An Emergency Fund serves as a financial safety net specifically designed to cover unexpected, urgent expenses such as medical emergencies or urgent home repairs. A Sidecar Fund, by contrast, is a more flexible savings pool allocated for less critical unforeseen costs, allowing greater freedom in spending decisions. Choosing between the two depends on your financial priorities and the level of risk you are willing to manage for future uncertainties.

Table of Comparison

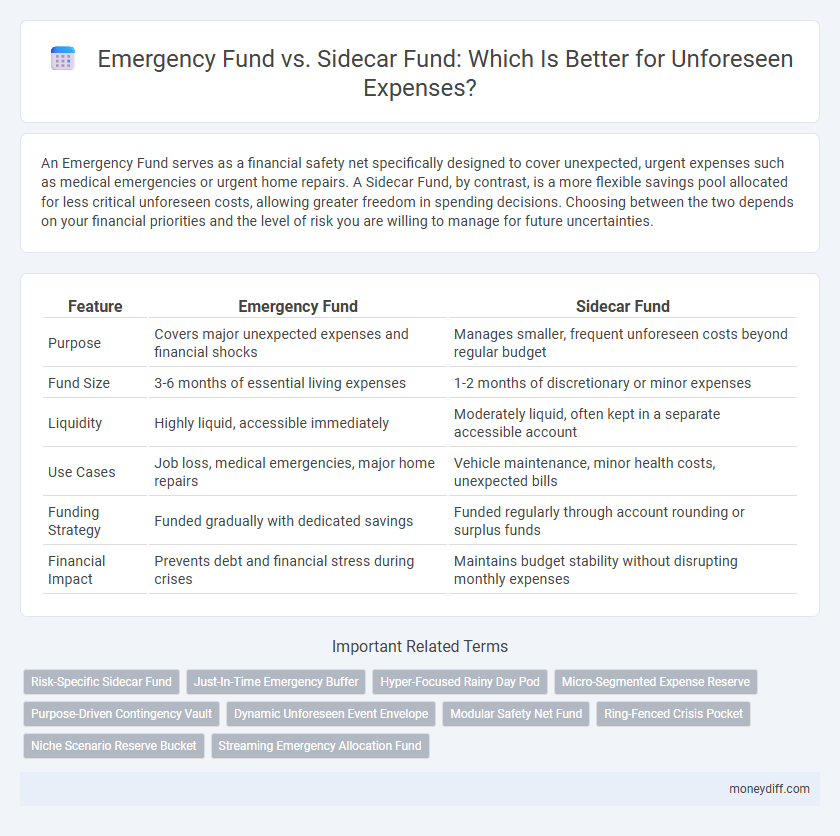

| Feature | Emergency Fund | Sidecar Fund |

|---|---|---|

| Purpose | Covers major unexpected expenses and financial shocks | Manages smaller, frequent unforeseen costs beyond regular budget |

| Fund Size | 3-6 months of essential living expenses | 1-2 months of discretionary or minor expenses |

| Liquidity | Highly liquid, accessible immediately | Moderately liquid, often kept in a separate accessible account |

| Use Cases | Job loss, medical emergencies, major home repairs | Vehicle maintenance, minor health costs, unexpected bills |

| Funding Strategy | Funded gradually with dedicated savings | Funded regularly through account rounding or surplus funds |

| Financial Impact | Prevents debt and financial stress during crises | Maintains budget stability without disrupting monthly expenses |

Understanding the Basics: Emergency Fund vs Sidecar Fund

An Emergency Fund is a readily accessible reserve designed to cover essential living expenses for three to six months during unexpected financial hardships such as job loss or medical emergencies. A Sidecar Fund, however, is a supplementary savings account aimed at handling irregular but predictable costs like car repairs or home maintenance, helping to prevent dipping into the primary Emergency Fund. Understanding these basics allows for better financial resilience by segregating core emergency needs from less critical, sporadic expenses.

