Credit card debt represents a quantifiable financial obligation with clear terms and interest rates, making it easier to manage and analyze in financial assessments. Behavioral debt, driven by spending habits and psychological factors, often lacks explicit documentation but significantly impacts long-term financial health and risk evaluation. Understanding the distinction between these debt types is crucial for comprehensive financial analysis and effective debt management strategies.

Table of Comparison

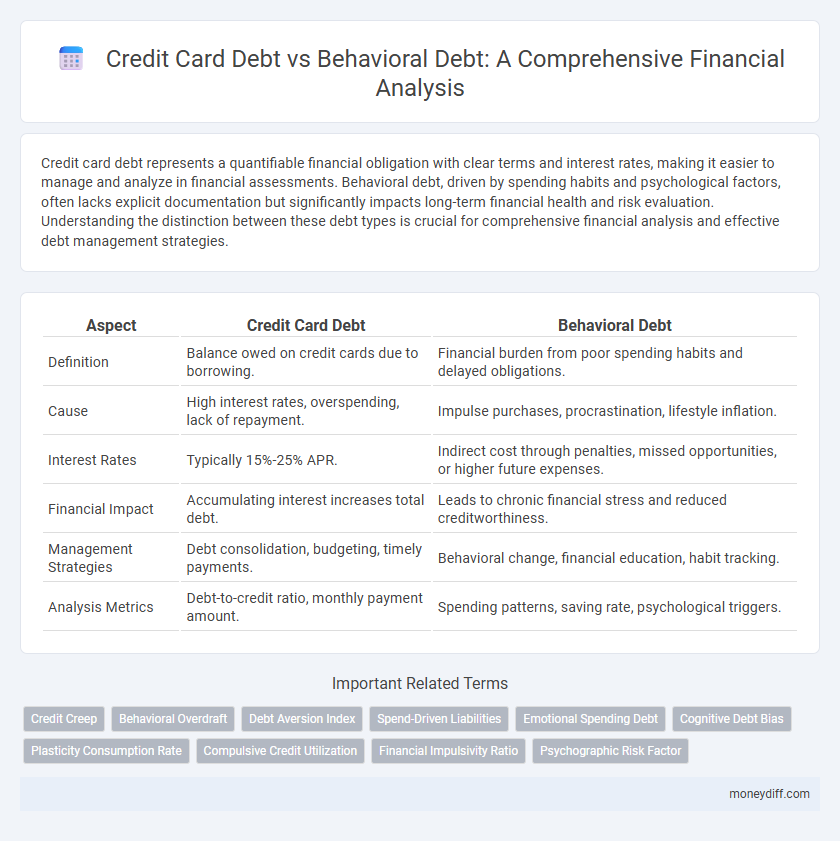

| Aspect | Credit Card Debt | Behavioral Debt |

|---|---|---|

| Definition | Balance owed on credit cards due to borrowing. | Financial burden from poor spending habits and delayed obligations. |

| Cause | High interest rates, overspending, lack of repayment. | Impulse purchases, procrastination, lifestyle inflation. |

| Interest Rates | Typically 15%-25% APR. | Indirect cost through penalties, missed opportunities, or higher future expenses. |

| Financial Impact | Accumulating interest increases total debt. | Leads to chronic financial stress and reduced creditworthiness. |

| Management Strategies | Debt consolidation, budgeting, timely payments. | Behavioral change, financial education, habit tracking. |

| Analysis Metrics | Debt-to-credit ratio, monthly payment amount. | Spending patterns, saving rate, psychological triggers. |

Understanding Credit Card Debt: Definition and Dynamics

Credit card debt refers to the outstanding balance on credit cards that accrues interest if unpaid by the statement due date, often influenced by spending habits and repayment patterns. Behavioral debt, on the other hand, encompasses the psychological and emotional factors driving individuals to incur and manage debt, such as impulsive buying or financial stress. Analyzing credit card debt through both financial metrics and behavioral insights provides a comprehensive understanding of consumer debt dynamics and repayment challenges.

