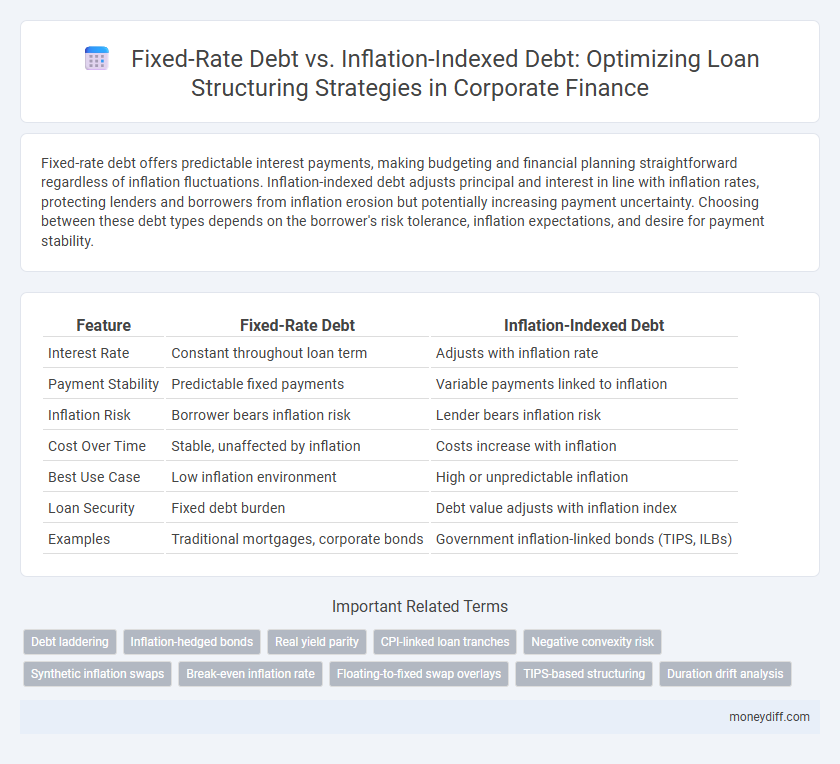

Fixed-rate debt offers predictable interest payments, making budgeting and financial planning straightforward regardless of inflation fluctuations. Inflation-indexed debt adjusts principal and interest in line with inflation rates, protecting lenders and borrowers from inflation erosion but potentially increasing payment uncertainty. Choosing between these debt types depends on the borrower's risk tolerance, inflation expectations, and desire for payment stability.

Table of Comparison

| Feature | Fixed-Rate Debt | Inflation-Indexed Debt |

|---|---|---|

| Interest Rate | Constant throughout loan term | Adjusts with inflation rate |

| Payment Stability | Predictable fixed payments | Variable payments linked to inflation |

| Inflation Risk | Borrower bears inflation risk | Lender bears inflation risk |

| Cost Over Time | Stable, unaffected by inflation | Costs increase with inflation |

| Best Use Case | Low inflation environment | High or unpredictable inflation |

| Loan Security | Fixed debt burden | Debt value adjusts with inflation index |

| Examples | Traditional mortgages, corporate bonds | Government inflation-linked bonds (TIPS, ILBs) |

Understanding Fixed-Rate Debt: Key Characteristics

Fixed-rate debt features an interest rate that remains constant throughout the loan term, providing predictable payment amounts and ease of budgeting for borrowers. This type of debt shields borrowers from interest rate volatility but can become costly if inflation rises significantly. Fixed-rate loans are preferred in stable economic conditions or when interest rates are low and expected to increase.

Inflation-Indexed Debt: Definition and Features

Inflation-indexed debt is a type of loan where the principal and interest payments are adjusted based on an inflation index, such as the Consumer Price Index (CPI), to protect lenders and investors from the eroding effects of inflation. This debt structure ensures that the real value of repayments remains stable over time, making it particularly attractive for long-term borrowing in inflationary environments. Governments and corporations use inflation-indexed debt to secure funding while minimizing inflation risk, providing a predictable real return to investors.

