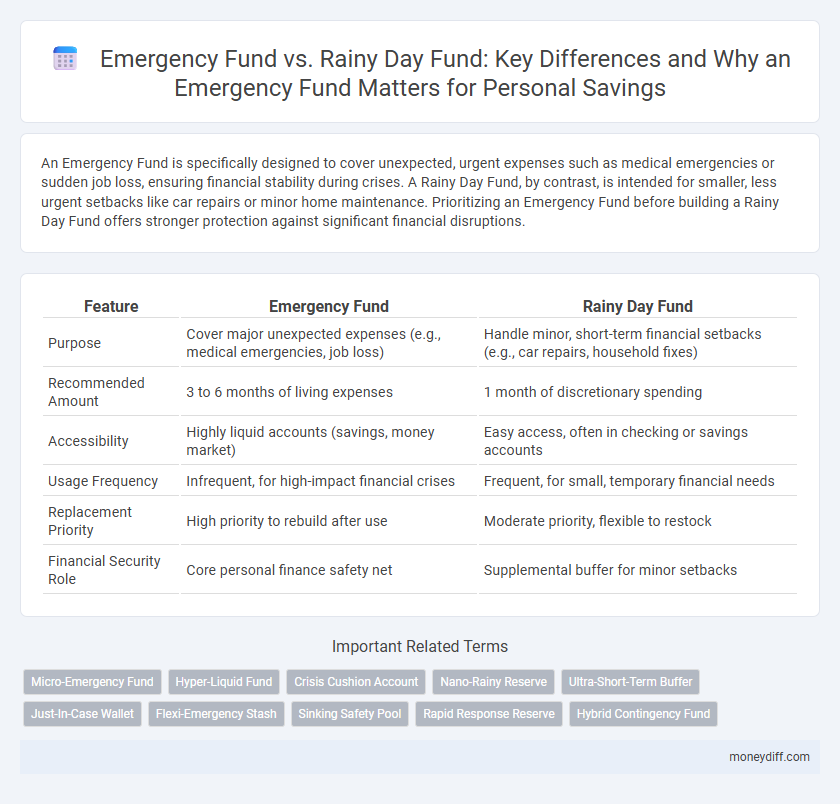

An Emergency Fund is specifically designed to cover unexpected, urgent expenses such as medical emergencies or sudden job loss, ensuring financial stability during crises. A Rainy Day Fund, by contrast, is intended for smaller, less urgent setbacks like car repairs or minor home maintenance. Prioritizing an Emergency Fund before building a Rainy Day Fund offers stronger protection against significant financial disruptions.

Table of Comparison

| Feature | Emergency Fund | Rainy Day Fund |

|---|---|---|

| Purpose | Cover major unexpected expenses (e.g., medical emergencies, job loss) | Handle minor, short-term financial setbacks (e.g., car repairs, household fixes) |

| Recommended Amount | 3 to 6 months of living expenses | 1 month of discretionary spending |

| Accessibility | Highly liquid accounts (savings, money market) | Easy access, often in checking or savings accounts |

| Usage Frequency | Infrequent, for high-impact financial crises | Frequent, for small, temporary financial needs |

| Replacement Priority | High priority to rebuild after use | Moderate priority, flexible to restock |

| Financial Security Role | Core personal finance safety net | Supplemental buffer for minor setbacks |

Understanding Emergency Funds vs. Rainy Day Funds

Emergency funds and rainy day funds serve distinct purposes in personal savings, with emergency funds designed to cover major unexpected expenses like medical emergencies or job loss, typically amounting to three to six months of living expenses. Rainy day funds, on the other hand, are smaller reserves set aside for minor, short-term financial setbacks such as car repairs or home maintenance. Understanding the difference helps individuals allocate savings effectively to maintain financial stability during both minor disruptions and significant crises.

