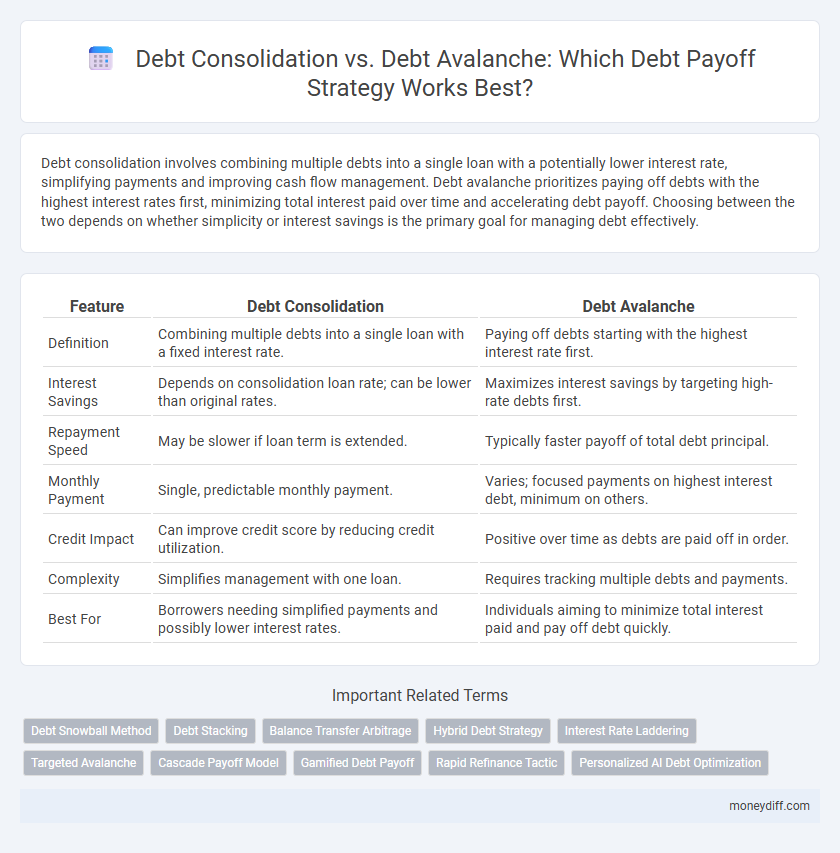

Debt consolidation involves combining multiple debts into a single loan with a potentially lower interest rate, simplifying payments and improving cash flow management. Debt avalanche prioritizes paying off debts with the highest interest rates first, minimizing total interest paid over time and accelerating debt payoff. Choosing between the two depends on whether simplicity or interest savings is the primary goal for managing debt effectively.

Table of Comparison

| Feature | Debt Consolidation | Debt Avalanche |

|---|---|---|

| Definition | Combining multiple debts into a single loan with a fixed interest rate. | Paying off debts starting with the highest interest rate first. |

| Interest Savings | Depends on consolidation loan rate; can be lower than original rates. | Maximizes interest savings by targeting high-rate debts first. |

| Repayment Speed | May be slower if loan term is extended. | Typically faster payoff of total debt principal. |

| Monthly Payment | Single, predictable monthly payment. | Varies; focused payments on highest interest debt, minimum on others. |

| Credit Impact | Can improve credit score by reducing credit utilization. | Positive over time as debts are paid off in order. |

| Complexity | Simplifies management with one loan. | Requires tracking multiple debts and payments. |

| Best For | Borrowers needing simplified payments and possibly lower interest rates. | Individuals aiming to minimize total interest paid and pay off debt quickly. |

Understanding Debt Consolidation: An Overview

Debt consolidation involves combining multiple high-interest debts into a single loan with a lower interest rate to simplify repayment and reduce overall interest costs. This strategy can improve cash flow and credit management by establishing a fixed monthly payment over a defined term. Comparing this to the debt avalanche method, which prioritizes paying off debts with the highest interest rates first, debt consolidation offers a streamlined approach that may lower monthly expenses but requires discipline to avoid accumulating new debt.

