Credit card debt typically incurs higher interest rates and can accumulate quickly if not managed properly, leading to long-term financial strain for consumers. Buy Now Pay Later (BNPL) options offer interest-free periods but may encourage overspending and lead to multiple small debts that add up over time. Consumers should carefully assess repayment terms and their ability to manage debt when choosing between credit cards and BNPL services.

Table of Comparison

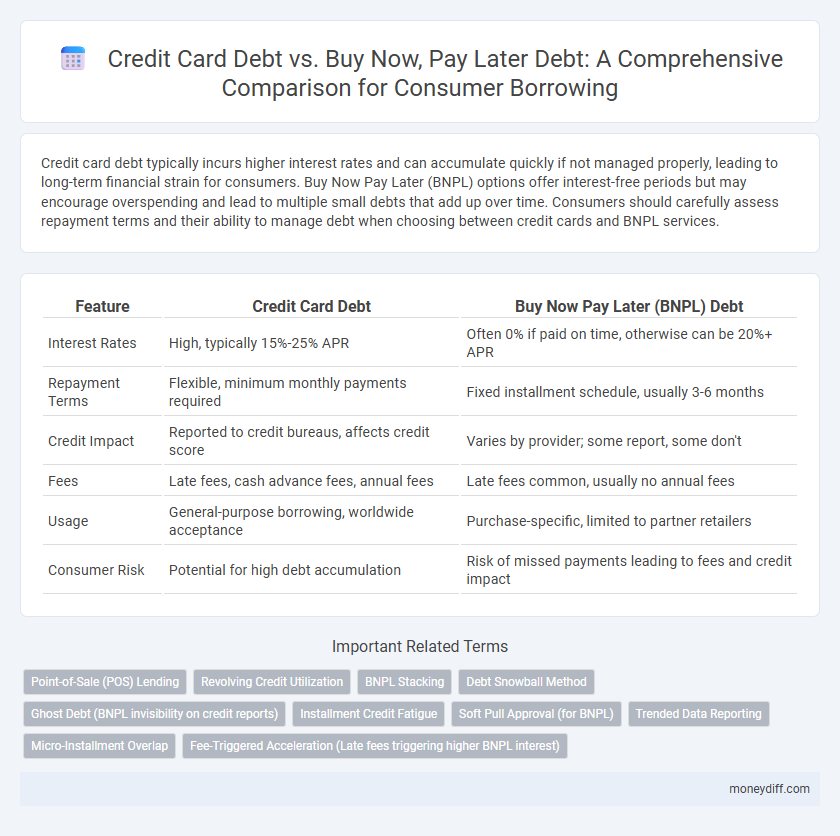

| Feature | Credit Card Debt | Buy Now Pay Later (BNPL) Debt |

|---|---|---|

| Interest Rates | High, typically 15%-25% APR | Often 0% if paid on time, otherwise can be 20%+ APR |

| Repayment Terms | Flexible, minimum monthly payments required | Fixed installment schedule, usually 3-6 months |

| Credit Impact | Reported to credit bureaus, affects credit score | Varies by provider; some report, some don't |

| Fees | Late fees, cash advance fees, annual fees | Late fees common, usually no annual fees |

| Usage | General-purpose borrowing, worldwide acceptance | Purchase-specific, limited to partner retailers |

| Consumer Risk | Potential for high debt accumulation | Risk of missed payments leading to fees and credit impact |

Understanding Credit Card Debt vs Buy Now Pay Later Debt

Credit card debt typically involves revolving credit with interest rates averaging between 15% and 25%, while Buy Now Pay Later (BNPL) debt often offers interest-free installments but can lead to higher late fees and shorter repayment windows. Consumers using BNPL services may underestimate the risk of accumulating multiple small debts that can quickly become unmanageable, unlike the transparent credit limits and monthly statements provided by credit cards. Understanding these differences is essential for managing borrowing costs and avoiding long-term financial stress.

