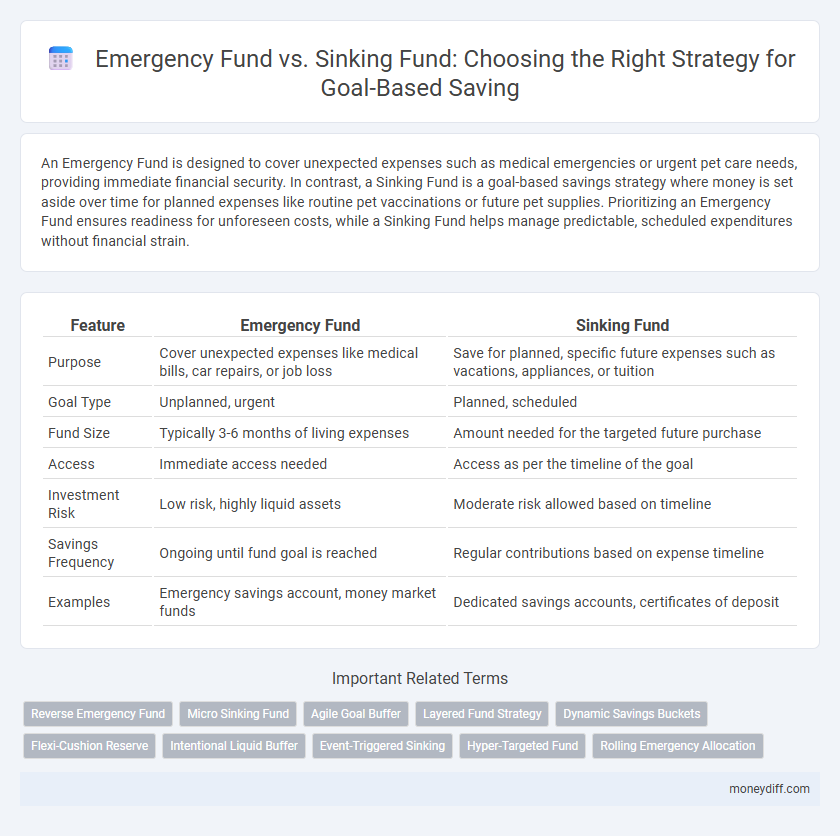

An Emergency Fund is designed to cover unexpected expenses such as medical emergencies or urgent pet care needs, providing immediate financial security. In contrast, a Sinking Fund is a goal-based savings strategy where money is set aside over time for planned expenses like routine pet vaccinations or future pet supplies. Prioritizing an Emergency Fund ensures readiness for unforeseen costs, while a Sinking Fund helps manage predictable, scheduled expenditures without financial strain.

Table of Comparison

| Feature | Emergency Fund | Sinking Fund |

|---|---|---|

| Purpose | Cover unexpected expenses like medical bills, car repairs, or job loss | Save for planned, specific future expenses such as vacations, appliances, or tuition |

| Goal Type | Unplanned, urgent | Planned, scheduled |

| Fund Size | Typically 3-6 months of living expenses | Amount needed for the targeted future purchase |

| Access | Immediate access needed | Access as per the timeline of the goal |

| Investment Risk | Low risk, highly liquid assets | Moderate risk allowed based on timeline |

| Savings Frequency | Ongoing until fund goal is reached | Regular contributions based on expense timeline |

| Examples | Emergency savings account, money market funds | Dedicated savings accounts, certificates of deposit |

Understanding Emergency Funds: Purpose and Importance

Emergency funds provide immediate financial security by covering unexpected expenses like medical emergencies or job loss, maintaining liquidity and peace of mind. Unlike sinking funds, which are earmarked for planned future expenses such as vacations or home repairs, emergency funds must remain easily accessible and separate from regular savings. Prioritizing an emergency fund ensures a financial safety net that prevents debt accumulation during unforeseen crises.

