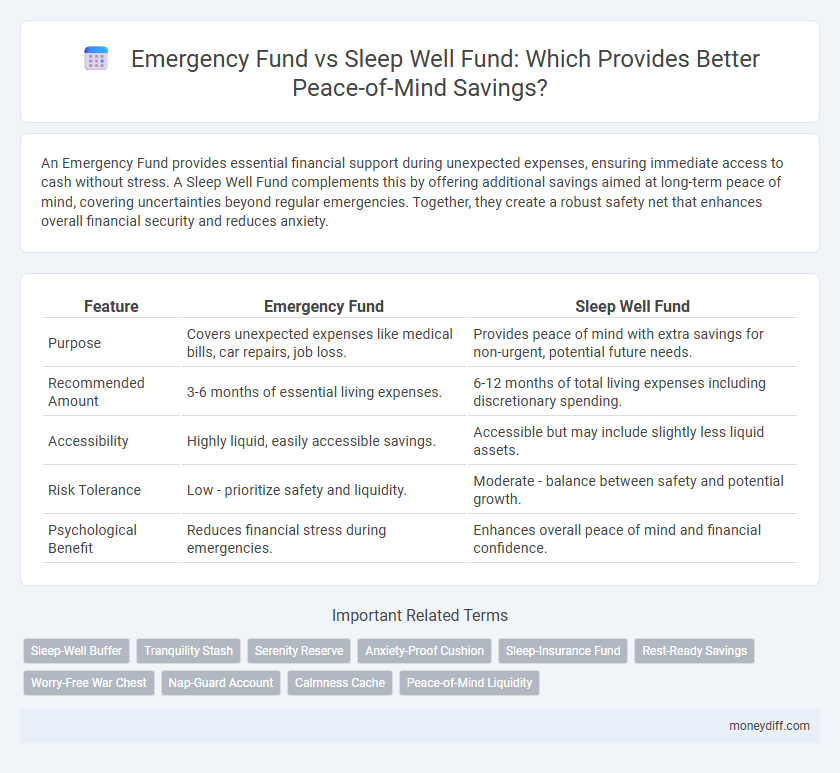

An Emergency Fund provides essential financial support during unexpected expenses, ensuring immediate access to cash without stress. A Sleep Well Fund complements this by offering additional savings aimed at long-term peace of mind, covering uncertainties beyond regular emergencies. Together, they create a robust safety net that enhances overall financial security and reduces anxiety.

Table of Comparison

| Feature | Emergency Fund | Sleep Well Fund |

|---|---|---|

| Purpose | Covers unexpected expenses like medical bills, car repairs, job loss. | Provides peace of mind with extra savings for non-urgent, potential future needs. |

| Recommended Amount | 3-6 months of essential living expenses. | 6-12 months of total living expenses including discretionary spending. |

| Accessibility | Highly liquid, easily accessible savings. | Accessible but may include slightly less liquid assets. |

| Risk Tolerance | Low - prioritize safety and liquidity. | Moderate - balance between safety and potential growth. |

| Psychological Benefit | Reduces financial stress during emergencies. | Enhances overall peace of mind and financial confidence. |

Understanding Emergency Funds: The Basics

An Emergency Fund is a dedicated savings pool designed to cover unexpected expenses such as medical emergencies, car repairs, or job loss, typically amounting to three to six months of living expenses. A Sleep Well Fund, by contrast, extends beyond urgent financial crises and includes savings aimed at reducing stress and ensuring peace of mind through broader financial security. Understanding the fundamental difference helps prioritize building an Emergency Fund first for immediate financial stability before expanding into a Sleep Well Fund for comprehensive peace-of-mind savings.

What Is a Sleep Well Fund?

A Sleep Well Fund is a type of savings account designed to provide peace of mind by covering non-essential but important expenses that reduce financial stress, such as minor home repairs or unexpected medical bills. Unlike an Emergency Fund, which is reserved strictly for true financial crises like job loss or major emergencies, a Sleep Well Fund offers a buffer to handle everyday surprises calmly. This approach helps maintain emotional stability and prevents dipping into long-term savings for smaller, unforeseen costs.

Emergency Fund vs Sleep Well Fund: Key Differences

An Emergency Fund is strictly reserved for unexpected financial crises like medical emergencies, car repairs, or job loss, typically covering three to six months of living expenses. A Sleep Well Fund, however, supplements this by providing extra savings beyond emergencies to offer peace of mind for uncertainties such as market volatility or future lifestyle changes. Both funds enhance financial security, but the Emergency Fund emphasizes immediate necessity while the Sleep Well Fund targets long-term psychological comfort.

Why You Need an Emergency Fund

An Emergency Fund provides crucial financial security by covering unexpected expenses like medical emergencies, car repairs, or job loss, ensuring peace of mind without disrupting daily finances. Unlike a Sleep Well Fund, which is designed for long-term comfort and discretionary spending, an Emergency Fund targets immediate, essential needs to prevent debt accumulation. Maintaining at least three to six months' worth of living expenses in an accessible Emergency Fund safeguards against financial instability and reduces stress during unforeseen crises.

The Psychological Power of a Sleep Well Fund

A Sleep Well Fund provides a distinct psychological advantage over traditional Emergency Funds by offering a dedicated peace-of-mind savings buffer that alleviates financial anxiety. Unlike standard Emergency Funds focused solely on unexpected expenses, Sleep Well Funds prioritize emotional security through accessible, flexible savings tailored to individual stress triggers. This targeted approach enhances mental well-being, fostering long-term financial resilience and confidence in uncertain times.

How Much Should You Save in Each Fund?

