An Emergency Fund provides a dedicated, easily accessible cash reserve specifically for unexpected expenses, ensuring financial stability during crises. In contrast, a Chaos Jar typically serves as a flexible, catch-all container for miscellaneous savings without a clear purpose, which can lead to disorganization and ineffective money management. Prioritizing an Emergency Fund enables disciplined saving and creates a structured safety net for true emergencies.

Table of Comparison

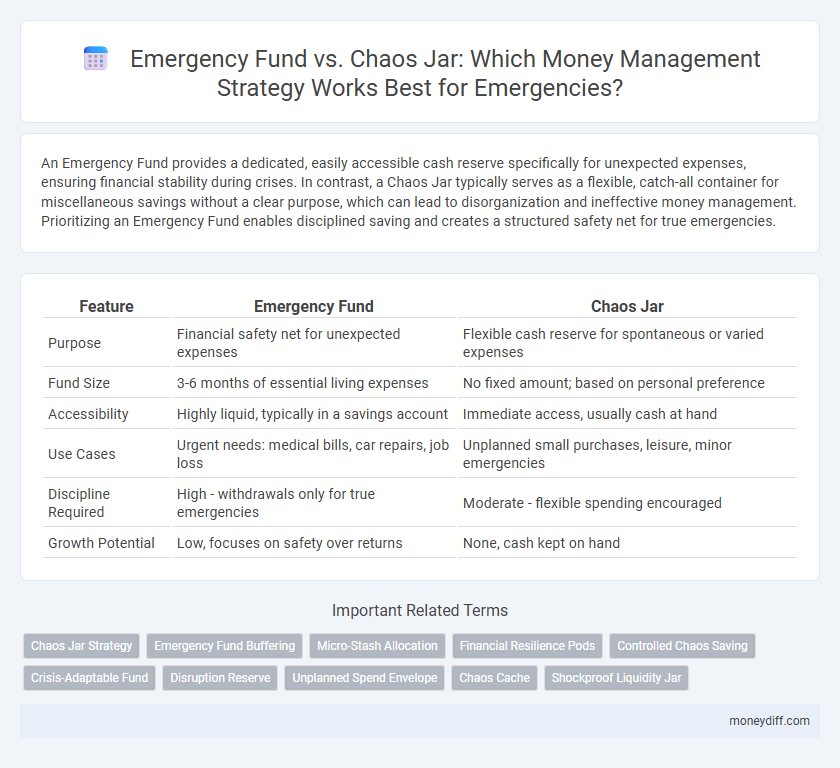

| Feature | Emergency Fund | Chaos Jar |

|---|---|---|

| Purpose | Financial safety net for unexpected expenses | Flexible cash reserve for spontaneous or varied expenses |

| Fund Size | 3-6 months of essential living expenses | No fixed amount; based on personal preference |

| Accessibility | Highly liquid, typically in a savings account | Immediate access, usually cash at hand |

| Use Cases | Urgent needs: medical bills, car repairs, job loss | Unplanned small purchases, leisure, minor emergencies |

| Discipline Required | High - withdrawals only for true emergencies | Moderate - flexible spending encouraged |

| Growth Potential | Low, focuses on safety over returns | None, cash kept on hand |

Understanding Emergency Fund and Chaos Jar: Key Differences

An Emergency Fund is a dedicated savings account designed to cover unexpected expenses such as medical emergencies, car repairs, or job loss, typically holding three to six months' worth of living expenses. In contrast, a Chaos Jar is a more informal, flexible cash reserve for minor, unpredictable financial hiccups like small home repairs or spontaneous urgent needs. Understanding these key differences helps optimize financial preparedness by categorizing and prioritizing funds based on the severity and immediacy of potential emergencies.

