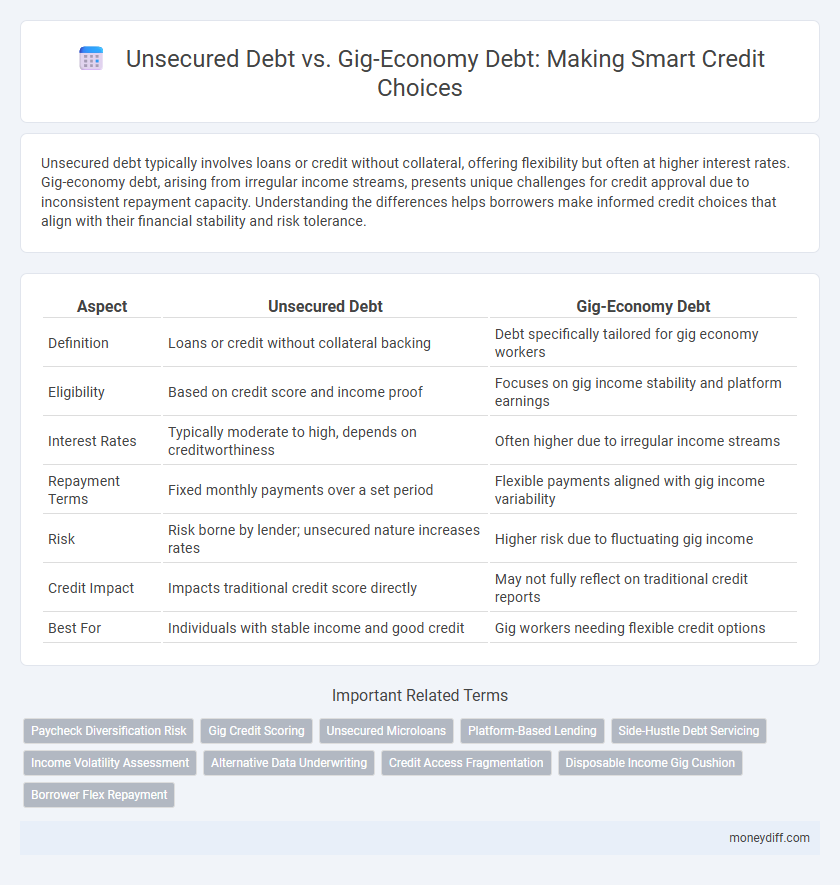

Unsecured debt typically involves loans or credit without collateral, offering flexibility but often at higher interest rates. Gig-economy debt, arising from irregular income streams, presents unique challenges for credit approval due to inconsistent repayment capacity. Understanding the differences helps borrowers make informed credit choices that align with their financial stability and risk tolerance.

Table of Comparison

| Aspect | Unsecured Debt | Gig-Economy Debt |

|---|---|---|

| Definition | Loans or credit without collateral backing | Debt specifically tailored for gig economy workers |

| Eligibility | Based on credit score and income proof | Focuses on gig income stability and platform earnings |

| Interest Rates | Typically moderate to high, depends on creditworthiness | Often higher due to irregular income streams |

| Repayment Terms | Fixed monthly payments over a set period | Flexible payments aligned with gig income variability |

| Risk | Risk borne by lender; unsecured nature increases rates | Higher risk due to fluctuating gig income |

| Credit Impact | Impacts traditional credit score directly | May not fully reflect on traditional credit reports |

| Best For | Individuals with stable income and good credit | Gig workers needing flexible credit options |

Understanding Unsecured Debt: Basics and Examples

Unsecured debt refers to loans or credit obtained without collateral, relying solely on the borrower's creditworthiness, commonly seen in credit cards, personal loans, and medical bills. Gig-economy debt emerges as freelancers and independent contractors face inconsistent income, often leading to higher reliance on unsecured credit options with variable interest rates. Evaluating credit choices requires understanding the risk profiles and repayment flexibility inherent in unsecured debt versus the fluctuating earnings influencing gig-economy debt dynamics.