Key Differences Between Emergency Funds and Sidecar Funds

Emergency funds primarily cover essential, unexpected expenses such as medical emergencies or job loss, ensuring financial stability during crises. Sidecar funds are designated for non-essential, specific unforeseen expenses like car repairs or home maintenance, allowing for targeted savings without depleting the emergency fund. The key difference lies in their purpose and flexibility: emergency funds prioritize liquidity and security, while sidecar funds offer controlled savings for predictable, smaller-scale financial surprises.

When to Use an Emergency Fund

An Emergency Fund is designed for immediate, essential expenses such as medical emergencies, job loss, or urgent home repairs, providing financial stability during unexpected crises. It should be accessed only when facing situations that threaten your basic living standards or financial security. In contrast, a Sidecar Fund handles less critical, planned or semi-urgent expenses, allowing your Emergency Fund to remain intact for true emergencies.

The Role of Sidecar Funds in Financial Planning

Sidecar funds serve as supplementary financial reserves designed to cover specific unforeseen expenses without depleting the primary emergency fund, thereby enhancing overall financial stability. These funds enable more precise budgeting by allocating money to distinct categories such as car repairs or medical bills, reducing the risk of tapping into the emergency fund for predictable, yet irregular costs. Integrating sidecar funds into financial planning improves liquidity management and helps preserve the emergency fund's core purpose of protecting against major financial crises.

Benefits of Maintaining Separate Funds for Unforeseen Expenses

Maintaining separate emergency and sidecar funds enhances financial resilience by clearly distinguishing between true emergencies and minor unforeseen expenses, enabling more precise budgeting and spending control. An emergency fund is typically reserved for critical situations like job loss or medical emergencies, while a sidecar fund covers smaller, non-critical unexpected costs such as car repairs or home maintenance. This separation prevents depletion of essential savings, ensuring long-term stability and reducing financial stress during emergencies.

Building Your Emergency Fund: Best Practices

Building your emergency fund requires prioritizing liquidity and accessibility to cover essential expenses during unforeseen events, ideally accumulating three to six months' worth of living costs in a high-yield savings account. Sidecar funds complement emergency savings by targeting non-critical but unpredictable expenses, such as car repairs or minor medical bills, without compromising your core emergency reserve. Regular contributions, automatic transfers, and periodic reviews of expenses ensure the emergency fund remains aligned with evolving financial needs and inflation.

How to Set Up an Effective Sidecar Fund

Establishing an effective Sidecar Fund for unforeseen expenses requires allocating a separate savings account distinct from your primary Emergency Fund, dedicated specifically to non-critical but unexpected costs. Start by analyzing past irregular expenses such as home repairs, car maintenance, and medical deductibles to estimate a realistic monthly contribution target, ensuring the fund grows steadily without disrupting your main emergency savings. Maintaining clear categorization and regular review of the Sidecar Fund helps prevent overspending and ensures quick access when these planned-but-unexpected expenses arise.

Which Fund Should You Prioritize First?

Prioritize building an Emergency Fund first, as it provides a financial safety net covering 3 to 6 months of essential living expenses for unexpected events like job loss or medical emergencies. A Sidecar Fund serves as a secondary pool for non-critical, irregular expenses, such as home repairs or car maintenance, which do not threaten financial stability. Establishing a robust Emergency Fund ensures foundational security before allocating resources to a Sidecar Fund.

Common Mistakes in Managing Emergency and Sidecar Funds

Common mistakes in managing emergency and sidecar funds include underestimating the amount needed, leading to insufficient coverage during unforeseen expenses. Many individuals fail to separate these funds properly, which causes confusion in their purpose and usage. Overusing sidecar funds for non-emergencies can also deplete resources meant for true financial crises.

Making the Right Choice: Emergency Fund, Sidecar Fund, or Both?

Emergency funds provide immediate financial security by covering three to six months of essential expenses, ensuring stability during unexpected crises. Sidecar funds complement emergency reserves by targeting specific irregular costs like auto repairs or medical bills, offering more precise budgeting without depleting core savings. Combining both strategies optimizes financial preparedness, balancing broad safety nets with targeted savings for unforeseen expenses.

