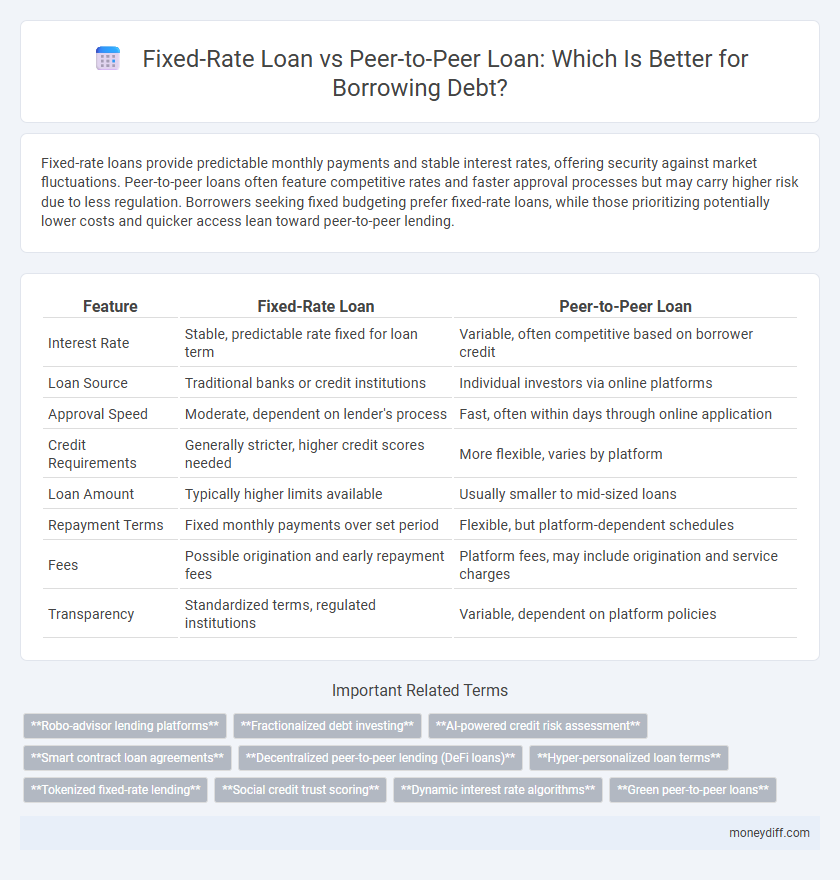

Fixed-rate loans provide predictable monthly payments and stable interest rates, offering security against market fluctuations. Peer-to-peer loans often feature competitive rates and faster approval processes but may carry higher risk due to less regulation. Borrowers seeking fixed budgeting prefer fixed-rate loans, while those prioritizing potentially lower costs and quicker access lean toward peer-to-peer lending.

Table of Comparison

| Feature | Fixed-Rate Loan | Peer-to-Peer Loan |

|---|---|---|

| Interest Rate | Stable, predictable rate fixed for loan term | Variable, often competitive based on borrower credit |

| Loan Source | Traditional banks or credit institutions | Individual investors via online platforms |

| Approval Speed | Moderate, dependent on lender's process | Fast, often within days through online application |

| Credit Requirements | Generally stricter, higher credit scores needed | More flexible, varies by platform |

| Loan Amount | Typically higher limits available | Usually smaller to mid-sized loans |

| Repayment Terms | Fixed monthly payments over set period | Flexible, but platform-dependent schedules |

| Fees | Possible origination and early repayment fees | Platform fees, may include origination and service charges |

| Transparency | Standardized terms, regulated institutions | Variable, dependent on platform policies |

Understanding Fixed-Rate Loans: Basics and Benefits

Fixed-rate loans provide borrowers with a consistent interest rate throughout the loan term, ensuring predictable monthly payments and shielding against market fluctuations. This stability makes fixed-rate loans ideal for long-term financial planning compared to peer-to-peer loans, which may have variable rates influenced by investor demand. The fixed-rate structure also simplifies budgeting and reduces the risk of payment increases, offering borrowers financial security and clearer expectations.

