An Emergency Fund is designed to cover unexpected personal expenses such as medical bills or urgent home repairs, providing immediate financial relief. A Disaster Cushion, however, is a larger reserve aimed at sustaining liquidity during widespread economic downturns or prolonged crises, ensuring business continuity or essential cash flow. Both serve critical roles in liquidity management but differ in scale and purpose, with the Emergency Fund addressing short-term emergencies and the Disaster Cushion preparing for systemic risks.

Table of Comparison

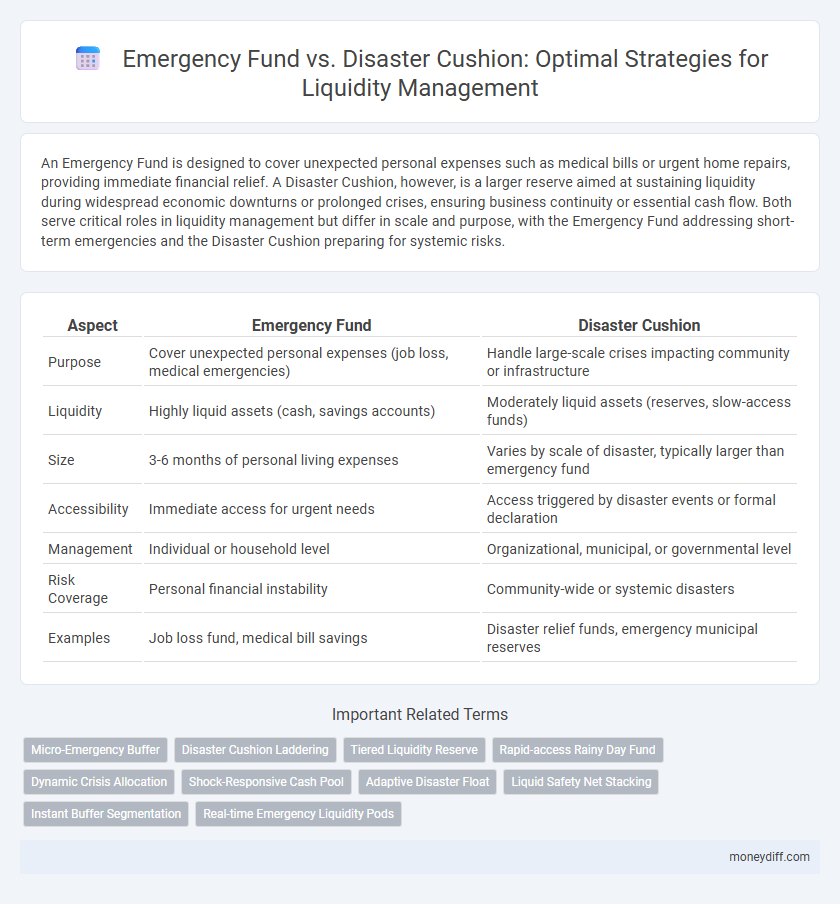

| Aspect | Emergency Fund | Disaster Cushion |

|---|---|---|

| Purpose | Cover unexpected personal expenses (job loss, medical emergencies) | Handle large-scale crises impacting community or infrastructure |

| Liquidity | Highly liquid assets (cash, savings accounts) | Moderately liquid assets (reserves, slow-access funds) |

| Size | 3-6 months of personal living expenses | Varies by scale of disaster, typically larger than emergency fund |

| Accessibility | Immediate access for urgent needs | Access triggered by disaster events or formal declaration |

| Management | Individual or household level | Organizational, municipal, or governmental level |

| Risk Coverage | Personal financial instability | Community-wide or systemic disasters |

| Examples | Job loss fund, medical bill savings | Disaster relief funds, emergency municipal reserves |

Defining Emergency Fund and Disaster Cushion

An Emergency Fund is a reserved amount of liquid assets specifically set aside to cover unexpected personal expenses such as medical emergencies, job loss, or urgent home repairs. A Disaster Cushion, in contrast, refers to a larger, strategically allocated pool of liquidity designed to sustain an organization or individual through prolonged crises or economic downturns, ensuring operational stability. Both serve distinct roles in liquidity management, with the Emergency Fund targeting short-term personal financial shocks, while the Disaster Cushion addresses extended financial resilience.