How Credit Card Debt Accumulates

Credit card debt accumulates primarily through high-interest rates and revolving balances that continue to grow if not paid in full each month. Unsupported minimum payments often extend the debt timeline, significantly increasing the total repayment amount. Unlike Buy Now Pay Later (BNPL) plans, credit card debt lacks fixed repayment schedules, leading to the risk of compounding interest and escalating consumer borrowing costs.

The Mechanics of Buy Now Pay Later Debt

Buy Now Pay Later (BNPL) debt allows consumers to split purchases into interest-free installments, typically paid over weeks or months, contrasting with credit card debt that often carries high-interest rates and revolving balances. BNPL providers conduct soft credit checks and do not usually report to credit bureaus, impacting borrowing mechanics and credit scores differently than credit cards. The ease of approval and fixed payment schedule can encourage higher spending but may lead to missed payments and fees if consumers do not manage their BNPL obligations carefully.

Interest Rates: Credit Cards vs BNPL Offers

Credit card debt typically comes with high interest rates averaging between 15% to 25% APR, making it expensive for consumers who carry balances month to month. Buy Now Pay Later (BNPL) offers often provide interest-free periods or lower rates, but late fees and short repayment windows can increase costs unexpectedly. Consumers should evaluate the true cost of borrowing by comparing APRs, fees, and repayment terms before choosing between credit cards and BNPL options.

Repayment Terms: What Consumers Need to Know

Credit card debt typically involves revolving credit with variable interest rates and minimum monthly payments, allowing consumers flexibility but potentially leading to high-interest costs over time. Buy Now Pay Later (BNPL) services often offer fixed short-term repayment schedules with little or no interest if paid on time, reducing immediate financial strain but risking late fees and credit score impacts if missed. Consumers should carefully review repayment terms to avoid unexpected charges and assess their ability to meet payment deadlines for both credit card and BNPL options.

Impact on Credit Score: Credit Cards vs BNPL

Credit card debt directly affects credit scores by influencing credit utilization ratios and payment history, which are key factors in credit scoring models like FICO and VantageScore. Buy Now Pay Later (BNPL) debt typically does not impact credit scores unless payments are missed and sent to collections, as most BNPL providers do not report to credit bureaus. Consumers relying heavily on credit cards may see more immediate fluctuations in their credit scores compared to those using BNPL services, though long-term courtesy in BNPL payments can build positive credit history if reported.

Hidden Fees and Charges: A Comparative Overview

Credit card debt often incurs hidden fees such as annual fees, late payment penalties, and interest rate hikes that can significantly increase the total repayment amount. Buy Now Pay Later (BNPL) services may seem fee-free initially but typically charge late fees, deferred interest, or higher costs for extended payment plans, which can accumulate quickly. Consumers should scrutinize the fine print to understand the full cost implications and avoid unexpected financial burdens.

Consumer Protections and Dispute Resolution

Credit card debt offers stronger consumer protections, including federal regulations such as the Truth in Lending Act and the Fair Credit Billing Act, which provide dispute resolution mechanisms and limit liability for unauthorized charges. Buy Now Pay Later (BNPL) debt often lacks standardized regulatory oversight, resulting in fewer protections and limited avenues for consumers to resolve billing disputes or errors. Consumers should carefully review terms before using BNPL services, as these platforms may not provide the same robust safeguards found with credit card agreements.

Financial Habits and Spending Behaviors

Credit card debt often reflects consumers' ongoing reliance on revolving credit with interest rates averaging around 16-22%, encouraging minimum payments that can extend debt repayment over years. Buy Now Pay Later (BNPL) debt typically involves interest-free installments paid over short terms, which may promote impulsive spending and reduced perception of total cost, particularly among younger consumers. Financial habits linked to credit cards include budget-conscious repayment strategies, while BNPL usage is correlated with frequent small purchases and less emphasis on debt accumulation awareness.

Choosing the Right Option for Your Financial Health

Credit card debt typically involves high interest rates and can quickly accumulate if not managed carefully, impacting your credit score and financial stability. Buy Now Pay Later (BNPL) options offer interest-free installments but may lead to overspending and missed payments that affect creditworthiness. Assess your repayment capacity, interest terms, and spending habits to choose the borrowing method that supports sustainable financial health.

