An emergency fund provides a financial safety net specifically designed to cover unexpected expenses, ensuring stability without derailing long-term goals. FU money, on the other hand, represents a larger sum that allows for greater work flexibility by enabling decisive career moves or quitting unfavorable jobs without immediate financial stress. Prioritizing an emergency fund builds security, while accumulating FU money offers freedom to pursue passion and negotiate better opportunities.

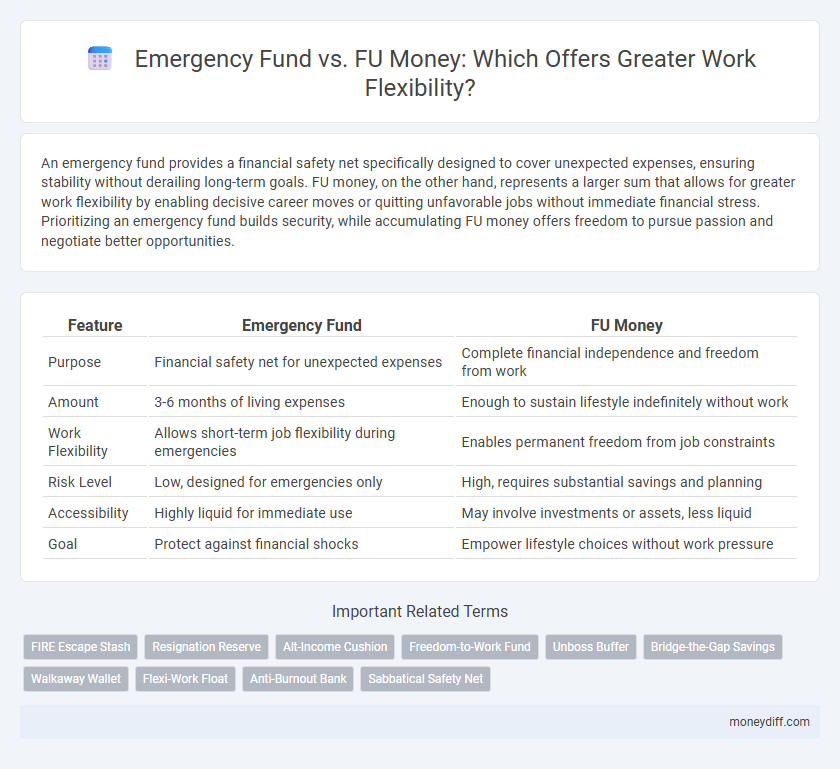

Table of Comparison

| Feature | Emergency Fund | FU Money |

|---|---|---|

| Purpose | Financial safety net for unexpected expenses | Complete financial independence and freedom from work |

| Amount | 3-6 months of living expenses | Enough to sustain lifestyle indefinitely without work |

| Work Flexibility | Allows short-term job flexibility during emergencies | Enables permanent freedom from job constraints |

| Risk Level | Low, designed for emergencies only | High, requires substantial savings and planning |

| Accessibility | Highly liquid for immediate use | May involve investments or assets, less liquid |

| Goal | Protect against financial shocks | Empower lifestyle choices without work pressure |

Defining Emergency Fund vs FU Money

An Emergency Fund consists of three to six months' worth of essential living expenses saved to cover unexpected financial setbacks like medical emergencies or job loss. FU Money refers to a larger, more substantial amount of savings designed to provide complete financial independence, allowing individuals to quit their job or refuse undesirable work without immediate income concerns. While an Emergency Fund emphasizes basic security and short-term resilience, FU Money prioritizes long-term freedom and work flexibility.

Core Purposes: Safety Net vs Financial Freedom

An emergency fund serves as a safety net designed to cover essential expenses during unexpected financial hardships, ensuring stability and peace of mind. FU money represents a larger sum that grants financial freedom, empowering individuals to make bold career choices without fear of immediate income loss. While an emergency fund prioritizes protection and survival, FU money prioritizes autonomy and the ability to exit undesirable work situations confidently.

How to Calculate Your Emergency Fund

An emergency fund typically covers three to six months of essential living expenses, calculated by totaling monthly costs such as housing, utilities, food, transportation, and insurance. To determine the precise amount, multiply your average monthly expenses by the number of months you want to be prepared for, usually between three and six for financial security. Unlike FU money, which aims for complete financial independence, an emergency fund is a focused safety net designed to maintain work flexibility during unforeseen events.

Building FU Money: When and How

Building FU Money requires disciplined savings beyond a standard emergency fund, targeting at least six to twelve months of living expenses to ensure full financial independence and work flexibility. Start by maximizing income streams and minimizing unnecessary expenditures while investing in diversified assets like index funds or real estate for long-term growth. Consistent contributions combined with strategic financial planning accelerate the accumulation of FU Money, empowering individuals to make career decisions without financial constraints.

Key Differences in Savings Strategies

Emergency funds are typically short-term savings designed to cover three to six months of living expenses for unexpected events, providing immediate financial security without disrupting daily life. FU Money refers to a larger, more flexible stash of savings intended to grant long-term independence and the power to leave unsatisfactory work or situations without financial stress. Key differences in savings strategies include the intended use--emergency funds prioritize liquidity and accessibility, while FU Money emphasizes building substantial wealth for freedom and personal choice.

Work Flexibility: Which Fund Supports It Best?

Emergency funds provide essential financial security by covering unexpected expenses and sustaining basic living costs, enabling individuals to maintain job stability during emergencies. FU money, typically a larger sum, offers greater work flexibility by empowering individuals to leave unsatisfactory jobs or negotiate better terms without immediate financial stress. For sustained work flexibility, FU money supports bold career moves, while emergency funds ensure short-term survivability.