What Is the Debt Avalanche Method?

The debt avalanche method prioritizes paying off debts with the highest interest rates first while making minimum payments on lower-interest debts, optimizing interest savings and reducing overall payoff time. This strategy minimizes total interest paid compared to other methods like debt consolidation, which combines multiple debts into a single loan with a fixed interest rate. Implementing the debt avalanche method requires disciplined budgeting and consistent payments to accelerate debt elimination efficiently.

Key Differences: Debt Consolidation vs Debt Avalanche

Debt consolidation combines multiple debts into a single loan with a fixed interest rate, simplifying payments and potentially lowering monthly costs, while the debt avalanche method prioritizes paying off debts with the highest interest rates first to minimize overall interest expenses. Debt consolidation reduces payment complexity but may extend the repayment period, whereas the debt avalanche accelerates payoff by focusing on cost efficiency, which saves more money in interest over time. Choosing between these strategies depends on the borrower's financial discipline, interest rates, and goals for managing debt repayment effectively.

Pros and Cons of Debt Consolidation

Debt consolidation simplifies multiple debts into a single monthly payment, often with a lower interest rate, improving cash flow and easing financial management. It can reduce the risk of missed payments and provide a clear timeline for debt payoff but may involve fees and potentially extend the repayment period, increasing total interest paid. However, it requires discipline to avoid accumulating new debt, and not all debts qualify for consolidation loans.

Benefits and Drawbacks of the Debt Avalanche Approach

The Debt Avalanche strategy prioritizes paying off debts with the highest interest rates first, which minimizes total interest paid and accelerates overall debt repayment. This approach benefits individuals by reducing the total cost of debt and fostering faster financial freedom but requires strong discipline and can be less motivating since smaller debts remain unpaid longer. A potential drawback is the psychological challenge of not eliminating smaller balances quickly, which may impact persistence for some borrowers.

Who Should Choose Debt Consolidation?

Debt consolidation is ideal for individuals with multiple high-interest debts seeking a simplified payment process through a single, lower-interest loan. Borrowers with steady income but difficulty managing various monthly payments benefit from reduced financial stress and improved budgeting. This strategy suits those aiming to lower overall interest costs while maintaining consistent repayment schedules.

Who Benefits Most from the Debt Avalanche Strategy?

The Debt Avalanche strategy benefits individuals with multiple high-interest debts who prioritize minimizing total interest paid over time. Borrowers with steady income streams and strong discipline to make consistent payments gain the most, as this method targets debts with the highest interest rates first. This approach accelerates debt payoff and reduces overall financial costs compared to other strategies like Debt Consolidation.

Impact on Credit Score: Consolidation vs Avalanche

Debt consolidation can improve your credit score by reducing the number of open accounts and lowering overall credit utilization, resulting in a more manageable payment structure. The debt avalanche method targets high-interest debts first, potentially minimizing total interest paid but may not immediately affect credit utilization or the number of open accounts. Credit score impact depends on consistent payments; consolidation shows quicker benefits in credit mix and utilization, whereas the avalanche method benefits credit history length and payment punctuality over time.

How to Decide Between Debt Consolidation and Debt Avalanche

Choosing between debt consolidation and the debt avalanche method depends on interest rates and financial discipline. Debt consolidation combines multiple debts into one loan with a potentially lower interest rate, simplifying payments and reducing monthly costs. The debt avalanche prioritizes paying off debts with the highest interest rates first, minimizing total interest paid over time and accelerating overall debt reduction.

Real-Life Case Studies: Success Stories and Lessons Learned

Real-life case studies show debt consolidation helps borrowers simplify payments and reduce interest rates, leading to quicker payoff and improved credit scores. In contrast, the debt avalanche method accelerates debt repayment by targeting high-interest balances first, saving thousands in interest and motivating disciplined payers. Lessons learned emphasize choosing strategies aligned with personal financial habits and tracking progress to maintain accountability and achieve debt freedom.