Related Important Terms

Point-of-Sale (POS) Lending

Credit card debt typically involves higher interest rates and revolving balances, whereas Buy Now Pay Later (BNPL) debt offers fixed payment schedules at POS, appealing to consumers seeking short-term, interest-free borrowing options. POS lending through BNPL platforms has surged, providing convenient financing but raising concerns about increased consumer debt and financial discipline.

Revolving Credit Utilization

Credit card debt involves revolving credit utilization, allowing consumers to carry balances with variable interest rates that impact credit scores based on utilization ratios, while Buy Now Pay Later (BNPL) debt typically functions as non-revolving credit with fixed repayment schedules and often does not affect credit utilization. High revolving credit utilization from credit cards can significantly lower credit scores, whereas BNPL debt may offer short-term financing without increasing revolving credit utilization, influencing borrowing behavior differently.

BNPL Stacking

Buy Now Pay Later (BNPL) stacking significantly increases consumer borrowing risks by allowing multiple overlapping installment plans that can lead to unmanageable debt, unlike traditional credit card debt which consolidates borrowing under a single credit limit. Research shows BNPL users are more likely to accumulate unpaid balances across several providers, escalating default rates and highlighting the need for clearer regulations and consumer protections.

Debt Snowball Method

The Debt Snowball Method prioritizes paying off smaller credit card debts first to build momentum, which can be more effective for consumer borrowing compared to Buy Now Pay Later (BNPL) debt that often lacks structured repayment plans. Credit card debt typically carries higher interest rates and impacts credit scores more significantly, making it crucial to eliminate before addressing BNPL liabilities.

Ghost Debt (BNPL invisibility on credit reports)

Buy Now Pay Later (BNPL) debt often remains invisible on credit reports, creating "ghost debt" that can mislead lenders and consumers about actual borrowing levels, unlike credit card debt which is consistently reported and impacts credit scores. This lack of transparency in BNPL borrowing risks increased consumer over-indebtedness and financial strain due to untracked spending accumulation.

Installment Credit Fatigue

Credit card debt and Buy Now Pay Later (BNPL) debt both contribute to installment credit fatigue, but BNPL often results in shorter repayment terms with multiple overlapping installments that can overwhelm consumers more quickly. High usage of BNPL services alongside existing credit card balances increases the risk of missed payments and credit score deterioration due to cumulative installment obligations.

Soft Pull Approval (for BNPL)

Buy Now Pay Later (BNPL) services use soft pull credit checks, allowing consumers to access short-term financing without impacting their credit scores, unlike traditional credit card debt that typically involves hard inquiries during approval. This soft pull approval process reduces barriers for consumers, promoting easier borrowing while managing the risk of accumulating high-interest credit card balances.

Trended Data Reporting

Trended data reporting reveals that credit card debt typically exhibits higher average balances and interest rates compared to Buy Now Pay Later (BNPL) debt, which often features shorter repayment terms and lower or zero interest. This detailed longitudinal analysis allows lenders and consumers to better assess repayment behavior, risk profiles, and borrowing trends between revolving credit and installment-based BNPL options.

Micro-Installment Overlap

Credit card debt typically involves revolving credit with higher interest rates and minimum monthly payments, whereas Buy Now Pay Later (BNPL) debt offers fixed micro-installments that overlap with traditional credit obligations, potentially increasing total monthly outflows. This micro-installment overlap can strain consumers' cash flow management by reducing flexibility and complicating debt repayment priorities across multiple borrowing platforms.

Fee-Triggered Acceleration (Late fees triggering higher BNPL interest)

Credit card debt typically accrues interest based on the outstanding balance with predictable late fees, while Buy Now Pay Later (BNPL) debt often includes fee-triggered acceleration, where missing a payment can rapidly increase interest rates and escalate total debt. This acceleration mechanism in BNPL agreements significantly raises borrowing costs, highlighting the importance of timely repayments to avoid costly fee-triggered interest hikes.

Credit card debt vs Buy Now Pay Later debt for consumer borrowing Infographic

moneydiff.com

moneydiff.com