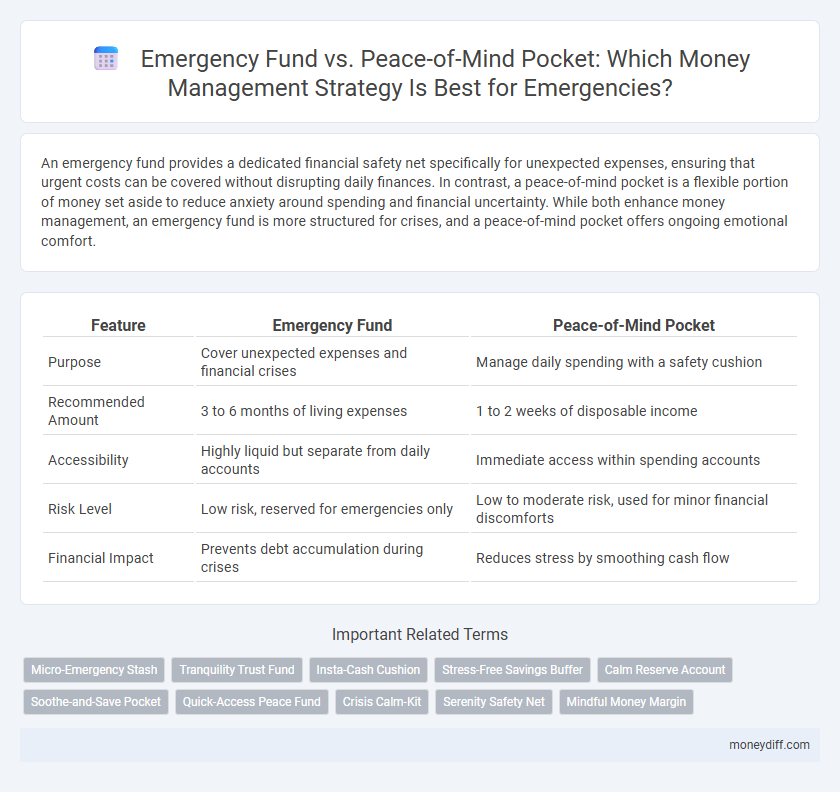

An emergency fund provides a dedicated financial safety net specifically for unexpected expenses, ensuring that urgent costs can be covered without disrupting daily finances. In contrast, a peace-of-mind pocket is a flexible portion of money set aside to reduce anxiety around spending and financial uncertainty. While both enhance money management, an emergency fund is more structured for crises, and a peace-of-mind pocket offers ongoing emotional comfort.

Table of Comparison

| Feature | Emergency Fund | Peace-of-Mind Pocket |

|---|---|---|

| Purpose | Cover unexpected expenses and financial crises | Manage daily spending with a safety cushion |

| Recommended Amount | 3 to 6 months of living expenses | 1 to 2 weeks of disposable income |

| Accessibility | Highly liquid but separate from daily accounts | Immediate access within spending accounts |

| Risk Level | Low risk, reserved for emergencies only | Low to moderate risk, used for minor financial discomforts |

| Financial Impact | Prevents debt accumulation during crises | Reduces stress by smoothing cash flow |

Understanding Emergency Funds: Definition and Purpose

An emergency fund is a reserved amount of money specifically for unexpected expenses like medical bills, car repairs, or job loss, ensuring financial stability during crises. Unlike a peace-of-mind pocket, which may cover minor convenience spending or short-term wants, an emergency fund prioritizes essential needs and prevents reliance on high-interest debt. Financial experts recommend saving three to six months' worth of living expenses to effectively safeguard against financial emergencies.

What Is a Peace-of-Mind Pocket?

