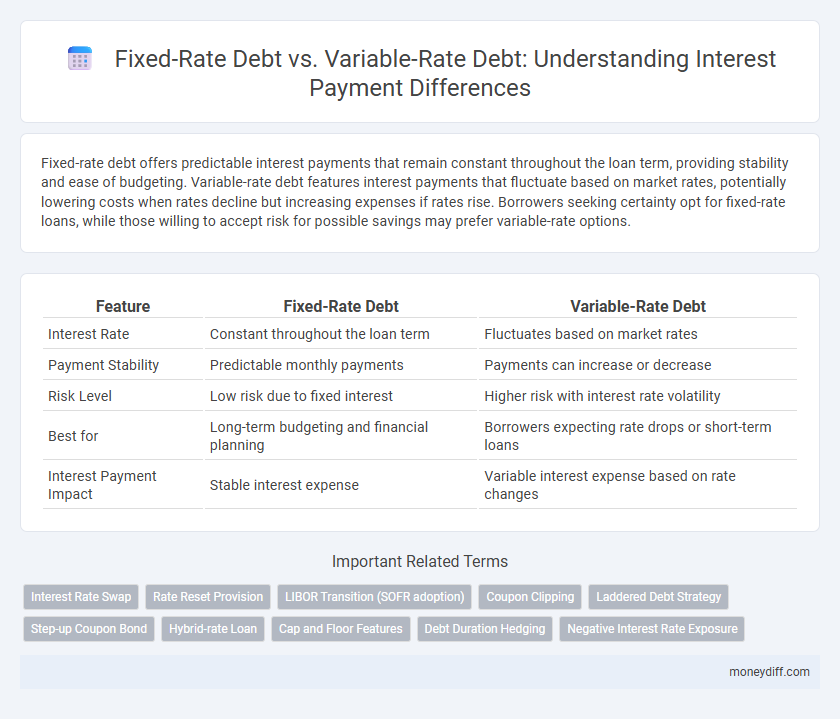

Fixed-rate debt offers predictable interest payments that remain constant throughout the loan term, providing stability and ease of budgeting. Variable-rate debt features interest payments that fluctuate based on market rates, potentially lowering costs when rates decline but increasing expenses if rates rise. Borrowers seeking certainty opt for fixed-rate loans, while those willing to accept risk for possible savings may prefer variable-rate options.

Table of Comparison

| Feature | Fixed-Rate Debt | Variable-Rate Debt |

|---|---|---|

| Interest Rate | Constant throughout the loan term | Fluctuates based on market rates |

| Payment Stability | Predictable monthly payments | Payments can increase or decrease |

| Risk Level | Low risk due to fixed interest | Higher risk with interest rate volatility |

| Best for | Long-term budgeting and financial planning | Borrowers expecting rate drops or short-term loans |

| Interest Payment Impact | Stable interest expense | Variable interest expense based on rate changes |

Understanding Fixed-Rate Debt: Stability in Interest Payments

Fixed-rate debt offers borrowers stability by locking in a constant interest rate throughout the loan term, eliminating the risk of payment fluctuations due to market changes. This predictability simplifies budgeting and financial planning, especially in environments with rising interest rates. Lenders typically charge higher initial rates for fixed-rate loans to compensate for the risk of inflation and market rate increases.

Exploring Variable-Rate Debt: Fluctuating Interest Costs

Variable-rate debt features interest rates that adjust periodically based on benchmark indexes like the LIBOR or the prime rate, causing fluctuations in interest payments over the loan term. Borrowers benefit from lower initial rates compared to fixed-rate debt, but they face uncertainty as rising rates increase the cost of borrowing. This dynamic nature requires careful cash flow management to mitigate risks associated with interest rate volatility.

Key Differences Between Fixed and Variable Interest Rates

Fixed-rate debt maintains a constant interest rate throughout the loan term, providing predictable monthly payments and protection against rising interest costs. Variable-rate debt features interest rates that fluctuate based on benchmark indices like the LIBOR or Treasury rates, which can lead to lower initial payments but higher risk if rates increase. Choosing between fixed and variable interest rates depends on risk tolerance, market conditions, and the borrower's financial stability.

Pros and Cons of Fixed-Rate Debt for Borrowers

Fixed-rate debt offers borrowers the advantage of predictable interest payments, which simplifies budgeting and shields against rising interest rates. This stability reduces financial uncertainty, making it easier to plan long-term projects or expenses. However, fixed rates may be higher initially compared to variable rates, potentially resulting in higher costs if interest rates decline.

Risks and Rewards of Variable-Rate Debt

Variable-rate debt exposes borrowers to interest rate fluctuations, potentially increasing payment amounts when rates rise, which poses a significant risk in volatile markets. However, the rewards include benefiting from lower initial rates and reduced interest payments if market rates decline. This flexibility can enhance cash flow management but requires careful monitoring of economic trends to mitigate unexpected cost spikes.

How Economic Trends Affect Variable-Rate Interest Payments

Variable-rate debt interest payments fluctuate based on benchmark rates such as the Federal Reserve's federal funds rate and inflation trends, directly impacting borrower costs during economic shifts. During periods of rising inflation or aggressive central bank rate hikes, variable interest rates increase, leading to higher debt servicing expenses. Conversely, in economic slowdowns or rate cuts, variable-rate payments tend to decrease, offering potential savings compared to fixed-rate debt.