What is a Sinking Fund? Key Features Explained

A sinking fund is a strategic savings account specifically designated for planned expenses or debt repayment, separate from an emergency fund that covers unforeseen financial crises. Key features of a sinking fund include targeted saving for known future costs, predictable contribution schedules, and reduced financial stress by avoiding debt accumulation. Unlike emergency funds that remain liquid for unexpected needs, sinking funds are goal-oriented, ensuring that specific financial objectives are met efficiently.

Emergency Fund vs Sinking Fund: Core Differences

An emergency fund is designed to cover unexpected expenses or financial emergencies, offering immediate liquidity and peace of mind, typically holding three to six months' worth of living expenses. In contrast, a sinking fund is established for planned, goal-based savings such as purchasing a car or funding a vacation, with regular contributions over time and a targeted amount. The core difference lies in their purpose: emergency funds prioritize accessibility for unforeseen events, while sinking funds emphasize disciplined saving for specific financial goals.

When to Use an Emergency Fund

An emergency fund is essential for unexpected expenses such as medical bills, job loss, or urgent repairs, offering immediate financial security without disrupting other savings goals. Unlike a sinking fund, which is designated for planned, specific future expenses like vacations or large purchases, an emergency fund is fluid and accessible whenever unforeseen events occur. Prioritizing an emergency fund ensures stability during financial uncertainty, preventing reliance on credit or high-interest loans.

Ideal Scenarios for Sinking Fund Usage

Sinking funds are ideal for planned, goal-based savings where expenses are predictable, such as saving for a car purchase, vacation, or home repairs. These funds allow for systematic contributions over time, reducing financial strain by spreading out costs. Unlike emergency funds, sinking funds are not meant for unexpected expenses but for known future expenditures with specific timelines.

How Much to Save: Calculating Fund Amounts

Emergency funds typically cover three to six months of essential living expenses, ensuring financial security during unexpected events such as job loss or medical emergencies. In contrast, sinking funds are allocated based on specific future goals, with amounts calculated by dividing the total anticipated cost by the number of months until the expense. Accurate calculation involves assessing monthly needs for emergency funds versus targeted saving periods for sinking funds, optimizing financial preparedness for both immediate crises and planned purchases.

Building Your Emergency Fund: Practical Steps

Building your emergency fund involves setting aside three to six months' worth of essential living expenses in a liquid, easily accessible account to cover unexpected financial crises. Unlike a sinking fund, which is earmarked for specific future expenses like vacations or major purchases, an emergency fund provides a financial safety net for unforeseen events such as job loss or medical emergencies. Prioritize consistent monthly contributions and automate savings transfers to steadily grow your emergency fund without disrupting your regular budget.

Starting a Sinking Fund: Simple Strategies

Starting a sinking fund involves setting aside specific amounts regularly to cover anticipated expenses, ensuring funds are available without disrupting your emergency reserve. Unlike an emergency fund designed for unexpected financial crises, sinking funds target planned goals such as vacations, car repairs, or home maintenance. Implementing automated transfers and tracking separate sinking funds for different goals helps maintain clear financial priorities and improves saving discipline.

Managing and Tracking Multiple Savings Funds

Emergency funds are essential for immediate financial emergencies and provide quick access to cash without penalties, while sinking funds are designated for planned expenses, allowing systematic savings over time. Managing multiple savings funds requires clear categorization and separate tracking, often facilitated by budgeting apps or financial software to ensure each fund's goals and timelines are met. Regular monitoring and adjusting contribution amounts help maintain the balance between emergency preparedness and goal-based savings efficiency.

Choosing the Right Fund for Your Financial Goals

Emergency funds provide immediate financial security by covering unexpected expenses, while sinking funds are tailored for planned, goal-based savings such as vacations or large purchases. Choosing the right fund depends on your financial objectives: an emergency fund prioritizes liquidity and accessibility for unforeseen crises, whereas sinking funds encourage disciplined saving for specific future goals. Aligning your savings strategy with these distinctions ensures optimal financial preparedness and goal achievement.