An Emergency Fund typically requires three to six months' worth of essential living expenses to cover unexpected financial shocks like job loss or medical emergencies. In contrast, a Sleep Well Fund, designed for peace-of-mind savings, can be smaller--often one to two months' expenses--providing quick access to funds for minor stress-relief purposes. Prioritizing proper allocation between these funds ensures financial stability and emotional comfort in varying situations.

Building Your Emergency Fund: Step-by-Step

Building your Emergency Fund starts with setting a clear savings goal covering three to six months of essential expenses to ensure financial security during unforeseen events. Prioritize automating monthly contributions to steadily grow your fund without disrupting your budget. Regularly review and adjust the fund to reflect changes in living costs or income, enhancing peace of mind and readiness.

Setting Up a Sleep Well Fund for Everyday Peace

Establishing a Sleep Well Fund involves setting aside a dedicated savings amount to cover routine expenses and minor unexpected costs, providing daily financial security and reducing stress. Unlike a traditional Emergency Fund geared toward significant crises, this fund targets peace-of-mind savings for everyday stability and cash flow management. Prioritizing consistent contributions ensures that small disruptions do not derail financial calm or budgeting goals.

Common Mistakes to Avoid with Both Funds

Common mistakes with Emergency Fund and Sleep Well Fund include underestimating the required savings amount, leading to inadequate coverage during crises. Failing to keep these funds liquid and easily accessible hampers timely access when urgent expenses arise. Mixing these funds with regular savings or investments can compromise their purpose, reducing peace of mind and financial stability in emergencies.

Integrating Emergency and Sleep Well Funds for Total Financial Calm

Integrating an Emergency Fund with a Sleep Well Fund creates a comprehensive financial safety net that balances immediate crisis coverage with long-term peace of mind. An Emergency Fund typically covers 3 to 6 months of essential expenses for unforeseen events such as job loss or medical emergencies, while the Sleep Well Fund targets psychological security by addressing potential future financial worries. Combining these funds optimizes liquidity and mental well-being, ensuring total financial calm.

Related Important Terms

Sleep-Well Buffer

The Sleep-Well Fund acts as a psychological safety net by covering non-essential expenses that reduce financial stress, complementing the traditional Emergency Fund which focuses on critical, unforeseen costs like medical bills or job loss. Maintaining a Sleep-Well Buffer ensures peace of mind by providing financial flexibility beyond urgent emergencies, promoting overall mental well-being and stability.

Tranquility Stash

Tranquility Stash offers a unique approach to peace-of-mind savings by blending an Emergency Fund with a Sleep Well Fund, ensuring financial security during unexpected crises while promoting stress-free rest. This dual-focus strategy optimizes liquidity and psychological comfort, ultimately enhancing long-term financial resilience.

Serenity Reserve

A Serenity Reserve, sometimes known as a Sleep Well Fund, extends beyond a traditional Emergency Fund by covering both unexpected financial crises and routine stressors, ensuring continuous peace of mind. This dual-purpose savings approach integrates risk management with emotional well-being, prioritizing liquidity and accessibility to support resilience during uncertain times.

Anxiety-Proof Cushion

An Emergency Fund serves as a critical financial buffer designed to cover unexpected expenses, providing an anxiety-proof cushion that ensures peace of mind during crises. Unlike a Sleep Well Fund, which prioritizes emotional comfort through savings for general well-being, the Emergency Fund focuses specifically on immediate, necessary financial protection to mitigate stress from unforeseen emergencies.

Sleep-Insurance Fund

A Sleep-Insurance Fund acts as a proactive peace-of-mind savings strategy, offering a broader financial safety net than a traditional Emergency Fund by covering not only urgent expenses but also unexpected lifestyle disruptions. This fund ensures consistent emotional well-being and financial stability, reducing stress by providing resources for both immediate crises and longer-term uncertainties.

Rest-Ready Savings

Emergency Fund focuses on immediate financial emergencies, covering essential expenses for 3-6 months, while Sleep Well Fund emphasizes long-term peace-of-mind savings, ensuring comfort and emotional security beyond basic needs; prioritizing Rest-Ready Savings bridges both by maintaining accessible funds designed to handle unexpected life disruptions without stress. Integrating both strategies strengthens overall financial resilience, promoting stability and mental well-being during uncertain times.

Worry-Free War Chest

An Emergency Fund serves as a Worry-Free War Chest designed to cover unexpected expenses and financial shocks, ensuring immediate access to liquid cash without disrupting long-term investments. Unlike a Sleep Well Fund, which aims to provide overall peace of mind through broader financial security, an Emergency Fund prioritizes liquidity and quick availability to maintain financial stability during crises.

Nap-Guard Account

The Nap-Guard Account serves as an innovative solution that combines the security of an Emergency Fund with the tranquility of a Sleep Well Fund, offering peace-of-mind savings tailored for unexpected expenses and restful confidence. This specialized account prioritizes liquidity and stability, ensuring quick access to funds while maintaining steady growth, making it ideal for comprehensive financial preparedness.

Calmness Cache

Calmness Cache, a specialized form of Emergency Fund, prioritizes peace-of-mind savings by covering unexpected expenses with a cushion that reduces financial anxiety. Unlike traditional Emergency Funds focused solely on urgent needs, Calmness Cache incorporates buffer amounts to maintain emotional calm during both minor disruptions and major crises.

Peace-of-Mind Liquidity

Emergency Fund provides immediate access to cash for unexpected expenses, ensuring financial stability during crises, while a Sleep Well Fund emphasizes peace-of-mind liquidity by maintaining a larger buffer that covers both emergencies and lifestyle comfort. Prioritizing peace-of-mind liquidity means choosing savings that not only protect against financial shocks but also reduce stress by offering a sense of long-term security and stability.

Emergency Fund vs Sleep Well Fund for peace-of-mind savings. Infographic

moneydiff.com

moneydiff.com