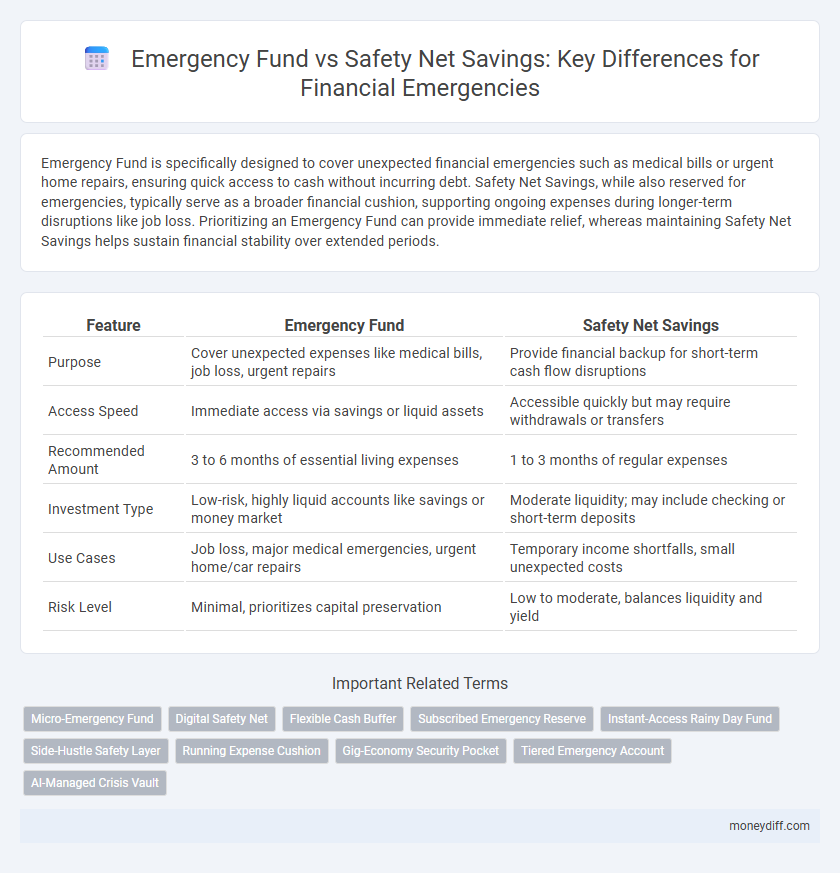

Emergency Fund is specifically designed to cover unexpected financial emergencies such as medical bills or urgent home repairs, ensuring quick access to cash without incurring debt. Safety Net Savings, while also reserved for emergencies, typically serve as a broader financial cushion, supporting ongoing expenses during longer-term disruptions like job loss. Prioritizing an Emergency Fund can provide immediate relief, whereas maintaining Safety Net Savings helps sustain financial stability over extended periods.

Table of Comparison

| Feature | Emergency Fund | Safety Net Savings |

|---|---|---|

| Purpose | Cover unexpected expenses like medical bills, job loss, urgent repairs | Provide financial backup for short-term cash flow disruptions |

| Access Speed | Immediate access via savings or liquid assets | Accessible quickly but may require withdrawals or transfers |

| Recommended Amount | 3 to 6 months of essential living expenses | 1 to 3 months of regular expenses |

| Investment Type | Low-risk, highly liquid accounts like savings or money market | Moderate liquidity; may include checking or short-term deposits |

| Use Cases | Job loss, major medical emergencies, urgent home/car repairs | Temporary income shortfalls, small unexpected costs |

| Risk Level | Minimal, prioritizes capital preservation | Low to moderate, balances liquidity and yield |

Understanding Emergency Funds vs Safety Net Savings

Emergency funds are liquid cash reserves designed to cover unexpected expenses like medical emergencies or job loss, typically amounting to three to six months of living expenses. Safety net savings, while similar, often include less liquid assets or insurance policies that serve as a backup financial resource during crises. Understanding the differences ensures proper financial planning by distinguishing immediately accessible funds from broader financial protections.

Key Differences Between Emergency Funds and Safety Nets

Emergency funds are liquid savings specifically set aside to cover essential expenses during unexpected financial crises, typically covering three to six months of living costs. Safety net savings, while also reserved for emergencies, may include more flexible assets such as investments or insurance policies that provide broader financial protection but might not be immediately accessible. The key difference lies in liquidity and purpose: emergency funds prioritize quick access for immediate needs, whereas safety nets offer wider financial security with varied accessibility.

Purposes and Goals of Each Fund

An emergency fund serves as liquid cash reserved for unforeseen expenses like medical emergencies or sudden job loss, ensuring immediate financial stability. Safety net savings are designed to cover longer-term financial gaps, such as extended unemployment or major home repairs, providing a buffer beyond daily emergencies. Both funds aim to reduce financial stress, but the emergency fund focuses on prompt access while the safety net targets sustained financial security.

When to Use Emergency Funds vs Safety Net Savings

Emergency funds should be used exclusively for unexpected and urgent financial crises such as medical emergencies, sudden job loss, or urgent home repairs. Safety net savings serve as a more flexible reserve for less immediate or smaller financial challenges like minor car repairs or temporary income shortfalls. Distinguishing between these two allows for strategic allocation of resources, preserving the emergency fund for high-impact situations while using safety net savings for manageable expenses.

How Much to Save: Emergency Fund vs Safety Net Recommendations

An emergency fund generally requires saving three to six months' worth of essential living expenses, covering rent, utilities, groceries, and healthcare costs to ensure financial stability during unexpected events. A safety net savings fund often demands a larger buffer, ranging from six to twelve months of total income, designed to protect against prolonged unemployment or major financial disruptions. Prioritizing the emergency fund first is critical for immediate crisis management, followed by building a safety net for long-term security in financial emergencies.

