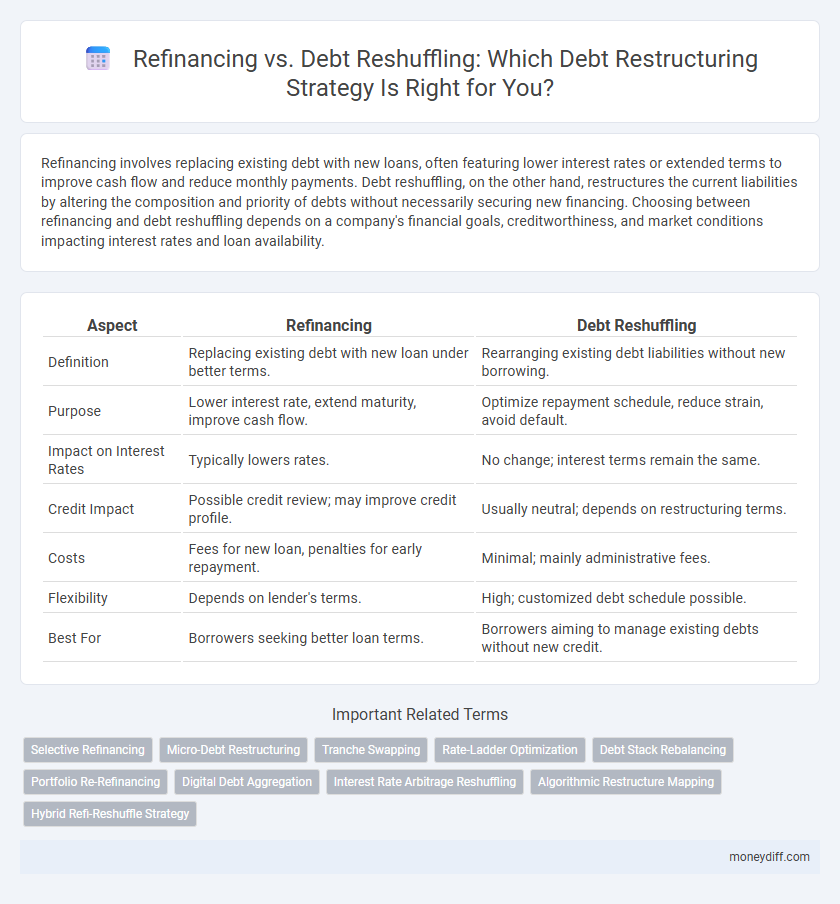

Refinancing involves replacing existing debt with new loans, often featuring lower interest rates or extended terms to improve cash flow and reduce monthly payments. Debt reshuffling, on the other hand, restructures the current liabilities by altering the composition and priority of debts without necessarily securing new financing. Choosing between refinancing and debt reshuffling depends on a company's financial goals, creditworthiness, and market conditions impacting interest rates and loan availability.

Table of Comparison

| Aspect | Refinancing | Debt Reshuffling |

|---|---|---|

| Definition | Replacing existing debt with new loan under better terms. | Rearranging existing debt liabilities without new borrowing. |

| Purpose | Lower interest rate, extend maturity, improve cash flow. | Optimize repayment schedule, reduce strain, avoid default. |

| Impact on Interest Rates | Typically lowers rates. | No change; interest terms remain the same. |

| Credit Impact | Possible credit review; may improve credit profile. | Usually neutral; depends on restructuring terms. |

| Costs | Fees for new loan, penalties for early repayment. | Minimal; mainly administrative fees. |

| Flexibility | Depends on lender's terms. | High; customized debt schedule possible. |

| Best For | Borrowers seeking better loan terms. | Borrowers aiming to manage existing debts without new credit. |

Understanding Debt Restructuring: Refinancing vs. Debt Reshuffling

Debt restructuring involves optimizing financial obligations to improve cash flow and reduce liabilities, with refinancing and debt reshuffling serving as key strategies. Refinancing replaces existing debt with new loans, often at lower interest rates or extended terms, enhancing repayment conditions and interest expenses. Debt reshuffling reorganizes current debt by altering payment priorities or terms without acquiring new funds, aiming to improve liquidity and debt management flexibility.