Core Principles of an Emergency Fund

An emergency fund is built on the core principles of liquidity, accessibility, and sufficiency, ensuring immediate availability of cash for unexpected expenses like medical emergencies or car repairs. Unlike a Chaos Jar, which often serves as a catch-all for miscellaneous spending without defined limits, an emergency fund prioritizes a predetermined savings goal typically covering three to six months of essential living costs. This structured approach promotes financial stability and peace of mind by segregating true emergencies from everyday expenditures.

What is a Chaos Jar? An Alternative Approach

A Chaos Jar is an alternative money management method where unpredictable expenses and spontaneous purchases are covered from a reserved cash pool, differing from the traditional Emergency Fund focused solely on crises. While an Emergency Fund typically targets significant, unexpected financial setbacks like medical bills or job loss, a Chaos Jar caters to everyday financial chaos such as last-minute social events or minor unplanned expenses. This flexible approach helps maintain financial stability by absorbing small shocks without dipping into long-term savings, complementing the structured safety net of an Emergency Fund.

When to Use an Emergency Fund

An Emergency Fund is essential for covering unexpected expenses such as medical emergencies, car repairs, or sudden job loss, providing financial security without compromising your budget. Unlike a Chaos Jar, which is typically used for sporadic, minor expenses or impulse spending, an Emergency Fund is strictly reserved for genuine financial crises. Prioritize building a fund with three to six months' worth of living expenses to ensure stability during unforeseen events.

Situations Best Suited for a Chaos Jar

A Chaos Jar is ideal for managing unpredictable, small-scale expenses that don't fit neatly into a traditional budget, such as spontaneous repairs, unexpected dining out, or last-minute gifts. Unlike an emergency fund, which is reserved for significant financial crises like job loss or major medical bills, a Chaos Jar offers flexibility for frequent, minor financial surprises. This method helps maintain budget stability by containing these irregular expenses without dipping into essential savings.

Building Your Emergency Fund: Step-by-Step

Building your emergency fund starts with setting a clear savings goal based on three to six months of essential living expenses. Unlike a chaos jar, which allows spontaneous spending, an emergency fund is strictly reserved for unforeseen financial crises such as medical emergencies or job loss. Automating regular contributions into a high-yield savings account accelerates fund growth and ensures liquidity when urgent expenses arise.

Setting Up a Chaos Jar for Financial Flexibility

Setting up a Chaos Jar provides financial flexibility by allocating a designated cash reserve for unexpected expenses outside of an Emergency Fund's strict criteria. Unlike traditional Emergency Funds, which are often rigidly structured and reserved for critical emergencies, a Chaos Jar allows for spontaneous, smaller-scale financial disruptions without disrupting primary savings goals. This approach enhances overall money management by balancing liquidity and preparedness for both major crises and daily financial surprises.

Pros and Cons: Emergency Fund vs Chaos Jar

An Emergency Fund offers a dedicated, liquid financial safety net specifically for unexpected expenses, ensuring quick access to cash without disrupting regular budgets, whereas a Chaos Jar acts as a flexible, catch-all savings container that can dilute focus but encourages habitual saving. Emergency Funds typically yield higher interest when kept in high-yield savings or money market accounts, contributing to wealth growth, while Chaos Jars often lack interest accrual, reducing potential financial benefits. The Emergency Fund's clear purpose limits impulsive spending, but may feel rigid, whereas the Chaos Jar's adaptability supports diverse goals but risks inadequate coverage during true emergencies.

Choosing the Right Strategy for Your Financial Goals

An emergency fund provides a dedicated cash reserve for unexpected expenses, ensuring financial stability during crises. In contrast, the chaos jar allows flexible spending without strict allocation, which may suit those prioritizing short-term adaptability over long-term security. Selecting the right strategy depends on your financial goals: build an emergency fund for risk mitigation and peace of mind, or use a chaos jar if you prefer managing irregular expenses with less structure.

