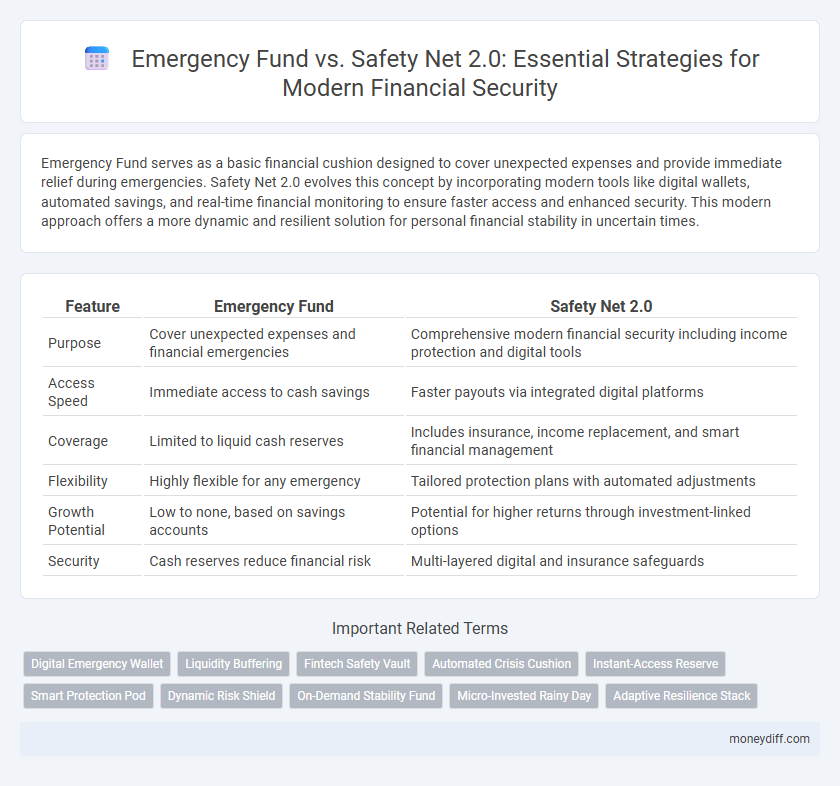

Emergency Fund serves as a basic financial cushion designed to cover unexpected expenses and provide immediate relief during emergencies. Safety Net 2.0 evolves this concept by incorporating modern tools like digital wallets, automated savings, and real-time financial monitoring to ensure faster access and enhanced security. This modern approach offers a more dynamic and resilient solution for personal financial stability in uncertain times.

Table of Comparison

| Feature | Emergency Fund | Safety Net 2.0 |

|---|---|---|

| Purpose | Cover unexpected expenses and financial emergencies | Comprehensive modern financial security including income protection and digital tools |

| Access Speed | Immediate access to cash savings | Faster payouts via integrated digital platforms |

| Coverage | Limited to liquid cash reserves | Includes insurance, income replacement, and smart financial management |

| Flexibility | Highly flexible for any emergency | Tailored protection plans with automated adjustments |

| Growth Potential | Low to none, based on savings accounts | Potential for higher returns through investment-linked options |

| Security | Cash reserves reduce financial risk | Multi-layered digital and insurance safeguards |

Understanding Emergency Funds: The Traditional Approach

Emergency funds traditionally consist of three to six months' worth of living expenses saved in a liquid, easily accessible account, designed to cover unexpected costs such as medical emergencies, job loss, or urgent home repairs. Unlike Safety Net 2.0, which incorporates digital tools, insurance products, and diversified financial buffers, traditional emergency funds emphasize simplicity and immediate availability. This foundational approach remains critical for financial resilience, providing a stable cash reserve before exploring more complex, modern security solutions.

What Is a Safety Net 2.0?

