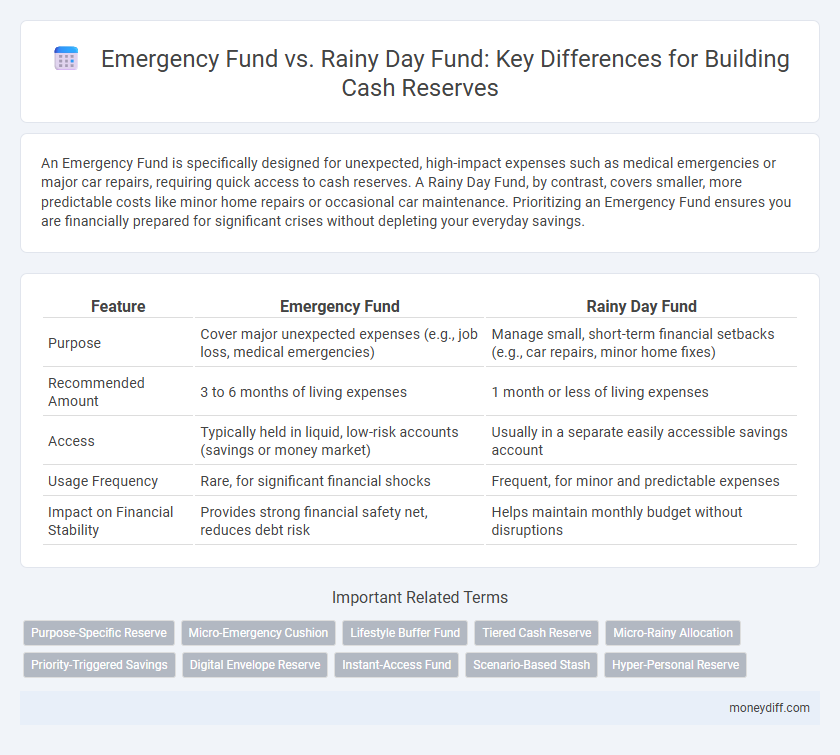

An Emergency Fund is specifically designed for unexpected, high-impact expenses such as medical emergencies or major car repairs, requiring quick access to cash reserves. A Rainy Day Fund, by contrast, covers smaller, more predictable costs like minor home repairs or occasional car maintenance. Prioritizing an Emergency Fund ensures you are financially prepared for significant crises without depleting your everyday savings.

Table of Comparison

| Feature | Emergency Fund | Rainy Day Fund |

|---|---|---|

| Purpose | Cover major unexpected expenses (e.g., job loss, medical emergencies) | Manage small, short-term financial setbacks (e.g., car repairs, minor home fixes) |

| Recommended Amount | 3 to 6 months of living expenses | 1 month or less of living expenses |

| Access | Typically held in liquid, low-risk accounts (savings or money market) | Usually in a separate easily accessible savings account |

| Usage Frequency | Rare, for significant financial shocks | Frequent, for minor and predictable expenses |

| Impact on Financial Stability | Provides strong financial safety net, reduces debt risk | Helps maintain monthly budget without disruptions |

Understanding Emergency Fund vs Rainy Day Fund

An Emergency Fund is a dedicated cash reserve designed to cover significant, unexpected financial crises such as job loss, medical emergencies, or major home repairs. A Rainy Day Fund, in contrast, addresses smaller, less severe expenses like minor car repairs or temporary increases in utility bills. Understanding the distinct purposes of these funds ensures proper allocation of savings, enhancing financial resilience and preventing debt accumulation during unforeseen events.

Key Differences Between Emergency and Rainy Day Funds

Emergency funds are designed to cover significant unexpected financial crises such as job loss, medical emergencies, or major home repairs, typically requiring three to six months' worth of living expenses. Rainy day funds focus on smaller, less severe expenses like car repairs or minor home maintenance, usually maintained with one to two months' worth of cash reserves. The key difference lies in their purpose and size, with emergency funds providing long-term financial security and rainy day funds offering short-term liquidity for routine unexpected costs.