Budgeting Strategies: Fixed-Rate vs Variable-Rate Loans

Fixed-rate debt offers predictable interest payments, making it easier for individuals and businesses to budget monthly expenses without unexpected fluctuations. Variable-rate debt can start with lower interest rates but introduces uncertainty since payments may increase with market interest rate shifts, complicating long-term financial planning. Understanding cash flow stability needs is crucial when choosing between fixed-rate loans for steady budgeting and variable-rate loans that may yield savings or higher costs depending on economic conditions.

How to Choose Between Fixed and Variable-Rate Debt

Choosing between fixed-rate and variable-rate debt depends on interest rate trends and budget stability needs. Fixed-rate debt offers predictable payments, ideal for long-term financial planning during rising interest environments. Variable-rate debt may reduce initial costs and benefit from falling rates, but carries the risk of payment increases if market rates climb.

Impact of Interest Rate Changes on Debt Repayment

Fixed-rate debt maintains consistent interest payments regardless of market fluctuations, providing predictable debt repayment schedules. Variable-rate debt adjusts interest payments based on prevailing rates, leading to potential increases or decreases in repayment amounts over time. Borrowers with variable-rate debt face uncertainty in budgeting due to the direct impact of interest rate changes on overall debt costs.

Long-Term Financial Planning with Fixed vs Variable Debt

Fixed-rate debt provides predictable interest payments, enabling stable long-term financial planning by shielding borrowers from market interest rate fluctuations. Variable-rate debt offers potential cost savings when rates decline but introduces uncertainty, complicating cash flow forecasting and risk management. Companies prioritizing budget stability and minimizing interest rate risk often prefer fixed-rate debt for strategic financial planning over extended periods.

Related Important Terms

Interest Rate Swap

Interest Rate Swaps enable debt holders to convert variable-rate debt into fixed-rate obligations, stabilizing interest payments against market fluctuations. This financial derivative is crucial for managing interest rate risk by exchanging variable rate cash flows for fixed rate cash flows, optimizing debt servicing costs.

Rate Reset Provision

Fixed-rate debt maintains a constant interest rate throughout the loan term, providing predictable payments without exposure to market fluctuations, while variable-rate debt features a rate reset provision that adjusts interest rates periodically based on benchmark indices like LIBOR or SOFR. This rate reset mechanism exposes borrowers to potential payment volatility, affecting cash flow management and risk assessment in financial planning.

LIBOR Transition (SOFR adoption)

Fixed-rate debt provides predictable interest payments unaffected by market fluctuations, ensuring budget stability amid the LIBOR transition to SOFR, which introduces variable-rate debt tied to the Secured Overnight Financing Rate. As SOFR replaces LIBOR, borrowers with variable-rate debt may face increased payment volatility due to SOFR's overnight, transaction-based nature, influencing interest expense forecasting.

Coupon Clipping

Fixed-rate debt offers predictable coupon clipping by maintaining consistent interest payments, reducing uncertainty for bondholders. Variable-rate debt exposes investors to fluctuating coupon clipping as interest payments adjust with market rates, increasing both risk and potential returns.

Laddered Debt Strategy

A laddered debt strategy balances fixed-rate debt, providing predictable interest payments, with variable-rate debt, which can lower costs when rates decline, optimizing overall interest expense management. This approach reduces refinancing risk and enhances cash flow stability by staggering maturities across both types of debt.

Step-up Coupon Bond

Step-up coupon bonds feature fixed-rate debt initially, with interest payments that increase at predetermined intervals, offering predictable cash flows while mitigating interest rate risk compared to variable-rate debt. This structure benefits investors seeking gradual income growth without exposure to fluctuating market rates inherent in variable-rate debt instruments.

Hybrid-rate Loan

Hybrid-rate loans combine fixed-rate debt stability with variable-rate debt flexibility by offering an initial fixed interest period followed by variable-rate adjustments, optimizing interest payments in fluctuating market conditions. This structure mitigates the risk of rising rates inherent in variable-rate debt while allowing borrowers to benefit from potential declines in interest rates over the loan term.

Cap and Floor Features

Fixed-rate debt offers predictable interest payments by maintaining a constant rate, protecting borrowers from rising costs but lacking flexibility to benefit from rate decreases. Variable-rate debt with cap and floor features provides a balance by limiting maximum and minimum interest payments, ensuring cost control while allowing potential savings when rates fluctuate within set boundaries.

Debt Duration Hedging

Fixed-rate debt offers predictable interest payments, minimizing risk during long debt durations by stabilizing cash flow and facilitating effective hedging against interest rate fluctuations. Variable-rate debt exposes borrowers to interest rate volatility, requiring dynamic hedging strategies to mitigate the impact of rate changes over the life of the debt.

Negative Interest Rate Exposure

Fixed-rate debt provides protection against negative interest rate exposure by locking in a consistent interest payment, eliminating the risk of fluctuating rates and potential increases in cost. Variable-rate debt exposes borrowers to negative interest rate environments, where rates can drop below zero, potentially reducing interest expenses but increasing uncertainty in financial planning.

Fixed-rate debt vs Variable-rate debt for interest payments Infographic

moneydiff.com

moneydiff.com