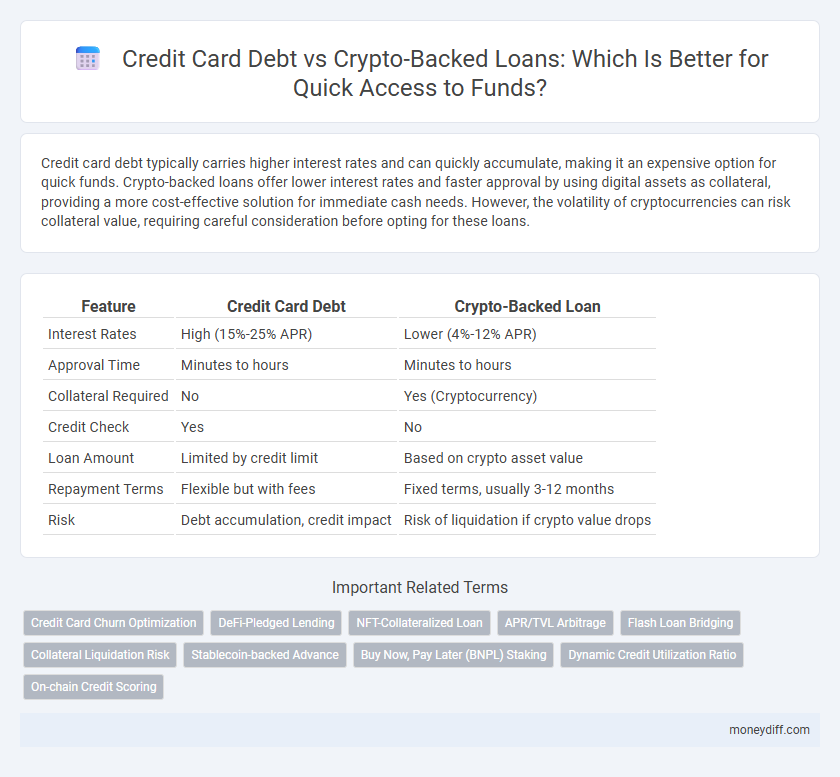

Credit card debt typically carries higher interest rates and can quickly accumulate, making it an expensive option for quick funds. Crypto-backed loans offer lower interest rates and faster approval by using digital assets as collateral, providing a more cost-effective solution for immediate cash needs. However, the volatility of cryptocurrencies can risk collateral value, requiring careful consideration before opting for these loans.

Table of Comparison

| Feature | Credit Card Debt | Crypto-Backed Loan |

|---|---|---|

| Interest Rates | High (15%-25% APR) | Lower (4%-12% APR) |

| Approval Time | Minutes to hours | Minutes to hours |

| Collateral Required | No | Yes (Cryptocurrency) |

| Credit Check | Yes | No |

| Loan Amount | Limited by credit limit | Based on crypto asset value |

| Repayment Terms | Flexible but with fees | Fixed terms, usually 3-12 months |

| Risk | Debt accumulation, credit impact | Risk of liquidation if crypto value drops |

Understanding Credit Card Debt: Fast Funds with High Interest

Credit card debt offers quick access to funds but comes with significantly high interest rates, often exceeding 20% annually, which can rapidly increase the total repayment amount. Unlike crypto-backed loans that use digital assets as collateral, credit card debt relies solely on unsecured borrowing, leading to higher financial risk for borrowers. Understanding the cost implications and repayment terms of credit card debt is crucial for effective financial management and avoiding long-term monetary strain.

Crypto-Backed Loans: An Innovative Financing Option

Crypto-backed loans offer a revolutionary alternative to traditional credit card debt by allowing borrowers to leverage their cryptocurrency assets as collateral for quick funds. These loans typically provide lower interest rates, flexible repayment terms, and faster approval processes compared to credit card debt. As a result, crypto-backed loans reduce reliance on high-interest credit cards while unlocking liquidity without forcing liquidation of crypto holdings.

Qualification and Approval Process: Credit Cards vs Crypto Loans

Credit card debt approval relies heavily on credit scores and income verification, often requiring higher creditworthiness for quick access to funds. Crypto-backed loans offer faster qualification through collateralizing cryptocurrency assets, bypassing traditional credit checks and enabling near-instant approval. This makes crypto loans a viable option for borrowers with lower credit scores seeking rapid funding without extensive underwriting.

Interest Rates: Comparing the Cost of Borrowing

Credit card debt typically carries high-interest rates, often ranging from 15% to 25% annually, making it an expensive option for quick funds. Crypto-backed loans offer lower interest rates, generally between 6% and 12%, as they are secured by digital assets, reducing lender risk. Borrowers should consider the volatility of cryptocurrencies and potential liquidation risks despite the cost advantage in interest rates.

Risk Factors: Collateral and Credit Implications

Credit card debt carries high interest rates and impacts credit scores directly, increasing financial risk if payments are missed. Crypto-backed loans use digital assets as collateral, which can be liquidated during market volatility, risking asset loss but often offering lower interest rates. Both options affect credit differently: credit card debt influences credit utilization and history, while crypto-backed loans may bypass traditional credit checks but expose borrowers to collateral price fluctuations.

Speed of Access: How Fast Are Funds Disbursed?

Credit card debt typically offers instant access to funds, allowing users to make purchases or withdraw cash immediately after approval. Crypto-backed loans require collateral verification and blockchain processing, which can take from a few hours to several days depending on the platform. Despite slightly longer processing times, crypto-backed loans often provide higher borrowing limits and lower interest rates compared to credit cards.

