An Emergency Fund is designed to cover unexpected expenses or financial emergencies, providing immediate liquidity for unforeseen events such as medical emergencies or sudden job loss. In contrast, a Sinking Fund is a savings strategy for planned expenses, allowing systematic allocation of money over time for anticipated costs like pet vaccinations or routine vet visits. Understanding the difference between these funds enhances financial preparedness by ensuring both urgent and planned expenses for pet care are adequately managed.

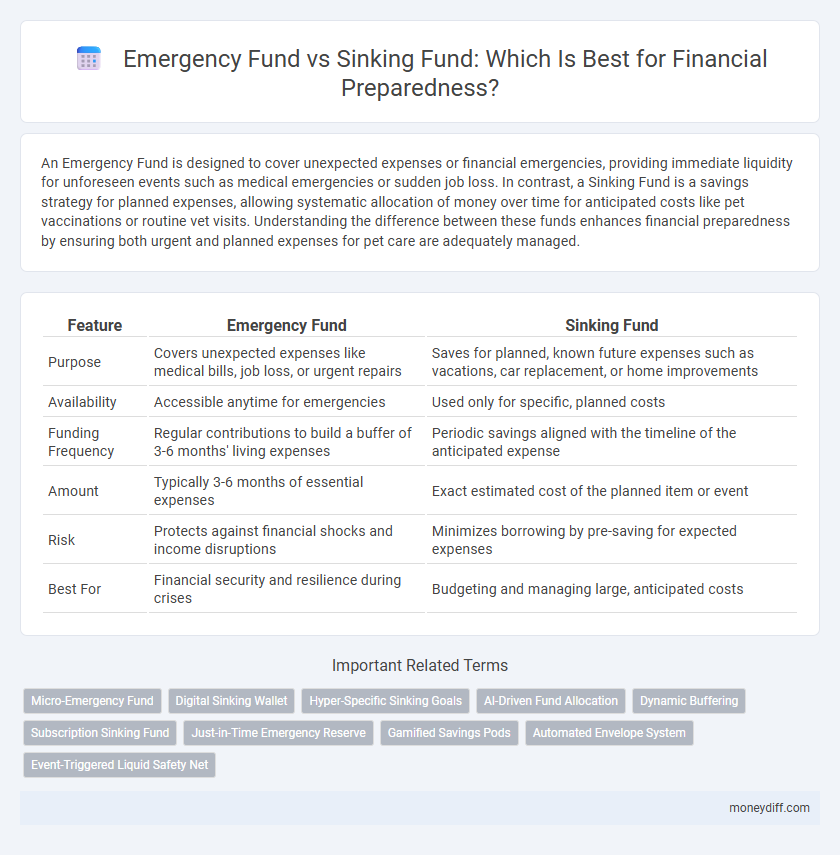

Table of Comparison

| Feature | Emergency Fund | Sinking Fund |

|---|---|---|

| Purpose | Covers unexpected expenses like medical bills, job loss, or urgent repairs | Saves for planned, known future expenses such as vacations, car replacement, or home improvements |

| Availability | Accessible anytime for emergencies | Used only for specific, planned costs |

| Funding Frequency | Regular contributions to build a buffer of 3-6 months' living expenses | Periodic savings aligned with the timeline of the anticipated expense |

| Amount | Typically 3-6 months of essential expenses | Exact estimated cost of the planned item or event |

| Risk | Protects against financial shocks and income disruptions | Minimizes borrowing by pre-saving for expected expenses |

| Best For | Financial security and resilience during crises | Budgeting and managing large, anticipated costs |

Understanding Emergency Funds: A Safety Net for Uncertainty

An emergency fund serves as a financial safety net designed to cover unexpected expenses such as medical emergencies, car repairs, or sudden job loss, ensuring immediate liquidity without debt accumulation. Unlike a sinking fund, which is earmarked for planned expenses like vacations or major purchases, an emergency fund prioritizes unpredictability and quick access. Maintaining three to six months' worth of living expenses in an emergency fund enhances financial preparedness and stability amid uncertain circumstances.