Key Differences Between Emergency Fund and Disaster Cushion

Emergency Fund primarily targets short-term liquidity needs for unexpected personal expenses such as medical emergencies or urgent repairs, while Disaster Cushion is designed to cover larger-scale, prolonged financial disruptions like job loss or economic downturns. Emergency Funds typically hold three to six months' worth of living expenses in highly liquid assets, whereas Disaster Cushions often require substantially greater reserves and may include more diverse, slightly less liquid investments. The key distinction lies in their purpose and scale: Emergency Funds ensure immediate cash flow maintenance, while Disaster Cushions provide financial resilience over an extended period of crisis.

Purpose and Scope of an Emergency Fund

An Emergency Fund is specifically designed to cover unexpected personal expenses such as medical emergencies, job loss, or urgent home repairs, ensuring short-term financial stability. It typically consists of three to six months' worth of essential living expenses kept in highly liquid accounts for immediate access. Unlike a Disaster Cushion, which is broader and may support larger-scale risks in business or community settings, an Emergency Fund is focused on individual or household liquidity needs, prioritizing quick availability and preserving financial security during personal crises.

The Role of a Disaster Cushion in Financial Planning

A disaster cushion serves as an additional financial buffer beyond a standard emergency fund, specifically designed to cover large-scale or prolonged crises such as natural disasters or economic downturns. This liquidity management tool ensures sustained access to critical funds, minimizing the risk of asset liquidation under distress. Integrating a disaster cushion into financial planning enhances resilience by providing targeted financial protection tailored to unpredictable, high-impact events.

Liquidity Management: Why It Matters

Emergency funds provide immediate access to cash for unexpected expenses, ensuring financial stability without relying on credit. Disaster cushions, typically larger and more strategic reserves, cater to prolonged crises or major financial disruptions, supporting sustained liquidity management. Effective liquidity management relies on balancing emergency funds and disaster cushions to maintain solvency and prevent cash flow interruptions during both short-term shocks and long-term emergencies.

When to Use an Emergency Fund vs Disaster Cushion

An emergency fund should be used for unexpected individual expenses like medical bills, car repairs, or sudden job loss, providing immediate liquidity for personal financial stability. A disaster cushion, on the other hand, is reserved for large-scale events impacting multiple aspects of finances, such as natural disasters or widespread economic downturns, offering broader financial protection. Maintaining both ensures optimal liquidity management by addressing different levels of financial emergencies effectively.

Building an Effective Emergency Fund

Building an effective emergency fund involves setting aside three to six months' worth of essential living expenses to cover unexpected financial setbacks. Unlike a disaster cushion, which focuses on sector-specific risks and broader economic disruptions, an emergency fund provides immediate liquidity for personal emergencies such as job loss, medical bills, or urgent home repairs. Maintaining this fund in highly liquid accounts, such as savings or money market accounts, ensures quick access while preserving capital.

Strategies for Establishing a Disaster Cushion

Establishing a disaster cushion involves setting aside an additional liquidity buffer beyond a regular emergency fund to cover unexpected large-scale financial shocks. Strategies include analyzing potential risks specific to regional or industry-related disasters, determining the cushion size based on scenario stress testing, and maintaining funds in highly liquid, low-risk assets such as money market accounts or short-term Treasury bills. Regularly reviewing and adjusting the disaster cushion ensures alignment with evolving risk profiles and cash flow needs.

Common Mistakes in Liquidity Management

Confusing an emergency fund with a disaster cushion often leads to liquidity mismanagement, as the emergency fund should cover short-term, unexpected expenses while the disaster cushion targets larger, long-term financial shocks. Common mistakes include underestimating the emergency fund size by mixing it with less liquid assets reserved for a disaster cushion, which reduces immediate cash availability. Proper separation ensures quick access to funds during emergencies without compromising preparedness for extended financial crises.

Integrating Both Tools for Financial Resilience

Emergency funds provide immediate financial support for unexpected personal expenses, while disaster cushions protect against larger-scale economic shocks and market disruptions. Integrating both tools ensures comprehensive liquidity management, balancing short-term access with long-term financial stability. Effective financial resilience arises from maintaining a liquid emergency fund for daily crises alongside a disaster cushion designed for prolonged economic downturns.