Key Differences Between Refinancing and Debt Reshuffling

Refinancing involves replacing existing debt with new debt under different terms, often to secure lower interest rates or extend the repayment period, whereas debt reshuffling restructures current debt by altering payment arrangements without necessarily introducing new loans. Refinancing typically aims to optimize financial costs and improve cash flow, while debt reshuffling focuses on managing debt maturity schedules and easing short-term liquidity pressures. Key differences include the involvement of new capital in refinancing versus internal rearrangement in debt reshuffling, and their distinct impacts on credit ratings and financial statements.

When Should You Choose Refinancing Over Debt Reshuffling?

Refinancing should be chosen over debt reshuffling when the goal is to secure lower interest rates, extend loan tenure, or improve cash flow by replacing existing loans with new debt under better terms. It is ideal for borrowers aiming to consolidate multiple high-interest obligations into a single, more manageable loan with consistent repayment schedules. Refinancing offers a strategic advantage for long-term financial stability, unlike debt reshuffling, which is more suited for short-term liquidity adjustments without changing the underlying loan structure.

Pros and Cons of Refinancing Debt

Refinancing debt offers the advantage of securing lower interest rates, which reduces overall borrowing costs and improves cash flow management. It also extends the loan term, providing immediate relief from high monthly payments but potentially increasing total interest paid over time. However, refinancing often involves fees and strict qualification requirements, which can limit access and create additional upfront expenses.

Advantages and Disadvantages of Debt Reshuffling

Debt reshuffling involves reorganizing existing debt by negotiating new terms, often prioritizing flexibility and improved cash flow management, which can help avoid default and maintain creditworthiness. However, it may lead to higher total interest costs over time and can damage lender relationships if perceived as a sign of financial distress. Unlike refinancing, debt reshuffling typically does not introduce new capital but reshapes the debt structure to better align with the borrower's current financial capacity.

Impact on Credit Score: Refinancing vs. Debt Reshuffling

Refinancing typically leads to a temporary dip in credit score due to hard inquiries and new account openings but may improve credit utilization and payment history over time, boosting the score. Debt reshuffling often involves consolidating or moving balances without new credit inquiries, which can have a neutral or slightly positive impact if payments remain timely and overall credit utilization decreases. Both strategies affect credit scores differently based on payment behavior, credit utilization ratios, and the presence of new credit accounts.

Costs Involved in Refinancing and Debt Reshuffling

Refinancing typically involves costs such as loan origination fees, prepayment penalties, appraisal costs, and legal fees, which can significantly impact the overall savings from obtaining a lower interest rate. Debt reshuffling incurs expenses related to negotiating new terms with creditors, possible restructuring fees, and administrative costs, often making it more time-consuming but sometimes less costly upfront than refinancing. Evaluating these costs in relation to potential benefits is crucial for determining the most cost-effective debt restructuring strategy.

Eligibility Criteria for Refinancing and Debt Reshuffling

Refinancing eligibility primarily depends on the borrower's creditworthiness, existing loan terms, and current interest rates, with lenders assessing debt-to-income ratios and collateral value to approve new loan terms. Debt reshuffling requires creditors' consent and is typically available to borrowers facing cash flow challenges who need extended repayment periods without necessarily altering the interest rate. Both options demand thorough financial analysis, but refinancing favors those aiming to reduce interest costs, while reshuffling suits borrowers focused on improving payment flexibility.

Long-Term Financial Implications of Each Approach

Refinancing typically involves replacing existing debt with new loans that often offer lower interest rates or extended maturities, reducing immediate financial pressure while potentially increasing total interest paid over the long term. Debt reshuffling, on the other hand, restructures existing obligations by altering payment schedules or consolidating debts, which can improve cash flow without necessarily changing overall interest costs, but may affect credit ratings. Both approaches impact long-term financial health differently, with refinancing focusing on cost optimization and debt reshuffling prioritizing liquidity management and credit profile adjustments.

