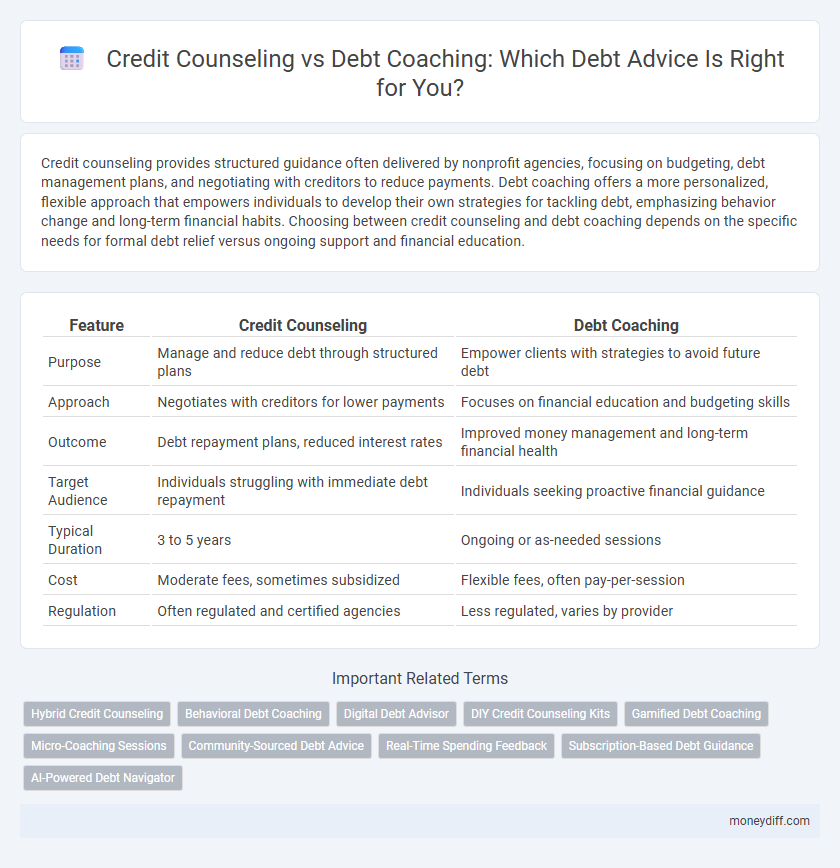

Credit counseling provides structured guidance often delivered by nonprofit agencies, focusing on budgeting, debt management plans, and negotiating with creditors to reduce payments. Debt coaching offers a more personalized, flexible approach that empowers individuals to develop their own strategies for tackling debt, emphasizing behavior change and long-term financial habits. Choosing between credit counseling and debt coaching depends on the specific needs for formal debt relief versus ongoing support and financial education.

Table of Comparison

| Feature | Credit Counseling | Debt Coaching |

|---|---|---|

| Purpose | Manage and reduce debt through structured plans | Empower clients with strategies to avoid future debt |

| Approach | Negotiates with creditors for lower payments | Focuses on financial education and budgeting skills |

| Outcome | Debt repayment plans, reduced interest rates | Improved money management and long-term financial health |

| Target Audience | Individuals struggling with immediate debt repayment | Individuals seeking proactive financial guidance |

| Typical Duration | 3 to 5 years | Ongoing or as-needed sessions |

| Cost | Moderate fees, sometimes subsidized | Flexible fees, often pay-per-session |

| Regulation | Often regulated and certified agencies | Less regulated, varies by provider |

Understanding Credit Counseling: An Overview

Credit counseling provides structured financial guidance from certified professionals who assess debt, create budgets, and develop repayment plans tailored to individual needs. It often involves working with nonprofit agencies that negotiate with creditors on behalf of clients to reduce interest rates or establish manageable payment schedules. Understanding credit counseling helps consumers access expert strategies and support designed to improve financial stability and prevent further debt accumulation.

What Is Debt Coaching? Key Concepts

Debt coaching is a personalized, client-centered approach that focuses on improving financial habits and decision-making skills to achieve long-term debt management. Unlike credit counseling, which often involves negotiating with creditors and creating repayment plans, debt coaching empowers individuals to develop sustainable strategies for budgeting, saving, and avoiding future debt. Key concepts include behavioral change, financial education, and accountability to foster responsible money management and prevent recurring debt cycles.

Main Differences Between Credit Counseling and Debt Coaching

Credit counseling involves professional guidance focused on managing debt through structured plans and negotiations with creditors, often provided by nonprofit agencies. Debt coaching emphasizes personalized education and skills development to empower individuals to make informed financial decisions independently. The main differences lie in credit counseling's direct creditor intervention and debt coaching's focus on long-term financial behavior change.

How Credit Counseling Works for Debt Management

Credit counseling involves a detailed assessment of an individual's financial situation followed by a tailored debt management plan that consolidates payments to creditors. Certified credit counselors negotiate lower interest rates and fees on behalf of clients, facilitating more affordable monthly payments and faster debt payoff. This structured approach offers continuous support and financial education to help prevent future debt problems.

How Debt Coaching Supports Financial Change

Debt coaching supports financial change by providing personalized, practical guidance tailored to individual spending habits and financial goals, rather than offering standardized solutions. It emphasizes long-term behavior modification, helping clients develop sustainable money management skills and build financial resilience. This approach fosters empowerment and confidence, enabling individuals to make informed financial decisions and avoid recurring debt cycles.