Behavioral Debt: Unpacking Psychological Spending

Behavioral debt stems from psychological factors driving spending habits rather than just credit limitations, influencing financial decision-making and long-term fiscal health. Emotional triggers, such as stress or social pressure, often lead to impulsive purchases that accumulate into significant debt beyond traditional credit card liabilities. Understanding behavioral debt offers deeper insights into consumer patterns, enabling more effective financial analysis and personalized debt management strategies.

Key Differences Between Credit Card and Behavioral Debt

Credit card debt represents a quantifiable financial liability incurred through borrowing on revolving credit accounts, typically reflected in monthly statements and balance sheets, while behavioral debt encompasses psychological and habitual patterns influencing spending and repayment behaviors without direct monetary tracking. Credit card debt is measurable through interest rates, credit limits, and payment histories, enabling precise financial analysis; behavioral debt requires qualitative assessment of factors such as impulse buying, financial literacy, and emotional triggers. Understanding these key differences aids in developing targeted strategies to manage financial risks and improve debt reduction outcomes.

Financial Impact: Short-Term vs Long-Term Perspectives

Credit card debt often exerts immediate financial pressure through high interest rates and minimum payments, increasing short-term expenses and limiting cash flow. Behavioral debt, stemming from patterns like impulsive spending or procrastination in payments, gradually amplifies financial strain, impacting long-term credit scores and wealth accumulation. Financial analysis must differentiate these debts, recognizing credit card debt's urgent cost and behavioral debt's deep-rooted, cumulative economic consequences.

Causes and Triggers of Credit Card Debt

Credit card debt primarily stems from impulsive spending, high interest rates, and insufficient financial literacy, leading consumers to accumulate balances beyond their repayment capacity. Behavioral debt arises from psychological factors such as stress, emotional spending, and lack of budgeting discipline, which trigger repeated borrowing despite awareness of financial strain. Understanding these causes is crucial for financial analysis to develop targeted debt management strategies and improve credit risk assessment.

Behavioral Patterns Leading to Debt Accumulation

Behavioral debt accumulates due to consistent spending habits driven by emotional triggers, such as impulsive purchases or using credit cards to cope with stress, rather than actual financial necessity. Unlike credit card debt, which can be quantified through interest rates and balances, behavioral debt requires analyzing patterns like frequency of transactions, psychological factors, and decision-making processes that lead to overspending. Understanding these behavioral patterns enables more effective financial analysis and tailored interventions to prevent chronic debt accumulation.

Credit Card Debt Metrics: Analysis and Measurement

Credit card debt metrics are critical for financial analysis, focusing on key indicators such as average balance per card, credit utilization ratio, and delinquency rates to assess consumer financial health and risk exposure. Behavioral debt analysis complements this by evaluating spending patterns, payment behaviors, and psychological factors driving credit card usage, providing deeper insights beyond raw financial data. Together, these measures enable a comprehensive assessment of credit risk and guide strategies for debt management and financial planning.

Behavioral Debt Indicators for Financial Analysts

Behavioral debt indicators, such as frequent minimum payments, late fees, and credit utilization spikes, provide financial analysts with crucial insights into consumer spending habits and risk profiles beyond traditional credit card debt balances. Tracking these behavioral patterns helps predict potential default risks and guides more personalized credit management strategies. Subtle shifts in payment consistency and borrowing behavior often reveal financial stress earlier than credit score changes alone.

Strategies for Managing and Reducing Both Debt Types

Effective strategies for managing credit card debt include creating a detailed budget, prioritizing high-interest balances, and utilizing debt consolidation or balance transfer offers to lower interest rates. Addressing behavioral debt requires identifying underlying spending triggers, implementing disciplined spending habits, and seeking behavioral therapy or financial counseling to reshape money management patterns. Combining financial tools with behavioral adjustments enhances long-term debt reduction and improves overall financial health.