Combining Emergency Fund and Chaos Jar: A Balanced Approach

Combining an emergency fund with a chaos jar creates a balanced approach to money management by addressing both predictable and unpredictable expenses. The emergency fund covers significant, unforeseen financial crises like medical emergencies or job loss, while the chaos jar handles smaller, irregular costs such as unexpected car repairs or household mishaps. This dual strategy optimizes financial stability and reduces stress by ensuring funds are allocated for both major and minor emergencies.

Related Important Terms

Chaos Jar Strategy

The Chaos Jar strategy simplifies money management by dividing funds into specific jars for immediate needs, creating a more flexible and visually organized approach compared to a traditional emergency fund. This method encourages proactive budgeting and quick access to cash for unexpected expenses, enhancing financial stability through tangible saving categories.

Emergency Fund Buffering

An Emergency Fund provides a dedicated buffer of liquid savings designed to cover unexpected expenses or income disruptions, ensuring financial stability without resorting to high-interest debt. Unlike a Chaos Jar, which mixes discretionary spending with emergency needs, an Emergency Fund is strategically allocated to maintain tight financial discipline and rapid access during true crises.

Micro-Stash Allocation

Micro-stash allocation in emergency funds enables targeted savings for specific unexpected expenses, offering a more structured approach than a chaos jar, which lumps all money into one pot. This strategy enhances financial preparedness by categorizing funds into distinct micro-reserves, reducing spending confusion during emergencies.

Financial Resilience Pods

Financial Resilience Pods enhance money management by integrating Emergency Funds with Chaos Jars, creating structured categories for unexpected expenses and spontaneous needs. This approach improves financial stability by ensuring dedicated reserves for emergencies while maintaining flexibility for unpredictable expenditures.

Controlled Chaos Saving

Controlled Chaos Saving uses a Chaos Jar to allocate funds flexibly for unexpected expenses, contrasting with a traditional Emergency Fund that maintains a fixed reserve for specific emergencies. This approach encourages adaptive money management by balancing liquidity with strategic saving, enabling quicker access to cash while still building financial security.

Crisis-Adaptable Fund

A Crisis-Adaptable Fund surpasses traditional Emergency Funds and Chaos Jars by offering flexible, real-time access to resources tailored for unexpected financial disruptions, ensuring liquidity for diverse crises beyond standard emergencies. Unlike fixed-purpose jars, this adaptive fund dynamically reallocates assets, optimizing stability and responsiveness during fluctuating economic events or personal financial shocks.

Disruption Reserve

An Emergency Fund serves as a dedicated financial buffer designed to cover unexpected expenses, ensuring stability during crises, while a Chaos Jar typically represents a casual stash for irregular spending without a specific disruption focus. The Disruption Reserve within an Emergency Fund prioritizes liquidity and accessibility to address sudden income loss or major emergencies, making it more reliable for sustained financial security compared to the less structured Chaos Jar.

Unplanned Spend Envelope

An Emergency Fund provides a dedicated financial reserve for unexpected expenses, ensuring stability without disrupting regular budgeting, whereas a Chaos Jar aggregates miscellaneous unplanned spend envelops, leading to less precise tracking and potential overspending. Prioritizing an Emergency Fund enhances money management by promoting clear boundaries for urgent costs and improving overall financial preparedness.

Chaos Cache

The Chaos Cache offers a more flexible approach to money management by allowing users to allocate funds for unpredictable expenses, contrasting with the traditional Emergency Fund's fixed-purpose savings. Prioritizing a Chaos Cache can enhance financial adaptability by addressing both planned and spontaneous financial needs, reducing stress during unexpected situations.

Shockproof Liquidity Jar

Shockproof Liquidity Jar ensures immediate access to funds during financial emergencies, acting as a buffer against unexpected expenses with a focus on liquidity and stability. Unlike an Emergency Fund designed purely for unforeseen costs, the Shockproof Liquidity Jar emphasizes maintaining a dedicated, easily accessible pool of money to mitigate financial chaos and preserve cash flow.

Emergency Fund vs Chaos Jar for money management. Infographic

moneydiff.com

moneydiff.com