Pros and Cons of Credit Counseling

Credit counseling offers structured debt management plans and professional negotiation with creditors, which can lower interest rates and consolidate payments, but often involves fees and limits financial flexibility. The service provides education on budgeting and credit use, enhancing long-term financial habits though it may require a lengthy commitment and impact credit scores temporarily. Credit counseling is ideal for individuals needing formal guidance and creditor intervention, but it may not suit those seeking personalized coaching or complete control over their debt strategy.

Advantages and Disadvantages of Debt Coaching

Debt coaching offers personalized guidance tailored to individual financial goals and behaviors, promoting long-term financial literacy and self-management. Unlike credit counseling, it avoids direct negotiations with creditors, which may limit immediate debt relief options but fosters proactive budgeting skills. However, debt coaching requires a higher level of personal discipline and may not provide the structured repayment plans available through credit counseling services.

Which Is Better for Your Debt Situation?

Credit counseling offers structured debt management plans and typically involves working with accredited agencies to negotiate lower interest rates and consolidate payments, making it ideal for individuals seeking direct assistance with debt repayment. Debt coaching provides personalized education and strategies to improve financial habits without directly managing payments, benefiting those who want to regain control and develop long-term financial discipline. Choosing between credit counseling and debt coaching depends on the severity of your debt and whether you need hands-on help with payment plans or guidance to change financial behaviors.

How to Choose Between Credit Counseling and Debt Coaching

Choosing between credit counseling and debt coaching depends on your financial situation and goals, as credit counseling typically offers structured debt management plans with creditor negotiation, while debt coaching focuses on personalized financial education and behavioral changes. Credit counseling suits those needing immediate debt relief and professional assistance with repayment, whereas debt coaching benefits individuals seeking long-term financial habits and debt prevention strategies. Evaluate your debt severity, willingness to follow a strict plan, and desire for financial skill-building to determine the best option.

Frequently Asked Questions About Debt Advice Services

Credit counseling typically involves working with a nonprofit agency to create a debt management plan and negotiate with creditors, while debt coaching provides personalized guidance to improve financial habits without debt consolidation offers. Common questions address eligibility for services, costs, how each approach impacts credit scores, and the duration of support provided. Understanding these differences helps individuals choose the right debt advice service tailored to their financial situation and goals.

Related Important Terms

Hybrid Credit Counseling

Hybrid credit counseling combines personalized debt coaching techniques with structured credit counseling services to provide tailored financial advice and debt management strategies. This approach enhances debt relief outcomes by integrating behavioral coaching with practical budgeting, credit score improvement, and debt repayment planning.

Behavioral Debt Coaching

Behavioral debt coaching emphasizes personalized strategies to change spending habits and improve financial decision-making, unlike traditional credit counseling that primarily focuses on debt management plans and negotiation with creditors. This approach enhances long-term financial health by addressing the psychological drivers of debt accumulation, fostering sustainable behavioral changes over time.

Digital Debt Advisor

Digital debt advisors offer personalized credit counseling with tailored repayment strategies based on real-time financial data, while debt coaching provides broader financial education and behavior modification techniques. Leveraging AI-driven platforms, digital debt advisors enhance accuracy and accessibility, making debt management more efficient than traditional coaching methods.

DIY Credit Counseling Kits

Credit counseling typically involves working directly with certified agencies offering structured debt management plans, while debt coaching focuses on empowering individuals with personalized strategies and tools to manage finances independently, such as DIY credit counseling kits. These kits provide step-by-step guidance, budgeting templates, and negotiation tips, enabling consumers to take control of their debt without the need for ongoing professional intervention.

Gamified Debt Coaching

Gamified debt coaching leverages interactive tools and reward systems to enhance engagement and motivation for individuals tackling debt, offering a dynamic alternative to traditional credit counseling that often focuses on rigid financial assessments and debt management plans. This approach fosters behavioral changes through real-time feedback and personalized challenges, making debt advice more accessible and effective for users seeking sustainable financial habits.

Micro-Coaching Sessions

Micro-coaching sessions in credit counseling provide structured guidance with certified counselors focusing on budget management and debt repayment strategies, while debt coaching offers a more flexible, personalized approach targeting behavioral changes and financial goal setting. Both methods improve debt management skills, but micro-coaching sessions in credit counseling often deliver measurable outcomes through tailored action plans and professional accountability.

Community-Sourced Debt Advice

Community-sourced debt advice through credit counseling provides structured guidance from certified professionals, focusing on creating manageable repayment plans and negotiating with creditors. Debt coaching offers personalized support emphasizing financial education and behavior change, empowering individuals to build long-term money management skills within a supportive community network.

Real-Time Spending Feedback

Credit counseling provides structured debt management plans with certified advice, while debt coaching focuses on personalized guidance and real-time spending feedback to improve day-to-day financial decisions. Real-time spending feedback from debt coaching helps consumers adjust behaviors immediately, fostering better habits and preventing debt accumulation more effectively than traditional credit counseling.

Subscription-Based Debt Guidance

Subscription-based debt guidance offers ongoing support through credit counseling or debt coaching, providing tailored strategies for managing debt effectively. Credit counseling typically includes budget analysis and debt management plans, while debt coaching emphasizes behavioral change and financial education to sustain long-term debt relief.

AI-Powered Debt Navigator

AI-Powered Debt Navigator enhances credit counseling by providing personalized, data-driven debt management plans that predict optimal repayment strategies. Unlike traditional debt coaching, this technology leverages machine learning algorithms to analyze spending patterns, automate budget adjustments, and deliver real-time recommendations, increasing the likelihood of efficient debt resolution.

Credit counseling vs debt coaching for debt advice. Infographic

moneydiff.com

moneydiff.com