Defining Sinking Funds: Purposeful Savings for Planned Expenses

Sinking funds are targeted savings accounts designated for anticipated expenses such as home repairs, car maintenance, or annual insurance premiums, enabling better budget management and avoiding debt. Unlike emergency funds, which cover unexpected financial crises, sinking funds promote disciplined saving by allocating money systematically for known future costs. Establishing sinking funds improves financial preparedness and reduces stress by separating planned expenses from emergency reserves.

Key Differences Between Emergency Fund and Sinking Fund

An Emergency Fund is designed to cover unexpected expenses such as medical emergencies or job loss, providing immediate financial security, whereas a Sinking Fund is allocated for planned future expenses like car repairs or vacations, allowing for systematic saving over time. Emergency Funds typically hold liquid assets for quick access, while Sinking Funds are more flexible in timing and may be held in less liquid accounts. The key difference lies in the purpose and urgency: Emergency Funds address unforeseen crises, whereas Sinking Funds prepare for anticipated, non-emergency costs.

Why Everyone Needs an Emergency Fund

An emergency fund serves as a financial safety net designed to cover unexpected expenses such as medical emergencies, car repairs, or sudden job loss, ensuring financial stability during crises. Unlike a sinking fund, which is earmarked for planned future expenses like vacations or home improvements, an emergency fund is unrestricted and accessible immediately. Establishing an emergency fund with three to six months' worth of living expenses is crucial for preventing debt accumulation and maintaining peace of mind in uncertain situations.

The Role of Sinking Funds in Financial Planning

Sinking funds play a crucial role in financial planning by setting aside money regularly for anticipated future expenses, ensuring funds are available without incurring debt. Unlike emergency funds, which cover unexpected financial shocks such as medical bills or car repairs, sinking funds are targeted savings for specific goals like vacations, home repairs, or large purchases. This strategic approach promotes disciplined savings habits and enhances overall financial stability.

When to Use an Emergency Fund vs. a Sinking Fund

An emergency fund is designed for unexpected, urgent expenses such as medical emergencies, job loss, or urgent car repairs, providing immediate financial security. A sinking fund, however, is intended for planned, known future expenses like saving for a vacation, home repairs, or annual insurance premiums, allowing for systematic saving over time. Use an emergency fund for sudden financial shocks and a sinking fund for predictable, non-emergency financial goals.

Building Your Emergency Fund: Steps for Success

Building your emergency fund requires setting clear savings goals and consistently allocating a portion of your income to a separate, easily accessible account. Prioritize accumulating three to six months' worth of essential living expenses to ensure financial stability during unexpected events. Regularly reassess and adjust your contributions to maintain sufficient liquidity for emergencies while avoiding the temptation to use these funds for non-urgent purchases.

Creating Sinking Funds for Major Life Events

Creating sinking funds for major life events allows individuals to systematically save specific amounts over time, ensuring adequate financial resources without disrupting emergency funds. Unlike emergency funds, which cover unexpected expenses like medical emergencies or job loss, sinking funds target predictable costs such as home renovations, vacations, or education fees. This strategic separation enhances overall financial preparedness by allocating funds efficiently based on the nature and timing of anticipated expenditures.

Common Mistakes: Mixing Emergency and Sinking Fund Purposes

Mixing emergency fund and sinking fund purposes often leads to inadequate financial preparedness by depleting critical reserves for unexpected expenses. An emergency fund is designed for immediate, unforeseen costs such as medical emergencies or job loss, while a sinking fund is allocated for planned future expenses like car repairs or home maintenance. Confusing these funds can result in insufficient liquidity during crises and disrupt long-term savings goals, emphasizing the importance of maintaining distinct accounts for each purpose.