Related Important Terms

Risk-Specific Sidecar Fund

A Risk-Specific Sidecar Fund allocates resources to targeted, high-impact emergencies, complementing a broader Emergency Fund by addressing unique risks such as medical bills or job loss without depleting general savings. This strategic separation enhances financial resilience by ensuring immediate access to funds tailored for specific unexpected expenses, reducing overall fiscal vulnerability.

Just-In-Time Emergency Buffer

A Just-In-Time Emergency Buffer, often managed through a Sidecar Fund, provides targeted, easily accessible cash for unforeseen expenses, complementing the broader, more substantial Emergency Fund designed for significant financial disruptions. This approach optimizes liquidity management by segregating immediate small emergency needs from long-term financial security, enhancing overall financial resilience.

Hyper-Focused Rainy Day Pod

A Hyper-Focused Rainy Day Pod, an advanced version of an Emergency Fund, is designed specifically for targeted unforeseen expenses, ensuring funds are readily available for precise emergencies without disrupting primary savings. Unlike a Sidecar Fund, which supplements overall finances with flexible boundaries, the Hyper-Focused Rainy Day Pod allocates money strictly for predefined scenarios, optimizing financial readiness and reducing risk during critical moments.

Micro-Segmented Expense Reserve

A Micro-Segmented Expense Reserve within an Emergency Fund targets specific unforeseen costs, enabling precise budgeting and quicker access compared to a broad Sidecar Fund. This approach enhances financial resilience by isolating smaller, category-specific reserves, reducing the risk of depleting the general emergency savings for minor expenses.

Purpose-Driven Contingency Vault

An Emergency Fund is designed as a primary financial safety net covering essential living expenses during unexpected crises like job loss or medical emergencies, ensuring immediate stability. A Sidecar Fund, serving as a Purpose-Driven Contingency Vault, supplements this by allocating resources for specific unforeseen expenses such as car repairs or home maintenance, providing targeted financial flexibility without depleting the main emergency reserve.

Dynamic Unforeseen Event Envelope

The Dynamic Unforeseen Event Envelope within an Emergency Fund adapts fluidly to varying expense magnitudes, offering superior flexibility compared to a rigid Sidecar Fund structure. This approach ensures optimal liquidity by dynamically allocating resources based on real-time risk assessments of unforeseen events, enhancing financial resilience.

Modular Safety Net Fund

A Modular Safety Net Fund combines the core stability of an Emergency Fund with the flexibility of a Sidecar Fund, allowing individuals to allocate specific amounts for different categories of unforeseen expenses such as medical emergencies, car repairs, or job loss, ensuring targeted financial protection. This approach enhances financial resilience by providing tailored funds that address varying risk levels without depleting the entire safety net.

Ring-Fenced Crisis Pocket

A Ring-Fenced Crisis Pocket within an Emergency Fund provides a dedicated, easily accessible reserve for urgent, unforeseen expenses, ensuring financial stability without dipping into long-term investments. Unlike a Sidecar Fund, which may serve supplementary purposes, the Ring-Fenced Crisis Pocket is specifically optimized for immediate crisis management, emphasizing liquidity and security.

Niche Scenario Reserve Bucket

A Niche Scenario Reserve Bucket within an Emergency Fund specifically targets unexpected expenses unique to an individual's lifestyle or profession, offering tailored financial security beyond a generic Sidecar Fund's broad coverage. This specialized reserve enhances preparedness by addressing precise risks that standard sidecar funds may overlook, ensuring optimal liquidity for niche emergencies.

Streaming Emergency Allocation Fund

An Emergency Fund provides immediate financial security for unexpected expenses, while a Sidecar Fund offers a dedicated pool of money for specific risks or short-term needs, such as a Streaming Emergency Allocation Fund tailored to cover sudden disruptions in subscription or freelance streaming income. The Streaming Emergency Allocation Fund ensures continuous cash flow and mitigates income volatility by addressing unforeseen gaps in streaming revenue streams.

Emergency Fund vs Sidecar Fund for unforeseen expenses. Infographic

moneydiff.com

moneydiff.com