Comparative Insights: Lessons for Financial Health

Credit card debt often reflects short-term borrowing with high interest rates, indicating immediate liquidity stress, while behavioral debt arises from prolonged overspending habits, signaling deeper psychological and financial management issues. Analyzing credit card debt provides insights into urgent cash flow problems, whereas behavioral debt reveals patterns that affect long-term financial stability. Understanding both types enables a comprehensive approach to improving financial health by addressing immediate obligations and underlying behavioral triggers.

Related Important Terms

Credit Creep

Credit card debt often exemplifies credit creep, where gradual increases in spending lead to escalating balances and heightened interest payments, significantly impacting financial health. Behavioral debt, driven by psychological patterns rather than necessity, exacerbates this trend, making debt management more complex and requiring targeted financial analysis to identify underlying causes.

Behavioral Overdraft

Behavioral overdraft, a form of behavioral debt, occurs when individuals frequently exceed their bank account limits due to habitual overspending or poor money management, contrasting with credit card debt accumulated through borrowing. Financial analysis distinguishes these by evaluating transaction patterns, with behavioral overdraft indicating short-term liquidity issues rather than the structured borrowing reflected in credit card balances.

Debt Aversion Index

Credit card debt reflects immediate financial obligations influenced by spending habits, whereas behavioral debt encompasses psychological factors driving prolonged indebtedness, both integral to assessing the Debt Aversion Index. This index quantifies individuals' resistance to accumulating debt, providing critical insights into credit risk and financial decision-making patterns.

Spend-Driven Liabilities

Credit card debt represents a quantifiable spend-driven liability reflecting consumer borrowing behavior based on revolving credit utilization and interest accrual, while behavioral debt encompasses less tangible liabilities influenced by spending habits, impulse purchases, and financial decision-making patterns. Financial analysis prioritizes credit card debt for its measurable impact on cash flow and credit risk, whereas behavioral debt requires deeper assessment of consumer psychology and spending discipline to predict long-term financial stability.

Emotional Spending Debt

Emotional spending debt, a subset of behavioral debt, arises from impulsive purchases driven by psychological triggers, contrasting with credit card debt that often accumulates from planned or necessary expenses. Analyzing emotional spending debt provides critical insights into consumer behavior patterns and helps tailor financial interventions to reduce stress-related overspending and improve debt management strategies.

Cognitive Debt Bias

Credit card debt represents tangible financial obligations tracked in credit reports, whereas behavioral debt stems from cognitive biases such as optimism bias and present bias, leading individuals to underestimate future repayment challenges. Analyzing credit card debt alongside cognitive debt bias provides a comprehensive view of an individual's true financial risk and decision-making patterns.

Plasticity Consumption Rate

Credit card debt reflects outstanding balances linked to revolving credit limits, while behavioral debt emerges from habitual overspending and poor financial habits influencing borrowing patterns. Analyzing the Plasticity Consumption Rate reveals how flexible consumer spending adjusts to changes in credit availability, highlighting the impact of behavioral tendencies on escalating credit card balances.

Compulsive Credit Utilization

Compulsive credit utilization significantly worsens credit card debt by driving excessive spending beyond budget limits, creating a cycle of escalating interest payments and reduced credit scores. Behavioral debt, rooted in psychological patterns of overspending, requires targeted financial interventions to break the habit and restore debt sustainability.

Financial Impulsivity Ratio

Credit card debt often reflects short-term liquidity needs and impulse spending, whereas behavioral debt captures deeper psychological patterns influencing financial decisions. The Financial Impulsivity Ratio quantifies the extent to which impulsive behavior drives debt accumulation, serving as a crucial metric in distinguishing between transactional credit usage and underlying behavioral debt tendencies.

Psychographic Risk Factor

Credit card debt reflects immediate financial liabilities, while behavioral debt highlights underlying psychographic risk factors such as impulsivity and emotional spending patterns that significantly impact long-term financial stability. Analyzing these psychographic dimensions provides deeper insight into credit risk profiles beyond traditional debt metrics.

Credit card debt vs behavioral debt for financial analysis. Infographic

moneydiff.com

moneydiff.com