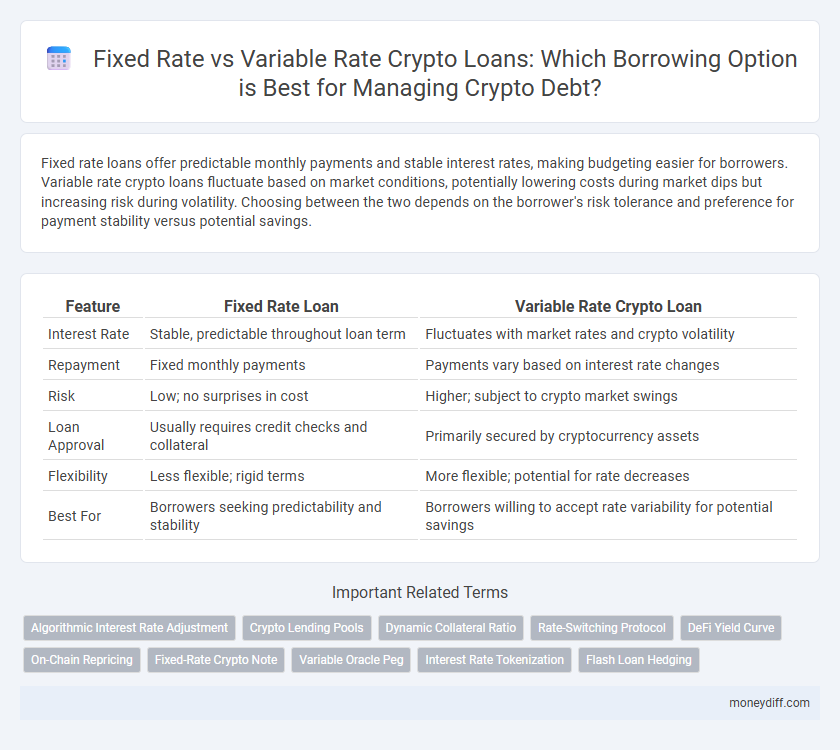

Fixed rate loans offer predictable monthly payments and stable interest rates, making budgeting easier for borrowers. Variable rate crypto loans fluctuate based on market conditions, potentially lowering costs during market dips but increasing risk during volatility. Choosing between the two depends on the borrower's risk tolerance and preference for payment stability versus potential savings.

Table of Comparison

| Feature | Fixed Rate Loan | Variable Rate Crypto Loan |

|---|---|---|

| Interest Rate | Stable, predictable throughout loan term | Fluctuates with market rates and crypto volatility |

| Repayment | Fixed monthly payments | Payments vary based on interest rate changes |

| Risk | Low; no surprises in cost | Higher; subject to crypto market swings |

| Loan Approval | Usually requires credit checks and collateral | Primarily secured by cryptocurrency assets |

| Flexibility | Less flexible; rigid terms | More flexible; potential for rate decreases |

| Best For | Borrowers seeking predictability and stability | Borrowers willing to accept rate variability for potential savings |

Understanding Fixed Rate Loans in Crypto Lending

Fixed rate loans in crypto lending provide borrowers with a guaranteed interest rate throughout the loan term, ensuring predictable repayment amounts regardless of market volatility. This stability helps manage financial planning by eliminating the risk of interest rate fluctuations typical in variable rate loans. Fixed rate crypto loans are particularly advantageous in volatile cryptocurrency markets where sudden price changes can impact borrowing costs.

What Are Variable Rate Crypto Loans?

Variable rate crypto loans are borrowing options where the interest rate fluctuates based on market conditions or underlying asset values, often tied to cryptocurrency price volatility. These loans offer flexibility and potential cost savings when rates decrease, but carry the risk of higher payments if rates rise, contrasting fixed rate loans that maintain a constant interest charge over the loan term. Variable rate crypto loans are popular in decentralized finance (DeFi) platforms, leveraging blockchain technology to provide transparent and dynamic loan agreements.

Key Differences Between Fixed and Variable Rate Crypto Loans

Fixed rate crypto loans offer predictable monthly payments with a set interest rate throughout the loan term, providing stability and risk management. Variable rate crypto loans feature interest rates that fluctuate based on market conditions or benchmark rates, which can lead to lower initial rates but increased payment uncertainty. Key differences include payment consistency, risk exposure to market volatility, and potential cost variations over the loan duration.

Pros and Cons of Fixed Rate Crypto Loans

Fixed rate crypto loans provide borrowers with predictable monthly payments and shield them from market volatility, ensuring budget stability over the loan term. These loans often come with higher interest rates compared to variable rate options, potentially increasing overall borrowing costs if market rates decrease. Access to fixed rate loans can be limited, and early repayment may incur penalties, reducing flexibility for borrowers seeking to refinance or pay off debt quickly.

Pros and Cons of Variable Rate Crypto Loans

Variable rate crypto loans offer borrowers lower initial interest rates compared to fixed rate loans, enabling cost savings when market rates decline. However, the fluctuating interest can lead to unpredictable monthly payments and increased financial risk if rates rise sharply. Borrowers benefit from flexibility and potential savings but must be prepared for volatility and possible higher overall costs over the loan term.

Risk Factors: Fixed vs Variable Rate Borrowing

Fixed rate loans offer predictable monthly payments and protection against interest rate volatility, reducing the risk of unexpected cost increases during the loan term. Variable rate crypto loans expose borrowers to market fluctuations and interest rate spikes, potentially leading to higher repayment amounts if crypto asset prices or base rates rise. Assessing risk tolerance and market conditions is crucial when choosing between the stability of fixed rates and the potential cost variability of variable rate borrowing.