Related Important Terms

Reverse Emergency Fund

A Reverse Emergency Fund strategically reallocates traditional emergency savings to prioritize sinking funds for specific financial goals, balancing immediate liquidity with targeted long-term planning. This approach enhances goal-based saving by reducing idle cash while maintaining sufficient reserves for unexpected expenses, optimizing overall financial readiness.

Micro Sinking Fund

A Micro Sinking Fund is a targeted savings strategy designed for short-term, specific goals, contrasting with an Emergency Fund that serves as a financial safety net for unexpected expenses. While an Emergency Fund prioritizes liquidity and accessibility for unforeseen emergencies, a Micro Sinking Fund enables disciplined saving for planned purchases or smaller financial objectives, optimizing goal-based saving efficiency.

Agile Goal Buffer

An Emergency Fund provides immediate financial liquidity for unexpected expenses, while a Sinking Fund is a planned savings pool allocated for specific future goals over time. Agile Goal Buffer combines the flexibility of an Emergency Fund with goal-specific Sinking Funds, enabling dynamic adjustments aligned with evolving priorities and reducing financial stress.

Layered Fund Strategy

An Emergency Fund provides immediate liquidity for unexpected expenses, safeguarding financial stability, while a Sinking Fund accumulates purpose-specific savings for planned future goals, optimizing cash flow management. Implementing a Layered Fund Strategy differentiates risk by prioritizing an Emergency Fund for short-term shocks and allocating additional funds into sinking accounts for medium- to long-term objectives, enhancing overall financial resilience.

Dynamic Savings Buckets

Dynamic savings buckets differentiate emergency funds from sinking funds by prioritizing liquidity and immediate access for unforeseen expenses, while sinking funds allocate money over time to specific, planned goals such as vacations or large purchases. Emergency funds ensure financial stability during unexpected events, whereas sinking funds support disciplined, goal-based saving with less focus on immediate availability.

Flexi-Cushion Reserve

An Emergency Fund provides a Flexi-Cushion Reserve designed for unexpected financial crises, offering immediate liquidity without predefined allocation, whereas a Sinking Fund targets specific, planned expenses with predetermined savings goals. The flexibility of an Emergency Fund ensures seamless financial resilience against sudden disruptions, contrasting the structured discipline of Sinking Funds for future liabilities.

Intentional Liquid Buffer

An Emergency Fund serves as an intentional liquid buffer designed to cover unexpected expenses like medical bills or job loss, ensuring immediate access to cash without disrupting long-term investments. In contrast, a Sinking Fund targets planned, goal-based savings with predetermined timelines, focusing on accumulating funds gradually for known future expenses.

Event-Triggered Sinking

Emergency funds provide immediate financial support for unforeseen expenses, while event-triggered sinking funds are strategically allocated for anticipated, specific future costs such as home repairs or medical bills. By segregating savings into sinking funds tied to defined events, individuals can optimize goal-based saving and avoid depleting their emergency reserves.

Hyper-Targeted Fund

An emergency fund provides immediate financial security for unforeseen expenses, while a sinking fund is a hyper-targeted fund designed for goal-based savings with specific time frames and purposes, such as vacations or home repairs. Prioritizing an emergency fund ensures liquidity and protection against financial shocks before allocating resources to sinking funds tailored for planned expenditures.

Rolling Emergency Allocation

Rolling Emergency Allocation in an Emergency Fund ensures liquidity for unforeseen expenses, unlike a Sinking Fund, which is earmarked for specific future goals with predetermined timelines. Prioritizing a flexible Emergency Fund enhances financial resilience by maintaining accessible cash reserves, while Sinking Funds allocate resources systematically toward planned objectives.

Emergency Fund vs Sinking Fund for goal-based saving. Infographic

moneydiff.com

moneydiff.com