What Constitutes Gig-Economy Debt?

Gig-economy debt encompasses financial obligations incurred from flexible, freelance work arrangements, including borrowing to cover inconsistent income or investing in equipment and expenses required for gig jobs. Unlike traditional unsecured debt such as credit cards or personal loans, gig-economy debt is often tied directly to the income variability and operational costs of independent contracting. Understanding this distinction is crucial for credit choices, as gig-economy workers face unique challenges in debt management and credit risk assessment.

Key Differences Between Unsecured Debt and Gig-Economy Debt

Unsecured debt, such as credit cards and personal loans, lacks collateral and typically depends on creditworthiness, while gig-economy debt arises from inconsistent income streams tied to freelance or contract work. Gig-economy debt poses higher risk due to income volatility, complicating credit approval and repayment terms compared to traditional unsecured debt. Lenders often require stricter documentation and higher interest rates for gig-economy workers to mitigate default risk.

Interest Rates: Comparing Unsecured Debt and Gig-Economy Debt

Interest rates for unsecured debt typically range from 10% to 36%, reflecting higher risk due to lack of collateral, while gig-economy debt often features variable rates influenced by income volatility and platform policies. Unsecured debt providers rely heavily on credit scores and repayment history, whereas gig-economy lenders assess cash flow patterns and freelance income stability. Comparing these rates helps borrowers choose between traditional credit options and flexible financing tailored to gig workers' unique financial situations.

Credit Impact: How Each Debt Type Affects Your Credit Score

Unsecured debt, such as credit cards and personal loans, directly impacts your credit score through factors like credit utilization and payment history, playing a significant role in credit risk assessment. Gig-economy debt, often involving variable income and informal lending sources, tends to have less direct reporting to credit bureaus, which may limit its influence on traditional credit scores but can affect creditworthiness through alternative data models. Understanding these differences helps borrowers strategically manage credit impact and optimize credit choices based on their debt type and repayment stability.

Flexibility and Repayment Terms: Unsecured vs. Gig-Economy Debt

Unsecured debt typically offers more standardized repayment terms with fixed interest rates and set monthly payments, providing predictable budgeting for borrowers. Gig-economy debt often features flexible repayment options tailored to fluctuating incomes but can carry higher interest rates and less formalized schedules. Choosing between the two depends on the borrower's need for consistent payment plans versus adaptability to variable cash flow.

Borrower Protections: Who’s More Vulnerable?

Unsecured debt typically offers stronger borrower protections under federal regulations such as the Truth in Lending Act, which mandates clear disclosure and limits on interest rates, whereas gig-economy debt often lacks standardized safeguards, exposing borrowers to higher financial risks. Gig-economy workers frequently rely on short-term loans or advances tied to fluctuating income without formal credit oversight, increasing vulnerability to predatory lending practices and debt cycles. The variability of gig income complicates repayment stability, making gig-economy debt borrowers more susceptible to default and less protected in dispute resolutions compared to those with traditional unsecured debt.

Accessibility: Which Debt Type is Easier to Obtain?

Unsecured debt, such as credit cards and personal loans, is generally easier to obtain due to fewer eligibility requirements and no need for collateral, making it accessible for a broad range of borrowers. Gig-economy debt, tailored for freelance or contract workers, often requires proof of consistent income streams, which can limit accessibility if earnings are irregular or undocumented. Lenders prioritize credit scores and income stability in unsecured debt, whereas gig-economy debt assessments emphasize cash flow from gig platforms, impacting approval rates.

Long-Term Financial Implications of Both Debt Types

Unsecured debt often carries higher interest rates and can significantly impact credit scores if not managed carefully, leading to long-term financial strain. Gig-economy debt, frequently characterized by flexible repayment terms and variable income sources, introduces income volatility that complicates consistent debt servicing but may allow for more adaptive credit management. Evaluating these debt types requires understanding their influence on credit risk profiles and potential long-term financial stability within fluctuating income environments.

