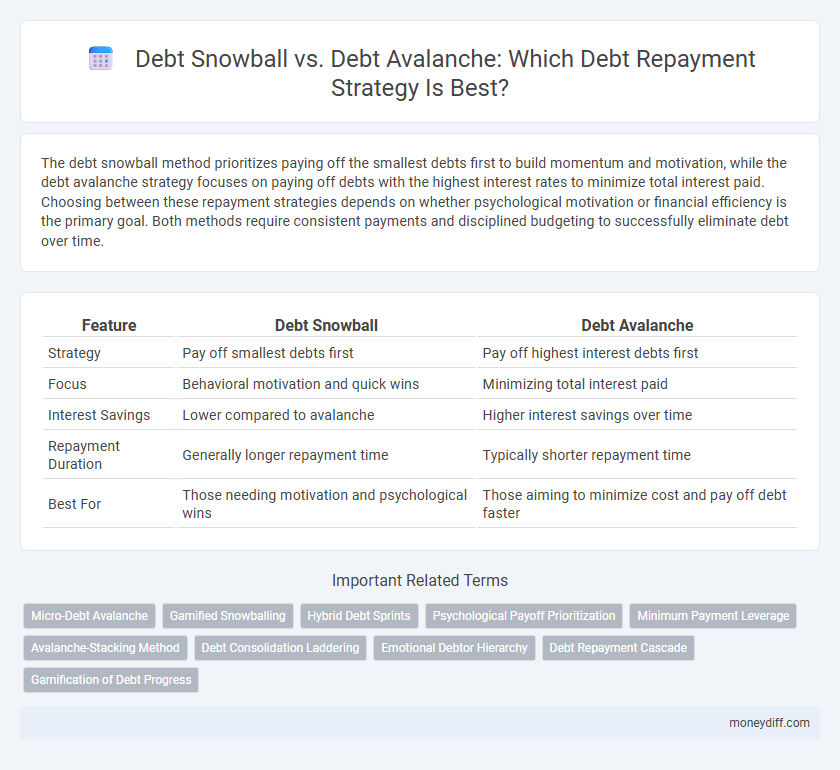

The debt snowball method prioritizes paying off the smallest debts first to build momentum and motivation, while the debt avalanche strategy focuses on paying off debts with the highest interest rates to minimize total interest paid. Choosing between these repayment strategies depends on whether psychological motivation or financial efficiency is the primary goal. Both methods require consistent payments and disciplined budgeting to successfully eliminate debt over time.

Table of Comparison

| Feature | Debt Snowball | Debt Avalanche |

|---|---|---|

| Strategy | Pay off smallest debts first | Pay off highest interest debts first |

| Focus | Behavioral motivation and quick wins | Minimizing total interest paid |

| Interest Savings | Lower compared to avalanche | Higher interest savings over time |

| Repayment Duration | Generally longer repayment time | Typically shorter repayment time |

| Best For | Those needing motivation and psychological wins | Those aiming to minimize cost and pay off debt faster |

Understanding the Debt Snowball Method

The Debt Snowball method prioritizes paying off the smallest debts first while making minimum payments on larger balances, creating a sense of achievement and motivation. This strategy emphasizes behavioral psychology by encouraging quick wins, which can increase commitment to overall debt repayment. Focusing on reducing the number of accounts with outstanding balances can improve financial confidence and momentum despite higher interest rates on larger debts.

Explaining the Debt Avalanche Approach

The Debt Avalanche approach prioritizes repaying debts with the highest interest rates first, minimizing the total interest paid over time. By allocating extra funds to the most expensive debt while making minimum payments on others, this method accelerates overall debt reduction. This strategy is especially effective for individuals aiming to save money on interest and become debt-free faster.

Key Differences Between Snowball and Avalanche

The Debt Snowball method prioritizes paying off the smallest debts first to build momentum, while the Debt Avalanche targets debts with the highest interest rates to minimize overall interest paid. Snowball emphasizes quick wins and psychological motivation, whereas Avalanche focuses on financial efficiency and cost savings over time. Choosing between these strategies depends on whether emotional satisfaction or interest optimization is the primary goal in debt repayment.

Pros and Cons of the Debt Snowball Technique

The Debt Snowball technique accelerates motivation by focusing on paying off the smallest debts first, creating early psychological wins that boost commitment. However, it may lead to higher overall interest costs compared to other methods, as it does not prioritize debts with the highest interest rates. This strategy is best suited for individuals needing consistent reinforcement to maintain momentum in their debt repayment journey.

Advantages and Disadvantages of the Debt Avalanche

The Debt Avalanche method prioritizes repaying debts with the highest interest rates first, which minimizes overall interest payments and accelerates debt elimination. This strategy reduces the total cost of borrowing and shortens the repayment period, making it financially efficient for individuals with multiple high-interest debts. However, the downside is that it may delay motivational milestones since larger, high-interest balances often take longer to clear compared to smaller debts, potentially impacting borrower morale.

Psychological Impact: Motivation vs. Math

The Debt Snowball method boosts motivation by prioritizing paying off smaller debts first, creating a sense of progress and accomplishment that encourages continued repayment. In contrast, the Debt Avalanche strategy focuses on minimizing overall interest costs by targeting higher-interest debts first, appealing to those motivated by mathematical efficiency. Both approaches harness different psychological triggers--emotional satisfaction versus logical calculation--impacting the debtor's commitment and ultimately their financial success.

