Mortgage debt typically requires borrowers to take on full responsibility for repayment, often resulting in higher monthly payments and interest costs. Shared equity mortgage debt allows homebuyers to reduce their initial loan amount by sharing ownership with an investor or lender, which can lower monthly payments and increase affordability. This option can make homeownership more accessible but may involve profit-sharing or equity repayment upon sale.

Table of Comparison

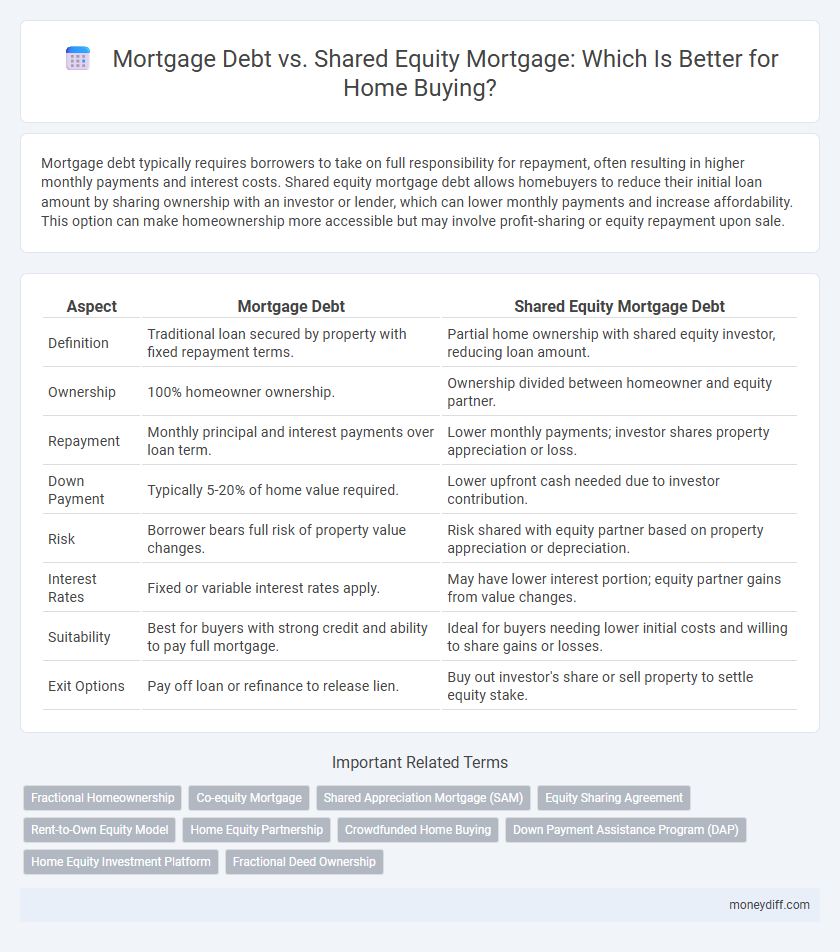

| Aspect | Mortgage Debt | Shared Equity Mortgage Debt |

|---|---|---|

| Definition | Traditional loan secured by property with fixed repayment terms. | Partial home ownership with shared equity investor, reducing loan amount. |

| Ownership | 100% homeowner ownership. | Ownership divided between homeowner and equity partner. |

| Repayment | Monthly principal and interest payments over loan term. | Lower monthly payments; investor shares property appreciation or loss. |

| Down Payment | Typically 5-20% of home value required. | Lower upfront cash needed due to investor contribution. |

| Risk | Borrower bears full risk of property value changes. | Risk shared with equity partner based on property appreciation or depreciation. |

| Interest Rates | Fixed or variable interest rates apply. | May have lower interest portion; equity partner gains from value changes. |

| Suitability | Best for buyers with strong credit and ability to pay full mortgage. | Ideal for buyers needing lower initial costs and willing to share gains or losses. |

| Exit Options | Pay off loan or refinance to release lien. | Buy out investor's share or sell property to settle equity stake. |

Understanding Traditional Mortgage Debt

Traditional mortgage debt involves borrowing a fixed amount from a lender to purchase a home, requiring regular principal and interest payments over a set term, typically 15 to 30 years. This form of debt builds home equity as the borrower repays the loan, with interest rates that can be fixed or variable, affecting monthly payment stability. Understanding traditional mortgage debt is crucial for homeowners to manage long-term financial commitments and plan for equity growth versus shared equity mortgage debt, which involves partial home ownership with a third party.

