An Emergency Fund is a dedicated savings account designed to cover unexpected expenses like medical emergencies or urgent pet care, providing financial security without disrupting your regular budget. A FU Fund, often viewed as a rebellious financial cushion, serves as a safety net for irreversible decisions or significant life changes, offering the freedom to walk away from unfavorable situations. Prioritizing an Emergency Fund ensures immediate stability, while a FU Fund empowers long-term independence and control over money management choices.

Table of Comparison

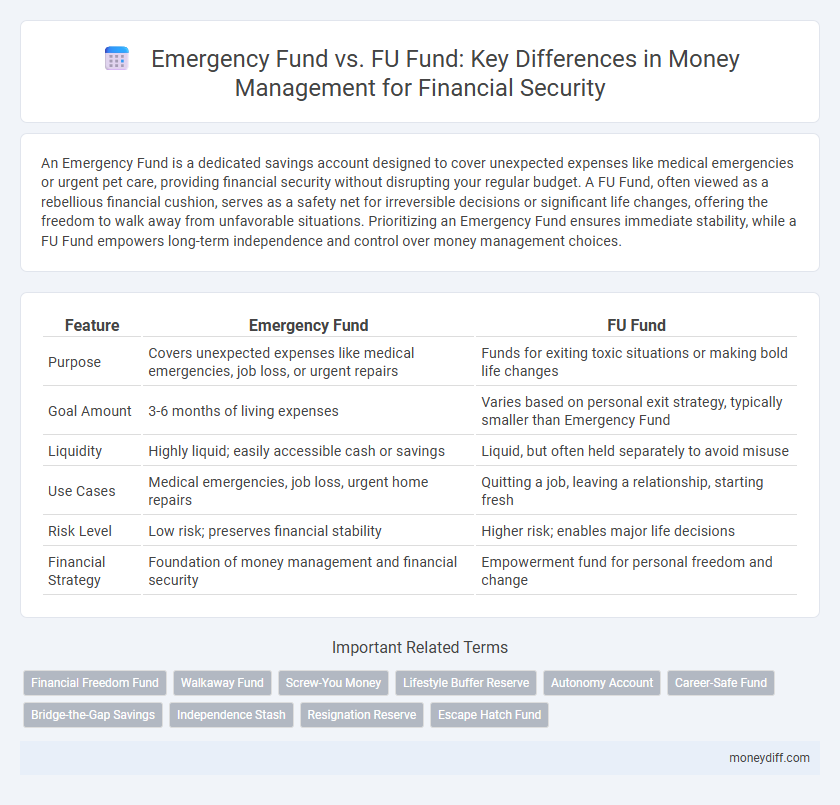

| Feature | Emergency Fund | FU Fund |

|---|---|---|

| Purpose | Covers unexpected expenses like medical emergencies, job loss, or urgent repairs | Funds for exiting toxic situations or making bold life changes |

| Goal Amount | 3-6 months of living expenses | Varies based on personal exit strategy, typically smaller than Emergency Fund |

| Liquidity | Highly liquid; easily accessible cash or savings | Liquid, but often held separately to avoid misuse |

| Use Cases | Medical emergencies, job loss, urgent home repairs | Quitting a job, leaving a relationship, starting fresh |

| Risk Level | Low risk; preserves financial stability | Higher risk; enables major life decisions |

| Financial Strategy | Foundation of money management and financial security | Empowerment fund for personal freedom and change |

Understanding Emergency Funds: Definition and Purpose

An emergency fund is a financial safety net designed to cover unexpected expenses such as medical bills, car repairs, or job loss, providing immediate liquidity without incurring debt. Unlike a FU fund, which is typically reserved for discretionary or confrontational spending to assert independence, an emergency fund prioritizes essential stability and peace of mind. Building a well-funded emergency reserve usually involves saving three to six months' worth of living expenses to ensure readiness for unforeseen financial disruptions.