Which Method Pays Off Debt Faster?

The Debt Avalanche method pays off debt faster by targeting high-interest debts first, minimizing the total interest paid over time. In contrast, the Debt Snowball method prioritizes smaller balances to boost motivation but can extend the overall repayment period. Choosing Debt Avalanche accelerates debt elimination and reduces long-term costs for borrowers.

Choosing the Best Strategy for Your Finances

Choosing between the debt snowball and debt avalanche methods depends on your financial goals and psychological motivation. The debt snowball prioritizes paying off smaller balances first to build momentum and motivation, while the debt avalanche targets debts with the highest interest rates to minimize total interest paid and accelerate repayment. Evaluating your budget, interest rates, and personal discipline helps determine the most effective strategy to manage and eliminate debt efficiently.

Real-Life Success Stories and Case Studies

Many real-life success stories highlight the effectiveness of the debt snowball method, where individuals like Dave Ramsey's clients eliminate smaller debts first, boosting motivation and leading to consistent repayments. Case studies of the debt avalanche strategy show faster interest savings by prioritizing high-interest debts, as demonstrated by credit counseling reports analyzing borrower outcomes. Both strategies prove effective depending on personal discipline and financial goals, with numerous testimonials supporting tailored approaches.

Tips for Sticking to Your Debt Repayment Plan

Set clear, measurable goals and track your progress regularly to maintain motivation when using either the debt snowball or debt avalanche method. Automate payments to avoid missed deadlines and reduce the temptation to spend funds allocated for debt repayment. Surround yourself with supportive resources, such as financial advisors or accountability partners, to stay disciplined and adapt your plan as needed.

Related Important Terms

Micro-Debt Avalanche

The Micro-Debt Avalanche method targets small debts with the highest interest rates first, maximizing interest savings while maintaining motivation by quickly eliminating multiple balances. This strategy blends the traditional Avalanche approach with the psychological benefits of swift wins, accelerating overall debt repayment efficiency.

Gamified Snowballing

Gamified snowballing leverages the psychological boost of quickly paying off smaller debts first, making debt snowball repayment more engaging and motivating through game-like elements such as rewards and progress tracking. This approach enhances commitment and persistence compared to the debt avalanche method, which prioritizes higher-interest debts but may lack immediate gratification.

Hybrid Debt Sprints

Hybrid Debt Sprints combine the psychological benefits of the Debt Snowball method by prioritizing small balances with the mathematical efficiency of the Debt Avalanche approach targeting high-interest debts first. This strategy accelerates repayment by alternating focus between quick wins and cost-effective balance reduction, optimizing both motivation and financial savings.

Psychological Payoff Prioritization

Debt snowball prioritizes psychological payoff by targeting smaller balances first, building momentum and motivation through quick wins, while debt avalanche emphasizes minimizing interest costs by focusing on high-interest debts, which may delay emotional satisfaction despite financial efficiency. Choosing the right strategy depends on balancing emotional reinforcement with cost-effective repayment to maintain long-term commitment.

Minimum Payment Leverage

The Debt Snowball method focuses on paying off the smallest debts first, leveraging minimum payments to quickly eliminate balances and build momentum, while the Debt Avalanche prioritizes debts with the highest interest rates, maximizing minimum payment leverage to reduce overall interest paid and accelerate payoff. Both strategies require consistent minimum payments, but the avalanche approach mathematically saves more money by targeting costly debt faster.

Avalanche-Stacking Method

The Debt Avalanche-Stacking Method prioritizes paying off debts with the highest interest rates first, minimizing total interest paid and accelerating debt freedom. By stacking extra payments on the highest-rate debt while maintaining minimums on others, borrowers reduce overall costs and shorten repayment timelines effectively.

Debt Consolidation Laddering

Debt consolidation laddering strategically combines the debt snowball and debt avalanche methods by addressing smaller balances first while targeting high-interest loans to minimize overall interest costs. This approach accelerates repayment through prioritized consolidation, enabling faster debt elimination and improved credit health.

Emotional Debtor Hierarchy

The Debt Snowball method targets smaller balances first, delivering quick emotional wins that boost motivation, while the Debt Avalanche strategy prioritizes higher-interest debts, maximizing financial efficiency but often requiring greater emotional discipline. Understanding one's Emotional Debtor Hierarchy helps tailor the repayment approach to balance psychological encouragement with long-term cost savings.

Debt Repayment Cascade

Debt repayment cascade leverages the psychological momentum of the debt snowball method by prioritizing small balance payoffs to build motivation, while the debt avalanche targets minimization of total interest by focusing on high-interest debts first; combining these strategies optimizes cash flow and accelerates debt elimination. Behavioral finance insights reveal that initiating repayments with smaller debts boosts confidence and payment consistency, whereas the avalanche's focus on interest rates ensures maximum cost efficiency over time.

Gamification of Debt Progress

The Debt Snowball method gamifies repayment by rewarding quick wins through paying off smaller balances first, boosting motivation and engagement. The Debt Avalanche strategy leverages gamification by emphasizing progress on high-interest debts, optimizing financial outcomes while tracking milestones to sustain momentum.

Debt snowball vs Debt avalanche for repayment strategy. Infographic

moneydiff.com

moneydiff.com