What Is Shared Equity Mortgage Debt?

Shared equity mortgage debt involves a financing arrangement where a lender or investor provides funds for a home purchase in exchange for a percentage of the property's future appreciation or ownership stake, reducing the borrower's initial loan burden. Unlike traditional mortgage debt, which requires full repayment with interest, shared equity mortgages align the lender's returns with the property's market performance, potentially lowering monthly payments and upfront costs for buyers. This model is particularly beneficial in high-cost housing markets, allowing buyers to access homeownership with less debt and mitigating the risk of negative equity.

Key Differences Between Mortgage and Shared Equity Mortgages

Mortgage debt typically involves borrowing a fixed amount with scheduled repayments and full ownership of the property upon completion, while shared equity mortgage debt requires partnering with an investor or entity that holds a stake in the property in exchange for reduced initial borrowing. Traditional mortgages often have fixed or variable interest rates solely borne by the borrower, whereas shared equity arrangements share both the appreciation and depreciation risks between the homeowner and the equity partner. This shared risk model can lower entry barriers for homebuyers but may reduce long-term financial gains compared to standard mortgage debt.

Eligibility Criteria for Mortgage vs Shared Equity Options

Mortgage debt eligibility typically requires a stable income, a satisfactory credit score above 620, and a debt-to-income ratio below 43%, ensuring borrowers can meet monthly payments independently. Shared equity mortgage debt often targets first-time homebuyers or low-to-moderate income earners with more flexible credit requirements and may require participation in income verification and residency conditions, as investors share ownership equity. Lenders evaluate risk differently, making traditional mortgages accessible through stringent financial criteria, while shared equity options provide an alternative pathway by sharing appreciation potential and upfront costs.

Interest Rates and Repayment Terms Compared

Mortgage debt typically involves higher interest rates compared to shared equity mortgage debt, where investors share both risks and rewards, often resulting in lower initial borrowing costs. Repayment terms for traditional mortgages include fixed or variable schedules over 15 to 30 years, whereas shared equity arrangements may require partial repayment upon home sale or refinancing, providing greater flexibility. These differences significantly impact overall financial planning and homeownership affordability.

Impact on Homeownership and Equity Growth

Mortgage debt influences homeownership by requiring regular principal and interest payments, which can build equity over time as the property's value appreciates. Shared equity mortgage debt involves partnering with an investor who shares the property's appreciation and depreciation, reducing initial borrowing costs but limiting full equity growth. This arrangement impacts long-term wealth accumulation differently, as traditional mortgages offer greater potential for sole ownership benefits, while shared equity models provide lower entry barriers with shared financial risks.

Financial Risks and Benefits of Each Option

Mortgage debt typically involves borrowing a fixed sum with regular repayments and interest, offering predictable costs but exposing homeowners to full repayment risks and potential foreclosure during financial hardship. Shared equity mortgage debt allows lenders or investors to share ownership and risk, reducing monthly payments and upfront costs, but may result in higher overall costs as the lender shares in property appreciation. Understanding these financial risks and benefits helps buyers choose between stable repayment commitments and flexible equity-sharing arrangements based on their financial stability and long-term goals.

Long-Term Costs: Mortgage vs Shared Equity Mortgages

Mortgage debt typically involves fixed or variable interest rates, leading to predictable monthly payments and long-term financial commitments that can significantly increase the total cost of homeownership over decades. Shared equity mortgage debt, by contrast, requires sharing a percentage of future home appreciation with the equity partner, which can reduce initial monthly costs but potentially increases total long-term expenses if the property's value rises substantially. Homebuyers must weigh the certainty of fixed debt repayments against the variable costs tied to market performance in shared equity agreements to optimize overall long-term financial outcomes.

Suitability for First-Time Homebuyers

Mortgage debt typically requires substantial down payments and carries fixed or variable interest rates, which may challenge first-time homebuyers with limited savings or income stability. Shared equity mortgage debt reduces initial financial burdens by allowing lenders or investors to share ownership equity, making homeownership more accessible and affordable for first-time buyers. This option aligns well with first-time homebuyers seeking lower upfront costs and flexible repayment terms while entering the housing market.

Making the Right Choice: Mortgage or Shared Equity?