What is an FU Fund? Distinctions and Origins

An FU Fund is a financial reserve specifically designed to provide individuals with the means to confidently walk away from toxic work environments or situations, reflecting a strong emphasis on personal empowerment and autonomy. Unlike a traditional Emergency Fund, which primarily covers unforeseen expenses like medical bills or car repairs, the FU Fund originates from the idea of creating a safety net that enables bold decisions without financial fear. This concept gained popularity through personal finance experts who advocate for financial independence as a tool to regain control over one's career and life choices.

Emergency Fund vs FU Fund: Key Differences

Emergency Fund is designed to cover essential expenses during financial emergencies, typically holding three to six months' worth of living costs in highly liquid, low-risk accounts. FU Fund, conversely, serves as a financial buffer for personal empowerment or discretionary spending, often earmarked for decisions that prioritize individual freedom or bold choices. The key difference lies in Emergency Fund's focus on stability and immediate necessity versus FU Fund's emphasis on autonomy and optional financial risk-taking.

When to Use an Emergency Fund

An Emergency Fund should be used exclusively for unexpected, essential expenses such as medical emergencies, urgent car repairs, or sudden job loss to maintain financial stability. FU Funds, often intended for discretionary or retaliatory spending, do not provide the same safety net for critical, unforeseen costs. Properly utilizing an Emergency Fund ensures readiness for genuine crises without jeopardizing long-term financial goals or creating further debt.

The Power of FU Fund: Financial Freedom Strategies

The Power of FU Fund lies in its bold approach to financial freedom, prioritizing assertive saving and investing strategies over traditional emergency fund models. Unlike emergency funds that simply cover unexpected expenses, FU Funds are designed to provide a runway for radical financial independence and personal empowerment. This aggressive financial strategy accelerates wealth-building by reducing dependency on external income sources, enabling greater control over life decisions and contingency planning.

Building an Emergency Fund: Step-by-Step Guide

Building an emergency fund involves saving three to six months' worth of essential expenses to cover unexpected financial crises such as job loss or medical emergencies. A FU Fund, typically larger and more aggressive, is designed for immediate independence or quitting a stressful job without financial worry, while an emergency fund prioritizes liquidity and accessibility over growth. Start by setting a realistic monthly savings goal, automate transfers to a high-yield savings account, and progressively increase your fund until you reach the target amount that safeguards your financial stability.

How to Grow Your FU Fund Effectively

Building your FU Fund requires disciplined saving beyond your Emergency Fund, targeting at least three to six months of living expenses plus extra for lifestyle upgrades or freedom from toxic situations. Automate contributions to a high-yield savings or investment account to maximize growth while maintaining liquidity. Prioritize increasing income streams and minimizing unnecessary expenses to accelerate your FU Fund's growth efficiently.

Pros and Cons: Emergency Fund vs FU Fund

An Emergency Fund provides financial security by covering essential expenses during unexpected situations such as job loss or medical emergencies, ensuring peace of mind and long-term stability. In contrast, a FU Fund offers liquidity and empowerment for immediate discretionary spending or abrupt life changes, promoting personal freedom but lacking the structured safety net of an Emergency Fund. While the Emergency Fund prioritizes risk mitigation with low-risk, easily accessible assets, the FU Fund emphasizes personal choice but may encourage impulsive spending without the protective buffer of essential reserves.

Choosing the Right Fund for Your Money Goals

An emergency fund is designed to cover unexpected expenses like medical bills or job loss, typically holding three to six months' worth of living costs in liquid, low-risk accounts. In contrast, a FU fund, often larger and more aggressive, serves as a financial exit strategy to empower major life changes or escape toxic situations, prioritizing higher returns with moderate risk tolerance. Selecting the right fund depends on your immediate security needs and long-term financial independence goals, balancing liquidity with growth potential tailored to your money management plan.

Combining Emergency and FU Funds for Complete Security

Combining an Emergency Fund and a FU Fund offers comprehensive financial security by addressing both unexpected expenses and personal freedom goals. An Emergency Fund covers essential costs like medical bills or car repairs, while a FU Fund empowers individuals to make bold life decisions without financial anxiety. Integrating these funds optimizes money management by ensuring both immediate stability and long-term empowerment.