Building Your Emergency Fund Step by Step

Building your emergency fund step by step involves setting clear savings goals and automating monthly transfers to a dedicated account separate from your safety net savings. While safety net savings provide a buffer for minor unexpected expenses, an emergency fund is specifically designed to cover major financial crises like job loss or medical emergencies. Prioritizing consistent contributions and gradually increasing the fund ensures you have sufficient liquidity to protect against significant financial disruptions.

Establishing a Reliable Safety Net Savings Plan

Establishing a reliable safety net savings plan involves setting aside three to six months' worth of essential expenses to cover unexpected financial emergencies, such as job loss or medical bills. Emergency funds are typically liquid and easily accessible, designed to provide immediate financial relief, while safety net savings may include slightly less liquid assets aimed at longer-term security. Prioritizing consistent contributions to a dedicated safety net savings account ensures financial stability and reduces reliance on high-interest debt during unforeseen circumstances.

Pros and Cons of Each Financial Safety Strategy

Emergency funds provide quick access to cash for unexpected expenses, offering liquidity and peace of mind, but they often yield lower returns compared to other savings options. Safety net savings, which may include diversified accounts or investments, potentially grow wealth over time but risk market volatility and slower access to funds during emergencies. Balancing immediate availability with potential growth is essential when choosing between an emergency fund and a broader safety net savings strategy.

Common Mistakes in Managing Financial Emergency Funds

Common mistakes in managing emergency funds include treating safety net savings as readily available for everyday expenses, which decreases their effectiveness during true financial crises. Many individuals underestimate the required fund size, often setting aside less than the recommended three to six months of essential living expenses. Neglecting regular fund replenishment after usage further compromises the financial cushion necessary for unexpected emergencies.

Integrating Both Funds Into Your Money Management Strategy

Integrating an emergency fund with safety net savings enhances financial resilience by covering unexpected expenses while maintaining overall liquidity. Allocate cash reserves based on immediate access needs and long-term stability, ensuring both short-term emergencies and larger financial disruptions are managed effectively. This dual-fund approach supports better budgeting, reduces reliance on credit, and strengthens overall money management strategies.

Related Important Terms

Micro-Emergency Fund

A Micro-Emergency Fund is a subset of a broader Safety Net Savings designed specifically for immediate, small-scale financial crises, typically covering expenses up to $500. This targeted approach enables quick access to cash for minor emergencies without disrupting larger, long-term emergency reserves.

Digital Safety Net

Digital Safety Net enhances traditional Emergency Fund strategies by providing instant access to funds through online platforms during financial emergencies. Leveraging mobile banking, digital wallets, and instant loans, Digital Safety Nets offer increased liquidity and flexibility compared to conventional Safety Net Savings.

Flexible Cash Buffer

An emergency fund serves as a flexible cash buffer designed to cover unexpected financial crises, offering immediate access to liquid assets without penalties. In contrast, safety net savings typically include more structured reserves like insurance or investments, which may not provide the same level of liquidity or rapid availability during urgent emergencies.

Subscribed Emergency Reserve

A Subscribed Emergency Reserve differs from a typical Safety Net Savings by involving pre-committed funds reserved specifically for urgent financial crises, ensuring immediate access without depletion of regular savings. This structured approach enhances financial resilience by separating emergency liquidity from discretionary savings, minimizing the risk of fund misallocation during unexpected events.

Instant-Access Rainy Day Fund

An Emergency Fund is a dedicated instant-access rainy day fund designed to cover unexpected expenses such as medical emergencies or urgent home repairs, typically holding three to six months' worth of living expenses in liquid assets like savings accounts or money market funds. Unlike broader Safety Net Savings, which may include less accessible assets or planned long-term reserves, an Emergency Fund ensures immediate liquidity to manage financial crises without resorting to high-interest debt.

Side-Hustle Safety Layer

An Emergency Fund typically covers three to six months of essential expenses for unexpected financial shocks, while Safety Net Savings act as an additional buffer specifically funded through side-hustle income streams to protect against prolonged job loss or income disruption. This Side-Hustle Safety Layer diversifies income sources, enhancing financial resilience by providing a flexible cash reserve beyond traditional emergency savings.

Running Expense Cushion

An Emergency Fund typically covers three to six months of essential living expenses, serving as a critical running expense cushion during financial emergencies. Safety Net Savings, while similar, may be more flexible in purpose but often lack the specific allocation for ongoing monthly costs, making them less reliable for immediate expense coverage.

Gig-Economy Security Pocket

Emergency funds provide immediate access to cash for unexpected expenses, while safety net savings offer a broader financial buffer that can cover extended income disruptions in the gig economy. Gig workers benefit from maintaining both, using an emergency fund for urgent costs and safety net savings as a longer-term security pocket to manage irregular earnings and fluctuating job opportunities.

Tiered Emergency Account

A Tiered Emergency Account strategically divides funds into multiple levels, ensuring immediate access to essential cash while allocating additional reserves for less urgent emergencies, optimizing liquidity and financial security. This approach contrasts with a traditional Safety Net Savings by offering structured flexibility, enabling better management of varying emergency scenarios and promoting efficient cash flow during financial crises.

AI-Managed Crisis Vault

AI-Managed Crisis Vault enhances Emergency Funds by using advanced algorithms to optimize Safety Net Savings for precise allocation during financial emergencies, ensuring liquidity and minimizing depletion of long-term investments. This intelligent system monitors real-time financial data to proactively adjust reserves, providing a dynamic buffer tailored to individual risk profiles.

Emergency Fund vs Safety Net Savings for financial emergencies. Infographic

moneydiff.com

moneydiff.com