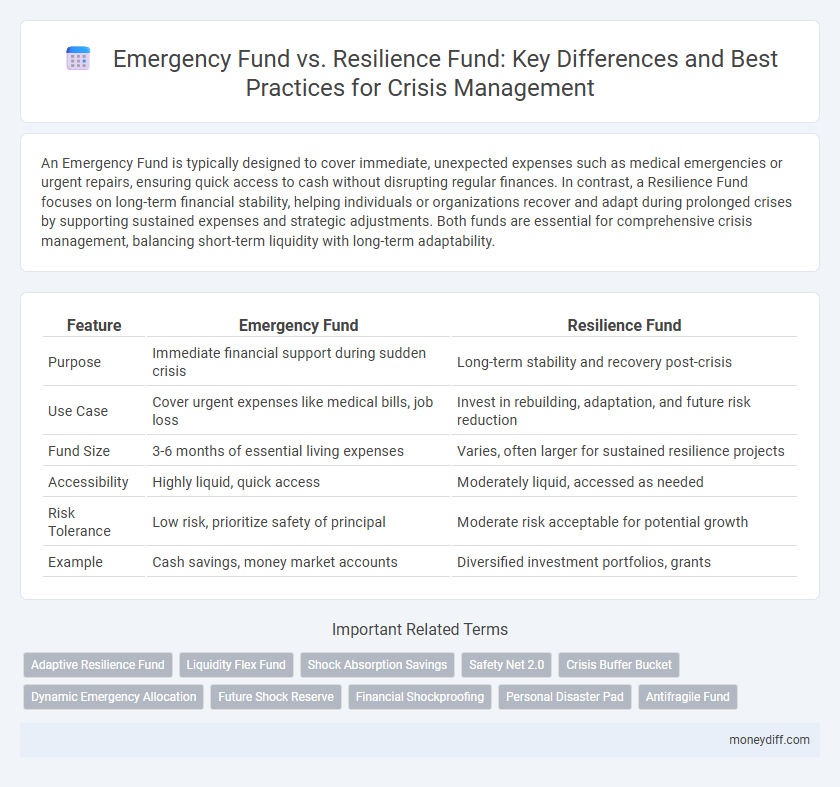

An Emergency Fund is typically designed to cover immediate, unexpected expenses such as medical emergencies or urgent repairs, ensuring quick access to cash without disrupting regular finances. In contrast, a Resilience Fund focuses on long-term financial stability, helping individuals or organizations recover and adapt during prolonged crises by supporting sustained expenses and strategic adjustments. Both funds are essential for comprehensive crisis management, balancing short-term liquidity with long-term adaptability.

Table of Comparison

| Feature | Emergency Fund | Resilience Fund |

|---|---|---|

| Purpose | Immediate financial support during sudden crisis | Long-term stability and recovery post-crisis |

| Use Case | Cover urgent expenses like medical bills, job loss | Invest in rebuilding, adaptation, and future risk reduction |

| Fund Size | 3-6 months of essential living expenses | Varies, often larger for sustained resilience projects |

| Accessibility | Highly liquid, quick access | Moderately liquid, accessed as needed |

| Risk Tolerance | Low risk, prioritize safety of principal | Moderate risk acceptable for potential growth |

| Example | Cash savings, money market accounts | Diversified investment portfolios, grants |

Understanding Emergency Funds: Definition and Purpose

Emergency funds are financial reserves specifically set aside to cover unexpected expenses such as medical emergencies, job loss, or urgent home repairs, providing immediate liquidity without incurring debt. In contrast, resilience funds focus on longer-term recovery and stability, supporting an organization or individual's capacity to adapt and bounce back from crises. Understanding the distinct purposes of emergency funds helps prioritize quick access to cash for urgent needs, while resilience funds enhance overall crisis preparedness and sustainability.