A Safety Net 2.0 redefines financial security by integrating digital assets, flexible income streams, and real-time budgeting tools, surpassing the traditional emergency fund's scope. It combines instant access to diversified funds with AI-driven risk assessment, enabling proactive protection against unexpected expenses in the modern economy. This advanced approach ensures continuous financial resilience through dynamic resource allocation and automated savings adjustments.

Key Differences: Emergency Fund vs. Safety Net 2.0

An Emergency Fund is a liquid cash reserve designed for unexpected expenses like medical emergencies or sudden job loss, typically covering three to six months of essential living costs. Safety Net 2.0 expands beyond traditional savings by integrating digital financial tools, insurance products, and community-based support networks, offering dynamic and tech-enabled security for modern uncertainties. Key differences lie in liquidity and scope: Emergency Funds emphasize immediate accessibility, while Safety Net 2.0 provides diversified, adaptive protection against a broader range of financial risks.

Pros and Cons of Emergency Funds

Emergency funds offer immediate liquidity to cover unexpected expenses, providing a straightforward financial buffer that enhances peace of mind. These funds typically yield low returns and may lose purchasing power over time due to inflation, limiting long-term growth potential. Unlike Safety Net 2.0 solutions, emergency funds lack integrated features like investment options or income protection, but their simplicity ensures quick access during critical financial situations.

The Benefits of a Modern Safety Net

A modern safety net, often called Safety Net 2.0, expands beyond a traditional emergency fund by integrating digital tools, diversified income streams, and real-time financial tracking for enhanced resilience. Unlike a static emergency fund, this approach leverages technology and strategic planning to provide immediate access to resources and minimize financial shocks during crises. The benefits include increased flexibility, faster response to unexpected expenses, and improved long-term financial security in an evolving economic landscape.

How Much Should You Save in Each?

An Emergency Fund typically covers three to six months of essential living expenses to handle unexpected financial setbacks like job loss or medical emergencies, while a Safety Net 2.0 extends this concept by integrating diversified income streams and digital asset reserves to enhance modern financial resilience. Aim to save at least three months' worth of fixed costs in your Emergency Fund for immediate liquidity and allocate additional resources in your Safety Net 2.0 to cover variable expenses and invest in alternative financial buffers. Balancing these savings ensures quick access to cash while maintaining long-term security against evolving economic challenges.

Adapting Your Savings to Today’s Risks

Emergency Fund serves as the foundational financial cushion for unexpected expenses, typically covering three to six months of essential living costs. Safety Net 2.0 expands on this concept by integrating modern risks such as cyber threats, gig economy income volatility, and healthcare changes, requiring a more dynamic and diversified savings approach. Adapting your savings strategy involves not only increasing reserve amounts but also incorporating flexible funds, insurance products, and digital asset protections to ensure comprehensive security.

Digital Tools and Apps for Building Modern Safety Nets

Digital tools and apps revolutionize the creation of modern safety nets by enabling automated savings, real-time expense tracking, and personalized financial insights, enhancing the traditional emergency fund approach. Platforms like Qapital, Digit, and Chime use algorithms to optimize savings goals and provide seamless access to funds during emergencies, ensuring greater financial resilience. Integrating these digital solutions transforms safety nets into dynamic resources tailored to contemporary financial challenges and lifestyle needs.

Choosing the Right Strategy for Your Situation

An emergency fund provides immediate liquidity for unforeseen expenses, while Safety Net 2.0 incorporates diversified financial tools like insurance, investments, and digital assets to enhance modern financial security. Evaluating your income stability, risk tolerance, and lifestyle expenses is crucial for selecting between a traditional emergency fund and a Safety Net 2.0 approach. Tailoring your financial safety strategy maximizes resilience against both short-term emergencies and long-term economic uncertainties.

Future-Proofing Your Financial Security

Emergency Fund serves as the foundational liquidity reserve for unexpected expenses, while Safety Net 2.0 integrates advanced financial tools like automated savings, diversified investments, and insurance coverage to future-proof your financial security. Leveraging technology and strategic asset allocation, Safety Net 2.0 adapts to evolving economic risks and inflation, ensuring sustained protection beyond immediate cash reserves. Prioritizing this modern approach enhances resilience against market volatility and unpredicted financial disruptions in the long term.