Making the Right Decision: Refinancing or Debt Reshuffling for Better Money Management

Choosing between refinancing and debt reshuffling hinges on the specific financial landscape and goals of the borrower. Refinancing involves replacing an existing loan with a new one, often at a lower interest rate or extended terms, improving monthly cash flow and reducing total interest costs. Debt reshuffling reallocates existing debts to optimize payment schedules without acquiring new loans, enhancing liquidity and managing debt burdens more effectively.

Related Important Terms

Selective Refinancing

Selective refinancing targets high-interest or short-term debts to optimize cash flow and reduce overall borrowing costs, enhancing financial stability while preserving existing credit lines. In contrast, debt reshuffling redistributes liabilities without necessarily lowering interest rates, potentially improving payment schedules but not directly reducing debt servicing expenses.

Micro-Debt Restructuring

Micro-debt restructuring through refinancing involves replacing existing high-interest microloans with new loans at lower rates, reducing repayment burdens and improving cash flow for small borrowers. Debt reshuffling reorganizes outstanding microloans into more manageable terms by extending maturities or consolidating debts without necessarily changing loan providers, offering immediate relief without additional funding.

Tranche Swapping

Tranche swapping, a key technique in debt restructuring, involves exchanging existing debt tranches for new ones with different terms to optimize cash flow and debt maturity profiles. Refinancing typically replaces old debt with new loans under better conditions, while debt reshuffling through tranche swapping restructures the original debt framework without acquiring additional financing.

Rate-Ladder Optimization

Refinancing involves replacing existing debt with new loans at lower interest rates or better terms, whereas debt reshuffling reallocates current debt obligations without necessarily changing the total amount owed. Rate-Ladder Optimization maximizes financial efficiency by strategically sequencing debt maturities and interest rates, reducing overall borrowing costs and enhancing cash flow flexibility.

Debt Stack Rebalancing

Debt stack rebalancing through refinancing involves replacing existing high-cost debt with new, lower-interest liabilities to optimize capital structure and reduce borrowing costs. Debt reshuffling restructures the current debt portfolio by reprioritizing payment schedules and reallocating credit lines to improve cash flow management without incurring new debt.

Portfolio Re-Refinancing

Portfolio re-refinancing involves replacing existing debt with new loans to achieve better interest rates or extended maturities, improving overall cash flow management. Debt reshuffling, in contrast, restructures the existing debt terms without securing new financing, aiming to optimize repayment schedules and reduce immediate financial strain.

Digital Debt Aggregation

Digital debt aggregation streamlines the analysis of multiple liabilities, enabling precise comparison between refinancing and debt reshuffling strategies for optimized restructuring. Leveraging real-time data analytics, digital platforms enhance decision-making by identifying cost-efficient options, improved cash flow management, and tailored repayment terms.

Interest Rate Arbitrage Reshuffling

Refinancing leverages lower interest rates to replace existing debt with new obligations, reducing overall borrowing costs through interest rate arbitrage. Debt reshuffling restructures current liabilities by adjusting payment schedules or consolidating loans, optimizing cash flow without necessarily changing the interest rate environment.

Algorithmic Restructure Mapping

Algorithmic Restructure Mapping leverages advanced data analytics and machine learning to optimize refinancing and debt reshuffling strategies by analyzing cash flow patterns, interest rates, and maturity timelines, ensuring tailored restructuring solutions. This approach enhances decision accuracy in restructuring by simulating various repayment scenarios, minimizing costs, and improving credit profiles through precise allocation of debt instruments.

Hybrid Refi-Reshuffle Strategy

A hybrid refi-reshuffle strategy combines refinancing existing debt with debt reshuffling to optimize cash flow and reduce interest expenses while extending maturities for improved liquidity management. This approach leverages lower interest rates from refinancing alongside the reallocation of debt terms, offering greater flexibility and tailored restructuring for enhanced financial stability.

Refinancing vs Debt reshuffling for restructuring. Infographic

moneydiff.com

moneydiff.com