A Peace-of-Mind Pocket is a designated sum of money set aside specifically for unexpected expenses or financial stressors, distinct from a traditional emergency fund that covers significant crises like job loss or major repairs. It provides immediate access to cash for minor, day-to-day uncertainties, helping maintain financial stability without disrupting long-term savings. This approach enhances overall money management by reducing anxiety over small financial surprises while preserving the emergency fund for larger, more critical events.

Key Differences Between Emergency Funds and Peace-of-Mind Pockets

Emergency funds are strictly designated savings set aside to cover unexpected financial crises such as job loss, medical emergencies, or major car repairs, typically equaling three to six months of living expenses. Peace-of-mind pockets are more flexible cash reserves meant for minor unexpected costs or to reduce financial anxiety, often smaller and accessible without strict rules. The key difference lies in their purpose and size: emergency funds provide a financial safety net for significant hardships, while peace-of-mind pockets offer a buffer for everyday surprises and mental comfort.

When to Use an Emergency Fund vs Peace-of-Mind Pocket

An Emergency Fund is designed exclusively for unexpected financial crises like job loss, medical emergencies, or urgent home repairs, providing a financial safety net that covers essential expenses for three to six months. A Peace-of-Mind Pocket, on the other hand, is a smaller, more flexible reserve used for minor setbacks or non-urgent expenses, such as car maintenance or a short-term income gap, helping to reduce financial stress without dipping into long-term savings. Use an Emergency Fund strictly for true emergencies to maintain financial stability, while the Peace-of-Mind Pocket supports day-to-day unexpected costs, enhancing overall money management efficiency.

How Much Should You Save in Each Fund?

Financial experts typically recommend saving three to six months' worth of essential living expenses in an emergency fund to cover unexpected costs like medical bills or job loss. A peace-of-mind pocket, designed for smaller, non-urgent expenses, usually requires a more flexible amount, often one to two months' worth of discretionary spending. Balancing these funds ensures both immediate stability and stress-free management of minor financial surprises.

Building Your Emergency Fund: Practical Steps

Building your emergency fund involves setting a clear savings goal, typically covering three to six months of essential expenses, to safeguard against unexpected financial hardships. Prioritize consistent contributions by automating transfers to a dedicated, easily accessible savings account separate from your peace-of-mind pocket, which holds smaller sums for minor daily stresses. Regularly review and adjust your emergency fund based on changing expenses and life circumstances to maintain optimal financial resilience.

Setting Up a Peace-of-Mind Pocket: Tips and Tricks

Setting up a Peace-of-Mind Pocket involves allocating a specific amount of money separate from your main accounts to cover unexpected expenses, ensuring financial stability without tapping into essential funds. Use high-yield savings accounts or accessible digital wallets for easy access and growth potential, and regularly review and adjust the amount based on changing needs and expenses. Automating transfers into the Peace-of-Mind Pocket can build the fund consistently, while tracking spending habits helps maintain its purpose strictly for emergencies.

Pros and Cons of Separate Savings Strategies

An Emergency Fund provides a dedicated financial safety net designed for unexpected expenses like medical emergencies or car repairs, ensuring quick access to cash without disrupting daily finances. In contrast, a Peace-of-Mind Pocket serves as a flexible savings buffer for minor, non-essential expenses, promoting psychological comfort but potentially blurring financial boundaries. Separating these savings strategies enhances clarity and discipline, though it may require more rigorous budgeting and tracking to maintain distinct goals effectively.

Integrating Both Funds into Your Money Management Plan

Integrating both an emergency fund and a peace-of-mind pocket enhances financial resilience by addressing unforeseen crises and everyday uncertainties simultaneously. Allocating a specific amount to a peace-of-mind pocket alongside a fully funded emergency fund of 3-6 months' living expenses ensures liquidity for minor expenses without depleting critical reserves. This dual-fund strategy optimizes cash flow, reduces financial stress, and supports sustained money management discipline.