What Is a Peer-to-Peer Loan? Key Features Explained

A peer-to-peer loan is a type of debt financing where borrowers obtain funds directly from individual investors through online platforms, bypassing traditional banks. Key features include fixed or variable interest rates determined by borrower credit risk, flexible loan terms, and potentially lower fees compared to conventional fixed-rate loans. This alternative lending model allows for faster approval processes and greater accessibility for borrowers with varying credit profiles.

Interest Rates: Fixed-Rate Loans vs Peer-to-Peer Loans

Fixed-rate loans offer stable interest rates that remain constant over the loan term, providing predictable monthly payments and budgeting ease. Peer-to-peer loans typically feature variable interest rates influenced by borrower risk profiles and market demand, potentially resulting in lower rates for high-credit borrowers but higher costs for others. Comparing both options requires evaluating interest rate stability and total repayment amounts to determine cost-effectiveness based on individual financial situations.

Application Process: Traditional Banks vs P2P Platforms

The application process for fixed-rate loans through traditional banks involves extensive paperwork, credit checks, and often a longer approval timeline due to strict underwriting standards. In contrast, peer-to-peer (P2P) loan platforms offer a streamlined, digital application process with faster approval times and more flexible eligibility criteria. Borrowers seeking quick access to funds and simplified procedures often prefer P2P platforms over conventional banking institutions.

Loan Approval Criteria Compared

Fixed-rate loans typically require stringent credit scores above 650, stable income verification, and comprehensive debt-to-income ratio assessments, ensuring lower risk for lenders. Peer-to-peer loan platforms often use alternative credit evaluation methods, placing emphasis on social proof, peer ratings, and may accept lower credit scores starting around 600. Approval speed is generally faster in peer-to-peer lending due to automated algorithms, while fixed-rate loans involve more rigorous underwriting processes.

Repayment Flexibility: Which Option Offers More Control?

Fixed-rate loans provide predictable monthly payments with fixed interest rates, ensuring consistent budgeting but limited repayment flexibility. Peer-to-peer loans often offer more customizable repayment terms, including variable schedules and early repayment options without penalties, giving borrowers greater control over cash flow management. Choosing peer-to-peer lending can benefit those seeking adaptable repayment plans to align with fluctuating income.

Fees and Additional Costs: Breaking Down the Numbers

Fixed-rate loans typically have predictable monthly payments with fixed interest rates and transparent fee structures, often including origination fees and potential prepayment penalties that influence the overall borrowing cost. Peer-to-peer loans may present varied fees such as platform service charges, origination fees that can range from 1% to 8%, and possible late payment fees, leading to less predictable total expenses. Comparing these costs requires analyzing APR, upfront fees, and potential penalties to determine which option minimizes overall borrowing expenses based on the loan amount and term.

Impact on Credit Score: What Borrowers Should Know

Fixed-rate loans typically have a predictable payment schedule that, when paid on time, positively impact credit scores by demonstrating consistent repayment behavior. Peer-to-peer loans can also boost credit scores if reported to credit bureaus, but missed payments may cause more immediate damage due to less structured lending environments. Borrowers should ensure timely payments and verify whether their lender reports to credit bureaus to manage their credit impact effectively.

Risk Factors: Security and Default Considerations

Fixed-rate loans offer borrowers predictable payments and are typically secured by collateral, reducing lender risk and providing clearer default consequences. Peer-to-peer loans often lack traditional collateral, increasing default risk and potentially leading to higher interest rates to compensate for unsecured lending. Evaluating security and default implications is crucial for borrowers choosing between the stability of fixed-rate loans and the flexibility of peer-to-peer lending platforms.

Choosing the Right Loan: Factors to Consider for Borrowers

Fixed-rate loans provide stability with consistent monthly payments and predictable interest rates, making them ideal for borrowers seeking minimizing financial uncertainty over the loan term. Peer-to-peer loans offer potentially lower interest rates and faster approval processes by connecting borrowers directly with individual investors through online platforms like LendingClub or Prosper. Borrowers should evaluate credit scores, loan amounts, repayment flexibility, and platform fees when choosing between these options to ensure the loan aligns with their financial goals and risk tolerance.

