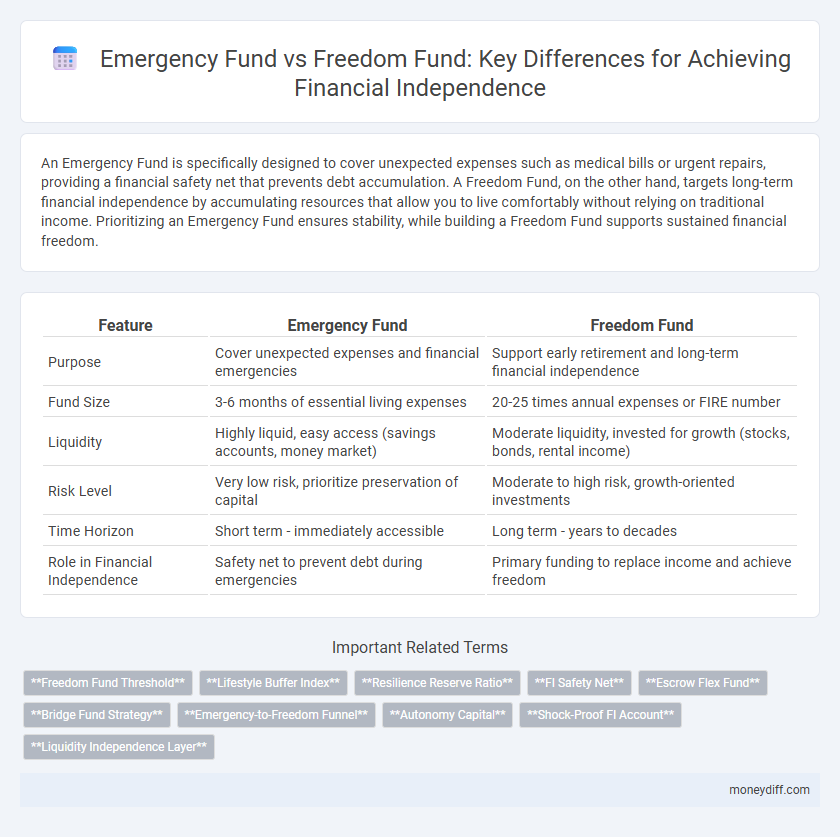

An Emergency Fund is specifically designed to cover unexpected expenses such as medical bills or urgent repairs, providing a financial safety net that prevents debt accumulation. A Freedom Fund, on the other hand, targets long-term financial independence by accumulating resources that allow you to live comfortably without relying on traditional income. Prioritizing an Emergency Fund ensures stability, while building a Freedom Fund supports sustained financial freedom.

Table of Comparison

| Feature | Emergency Fund | Freedom Fund |

|---|---|---|

| Purpose | Cover unexpected expenses and financial emergencies | Support early retirement and long-term financial independence |

| Fund Size | 3-6 months of essential living expenses | 20-25 times annual expenses or FIRE number |

| Liquidity | Highly liquid, easy access (savings accounts, money market) | Moderate liquidity, invested for growth (stocks, bonds, rental income) |

| Risk Level | Very low risk, prioritize preservation of capital | Moderate to high risk, growth-oriented investments |

| Time Horizon | Short term - immediately accessible | Long term - years to decades |

| Role in Financial Independence | Safety net to prevent debt during emergencies | Primary funding to replace income and achieve freedom |

Understanding Emergency Funds: The First Step to Financial Security

Emergency funds provide a financial safety net covering 3 to 6 months of essential expenses, ensuring stability during unexpected events like job loss or medical emergencies. In contrast, freedom funds are geared towards long-term financial independence, focusing on wealth accumulation through investments and passive income streams. Prioritizing the establishment of an emergency fund is crucial for building a secure foundation before pursuing greater financial freedom.