Key Differences Between Emergency and Rainy Day Savings

Emergency funds typically cover major unexpected expenses such as medical emergencies, job loss, or significant home repairs, aiming for a reserve of three to six months' living expenses. Rainy day funds are designed for smaller, less urgent costs like minor car repairs or utility bills, usually amounting to one to two months' worth of expenses. The primary difference lies in the fund's purpose and size, with emergency funds providing greater financial security during severe disruptions, while rainy day funds help manage routine unforeseen expenses.

Why Everyone Needs Both Types of Funds

Emergency funds provide financial security for major unexpected expenses such as medical emergencies or job loss, while rainy day funds cover smaller, routine unexpected costs like car repairs or minor home maintenance. Maintaining both types of savings ensures comprehensive protection, minimizing the risk of debt accumulation and financial stress during diverse emergencies. Personal finance experts recommend separate accounts for emergency funds and rainy day funds to optimize accessibility and dedicated usage.

When to Use an Emergency Fund

An emergency fund is specifically designed to cover unexpected, significant financial crises such as medical emergencies, job loss, or major home repairs. It should be accessed only for genuine emergencies to avoid depleting savings for routine or minor expenses that a rainy day fund would cover. Maintaining a separate emergency fund ensures financial stability during severe disruptions while the rainy day fund handles smaller, less urgent costs.

Common Uses for a Rainy Day Fund

A Rainy Day Fund is typically used for smaller, unexpected expenses such as minor car repairs, home maintenance, or temporary event cancellations, providing quick access to cash without disrupting long-term savings. Unlike an Emergency Fund, which covers significant financial crises like job loss or major medical emergencies, a Rainy Day Fund focuses on short-term, manageable costs. Maintaining a separate Rainy Day Fund ensures personal savings remain intact for more severe financial emergencies, promoting better money management.

How Much Should You Save in Each Fund?

Emergency funds typically require saving three to six months' worth of essential living expenses to cover major unexpected events like job loss or medical emergencies. Rainy day funds, on the other hand, often hold a smaller amount, usually between $500 and $1,000, to manage minor, short-term expenses such as car repairs or home maintenance. Allocating savings appropriately between these funds ensures financial resilience across varying emergency scenarios.

Steps to Build Your Emergency Fund

Start by assessing your monthly essential expenses to determine the target amount for your emergency fund, typically three to six months of living costs. Open a separate, high-yield savings account to maintain liquidity and track your progress without the temptation to spend. Automate regular transfers from your paycheck or checking account to consistently build your emergency fund alongside your rainy day fund, which covers smaller, unforeseen expenses.

Simple Tips to Grow Your Rainy Day Fund

Building a rainy day fund requires setting aside small, consistent contributions from each paycheck to gradually increase your savings. Automate transfers to a dedicated account to avoid the temptation of spending and track your progress monthly to stay motivated. Prioritize liquid, low-risk accounts to ensure quick access during unexpected expenses while avoiding high fees or penalties.

Prioritizing Savings: Which Fund Comes First?

Emergency funds should take priority over rainy day funds because they provide a financial cushion for unexpected major expenses such as medical emergencies, job loss, or urgent home repairs. While rainy day funds cover smaller, less critical costs like minor car repairs or household items, an emergency fund ideally covers three to six months of essential living expenses for maximum security. Establishing a fully funded emergency account first ensures financial stability before allocating money towards less critical short-term savings.

Maintaining and Replenishing Your Safety Nets

Maintaining an emergency fund requires regular monitoring to ensure it covers at least three to six months of essential living expenses, while a rainy day fund typically covers smaller, unexpected costs like minor car repairs or medical bills. Replenishing these safety nets promptly after use is crucial to avoid financial strain and to keep your personal savings secure and prepared for future uncertainties. Consistent contributions and adjusting fund targets based on lifestyle changes or inflation help sustain adequate financial protection.