Purpose: Emergency Fund and Rainy Day Fund Explained

An Emergency Fund is designed to cover significant, unexpected expenses such as medical emergencies, job loss, or major repairs, providing financial stability during critical crises. A Rainy Day Fund, by contrast, is intended for smaller, less severe financial needs like minor car repairs or household maintenance, offering a buffer for routine, irregular costs. Differentiating these funds ensures adequate cash reserves tailored to both sudden emergencies and predictable, smaller financial setbacks.

How Much Should You Save in Each Fund?

An emergency fund typically requires saving three to six months' worth of essential living expenses to cover major unexpected events like job loss or medical emergencies. A rainy day fund, by contrast, usually consists of a smaller cash reserve equal to one to two months of discretionary expenses for minor, short-term financial setbacks. Prioritizing the size of each fund depends on individual risk tolerance, income stability, and monthly expenses, ensuring adequate liquidity to handle both large-scale crises and everyday surprises.

Situations: When to Use an Emergency vs Rainy Day Fund

Emergency funds are designed for major financial crises such as job loss, medical emergencies, or unexpected large expenses, providing a safety net that covers three to six months of living expenses. Rainy day funds serve smaller, less urgent cash needs like car repairs, minor home maintenance, or short-term budget shortfalls, typically holding one to two months' worth of expenses. Using the right fund ensures financial stability by matching the reserve size and purpose to the severity and timing of the situation.

Building Your Emergency Fund Efficiently

Building your emergency fund efficiently involves distinguishing it from a rainy day fund, as the emergency fund caters to major unexpected expenses like medical emergencies or job loss, typically covering three to six months of living expenses. A rainy day fund is smaller, designed for minor, short-term disruptions such as car repairs or household maintenance. Prioritizing automatic transfers to a high-yield savings account accelerates growth while maintaining liquidity for urgent access.

Growing a Rainy Day Fund for Small Unexpected Expenses

A Rainy Day Fund specifically addresses small, unexpected expenses like minor car repairs or medical co-pays, providing quick access without disrupting long-term savings. Unlike an Emergency Fund, which targets significant financial crises such as job loss or major home repairs, a Rainy Day Fund helps maintain everyday financial stability. Building this fund with easily accessible cash or liquid assets ensures readiness for routine financial surprises while preserving emergency savings for larger crises.

Where to Keep Your Cash Reserves Safely

Cash reserves for both Emergency Funds and Rainy Day Funds should be stored in highly liquid, low-risk accounts such as high-yield savings accounts or money market accounts to ensure quick access and capital preservation. Emergency Funds typically require larger amounts and longer-term availability, making FDIC-insured savings accounts or short-term certificates of deposit (CDs) suitable options. Rainy Day Funds, designed for smaller, more immediate unexpected expenses, benefit from maintaining cash in checking or easily accessible online savings accounts for instant liquidity.

Mistakes to Avoid With Emergency and Rainy Day Funds

Mistakes to avoid with emergency and rainy day funds include underestimating necessary cash reserves, which can leave individuals unprepared for unexpected expenses like medical bills or job loss. Failing to separate these funds can cause confusion and misuse, reducing financial security during crises. Neglecting to regularly review and replenish these funds risks depleting resources just when they are needed most.

Tips to Successfully Manage Both Cash Reserve Funds

Establish clear guidelines for each cash reserve fund by defining specific purposes: an emergency fund should cover unexpected, significant expenses like medical emergencies, while a rainy day fund targets smaller, predictable costs such as car repairs or minor home maintenance. Automate regular contributions to ensure consistent growth and avoid dipping into funds prematurely by setting minimum balance thresholds and replenishment plans after withdrawals. Review and adjust fund amounts annually based on changing financial obligations and income stability to maintain adequate liquidity for both short-term disruptions and long-term financial security.