Related Important Terms

Micro-Emergency Buffer

A Micro-Emergency Buffer represents a smaller, readily accessible portion of an Emergency Fund designed to cover immediate, minor unexpected expenses without disrupting long-term savings or a larger Disaster Cushion reserved for major financial crises. Prioritizing a Micro-Emergency Buffer enhances liquidity management by ensuring quick access to cash for everyday emergencies while maintaining overall financial resilience.

Disaster Cushion Laddering

Disaster Cushion Laddering enhances liquidity management by structuring multiple short-term reserves that mature sequentially, ensuring immediate access to funds without depleting the primary Emergency Fund. This approach mitigates risk through staged liquidity, optimizing cash flow during unexpected financial disruptions while preserving long-term financial stability.

Tiered Liquidity Reserve

A Tiered Liquidity Reserve strategically categorizes funds into an Emergency Fund for immediate, essential expenses and a Disaster Cushion for larger, less frequent financial shocks. This layered approach ensures optimal cash flow management by maintaining readily accessible liquid assets while securing deeper reserves for catastrophic events.

Rapid-access Rainy Day Fund

A Rapid-access Rainy Day Fund is designed for immediate liquidity, covering unexpected expenses like medical emergencies or urgent home repairs, ensuring cash availability within 24 hours. In contrast, a Disaster Cushion targets larger-scale financial shocks such as job loss or natural disasters, typically held in less liquid assets, requiring longer access time but offering more substantial financial security.

Dynamic Crisis Allocation

Dynamic Crisis Allocation enhances liquidity management by differentiating between an Emergency Fund, which covers short-term unforeseen expenses, and a Disaster Cushion designed for larger-scale, prolonged financial disruptions. This approach optimizes cash flow by allocating resources flexibly to immediate needs and sustained crisis recovery, ensuring resilience across varying emergency scenarios.

Shock-Responsive Cash Pool

A Shock-Responsive Cash Pool serves as a flexible liquidity buffer designed to rapidly address unforeseen financial shocks, complementing traditional Emergency Funds that typically cover personal crises over shorter periods. Unlike static Emergency Funds, these pools leverage real-time data and multi-agency coordination to allocate resources efficiently during large-scale disasters, enhancing overall resilience in liquidity management.

Adaptive Disaster Float

An Emergency Fund provides immediate access to cash for unforeseen personal expenses, while a Disaster Cushion, specifically an Adaptive Disaster Float, dynamically adjusts liquidity based on evolving disaster risks and financial exposure. This adaptive approach enhances liquidity management by allocating funds proportionally to potential crisis impacts, ensuring optimal readiness without overcommitting resources.

Liquid Safety Net Stacking

An Emergency Fund provides immediate access to cash for unexpected expenses, ensuring quick liquidity without penalties, while a Disaster Cushion serves as a secondary layer of financial protection for large-scale, prolonged crises. Liquid Safety Net Stacking combines both strategies to optimize liquidity management by prioritizing accessible funds for short-term emergencies and reserving deeper reserves for significant disasters, enhancing overall financial resilience.

Instant Buffer Segmentation

Emergency Fund serves as a readily accessible financial reserve designed to cover regular unexpected expenses, while Disaster Cushion focuses on larger, less frequent catastrophes requiring extended liquidity. Instant Buffer Segmentation divides available liquidity into distinct tiers, enhancing cash flow management by ensuring immediate access to funds for minor emergencies without depleting resources intended for major disasters.

Real-time Emergency Liquidity Pods

Emergency Fund and Disaster Cushion serve distinct roles in liquidity management, with the Emergency Fund providing immediate cash reserves for unforeseen everyday expenses, while Disaster Cushion addresses larger-scale crises requiring extended financial support; Real-time Emergency Liquidity Pods enhance this framework by enabling instant access to segmented financial resources tailored for specific emergency scenarios. These pods optimize liquidity by ensuring rapid deployment of funds without disrupting broader asset allocation, thereby improving financial resilience and response efficiency.

Emergency Fund vs Disaster Cushion for liquidity management. Infographic

moneydiff.com

moneydiff.com