Related Important Terms

Digital Emergency Wallet

Digital Emergency Wallets enhance traditional Emergency Funds by providing instant access to critical resources and real-time financial tracking, bridging the gap between fundamental savings and the dynamic demands of Safety Net 2.0. Integrating features like biometric security and automated alerts, these digital solutions offer a more resilient and accessible safety net tailored for modern, unpredictable economic challenges.

Liquidity Buffering

An Emergency Fund serves as a fundamental liquidity buffer, providing immediate access to cash for unforeseen expenses, while Safety Net 2.0 integrates advanced financial tools like instant credit access and digital assets to enhance modern financial security. Emphasizing liquidity buffering, Emergency Funds prioritize cash availability, whereas Safety Net 2.0 leverages technology for a more dynamic and resilient safety mechanism.

Fintech Safety Vault

Fintech Safety Vault redefines modern security by merging traditional Emergency Fund concepts with advanced digital asset protection, offering instant liquidity and real-time fraud monitoring. This innovative Safety Net 2.0 ensures seamless access to emergency savings through encrypted platforms, safeguarding funds against cyber threats and economic volatility.

Automated Crisis Cushion

Emergency Fund serves as a traditional financial buffer, while Safety Net 2.0 integrates an Automated Crisis Cushion powered by AI-driven analytics to dynamically adjust support based on real-time risk assessments. This modern security approach enhances resilience by proactively allocating resources, reducing recovery time during economic shocks or personal emergencies.

Instant-Access Reserve

An Emergency Fund serves as a traditional financial buffer for unexpected expenses, offering instant-access reserves to cover short-term crises without debt reliance. Safety Net 2.0 enhances this concept by integrating instant-access digital accounts and real-time liquidity management, providing modern security through seamless fund availability and adaptive financial resilience.

Smart Protection Pod

Smart Protection Pod redefines emergency funds by integrating real-time data analytics and adaptive financial algorithms, offering dynamic adjustments to coverage based on evolving personal risk profiles. Unlike traditional safety nets, it provides proactive security through automated savings triggers and instant access to liquidity, ensuring modern users maintain optimal financial resilience during unforeseen events.

Dynamic Risk Shield

Emergency Fund acts as a traditional financial buffer for unexpected expenses, while Safety Net 2.0 integrates Dynamic Risk Shield technology to provide adaptive, real-time protection against evolving financial threats. Dynamic Risk Shield leverages predictive analytics and automated adjustments to optimize liquidity and coverage, ensuring modern security beyond static savings.

On-Demand Stability Fund

Emergency Fund provides basic financial backup for unexpected expenses, while Safety Net 2.0 transforms this concept into an On-Demand Stability Fund, offering instant access to tailored liquidity through digital platforms and smart financial tools. This modern approach enhances financial resilience by integrating real-time monitoring and adaptive fund allocation to meet evolving personal and economic emergencies.

Micro-Invested Rainy Day

Emergency Fund traditionally serves as a fixed cash reserve for unexpected expenses, while Safety Net 2.0 integrates Micro-Invested Rainy Day strategies to enhance liquidity and growth potential through automated, small-scale investments. This modern security approach leverages micro-investing platforms to build a dynamic, accessible financial buffer that adapts to fluctuating economic conditions and personal spending patterns.

Adaptive Resilience Stack

Emergency Fund serves as the foundational financial buffer, while Safety Net 2.0 integrates the Adaptive Resilience Stack, combining real-time data analytics, automated liquidity management, and personalized risk assessment to enhance modern security beyond traditional savings. This innovative framework ensures dynamic protection against unpredictable economic shocks by continuously optimizing resource allocation and stress response mechanisms.

Emergency Fund vs Safety Net 2.0 for modern security. Infographic

moneydiff.com

moneydiff.com