security and stability by covering unexpected expenses such as medical emergencies, car repairs, or job loss, ensuring individuals avoid debt during crises. A freedom fund, in contrast, is designed to support lifestyle choices and pursue personal goals without financial constraints. Prioritizing an emergency fund establishes a safety net that protects against financial shocks and lays the foundation for long-term fiscal resilience.

Defining a Freedom Fund: Enabling Lifestyle Flexibility

A Freedom Fund is a choice-driven reserve designed to provide lifestyle flexibility beyond basic emergency expenses, enabling individuals to pursue opportunities without financial constraint. Unlike a traditional Emergency Fund, which covers essential unexpected costs like medical bills or job loss, a Freedom Fund supports discretionary spending such as career changes, travel, or personal development. Building a Freedom Fund empowers greater financial autonomy by funding intentional life decisions rather than solely reacting to crises.

How Much Should You Save in Each Fund? Setting Target Amounts

Emergency funds typically target three to six months of essential living expenses to cover unexpected financial emergencies, ensuring immediate liquidity and peace of mind. Freedom funds, by contrast, aim for a higher savings threshold that supports lifestyle choices and long-term financial independence, often equivalent to one to two years of discretionary and fixed expenses. Setting precise target amounts depends on individual risk tolerance, income stability, and personal goals, with emergency funds prioritized for safety and freedom funds focused on expanding financial options.

When to Use an Emergency Fund and When to Tap the Freedom Fund

An Emergency Fund is essential for covering unexpected expenses like medical emergencies, urgent car repairs, or sudden job loss, ensuring immediate financial stability. The Freedom Fund, on the other hand, is designed for choice-driven opportunities such as career changes, entrepreneurship, or sabbaticals, providing financial flexibility without stress. Use the Emergency Fund strictly for unplanned crises, while the Freedom Fund supports proactive life decisions that enhance long-term personal and financial growth.

Building Both Funds: Steps for Dual Savings Success

Building both an Emergency Fund and a Freedom Fund requires setting clear financial goals and automating consistent contributions to each account. Prioritize the Emergency Fund to cover 3-6 months of essential expenses for immediate financial security, while simultaneously allocating funds toward the Freedom Fund to support long-term aspirations and lifestyle choices. Regularly review and adjust contribution amounts based on changing income, expenses, and personal priorities to maintain a balanced and effective dual savings strategy.

Psychological Benefits: Peace of Mind vs Personal Empowerment

An Emergency Fund offers peace of mind by providing a financial safety net for unexpected expenses, reducing stress and anxiety during crises. In contrast, a Freedom Fund emphasizes personal empowerment, encouraging proactive financial choices that enable greater control over one's lifestyle and opportunities. Both funds support mental well-being but differ in motivation--security versus self-directed freedom.

Common Mistakes: Mixing Up Emergency and Freedom Funds

Confusing emergency funds with freedom funds often leads to financial mismanagement, as emergency funds are strictly for unexpected expenses like medical emergencies or urgent repairs, whereas freedom funds support lifestyle choices such as sabbaticals or career shifts. Mixing these reserves can deplete emergency funds prematurely, compromising financial security during crises. Maintaining separate accounts ensures clear allocation, preserving true liquidity for emergencies and dedicated savings for personal freedom goals.

Related Important Terms

Choice Capital

Emergency Fund primarily covers unexpected expenses, ensuring financial stability during crises, while Freedom Fund focuses on choice-driven reserves supporting personal opportunities and lifestyle flexibility. Choice Capital optimizes fund allocation by balancing immediate security with long-term freedom, empowering individuals to tailor reserves for both necessity and aspiration.

Autonomy Buffer

An Emergency Fund covers unexpected expenses while an Autonomy Buffer within a Freedom Fund expands financial choice by sustaining lifestyle preferences during periods of uncertainty. Prioritizing an Autonomy Buffer enhances personal freedom by enabling proactive decisions rather than reactive spending during crises.

Empowerment Reserve

An Emergency Fund provides immediate financial security for unexpected expenses, while a Freedom Fund, also known as an Empowerment Reserve, offers a choice-driven reserve that empowers individuals to pursue opportunities without financial constraint. Prioritizing an Empowerment Reserve enhances financial independence by supporting proactive decision-making beyond mere survival.

Lifestyle Liquidity

An Emergency Fund provides essential Lifestyle Liquidity by covering unexpected expenses and safeguarding financial stability during crises, while a Freedom Fund offers choice-driven reserves that empower flexibility for lifestyle changes and personal growth opportunities. Prioritizing both funds balances immediate security with long-term financial freedom, ensuring comprehensive liquidity tailored to varying life scenarios.

Freedom Float

Freedom Float emphasizes flexibility and growth potential in choice-driven reserves by allowing funds to be allocated beyond immediate emergencies, supporting lifestyle goals and financial independence. Unlike a traditional Emergency Fund, which prioritizes liquidity and safety for unforeseen expenses, a Freedom Float balances risk and opportunity to empower long-term financial freedom.

Opportunity Surplus

An Emergency Fund provides immediate liquidity for unexpected expenses, ensuring financial stability, while a Freedom Fund serves as a choice-driven reserve enabling investment in opportunity surplus scenarios that maximize long-term wealth growth. Balancing both funds allows individuals to mitigate risk while capitalizing on high-return opportunities without compromising financial security.

Purpose Fund

An Emergency Fund serves as a safety net for unexpected expenses such as medical bills or car repairs, ensuring financial stability during crises. In contrast, a Freedom Fund focuses on choice-driven reserves that enable life decisions like career changes or early retirement, emphasizing long-term financial independence rather than immediate necessity.

Escape Stash

Escape Stash serves as a choice-driven reserve, blending the security of an Emergency Fund with the flexibility of a Freedom Fund by allowing individuals to allocate funds for both unexpected expenses and personal freedom goals. This hybrid approach optimizes financial resilience by maintaining liquidity for emergencies while fostering opportunities for intentional life choices.

Flexibility Fund

Flexibility Fund prioritizes adaptable liquid assets that can cover both unexpected expenses and lifestyle choices, unlike traditional Emergency Funds which focus solely on essential safety nets. This approach combines financial security with personal freedom, allowing choice-driven reserves to support a wider range of financial goals.

Self-Determined Cushion

An Emergency Fund serves as a vital financial buffer designed to cover unforeseen expenses, while a Freedom Fund represents a choice-driven reserve that empowers individuals with greater self-determination over their financial future. The Self-Determined Cushion within these funds emphasizes flexible savings that align with personal goals, providing both security and the autonomy to pursue opportunities without reliance on external circumstances.

Emergency Fund vs Freedom Fund for choice-driven reserves. Infographic

moneydiff.com

moneydiff.com