Interest Rate Risk: Fixed vs Inflation-Indexed Debt

Fixed-rate debt offers predictable interest payments, insulating borrowers from rising interest rate fluctuations but exposing them to inflation risk that can erode real returns. Inflation-indexed debt adjusts principal and interest payments based on inflation metrics, protecting investors from inflation but introducing variability in payment amounts that complicate cash flow planning. Choosing between fixed-rate and inflation-indexed debt depends on the borrower's risk tolerance for interest rate volatility versus inflation uncertainty in loan structuring.

Impact of Economic Inflation on Loan Repayment

Fixed-rate debt maintains a consistent interest rate throughout the loan term, resulting in predictable repayment amounts regardless of economic inflation, which can erode the real value of repayments over time. Inflation-indexed debt adjusts principal and interest based on inflation indices, preserving the lender's real returns and placing repayment risk on the borrower as inflation rises. Selecting between fixed-rate and inflation-indexed debt significantly impacts loan structuring strategies, with inflation-indexed options providing protection against inflation-induced repayment value erosion.

Cash Flow Predictability: Comparing Both Options

Fixed-rate debt offers consistent cash flow payments, providing borrowers with predictable budgeting regardless of inflation fluctuations. Inflation-indexed debt adjusts payments based on inflation rates, protecting lenders from purchasing power erosion but introducing variability in borrower cash flow obligations. Structuring loans requires balancing the certainty of fixed-rate repayments against the inflation protection and payment variability inherent in inflation-indexed debt.

Suitability for Borrowers: Fixed-Rate vs Inflation-Indexed Loans

Fixed-rate debt offers borrowers predictable repayment amounts, shielding them from inflation fluctuations and providing budgeting certainty. Inflation-indexed debt adjusts principal and interest payments based on inflation rates, making it suitable for borrowers expecting rising inflation or seeking to preserve real debt value. Choosing between fixed-rate and inflation-indexed loans depends on the borrower's risk tolerance and inflation outlook, impacting long-term financial stability and cost management.

Long-Term Cost Implications for Loan Structuring

Fixed-rate debt provides predictable long-term interest payments, shielding borrowers from inflation volatility but potentially resulting in higher real costs if inflation rises significantly. Inflation-indexed debt adjusts interest payments based on inflation rates, offering protection against inflation eroding loan value but introducing variability in debt servicing costs. Evaluating long-term cost implications requires balancing the certainty of fixed expenses with the inflation risk coverage of indexed debt to optimize loan structuring strategies.

Hedging Strategies with Fixed and Inflation-Linked Debt

Fixed-rate debt offers predictable interest payments, making it a reliable tool for hedging against interest rate volatility but leaves borrowers exposed to inflation risk. Inflation-indexed debt adjusts principal and interest payments based on inflation metrics, providing a natural hedge against rising inflation but may have higher initial costs. Combining fixed-rate and inflation-linked debt allows loan structurers to balance interest rate stability with inflation protection, optimizing risk management in volatile economic environments.

Market Conditions Influencing Debt Type Selection

Fixed-rate debt offers predictability in payments regardless of inflation fluctuations, making it preferable in stable or low-inflation environments. Inflation-indexed debt adjusts principal and interest according to inflation rates, providing protection against rising inflation but potentially higher costs in low-inflation scenarios. Market conditions such as expected inflation trends, central bank policies, and interest rate volatility heavily influence the choice between fixed-rate and inflation-indexed debt in loan structuring.

Best Practices for Structuring Loans Amid Inflation Uncertainty

Fixed-rate debt provides predictability in repayment amounts, safeguarding borrowers from rising inflation but potentially becoming costly if inflation falls. Inflation-indexed debt adjusts principal and interest payments based on inflation rates, protecting lenders and borrowers against inflation risk but introducing payment variability. Best practices for loan structuring amid inflation uncertainty include balancing fixed-rate and inflation-indexed components to optimize risk management and cash flow stability.