Related Important Terms

Financial Freedom Fund

A Financial Freedom Fund prioritizes long-term wealth building and passive income generation, whereas an Emergency Fund strictly covers unforeseen expenses and short-term financial disruptions. Allocating resources first to a sufficient Emergency Fund ensures stability, enabling consistent contributions to a FU Fund aimed at achieving financial independence and sustainable money management.

Walkaway Fund

An Emergency Fund is designed to cover essential expenses during unexpected financial hardships, while a Walkaway Fund, often called a FU Fund, enables individuals to confidently exit toxic situations without financial strain. Prioritizing a Walkaway Fund provides psychological freedom and empowerment, making it a strategic complement to traditional emergency savings for comprehensive money management.

Screw-You Money

An Emergency Fund provides financial security for unforeseen expenses, typically covering 3 to 6 months of living costs, whereas Screw-You Money, or FU Fund, offers greater financial freedom by accumulating enough wealth to confidently walk away from undesirable situations or jobs. Prioritizing a robust Emergency Fund ensures stability, while building Screw-You Money fosters long-term independence and power in money management decisions.

Lifestyle Buffer Reserve

A Lifestyle Buffer Reserve differs from a traditional Emergency Fund by covering not only unforeseen expenses but also temporary lifestyle adjustments during financial disruptions. While an Emergency Fund typically secures essential needs like housing and food, a Lifestyle Buffer Reserve includes discretionary spending to maintain quality of life and reduce stress in uncertain times.

Autonomy Account

An Emergency Fund is essential for covering unexpected expenses, while a FU Fund prioritizes financial autonomy by allowing discretionary spending without guilt or dependency. Autonomy Account integrates both concepts, offering a secure reserve for emergencies alongside flexible funds to empower personal financial independence.

Career-Safe Fund

A Career-Safe Fund prioritizes financial stability by covering essential expenses during career disruptions, distinguishing it from a traditional Emergency Fund that addresses unforeseen general expenses. Unlike a FU Fund designed for immediate, often emotional responses to job loss or conflicts, a Career-Safe Fund strategically secures income continuity and skill development to ensure long-term career resilience.

Bridge-the-Gap Savings

Bridge-the-Gap Savings in an Emergency Fund provides immediate access to cash for unexpected expenses, ensuring financial stability without disrupting long-term goals, whereas an FU Fund is typically reserved for severance or drastic life changes, prioritizing empowerment over short-term liquidity. Establishing a well-defined Emergency Fund focused on bridge-the-gap savings enhances money management by covering urgent costs and preventing high-interest debt accumulation.

Independence Stash

An Emergency Fund is designed to cover unexpected expenses and maintain financial stability, while a FU Fund prioritizes rapid financial independence by enabling bold decisions or exits from unfavorable situations. Building an Independence Stash--a robust, accessible reserve combining both emergency savings and FU Fund principles--empowers individuals to confidently navigate uncertainties and seize opportunities without debt reliance.

Resignation Reserve

An Emergency Fund is designed to cover unexpected expenses like medical emergencies or urgent repairs, typically holding three to six months' worth of living expenses, while a FU Fund, often called a Resignation Reserve, is specifically set aside to provide financial security upon quitting a job or making a career transition, usually encompassing six to twelve months of living costs to allow for an extended job search or entrepreneurial pursuits. Prioritizing a Resignation Reserve within money management strategies ensures readiness for voluntary job departures without financial strain, distinguishing it from the more defensive, reactive purpose of a traditional Emergency Fund.

Escape Hatch Fund

An Emergency Fund serves as a critical financial safety net for unexpected expenses like medical emergencies or urgent home repairs, ensuring stability without incurring debt. In contrast, an Escape Hatch Fund, often part of a FU Fund, empowers individuals to exit toxic jobs or situations quickly, emphasizing proactive financial freedom alongside traditional emergency savings.

Emergency Fund vs FU Fund for money management Infographic

moneydiff.com

moneydiff.com