What Is a Freedom Fund? Goals Beyond Emergencies

A Freedom Fund is a financial reserve designed to support life choices and personal growth beyond just covering emergencies, enabling greater autonomy and flexibility in career and lifestyle decisions. Unlike an Emergency Fund that focuses solely on unexpected expenses like medical bills or car repairs, a Freedom Fund targets goals such as early retirement, sabbaticals, or starting a passion project. Building a Freedom Fund accelerates financial independence by providing resources to pursue opportunities without the immediate pressure of income constraints.

Emergency Fund vs Freedom Fund: Key Differences Explained

Emergency Fund is designed to cover unexpected expenses and financial emergencies, typically maintaining three to six months of essential living costs in liquid savings. Freedom Fund focuses on building wealth to achieve financial independence, often involving long-term investments that generate passive income over time. The key difference lies in purpose and accessibility: Emergency Fund provides immediate financial security, while Freedom Fund aims to fund lifestyle freedom through sustained financial growth.

Why You Need Both: Balancing Preparedness and Independence

An Emergency Fund provides essential financial security by covering unexpected expenses like medical emergencies or job loss, ensuring short-term stability. A Freedom Fund, focused on long-term financial independence, enables investments that generate passive income and reduce reliance on active employment. Balancing both funds creates a solid foundation where immediate crises are managed without derailing progress toward achieving lasting financial freedom.

How Much Should You Save in Your Emergency Fund?

An emergency fund should ideally cover three to six months' worth of essential living expenses, including rent or mortgage, utilities, groceries, and debt payments, to provide a financial safety net during unexpected events. Factors such as job stability, income sources, and personal financial obligations influence the precise amount one needs to save, ensuring liquidity without sacrificing long-term investment growth. Prioritizing this fund before building a freedom fund strengthens overall financial independence by safeguarding against sudden financial disruptions.

Building Your Freedom Fund for Long-Term Goals

Building your Freedom Fund involves strategic saving beyond the basic Emergency Fund, targeting long-term financial independence and major life goals like retirement or entrepreneurship. Unlike an Emergency Fund, which covers urgent expenses typically 3 to 6 months of living costs, the Freedom Fund focuses on accumulating substantial assets that generate passive income and wealth over time. Prioritizing consistent contributions and diversified investments within the Freedom Fund accelerates wealth creation essential for true financial freedom.

Emergency Fund Prioritization: When to Start Your Freedom Fund

An emergency fund should be established before starting a freedom fund to ensure financial stability during unexpected expenses like medical emergencies or job loss. Experts recommend saving three to six months' worth of essential living expenses in an easily accessible account to create a safety net. Prioritizing the emergency fund helps prevent dipping into long-term investments, preserving the momentum toward financial independence.

Funding Strategies: How to Grow Both Funds Simultaneously

Maximize cash flow allocation by directing a fixed percentage of income towards both the Emergency Fund and Freedom Fund, ensuring consistent growth without depleting resources. Utilize high-yield savings accounts for the Emergency Fund to maintain liquidity, while investing the Freedom Fund in diversified portfolios to accelerate wealth accumulation. Automate contributions and periodically reassess fund targets based on changing expenses and financial goals to optimize simultaneous funding strategies.

Common Pitfalls in Managing Emergency and Freedom Funds

Common pitfalls in managing Emergency and Freedom Funds include underestimating the required fund size, leading to insufficient coverage during critical times, and mixing funds for different purposes, which compromises financial clarity and discipline. Another frequent mistake is neglecting regular fund reviews, causing allocations to become misaligned with evolving financial needs and goals, thus hindering progress toward financial independence. Effective management requires clear distinction, appropriate sizing based on personal risk assessment, and periodic adjustments to maintain fund integrity and purpose.