Interest Rate Fluctuations and Borrower Impact

Fixed-rate loans offer predictable interest payments, shielding borrowers from market volatility and ensuring consistent budgeting. Variable-rate crypto loans expose borrowers to fluctuating interest rates, which can increase borrowing costs significantly during market spikes or decrease costs during dips. This volatility affects financial planning and risk management, making fixed-rate loans preferable for stability, while variable-rate loans may benefit borrowers seeking lower initial rates or willing to accept market risk.

Choosing the Right Crypto Loan for Your Needs

Fixed rate loans provide predictable monthly payments and protect borrowers from market volatility, making them suitable for those who prioritize budgeting stability in the crypto lending space. Variable rate crypto loans offer lower initial interest rates but come with fluctuating payments tied to market conditions, appealing to borrowers willing to take on risk for potential cost savings. Evaluating your risk tolerance, repayment timeline, and market outlook is essential when choosing between fixed and variable rate crypto loans to ensure alignment with your financial goals.

Cost Comparison: Fixed vs Variable Rate Crypto Loans

Fixed rate crypto loans provide predictable monthly payments and shield borrowers from market volatility, often resulting in higher initial interest rates compared to variable rate loans. Variable rate crypto loans offer potentially lower costs at the outset but expose borrowers to fluctuating interest expenses linked to crypto market conditions and underlying benchmark rates. Borrowers prioritizing budgeting security may favor fixed rates, while those comfortable with risk might benefit from variable rates when market trends lean toward lower interest rates, affecting overall loan cost.

Real-World Scenarios: When to Choose Fixed or Variable Rate Loans

Fixed rate loans provide predictable monthly payments, ideal for borrowers seeking stability during periods of market volatility or rising interest rates. Variable rate crypto loans offer lower initial rates, benefiting users comfortable with risk and expecting interest rates to decrease or remain stable. Real-world scenarios favor fixed rates for budgeting security in long-term borrowing, while variable rates suit short-term loans or speculative investments in fluctuating crypto markets.

Related Important Terms

Algorithmic Interest Rate Adjustment

Fixed rate loans offer borrowers predictable payments by locking in a stable interest rate throughout the loan term, eliminating exposure to market fluctuations. In contrast, variable rate crypto loans utilize algorithmic interest rate adjustment mechanisms that dynamically alter rates based on supply, demand, and market volatility, potentially lowering costs in stable markets but increasing risk during periods of high crypto price instability.

Crypto Lending Pools

Fixed rate loans in crypto lending pools offer predictable repayment terms and protection against market volatility, making them ideal for borrowers seeking stability in debt management. Variable rate crypto loans provide flexibility and potentially lower interest costs, but expose borrowers to fluctuating rates tied to market conditions within decentralized lending platforms.

Dynamic Collateral Ratio

Fixed rate loans offer predictable repayment terms but often require a higher dynamic collateral ratio to mitigate lender risk during market volatility. Variable rate crypto loans adjust interest based on market conditions, allowing a lower initial collateral ratio but increased exposure to margin calls if crypto asset values fluctuate sharply.

Rate-Switching Protocol

Rate-switching protocols in crypto loans enable borrowers to dynamically switch between fixed and variable interest rates, providing flexibility to manage debt costs amid market volatility. This feature leverages smart contracts to optimize repayment strategies, minimizing interest expenses by aligning loan rates with real-time blockchain interest rate trends.

DeFi Yield Curve

Fixed rate loans in DeFi provide predictable repayment terms by locking in interest rates, reducing exposure to market volatility, while variable rate crypto loans adjust rates based on supply-demand dynamics reflected in the DeFi yield curve, offering potentially lower costs during favorable market conditions but higher risk during rate spikes. Understanding the DeFi yield curve's influence on loan rates enables borrowers to optimize debt strategies by balancing stability and cost efficiency in decentralized finance ecosystems.

On-Chain Repricing

Fixed rate loans provide borrowers with predictable repayment amounts, protecting against interest rate fluctuations, while variable rate crypto loans enable on-chain repricing to reflect real-time market conditions and potentially lower borrowing costs. On-chain repricing leverages blockchain transparency and smart contract automation, allowing dynamic adjustment of interest rates based on market demand and collateral value volatility.

Fixed-Rate Crypto Note

Fixed-rate crypto loans offer borrowers predictable monthly payments and protection from market volatility, locking in interest rates that remain constant throughout the loan term. Unlike variable rate crypto loans, fixed-rate crypto notes provide stability and certainty, making them an ideal option for managing long-term debt in the fluctuating cryptocurrency market.

Variable Oracle Peg

Variable rate crypto loans leveraging a Variable Oracle Peg offer dynamic interest rates that adjust based on real-time market data, reducing the risk of overpaying during low volatility periods compared to fixed rate loans. This oracle-driven mechanism ensures borrowers benefit from transparent, decentralized price feeds, resulting in potentially lower borrowing costs and increased flexibility in volatile crypto markets.

Interest Rate Tokenization

Fixed rate loans offer predictable repayment schedules through locked interest rates, while variable rate crypto loans utilize blockchain-based interest rate tokenization to enable dynamic rate adjustments and transparent market-driven pricing. Interest rate tokenization in crypto loans allows borrowers to trade or hedge exposure, enhancing liquidity and risk management compared to traditional fixed rate borrowing options.

Flash Loan Hedging

Fixed rate loans offer predictable repayment terms with stable interest rates, ideal for mitigating market volatility in crypto borrowing. Variable rate crypto loans, combined with flash loan hedging, enable borrowers to quickly capitalize on short-term arbitrage and reduce exposure to sudden interest rate spikes in decentralized finance ecosystems.

Fixed Rate Loan vs Variable Rate Crypto Loan for borrowing options. Infographic

moneydiff.com

moneydiff.com