Related Important Terms

Debt Snowball Method

The Debt Snowball Method emphasizes paying off the smallest debts first to build momentum and motivation, differing from the Debt Avalanche strategy that targets highest-interest debts to minimize overall interest costs. This approach enhances psychological motivation and quick wins, which can be crucial for maintaining consistent debt repayment habits.

Debt Stacking

Debt stacking combines elements of debt consolidation and the debt avalanche method by prioritizing high-interest debts first while making minimum payments on others, optimizing interest savings and accelerating payoff. Debt stacking strategically targets costly debts earliest, improving cash flow management and reducing overall debt burden more effectively than simple lump-sum consolidation.

Balance Transfer Arbitrage

Debt consolidation through balance transfer arbitrage leverages low or 0% introductory credit card rates to reduce interest costs and accelerate payoff timelines. The debt avalanche method prioritizes paying off highest-interest debts first, but balance transfer arbitrage can outperform it by maximizing interest savings during promotional periods.

Hybrid Debt Strategy

Hybrid debt strategy combines debt consolidation and debt avalanche methods by grouping smaller debts into a single payment while aggressively targeting high-interest balances first, accelerating payoff and reducing overall interest costs. This approach maximizes financial efficiency by balancing manageable monthly payments with a focus on minimizing long-term debt burden.

Interest Rate Laddering

Debt consolidation combines multiple debts into a single loan with a fixed interest rate, simplifying payments but often averaging out higher rates, whereas the debt avalanche method targets paying off debts with the highest interest rates first to minimize total interest paid. Interest rate laddering in the debt avalanche strategy accelerates payoff by allocating more funds to high-interest debts, reducing principal faster and overall interest burden.

Targeted Avalanche

Targeted Avalanche debt payoff strategy prioritizes high-interest debts with the smallest balances to maximize interest savings while accelerating debt reduction. This method blends the benefits of debt consolidation and the traditional debt avalanche by focusing payments on strategically selected debts, enhancing payoff efficiency and minimizing overall interest costs.

Cascade Payoff Model

The Cascade Payoff Model prioritizes paying off smaller debts first to quickly eliminate balances and gain psychological momentum, contrasting with the Debt Avalanche strategy that targets high-interest debts to minimize total interest paid. This approach reduces the number of debts rapidly, enhancing motivation and simplifying the payoff process, although it may result in higher cumulative interest compared to avalanche methods.

Gamified Debt Payoff

Gamified debt payoff leverages interactive tools and rewards to enhance motivation, favoring either debt consolidation for simplified payments or the debt avalanche method targeting high-interest debts first to minimize overall costs. Integrating gamification with the debt avalanche strategy can accelerate payoff by visually tracking progress and incentivizing timely payments on high-interest balances.

Rapid Refinance Tactic

Debt consolidation simplifies multiple debts into a single loan with a lower interest rate, while the debt avalanche method prioritizes paying off highest-interest debts first to minimize overall interest costs; incorporating a rapid refinance tactic accelerates payoff by quickly obtaining better loan terms when credit improves, reducing both interest expenses and repayment duration. Rapid refinancing leverages favorable market conditions or improved credit scores to restructure consolidated debt, enhancing the efficiency of debt payoff strategies and optimizing financial outcomes.

Personalized AI Debt Optimization

Personalized AI Debt Optimization leverages algorithms to tailor strategies that balance Debt Consolidation's simplicity with the Debt Avalanche method's focus on minimizing interest costs, delivering customized payoff plans that maximize financial efficiency. By analyzing individual debt portfolios and interest rates, AI-driven tools prioritize high-interest debts while incorporating consolidation benefits to accelerate overall repayment time and reduce total interest paid.

Debt consolidation vs Debt avalanche for payoff strategy Infographic

moneydiff.com

moneydiff.com