What is a Resilience Fund? Key Differences Explained

A Resilience Fund is designed to enhance long-term crisis adaptability by supporting recovery and growth beyond immediate emergencies, unlike an Emergency Fund that covers short-term financial shocks. While Emergency Funds provide quick access to cash for unforeseen expenses, Resilience Funds invest in systemic stability and sustainable resources to withstand future crises. Key differences include the scope, duration, and purpose: Emergency Funds focus on immediate relief, whereas Resilience Funds aim for strategic recovery and ongoing risk mitigation.

Emergency Fund vs Resilience Fund: Core Functions

Emergency funds provide immediate financial support to cover unexpected expenses such as medical emergencies, job loss, or urgent home repairs, ensuring short-term liquidity and stability. Resilience funds focus on long-term crisis management by investing in adaptive strategies, resource allocation, and recovery mechanisms to strengthen overall organizational or community preparedness. Both funds are essential, with emergency funds addressing immediate needs and resilience funds supporting sustainable crisis mitigation and recovery efforts.

How Much Should You Save? Emergency vs Resilience Fund Goals

An emergency fund typically covers three to six months of essential living expenses to provide a financial buffer against unexpected job loss or urgent medical bills. In contrast, a resilience fund is designed to support long-term financial stability and may require saving six to twelve months of expenses to handle extended economic downturns or systemic crises. Prioritizing the right fund depends on your personal risk tolerance, financial obligations, and the potential duration of crises you aim to withstand.

Types of Crises: When to Use Each Fund

Emergency funds are designed primarily for sudden personal financial crises such as job loss, medical emergencies, or urgent home repairs. Resilience funds focus on broader, systemic crises like natural disasters, economic downturns, or community-wide disruptions that require longer-term recovery and adaptive strategies. Choosing between these funds depends on the crisis scope--emergency funds for immediate individual needs and resilience funds for sustained community or organizational stability.

Building Your Emergency Fund: Best Practices

Building your emergency fund requires prioritizing liquidity and accessibility to cover unexpected expenses immediately. Aim to save three to six months' worth of essential living costs in a high-yield savings account or money market fund to ensure quick access and growth. Regularly review and adjust contributions based on changes in income, expenses, and potential risks to maintain adequate financial resilience during crises.

Resilience Fund Strategies for Long-Term Security

Resilience Fund strategies prioritize long-term financial security by diversifying investments across various asset classes, including low-risk bonds, real estate, and inflation-protected securities, to withstand economic fluctuations. Unlike Emergency Funds designed for immediate liquidity, Resilience Funds emphasize growth and stability, incorporating regular contributions and rebalancing to adapt to changing market conditions. Integrating these strategies enhances crisis management by ensuring sustained access to resources without compromising future financial goals.

Access and Liquidity: Comparing Fund Structures

Emergency Funds typically offer quicker access and higher liquidity, designed to provide immediate financial support during unforeseen crises, whereas Resilience Funds prioritize long-term sustainability and may have restrictions on withdrawals to ensure ongoing resource availability. The structure of Emergency Funds often includes liquid assets such as cash or equivalents, enabling rapid deployment, while Resilience Funds invest in diversified portfolios that balance growth and preservation but can delay access. Comparing these fund structures highlights Emergency Funds as optimal for urgent needs, while Resilience Funds support sustained crisis management strategies.

Psychological Benefits: Peace of Mind vs Growth Mindset

An Emergency Fund primarily offers peace of mind by providing immediate financial security during crises, reducing anxiety and stress associated with unexpected expenses. In contrast, a Resilience Fund fosters a growth mindset by encouraging proactive planning and adaptability, empowering individuals to view challenges as opportunities for development. Both funds contribute uniquely to psychological well-being, balancing stability with personal growth during financial uncertainty.

Creating a Dual Fund Approach for Robust Crisis Management

Creating a dual fund approach combines an Emergency Fund for immediate, short-term financial needs with a Resilience Fund designed to support long-term recovery and adaptation during crises. The Emergency Fund ensures liquidity to address urgent expenses, while the Resilience Fund invests in strategic initiatives that enhance organizational or community capacity to withstand future shocks. This synergy between immediate relief and sustainable resilience strengthens overall crisis management effectiveness.