Related Important Terms

Robo-advisor lending platforms

Robo-advisor lending platforms streamline the borrowing process by offering fixed-rate loans with predictable interest and repayment schedules, reducing borrower uncertainty. Peer-to-peer loan options on these platforms may provide competitive rates based on individual credit profiles while leveraging AI-driven risk assessments to match lenders and borrowers efficiently.

Fractionalized debt investing

Fixed-rate loans provide predictable repayments with fixed interest rates, offering stability for fractionalized debt investors seeking consistent cash flow, while peer-to-peer loans enable diversified, fractionalized investments across multiple borrowers, potentially enhancing returns but with higher default risk. Fractionalized debt investing through peer-to-peer platforms allows investors to acquire small portions of multiple loans, spreading risk and increasing portfolio flexibility compared to traditional fixed-rate loans.

AI-powered credit risk assessment

AI-powered credit risk assessment enhances fixed-rate loan approval by analyzing extensive financial data with high accuracy, ensuring stable interest rates for borrowers. In peer-to-peer loans, AI-driven algorithms dynamically evaluate creditworthiness, enabling personalized rates and potentially lower borrowing costs for qualified applicants.

Smart contract loan agreements

Smart contract loan agreements automate fixed-rate loan terms by embedding predefined interest rates and repayment schedules into blockchain protocols, ensuring transparency and reducing default risk. Peer-to-peer loans leverage smart contracts to facilitate direct borrower-lender interactions, dynamically adjusting terms based on credit scoring algorithms and eliminating intermediaries for faster disbursement.

Decentralized peer-to-peer lending (DeFi loans)

Decentralized peer-to-peer lending (DeFi loans) offers borrowers fixed or variable interest rates determined by smart contracts on blockchain platforms, providing increased transparency and eliminating traditional banking intermediaries. Fixed-rate loans guarantee consistent repayment terms with predictable monthly payments, while DeFi loans leverage liquidity pools and decentralized protocols to enable more flexible, permissionless borrowing experiences.

Hyper-personalized loan terms

Fixed-rate loans offer stable interest rates and predictable monthly payments, providing borrowers with financial certainty over the loan term. Peer-to-peer loans enable hyper-personalized loan terms by leveraging individual credit profiles and investor preferences, often resulting in more flexible repayment schedules and tailored interest rates.

Tokenized fixed-rate lending

Tokenized fixed-rate lending leverages blockchain technology to offer borrowers predictable interest payments and transparent terms by converting loan agreements into digital tokens, enhancing liquidity and fractional ownership in fixed-rate loans. Compared to peer-to-peer loans, tokenized fixed-rate lending provides greater security, standardized contracts, and easier secondary market trading, reducing counterparty risk and improving access to capital.

Social credit trust scoring

Fixed-rate loans typically rely on traditional credit scoring models using financial history and credit bureaus, while peer-to-peer loans increasingly incorporate social credit trust scoring by evaluating social behavior, online reputation, and community feedback to assess borrower reliability. This integration of social credit trust scoring in P2P lending platforms enhances risk assessment accuracy and broadens access to credit for individuals with limited formal credit history.

Dynamic interest rate algorithms

Fixed-rate loans offer stability with a constant interest rate throughout the term, providing predictable monthly payments, whereas peer-to-peer loans can utilize dynamic interest rate algorithms that adjust rates based on real-time credit risk assessments and market demand. These algorithms enable more personalized and potentially lower rates for borrowers, leveraging data-driven models to optimize lender returns and borrower costs.

Green peer-to-peer loans

Green peer-to-peer loans offer competitive fixed interest rates while directly funding environmentally sustainable projects, providing borrowers with eco-friendly financing options that traditional fixed-rate loans often lack. These loans leverage decentralized lending platforms to reduce overhead costs and increase transparency, making green P2P loans an attractive alternative for borrowers prioritizing impact and sustainability alongside affordability.

Fixed-rate loan vs Peer-to-peer loan for borrowing. Infographic

moneydiff.com

moneydiff.com