Making Smarter Credit Choices: Deciding What Works for You

Unsecured debt, such as personal loans and credit cards, offers flexibility without collateral but often comes with higher interest rates, making it essential to assess your repayment capacity carefully. Gig-economy debt, typically involving income-based lending tied to fluctuating freelance earnings, requires evaluating the stability of your gig revenue streams to avoid overextension. Understanding your financial situation and cash flow consistency helps in making smarter credit choices tailored to your unique economic context.

Related Important Terms

Paycheck Diversification Risk

Unsecured debt often carries higher interest rates due to the lack of collateral, making repayment challenging for gig-economy workers who face paycheck diversification risk from fluctuating income streams. Gig-economy debt options may offer more flexible terms that align better with irregular earnings but can result in greater credit cost variability and potential financial instability.

Gig Credit Scoring

Gig credit scoring leverages alternative data from gig economy earnings, providing a more accurate assessment of creditworthiness compared to traditional unsecured debt evaluations based solely on credit history. This method enables lenders to extend credit to gig workers who often lack conventional financial records, improving access to loans and credit products tailored to the gig economy's unique income patterns.

Unsecured Microloans

Unsecured microloans offer flexible credit options without collateral, making them ideal for gig-economy workers who face unpredictable income streams. These microloans typically feature higher interest rates due to increased risk but provide quick access to funds, supporting financial stability and growth opportunities in the gig economy.

Platform-Based Lending

Unsecured debt typically includes credit cards and personal loans without collateral, whereas gig-economy debt through platform-based lending often uses income data from gig work to assess borrower risk and tailor credit options. Platform-based lending leverages real-time earnings and work patterns from gig economy platforms to provide more flexible, accessible credit solutions compared to traditional unsecured debt.

Side-Hustle Debt Servicing

Unsecured debt often carries higher interest rates and fewer repayment options compared to gig-economy debt, which is increasingly tailored for side-hustlers with flexible payment plans aligned to irregular income streams. Side-hustle debt servicing solutions prioritize adaptive credit choices, helping gig workers manage cash flow variability while maintaining credit health.

Income Volatility Assessment

Unsecured debt typically relies on stable income verification, whereas gig-economy debt requires advanced income volatility assessment due to irregular earnings and fluctuating cash flow. Lenders increasingly utilize real-time income analytics and cash flow trends to accurately evaluate credit risk for gig workers facing inconsistent revenue streams.

Alternative Data Underwriting

Unsecured debt often relies on traditional credit scores, whereas gig-economy debt underwriting increasingly utilizes alternative data such as income stability, transaction frequency, and platform ratings to assess creditworthiness. Leveraging these non-traditional data points enables more accurate risk evaluation and broader access to credit for gig workers with irregular income streams.

Credit Access Fragmentation

Unsecured debt typically offers broader credit access with fewer collateral requirements, while gig-economy debt presents fragmented credit options due to irregular income streams and alternative lending platforms. This fragmentation complicates credit scoring, leading to inconsistent borrowing terms and limited financial inclusion for gig workers.

Disposable Income Gig Cushion

Unsecured debt typically requires higher interest rates due to the lack of collateral, placing greater strain on disposable income, whereas gig-economy debt often offers flexible repayment options aligned with fluctuating gig earnings, enhancing the disposable income gig cushion. Evaluating credit choices in this context involves analyzing the stability of gig income streams to optimize debt management and maintain financial resilience.

Borrower Flex Repayment

Unsecured debt typically offers fixed or variable repayment terms without collateral, while gig-economy debt often provides flexible repayment options tailored to irregular income streams. Borrowers in the gig economy benefit from adaptable schedules that align with fluctuating earnings, enhancing credit accessibility and repayment feasibility.

Unsecured debt vs gig-economy debt for credit choices. Infographic

moneydiff.com

moneydiff.com