Choosing the Right Account: Where to Park Your Funds Safely

Choosing the right account for your Emergency Fund ensures liquidity and safety, typically favoring high-yield savings accounts or money market accounts with FDIC insurance. Freedom Funds, aimed at long-term financial independence, often benefit from investment accounts like Roth IRAs or taxable brokerage accounts, which offer growth potential but less immediate access. Balancing the need for quick access in emergencies with the desire for growth in freedom funds is key to optimizing financial stability and independence.

Related Important Terms

Freedom Fund Threshold

The Freedom Fund Threshold represents the minimum amount of savings required to generate passive income that covers all essential living expenses, marking a critical milestone beyond the traditional Emergency Fund. While an Emergency Fund safeguards against unexpected financial shocks with 3-6 months of expenses, reaching the Freedom Fund Threshold enables true financial independence by ensuring sustainable income without active employment.

Lifestyle Buffer Index

The Lifestyle Buffer Index measures how many months your essential expenses can be covered by your Emergency Fund, providing a clear metric to distinguish it from a Freedom Fund, which supports long-term financial independence by covering discretionary spending and lifestyle choices. Tracking the Lifestyle Buffer Index ensures your fund adequately protects against income disruptions while maintaining your standard of living without tapping into Freedom Fund assets.

Resilience Reserve Ratio

The Resilience Reserve Ratio measures the adequacy of an Emergency Fund in covering essential expenses during financial shocks, contrasting with the Freedom Fund which prioritizes investment growth for long-term financial independence. Maintaining a high Resilience Reserve Ratio ensures immediate liquidity for unexpected events, reinforcing financial stability before pursuing Freedom Fund goals.

FI Safety Net

An Emergency Fund provides a vital FI safety net by covering unexpected expenses and protecting against financial setbacks during the pursuit of financial independence. In contrast, a Freedom Fund focuses on wealth accumulation for long-term goals, making the Emergency Fund essential for immediate security and stability.

Escrow Flex Fund

Escrow Flex Fund offers a hybrid approach combining the safety of an emergency fund with the strategic growth potential of a freedom fund, designed to accelerate financial independence. By maintaining liquidity while allowing flexible investment options, Escrow Flex Fund optimizes cash reserves for both unexpected expenses and long-term wealth building.

Bridge Fund Strategy

The Bridge Fund Strategy leverages an Emergency Fund to cover immediate, unexpected expenses while positioning the Freedom Fund as a long-term financial independence goal that supports lifestyle freedom without reliance on traditional income. Structuring savings this way ensures quick liquidity through a Bridge Fund while systematically building a Freedom Fund to sustain financial autonomy.

Emergency-to-Freedom Funnel

The Emergency-to-Freedom Funnel strategically channels savings from a fully funded emergency fund into a dedicated Freedom Fund, accelerating the path to financial independence by prioritizing liquidity before investing for long-term growth. This method ensures financial security while progressively building wealth, minimizing risk and enhancing flexibility during economic uncertainties.

Autonomy Capital

Autonomy Capital emphasizes building an Emergency Fund as a crucial first step toward financial independence, providing a safety net that covers unexpected expenses and prevents debt accumulation. Unlike a Freedom Fund aimed at early retirement investments, the Emergency Fund prioritizes liquidity and accessibility to ensure financial stability during unforeseen crises.

Shock-Proof FI Account

A Shock-Proof FI Account combines the stability of an Emergency Fund with the growth potential of a Freedom Fund, ensuring financial independence remains resilient against unexpected expenses and market volatility. Prioritizing liquid, low-risk assets in this hybrid fund safeguards your financial freedom while maintaining accessible reserves for immediate shocks.

Liquidity Independence Layer

The Emergency Fund serves as the essential Liquidity Independence Layer, providing immediate access to cash for unexpected expenses, while the Freedom Fund focuses on long-term wealth growth and financial autonomy. Prioritizing a well-funded Emergency Fund ensures financial stability without liquidating investments, maintaining liquidity independence during crises.

Emergency Fund vs Freedom Fund for financial independence. Infographic

moneydiff.com

moneydiff.com