Related Important Terms

Purpose-Specific Reserve

An Emergency Fund is a purpose-specific reserve designed to cover essential expenses during unforeseen financial crises, such as job loss or medical emergencies, typically amounting to three to six months of living costs. In contrast, a Rainy Day Fund is a smaller cash reserve intended for minor, short-term expenses like car repairs or home maintenance, ensuring liquidity without disrupting long-term financial plans.

Micro-Emergency Cushion

A Micro-Emergency Cushion serves as a small-scale cash reserve designed for immediate, minor unexpected expenses, typically covering essential costs like transportation or urgent repairs. Unlike broader Emergency Funds or Rainy Day Funds, this cushion focuses on quick access and liquidity for short-term disruptions, enhancing financial resilience without depleting larger savings.

Lifestyle Buffer Fund

The Lifestyle Buffer Fund serves as a crucial component of cash reserves, positioned between the Emergency Fund and Rainy Day Fund by covering non-urgent yet essential expenses like subscriptions, minor car repairs, or seasonal clothing updates. Unlike the strict Emergency Fund designed for severe financial crises, the Lifestyle Buffer Fund provides flexibility to maintain lifestyle continuity without dipping into longer-term savings.

Tiered Cash Reserve

A Tiered Cash Reserve strategy differentiates between an Emergency Fund, designed to cover unexpected, significant financial shocks like job loss or major medical expenses, and a Rainy Day Fund, which addresses smaller, short-term cash needs such as car repairs or minor home maintenance. Allocating cash into these tiers ensures liquidity for immediate, less severe expenses while preserving larger reserves for critical emergencies, optimizing financial resilience and reducing reliance on high-interest debt.

Micro-Rainy Allocation

Emergency funds typically cover three to six months of essential expenses for major unexpected events, while rainy day funds are smaller cash reserves allocated for minor, short-term financial disruptions. Micro-rainy allocation involves setting aside a subset of the rainy day fund for daily, low-impact emergencies, ensuring liquidity without depleting the main emergency savings.

Priority-Triggered Savings

An Emergency Fund is designed for unexpected, high-priority expenses such as medical bills or job loss, whereas a Rainy Day Fund covers smaller, less urgent cash reserves like minor home repairs or car maintenance. Prioritizing savings based on the severity and immediacy of financial needs ensures efficient cash reserve management and financial stability.

Digital Envelope Reserve

Emergency Fund typically covers three to six months of essential living expenses for major financial disruptions, whereas a Rainy Day Fund is a smaller cash reserve for unexpected minor expenses or short-term needs. Digital Envelope Reserve leverages budgeting apps to allocate and manage these funds separately, ensuring precise tracking and optimized cash flow for both emergency and rainy day scenarios.

Instant-Access Fund

An Emergency Fund typically covers 3 to 6 months of essential expenses and is designed for significant, unexpected financial crises, requiring substantial cash reserves with instant accessibility. A Rainy Day Fund, often smaller, targets minor, short-term needs like car repairs or utility bills and also prioritizes instant-access liquidity to avoid credit usage for immediate expenses.

Scenario-Based Stash

An Emergency Fund targets significant financial crises such as job loss or medical emergencies, typically covering 3-6 months of essential expenses, while a Rainy Day Fund addresses smaller, unexpected costs like car repairs or minor home maintenance, usually holding a few hundred to a thousand dollars. Scenario-Based Stash planning differentiates these funds by aligning reserves with specific risk levels, ensuring adequate liquidity tailored to varying financial emergencies.

Hyper-Personal Reserve

An Emergency Fund is a dedicated cash reserve designed to cover significant unexpected expenses such as medical emergencies or job loss, typically holding three to six months of living expenses, whereas a Rainy Day Fund targets smaller, short-term financial setbacks like car repairs or minor home maintenance. Hyper-Personal Reserve supercharges these funds by customizing savings goals based on individual risk profiles, income volatility, and lifestyle needs, ensuring optimized liquidity and financial resilience.

Emergency Fund vs Rainy Day Fund for cash reserves. Infographic

moneydiff.com

moneydiff.com