Choosing between traditional mortgage debt and shared equity mortgage debt hinges on factors such as upfront costs, long-term financial obligations, and ownership control. Mortgage debt entails fixed monthly payments with full equity accumulation, while shared equity involves partnering with investors who share ownership and potential appreciation or depreciation, reducing initial payments but affecting future profits. Evaluating income stability, market volatility, and personal financial goals is essential to determine which financing option aligns best with your home buying strategy.

Related Important Terms

Fractional Homeownership

Mortgage debt typically requires full loan repayment over time, whereas shared equity mortgage debt involves partnering with investors who own a fractional share of the property, reducing the borrower's initial financial burden. Fractional homeownership through shared equity arrangements allows buyers to access homeownership with lower upfront costs while sharing future property appreciation or depreciation with equity partners.

Co-equity Mortgage

Co-equity mortgage debt combines traditional mortgage financing with shared equity arrangements, allowing homebuyers to reduce their initial loan amount by partnering with an investor who shares in the property's future appreciation. This approach lowers monthly payments compared to conventional mortgage debt, while offering an alternative path to homeownership and risk sharing in real estate investments.

Shared Appreciation Mortgage (SAM)

Shared Appreciation Mortgage (SAM) allows homebuyers to reduce upfront borrowing costs by sharing future home value appreciation with the lender, contrasting with traditional mortgage debt that requires fixed repayments and full interest on the principal. SAM offers a flexible alternative for managing mortgage debt, particularly in markets with rising property values, by aligning lender returns with the home's appreciation rather than fixed interest rates.

Equity Sharing Agreement

Mortgage debt typically involves borrowing a fixed amount to purchase a home, with the borrower responsible for full repayment plus interest, while shared equity mortgage debt under an Equity Sharing Agreement allows a buyer and investor to jointly own the property, sharing both the equity appreciation and financial risks. Equity Sharing Agreements reduce the initial financial burden on the buyer by lowering upfront mortgage requirements and enabling access to homeownership with less capital, while investors benefit from potential market gains without direct involvement in property management.

Rent-to-Own Equity Model

Mortgage debt typically involves traditional loans requiring full repayment with interest, whereas shared equity mortgage debt, particularly in the Rent-to-Own Equity Model, allows buyers to build equity gradually through rent payments that contribute to homeownership. This model reduces upfront financial barriers and spreads equity acquisition over time, making home buying more accessible and potentially lowering default risk compared to conventional mortgage debt.

Home Equity Partnership

Mortgage debt typically requires full repayment with interest, whereas Shared Equity Mortgage Debt through a Home Equity Partnership allows homeowners to share future property appreciation with investors in exchange for reduced upfront costs. This model reduces monthly payments and lowers the barrier to homeownership, making it an attractive alternative for buyers seeking to manage debt while building equity.

Crowdfunded Home Buying

Mortgage debt typically involves traditional loans with fixed repayment schedules, while shared equity mortgage debt in crowdfunded home buying allows multiple investors to share ownership and risk. Crowdfunded approaches reduce individual borrower debt burden by distributing equity stakes, enhancing affordability and access to homeownership in competitive markets.

Down Payment Assistance Program (DAP)

Mortgage debt typically requires a significant down payment, which can be a barrier for many homebuyers, while Shared Equity Mortgage Debt, facilitated by Down Payment Assistance Programs (DAP), reduces initial cash outlay by allowing shared ownership between the buyer and assistance provider. DAP enables increased home affordability by providing partial funding for the down payment, thus lowering the mortgage principal and monthly payments compared to traditional mortgage debt.

Home Equity Investment Platform

Mortgage debt typically involves borrowing a fixed amount with regular payments and interest, while shared equity mortgage debt through a Home Equity Investment Platform allows homeowners to access funds by sharing future property appreciation without monthly loan payments. This innovative platform reduces borrower risk and increases affordability by tying repayment to the home's market performance rather than traditional amortization schedules.

Fractional Deed Ownership

Mortgage debt involves borrowing a fixed amount to purchase a home, while shared equity mortgage debt, often linked to fractional deed ownership, allows buyers to co-own property by sharing both equity and risk with investors. Fractional deed ownership reduces individual financial burden and offers a flexible path to homeownership by splitting property rights and potential appreciation among multiple stakeholders.

Mortgage debt vs Shared equity mortgage debt for home buying Infographic

moneydiff.com

moneydiff.com