Which Option is Right for You? Situational Scenarios

Emergency funds are best suited for unexpected financial crises such as medical emergencies, job loss, or urgent home repairs, offering a secured buffer of three to six months' living expenses. Peace-of-mind pockets are ideal for individuals who prefer smaller, flexible savings for minor unexpected costs, providing quick access without disrupting long-term savings goals. Choosing the right option depends on your risk tolerance, financial stability, and the likelihood of needing significant funds suddenly versus frequent smaller expenses.

Related Important Terms

Micro-Emergency Stash

A Micro-Emergency Stash, distinct from a traditional Emergency Fund, serves as a readily accessible peace-of-mind pocket designed to cover small, unexpected expenses without disrupting long-term savings. This strategic money management tool ensures financial resilience by addressing minor emergencies swiftly while preserving the integrity of larger emergency reserves.

Tranquility Trust Fund

The Tranquility Trust Fund offers a unique approach to money management by combining the accessibility of a traditional emergency fund with the strategic growth potential of a peace-of-mind pocket, ensuring financial security and mental calm during unexpected events. This hybrid fund prioritizes liquidity and low-risk investments, providing a balanced solution that addresses immediate cash needs while fostering long-term financial stability.

Insta-Cash Cushion

An Emergency Fund serves as a dedicated financial reserve for unexpected expenses, while a Peace-of-Mind Pocket like the Insta-Cash Cushion offers immediate, flexible access to funds for urgent needs without depleting long-term savings. Instacash Cushion provides seamless liquidity and reduces reliance on high-interest credit, enhancing overall money management efficiency.

Stress-Free Savings Buffer

An emergency fund serves as a vital financial safety net designed to cover unexpected expenses like medical bills or car repairs, ensuring stability during financial shocks. The peace-of-mind pocket, however, functions as a stress-free savings buffer for minor, non-urgent costs, reducing anxiety and preventing disruptions to your primary budget.

Calm Reserve Account

Calm Reserve Account serves as a dedicated Emergency Fund designed to cover unexpected expenses, providing financial stability without disrupting monthly budgets. Unlike a Peace-of-Mind Pocket, which may be more flexible but less structured, the Calm Reserve Account ensures funds are readily accessible and reserved solely for urgent needs, optimizing money management during crises.

Soothe-and-Save Pocket

The Soothe-and-Save Pocket balances the Emergency Fund's role by providing a flexible reserve for unexpected expenses while promoting steady savings growth. This approach combines immediate financial relief with long-term security, enhancing overall money management effectiveness.

Quick-Access Peace Fund

A Quick-Access Peace Fund differs from a traditional Emergency Fund by prioritizing immediate availability and stress-free access to cash without penalties or delays. This approach enhances financial security by ensuring funds are easily reachable for sudden expenses, promoting both liquidity and peace of mind in money management.

Crisis Calm-Kit

An Emergency Fund provides essential financial security for unexpected expenses, while a Peace-of-Mind Pocket offers immediate access to smaller, manageable cash reserves designed to reduce stress during minor disruptions. The Crisis Calm-Kit integrates both concepts, combining a robust Emergency Fund with a ready-to-use cash buffer, optimizing money management for enhanced preparedness and psychological relief.

Serenity Safety Net

An Emergency Fund serves as a crucial financial buffer specifically reserved for unexpected expenses, ensuring immediate access to cash without disrupting long-term investments. The Peace-of-Mind Pocket offers a Serenity Safety Net by combining quick liquidity with personalized spending flexibility, enhancing overall money management and reducing stress during unforeseen financial challenges.

Mindful Money Margin

Emergency Fund represents a foundational financial buffer designed to cover 3-6 months of essential expenses during unforeseen circumstances, ensuring long-term security. Peace-of-Mind Pocket offers a smaller, readily accessible Mindful Money Margin, enabling immediate stress relief and flexible money management for minor emergencies or daily financial uncertainties.

Emergency Fund vs Peace-of-Mind Pocket for money management Infographic

moneydiff.com

moneydiff.com