Integrating Both Funds for Comprehensive Financial Preparedness

Integrating an emergency fund with a sinking fund creates a robust financial safety net, addressing both unexpected expenses and planned future costs. An emergency fund provides immediate liquidity for sudden crises such as medical emergencies or job loss, while a sinking fund allocates savings systematically for known upcoming expenditures like car repairs or home maintenance. Combining these funds ensures comprehensive financial preparedness by balancing liquidity and targeted savings, minimizing reliance on credit during financial disruptions.

Related Important Terms

Micro-Emergency Fund

A Micro-Emergency Fund typically covers small, unexpected expenses such as minor car repairs or medical co-pays, providing immediate financial relief without disrupting your main savings. Unlike a Sinking Fund, which is earmarked for planned expenses like vacations or large purchases, a Micro-Emergency Fund focuses exclusively on urgent, unplanned financial needs to enhance overall financial preparedness.

Digital Sinking Wallet

A Digital Sinking Wallet offers a specialized approach for managing long-term financial goals by systematically allocating funds for future expenses, while an Emergency Fund provides immediate liquidity to cover unexpected financial crises. Integrating a Digital Sinking Wallet alongside an Emergency Fund enhances financial preparedness by ensuring both short-term accessibility and disciplined savings for planned costs.

Hyper-Specific Sinking Goals

An emergency fund provides immediate liquidity for unexpected expenses, while a sinking fund targets hyper-specific sinking goals such as saving for a planned car repair or a vacation, allowing for more precise financial preparedness. Allocating distinct amounts to sinking funds helps manage anticipated costs systematically without depleting the emergency reserve.

AI-Driven Fund Allocation

AI-driven fund allocation enhances financial preparedness by dynamically distinguishing between emergency funds, designed for unexpected expenses, and sinking funds, intended for planned future liabilities. Leveraging machine learning algorithms, this approach optimizes cash flow management, ensuring liquidity for urgent needs while systematically accumulating resources for scheduled obligations.

Dynamic Buffering

An emergency fund provides a dynamic liquidity buffer tailored for unexpected financial shocks, offering immediate access to cash to cover urgent expenses without affecting long-term savings. Unlike a sinking fund, which is earmarked for planned future costs, the emergency fund adapts flexibly to unforeseen financial demands, ensuring optimal financial preparedness.

Subscription Sinking Fund

An emergency fund provides immediate cash liquidity for unforeseen expenses, while a subscription sinking fund accumulates designated savings systematically to cover predictable, recurring obligations such as insurance premiums or subscriptions. Allocating resources to a subscription sinking fund ensures financial preparedness by preventing disruptions in essential payments while maintaining a separate emergency fund for unpredictable crises.

Just-in-Time Emergency Reserve

An emergency fund provides a just-in-time financial reserve to cover unexpected expenses like medical emergencies or sudden job loss, ensuring immediate liquidity without disrupting long-term savings. In contrast, a sinking fund is a planned savings pool for large, anticipated expenses, focusing on gradual accumulation rather than instant access during unforeseen crises.

Gamified Savings Pods

Gamified Savings Pods enhance financial preparedness by engaging users in building an Emergency Fund, which covers unexpected expenses, while distinguishing it from a Sinking Fund designed for planned, specific future costs. These interactive tools leverage behavioral economics to motivate consistent savings, ensuring funds are readily available for genuine emergencies without compromising long-term financial goals.

Automated Envelope System

Emergency funds provide immediate liquidity for unexpected expenses, whereas sinking funds allocate specific savings for known future costs, both optimized through an Automated Envelope System that categorizes and automates deposits to ensure disciplined financial preparedness. This system enhances cash flow management by dynamically adjusting contributions based on upcoming needs and emergency fund targets, promoting stability and reducing financial stress.

Event-Triggered Liquid Safety Net

An emergency fund serves as an immediate, liquid safety net specifically designed to cover unexpected events like job loss or medical emergencies, ensuring quick access to cash without penalties. In contrast, a sinking fund is a planned savings strategy allocated for known future expenses, providing financial preparedness without compromising liquidity for unforeseen crises.

Emergency Fund vs Sinking Fund for financial preparedness. Infographic

moneydiff.com

moneydiff.com