Psychological Impact: Peace of Mind vs Empowerment

Emergency funds provide peace of mind by offering financial security during unexpected situations, reducing anxiety and stress related to sudden expenses. FU money, on the other hand, empowers individuals with greater work flexibility and control, granting the psychological freedom to leave undesirable jobs without financial fear. Both financial tools enhance mental well-being, but emergency funds focus on stability, while FU money emphasizes autonomy and empowerment.

Emergency Fund and FU Money: Can You Have Both?

An emergency fund provides financial security by covering essential expenses during unexpected situations, while FU money offers a larger sum for true work flexibility and independence. Maintaining an emergency fund ensures peace of mind for short-term crises, whereas accumulating FU money supports long-term career choices without financial constraints. Balancing both allows individuals to manage immediate risks and pursue freedom in their professional lives effectively.

Prioritizing Your Money Goals Strategically

Emergency funds provide immediate financial security for unexpected expenses, while FU Money offers long-term work flexibility and independence. Prioritizing an emergency fund first ensures basic stability, enabling measured progress toward accumulating FU Money for greater career freedom. Strategic allocation balances short-term protection with future empowerment, optimizing financial resilience and personal autonomy.

Real-Life Scenarios: Choosing the Right Fund

Emergency funds provide immediate financial security during unexpected events like medical emergencies or job loss, ensuring essential expenses are covered without debt. FU money offers greater work flexibility by enabling individuals to leave toxic jobs or pursue passion projects without financial pressure. Real-life scenarios suggest balancing both funds--using emergency savings for urgent needs while building FU money to empower long-term career freedom.

Related Important Terms

FIRE Escape Stash

Emergency Funds provide a critical safety net covering 3-6 months of essential expenses for unexpected job loss or urgent costs, ensuring basic financial security during instability. FU Money, often a larger sum beyond an emergency fund, grants greater work flexibility and autonomy, enabling early retirement or FIRE (Financial Independence, Retire Early) Escape Stash strategies where individuals can leave unsatisfying jobs without financial stress.

Resignation Reserve

An Emergency Fund serves as a Resignation Reserve, providing financial stability during job transitions without immediate income, whereas FU Money offers greater work flexibility by allowing unconditional resignation without financial stress. Maintaining a robust Emergency Fund ensures basic living expenses are covered for 3 to 6 months, supporting measured career moves while FU Money enables bold decisions driven solely by personal priorities.

Alt-Income Cushion

An Emergency Fund provides a critical financial cushion for unforeseen expenses, ensuring stability during income disruptions, while FU Money offers a larger, more flexible reserve enabling decisive career moves without immediate financial worries. Prioritizing an alternate income cushion bridges the gap between basic emergency savings and FU Money, granting enhanced work flexibility and peace of mind.

Freedom-to-Work Fund

An Emergency Fund typically covers 3-6 months of living expenses to provide security during unexpected financial setbacks, while FU Money, also known as a Freedom-to-Work Fund, offers a larger, more robust financial cushion that grants true work flexibility by empowering individuals to quit unfulfilling jobs without immediate income pressure. This Freedom-to-Work Fund enables greater career autonomy and reduces dependence on paycheck-to-paycheck living, fostering long-term financial independence and mental well-being.

Unboss Buffer

An Emergency Fund provides essential financial security by covering unexpected expenses, while FU Money offers greater work flexibility by enabling individuals to make bold career choices without fear of income loss; the Unboss Buffer bridges these concepts by creating a tailored savings plan that supports both stability and independence for unbossed professionals. This strategic approach empowers workers to maintain financial resilience while pursuing entrepreneurial freedom and unconventional work arrangements.

Bridge-the-Gap Savings

Bridge-the-gap savings serves as a crucial financial buffer between an emergency fund and FU money, providing immediate liquidity to cover short-term expenses without compromising long-term wealth-building goals. This intermediate fund supports work flexibility by enabling individuals to take calculated career risks or transition periods without the pressure of depleting essential reserves.

Walkaway Wallet

Emergency Fund provides essential financial cushioning for unexpected expenses, ensuring immediate stability, while FU Money, often represented by a Walkaway Wallet, offers greater work flexibility by empowering individuals to leave unsatisfactory jobs without financial strain. The Walkaway Wallet strategy emphasizes saving a sufficient amount to cover several months of living expenses, granting freedom to make career choices without urgency or pressure.

Flexi-Work Float

Emergency Fund provides short-term financial security covering 3-6 months of essential expenses, essential for immediate crises, while FU Money offers a larger financial buffer enabling true work flexibility and independence from job constraints. Flexi-Work Float leverages FU Money to empower individuals to negotiate flexible schedules or take career breaks without income stress, enhancing long-term career control and personal well-being.

Anti-Burnout Bank

Emergency Funds serve as an Anti-Burnout Bank by providing immediate financial security during unexpected events, enabling work flexibility without the stress of financial instability. FU Money, while offering long-term independence, often requires more substantial savings, making Emergency Funds a practical first step for maintaining mental health and avoiding burnout in uncertain work environments.

Sabbatical Safety Net

An emergency fund typically covers 3 to 6 months of essential expenses, providing a sabbatical safety net that enables work flexibility without financial disruption. FU money, often a larger sum, grants complete independence to leave a job or take extended breaks, but a well-funded emergency stash balances risk management with career adaptability.

Emergency Fund vs FU Money for work flexibility. Infographic

moneydiff.com

moneydiff.com