Related Important Terms

Debt laddering

Fixed-rate debt provides predictable interest payments, allowing precise debt laddering to manage cash flows and refinancing risks, while inflation-indexed debt adjusts principal and interest with inflation, protecting real value but complicating cash flow forecasting. Combining both types in a debt ladder optimizes risk diversification and shields against inflationary pressures without sacrificing payment stability.

Inflation-hedged bonds

Inflation-hedged bonds, a form of inflation-indexed debt, provide protection against rising inflation by adjusting principal and interest payments according to inflation rates, ensuring real returns remain stable over time. Fixed-rate debt offers predictable payments but exposes borrowers to inflation risk, making inflation-hedged bonds a strategic choice for long-term loan structuring in inflationary environments.

Real yield parity

Fixed-rate debt offers predictable nominal payments, but its real yield varies inversely with inflation, exposing borrowers to inflation risk, whereas inflation-indexed debt maintains real yield parity by adjusting principal and interest payments based on inflation rates, protecting both lenders and borrowers from purchasing power erosion. Loan structuring with inflation-indexed debt ensures real cost stability over time, making it preferable in environments with high or uncertain inflation expectations.

CPI-linked loan tranches

Fixed-rate debt offers predictable repayments, shielding lenders from inflation risks but potentially burdening borrowers when inflation rises, while inflation-indexed debt, specifically CPI-linked loan tranches, adjusts principal and interest with consumer price index movements, aligning debt service with inflation and preserving purchasing power. CPI-linked loan tranches are particularly advantageous in volatile inflation environments, as they provide a natural hedge against inflation erosion and stabilize real debt costs over the loan term.

Negative convexity risk

Fixed-rate debt exposes borrowers to negative convexity risk as rising interest rates can increase the cost of refinancing or reduce the value of the debt, leading to potential financial losses. Inflation-indexed debt mitigates negative convexity by adjusting principal and interest payments with inflation, providing a hedge against inflation risk and stabilizing real debt service costs.

Synthetic inflation swaps

Synthetic inflation swaps enable precise management of inflation risk by converting fixed-rate debt exposure into inflation-indexed debt, enhancing loan structuring flexibility. This approach reduces uncertainty in cash flows linked to inflation by effectively hedging real interest rate fluctuations without altering the underlying fixed-rate loan terms.

Break-even inflation rate

Fixed-rate debt provides predictability in payments but risks real value erosion if inflation exceeds expectations, whereas inflation-indexed debt adjusts principal based on inflation, protecting lenders but often at higher nominal costs. The break-even inflation rate, the inflation threshold where fixed-rate and inflation-indexed debt yield equal returns, serves as a critical metric for optimal loan structuring decisions.

Floating-to-fixed swap overlays

Floating-to-fixed swap overlays help manage interest rate risk by converting variable-rate debt into fixed-rate obligations, enhancing predictability in loan repayments during volatile markets. Inflation-indexed debt, combined with these swaps, offers protection against inflation-driven increases in cash flow requirements while maintaining cost stability compared to conventional fixed-rate debt.

TIPS-based structuring

Fixed-rate debt provides predictable loan payments unaffected by inflation, ensuring stable cash flow, while inflation-indexed debt, such as TIPS-based structuring, adjusts principal and interest with CPI changes, protecting against inflation risk. TIPS-based debt structures offer investors real yield preservation and borrowers inflation risk mitigation, making them optimal for environments with uncertain inflation expectations.

Duration drift analysis

Fixed-rate debt maintains a constant interest rate over the loan term, resulting in stable but potentially mismatched cash flows during inflation fluctuations, causing duration drift that may increase interest rate risk. Inflation-indexed debt adjusts principal and interest payments based on inflation metrics like CPI, minimizing duration drift by aligning cash flow timing and real value, thereby stabilizing the loan's interest rate sensitivity over time.

Fixed-rate debt vs Inflation-indexed debt for loan structuring Infographic

moneydiff.com

moneydiff.com