Repayment Terms and Flexibility

Credit card debt typically demands high-interest rates with fixed monthly minimum payments, limiting flexibility in repayment schedules and often extending the payoff period. Crypto-backed loans offer customizable repayment terms, allowing borrowers to repay principal and interest according to market conditions and personal cash flow, often resulting in lower overall costs. The ability to renegotiate loan terms or make early payments without penalties makes crypto-backed loans a more adaptable solution for managing short-term liquidity needs.

Impact on Credit Score: Traditional vs Crypto Lenders

Credit card debt directly impacts credit scores through utilization rates and payment history, often lowering scores if balances remain high or payments are late. Crypto-backed loans typically do not affect credit scores since most crypto lenders do not report to credit bureaus, offering an alternative for quick funds without credit score risk. However, failure to repay a crypto-backed loan could lead to collateral liquidation rather than credit score damage, contrasting with traditional credit consequences.

Security and Regulatory Considerations

Credit card debt typically involves higher interest rates and less regulatory oversight compared to crypto-backed loans, which operate under emerging frameworks designed to protect borrowers and lenders. Crypto-backed loans offer enhanced security through blockchain transparency and collateralization, reducing the risk of default but exposing borrowers to price volatility of the underlying digital assets. Regulatory considerations remain crucial, as traditional credit card debt benefits from well-established consumer protection laws, while crypto-backed loans face evolving regulations that vary significantly by jurisdiction.

Which Option Is Best for Quick Cash Needs?

Credit card debt typically offers faster access to quick cash with immediate approval but comes with higher interest rates and fees compared to crypto-backed loans. Crypto-backed loans provide lower interest rates by using digital assets as collateral, though the approval process can take longer and involves the risk of asset liquidation in volatile markets. For urgent cash needs, credit cards are more accessible, but crypto-backed loans are cost-effective for borrowers with valuable cryptocurrency holdings.

Related Important Terms

Credit Card Churn Optimization

Credit card churn optimization strategically leverages new credit card offers to access quick funds while minimizing interest and fees, offering a flexible alternative to crypto-backed loans that often entail volatile collateral risks. Optimizing credit card usage and timing can reduce debt costs and improve credit scores, whereas crypto-backed loans may expose borrowers to market fluctuations and potential liquidation.

DeFi-Pledged Lending

Credit card debt often features high-interest rates and rigid repayment schedules, whereas DeFi-pledged lending offers crypto-backed loans with lower interest and flexible terms by leveraging decentralized finance protocols for quick funds. Utilizing collateralized digital assets in DeFi lending platforms reduces reliance on traditional credit and provides faster access to liquidity without credit score impact.

NFT-Collateralized Loan

NFT-collateralized loans offer quick funds by leveraging digital assets as collateral, often with lower interest rates compared to traditional credit card debt. Unlike high-interest credit card debt, NFT-backed loans provide flexible repayment terms while preserving liquidity in volatile markets.

APR/TVL Arbitrage

Credit card debt typically carries an APR ranging from 15% to 25%, significantly higher than crypto-backed loan rates, which can be as low as 4% to 12%, leveraging the total value locked (TVL) in decentralized finance platforms for liquidity arbitrage. This APR/TVL differential allows borrowers to optimize quick funding costs by using crypto assets as collateral, reducing interest expenses compared to traditional credit lines.

Flash Loan Bridging

Credit card debt typically involves high-interest rates and lengthy repayment schedules, whereas crypto-backed loans offer faster access to funds with flexible terms by leveraging digital assets as collateral. Flash loan bridging enables instantaneous, unsecured loans within blockchain networks, providing liquidity without traditional credit checks, thus revolutionizing quick fund access in decentralized finance.

Collateral Liquidation Risk

Credit card debt offers quick funds with fixed interest but no collateral liquidation risk, whereas crypto-backed loans require securing digital assets that may be liquidated if asset values drop, increasing the risk of losing collateral. Evaluating volatility and loan-to-value ratios in crypto-backed loans is essential to managing potential collateral liquidation risks compared to unsecured credit card debts.

Stablecoin-backed Advance

Credit card debt typically carries high-interest rates and rigid repayment schedules, making it expensive for quick funds, whereas a crypto-backed loan, especially a stablecoin-backed advance, offers lower interest rates and flexible terms by leveraging digital assets as collateral. Stablecoin-backed advances reduce volatility risks inherent in cryptocurrency loans, providing borrowers with more predictable repayment values and faster access to liquidity without liquidating assets.

Buy Now, Pay Later (BNPL) Staking

Credit card debt often carries high interest rates and rigid repayment schedules, making it less ideal for quick, flexible funding compared to crypto-backed loans that leverage digital assets as collateral. Buy Now, Pay Later (BNPL) staking within crypto lending platforms offers innovative financing by allowing users to access immediate liquidity while earning staking rewards, optimizing both access to funds and investment growth.

Dynamic Credit Utilization Ratio

Credit card debt typically results in a high dynamic credit utilization ratio due to fluctuating balances and high interest rates, negatively impacting credit scores and borrowing capacity. In contrast, crypto-backed loans maintain a more stable utilization ratio by using digital assets as collateral, offering quicker access to funds with potentially lower interest rates and reduced impact on credit health.

On-chain Credit Scoring

Crypto-backed loans leverage on-chain credit scoring to offer swift fund access with transparent blockchain-based risk assessment, contrasting with traditional credit card debt reliant on off-chain credit histories and higher interest rates. This decentralized evaluation method enhances loan approval efficiency and reduces reliance on conventional credit scores, optimizing borrowing for crypto users.

Credit card debt vs Crypto-backed loan for quick funds Infographic

moneydiff.com

moneydiff.com