Related Important Terms

Adaptive Resilience Fund

An Adaptive Resilience Fund differs from a traditional Emergency Fund by emphasizing flexible, long-term crisis management strategies that not only address immediate financial needs but also enhance systemic robustness to future shocks. This fund allocates resources dynamically to support rapid response, recovery, and adaptive capacity building, making it a critical tool for sustained resilience in volatile environments.

Liquidity Flex Fund

Emergency Fund prioritizes immediate liquidity to cover unexpected expenses, while Resilience Funds focus on long-term financial stability during crises; a Liquidity Flex Fund bridges both by offering adaptable liquid assets tailored for rapid access and flexible deployment in various emergency scenarios. This hybrid fund type enhances crisis management by providing both quick cash flow and strategic financial resilience without compromising overall portfolio stability.

Shock Absorption Savings

Emergency Fund primarily serves as immediate shock absorption savings, providing quick liquidity to cover unexpected expenses such as medical emergencies or job loss, while a Resilience Fund encompasses broader, long-term financial strategies to sustainably manage and recover from prolonged crises. Shock absorption savings ensure rapid access to cash, minimizing financial disruption, whereas Resilience Funds often integrate diversified assets and income streams for enhanced crisis endurance.

Safety Net 2.0

An Emergency Fund provides immediate financial support for unexpected personal crises, while a Resilience Fund offers a broader, community-based safety net designed to enhance long-term crisis management and recovery. Safety Net 2.0 integrates these concepts by leveraging digital tools and collaborative resources to create a scalable, adaptive financial buffer that strengthens economic stability during emergencies.

Crisis Buffer Bucket

The Crisis Buffer Bucket within an Emergency Fund provides immediate liquidity to cover critical expenses during unexpected financial disruptions, ensuring short-term stability without the need for debt. In contrast, a Resilience Fund is designed to support long-term recovery and adaptation, offering sustained financial security beyond the initial crisis period.

Dynamic Emergency Allocation

Dynamic Emergency Allocation in an Emergency Fund provides flexible, immediate access to capital specifically set aside for unforeseen crises, whereas a Resilience Fund emphasizes long-term financial stability and recovery capacity. Prioritizing Dynamic Emergency Allocation enhances rapid response efficiency by adapting funding levels based on real-time risk assessments and evolving crisis needs.

Future Shock Reserve

A Future Shock Reserve enhances traditional Emergency Funds by specifically addressing unpredictable, large-scale crises that disrupt economic stability beyond immediate emergencies. This Resilience Fund integrates proactive financial planning, ensuring greater adaptability and sustained recovery in the face of rapid societal or environmental changes.

Financial Shockproofing

An Emergency Fund provides immediate liquidity for unexpected expenses such as medical emergencies or sudden job loss, while a Resilience Fund is designed for long-term financial stability and recovery through diversified assets and savings strategies. Prioritizing Financial Shockproofing involves integrating both funds to ensure rapid access to cash alongside sustainable wealth protection against prolonged economic disruptions.

Personal Disaster Pad

An Emergency Fund is a financial safety net reserved for unexpected personal crises like medical emergencies or job loss, while a Resilience Fund extends beyond immediate needs to support long-term recovery and adaptation in a broader range of disasters. Personal Disaster Pads emphasize the importance of maintaining a readily accessible Emergency Fund to ensure quick response and stability during sudden financial shocks.

Antifragile Fund

An Emergency Fund provides immediate financial resources for unforeseen expenses, while a Resilience Fund, often structured as an Antifragile Fund, not only covers emergencies but also strengthens an individual's or organization's ability to grow stronger after crises by leveraging stressors for long-term financial adaptability and growth. Investing in an Antifragile Fund incorporates diversified assets and flexible strategies designed to thrive under volatility, enhancing overall crisis management effectiveness beyond mere damage control.

Emergency Fund vs Resilience Fund for crisis management. Infographic

moneydiff.com

moneydiff.com