Related Important Terms

Micro-Emergency Fund

A Micro-Emergency Fund typically covers small, unexpected expenses like minor car repairs or medical co-pays, differentiating it from an Emergency Fund designed to handle larger financial crises such as job loss or major home repairs. While both serve as financial safety nets, the Micro-Emergency Fund emphasizes liquidity and quick access for immediate, less severe emergencies, complementing a broader Rainy Day Fund intended for routine but unplanned expenses.

Hyper-Liquid Fund

An emergency fund is a hyper-liquid financial reserve designed to cover essential expenses for 3 to 6 months, offering immediate access during unforeseen crises like job loss or medical emergencies. In contrast, a rainy day fund typically holds smaller amounts for minor, non-urgent expenses, emphasizing liquidity but with less stringent accessibility compared to an emergency fund.

Crisis Cushion Account

A Crisis Cushion Account serves as a specialized Emergency Fund designed specifically to cover significant, unexpected financial crises such as job loss, major medical expenses, or emergency home repairs, providing a larger, more accessible reserve compared to a Rainy Day Fund. Unlike a Rainy Day Fund, which typically handles minor, short-term expenses like car maintenance or small household repairs, the Crisis Cushion Account prioritizes long-term financial stability by maintaining a higher savings balance to protect against severe economic disruptions.

Nano-Rainy Reserve

An Emergency Fund typically covers 3 to 6 months of essential expenses, providing long-term financial security during major disruptions, while a Rainy Day Fund, such as a Nano-Rainy Reserve, is a smaller, more liquid savings pool designed for immediate access to cover minor, unexpected costs. The Nano-Rainy Reserve functions as a quick-access buffer, maintaining financial flexibility and preventing the depletion of the larger Emergency Fund for everyday mishaps.

Ultra-Short-Term Buffer

An emergency fund typically covers three to six months of essential expenses to safeguard against significant financial shocks, while a rainy day fund acts as an ultra-short-term buffer for smaller, unexpected costs like car repairs or medical copays. Prioritizing a rainy day fund within personal savings ensures immediate liquidity without compromising the stability of the larger emergency fund.

Just-In-Case Wallet

A Just-In-Case Wallet serves as a hybrid between an Emergency Fund and a Rainy Day Fund, offering immediate access to cash for unexpected expenses while maintaining liquidity for minor financial surprises. Unlike traditional Emergency Funds, which are typically larger and stored separately, the Just-In-Case Wallet is designed for quick withdrawals, bridging the gap between daily spending and long-term savings.

Flexi-Emergency Stash

A Flexi-Emergency Stash combines the liquidity of a Rainy Day Fund with the structured preparedness of a traditional Emergency Fund, allowing quick access to cash for unexpected expenses while maintaining dedicated savings for longer-term financial shocks. Its adaptive nature ensures personal savings are optimized for both minor inconveniences and major emergencies without compromising overall financial security.

Sinking Safety Pool

An Emergency Fund is a dedicated sinking safety pool designed to cover major unexpected expenses such as medical emergencies, job loss, or urgent home repairs, typically amounting to three to six months of living expenses. In contrast, a Rainy Day Fund caters to smaller, less urgent financial setbacks like minor car repairs or routine home maintenance, serving as a short-term buffer within personal savings strategies.

Rapid Response Reserve

A Rapid Response Reserve prioritizes immediate accessibility to cover urgent, unforeseen expenses, distinguishing it from a Rainy Day Fund which typically addresses less critical, short-term financial needs. Structuring personal savings with a dedicated Emergency Fund ensures quick liquidity for major crises like job loss or medical emergencies, enhancing financial resilience.

Hybrid Contingency Fund

A Hybrid Contingency Fund combines the immediate accessibility of an Emergency Fund with the flexible scope of a Rainy Day Fund, offering a versatile savings solution for both urgent crises and unexpected minor expenses. This fund typically holds three to six months of essential living expenses in liquid assets, balancing security and accessibility to optimize personal financial resilience.

Emergency Fund vs Rainy Day Fund for personal savings. Infographic

moneydiff.com

moneydiff.com