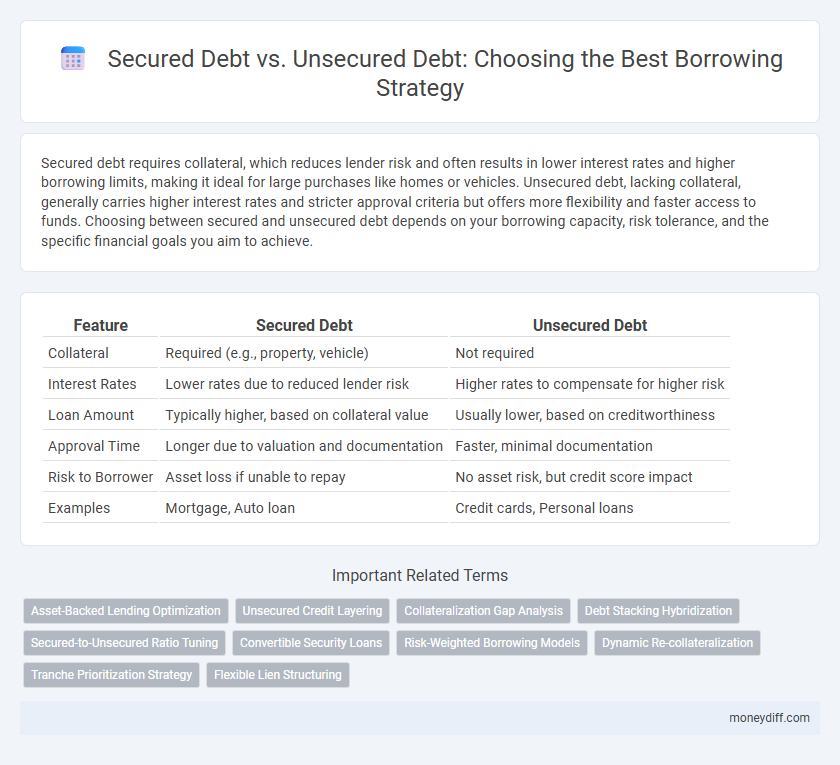

Secured debt requires collateral, which reduces lender risk and often results in lower interest rates and higher borrowing limits, making it ideal for large purchases like homes or vehicles. Unsecured debt, lacking collateral, generally carries higher interest rates and stricter approval criteria but offers more flexibility and faster access to funds. Choosing between secured and unsecured debt depends on your borrowing capacity, risk tolerance, and the specific financial goals you aim to achieve.

Table of Comparison

| Feature | Secured Debt | Unsecured Debt |

|---|---|---|

| Collateral | Required (e.g., property, vehicle) | Not required |

| Interest Rates | Lower rates due to reduced lender risk | Higher rates to compensate for higher risk |

| Loan Amount | Typically higher, based on collateral value | Usually lower, based on creditworthiness |

| Approval Time | Longer due to valuation and documentation | Faster, minimal documentation |

| Risk to Borrower | Asset loss if unable to repay | No asset risk, but credit score impact |

| Examples | Mortgage, Auto loan | Credit cards, Personal loans |

Understanding Secured Debt: Definition and Examples

Secured debt is a type of borrowing backed by collateral, such as a home or vehicle, which the lender can claim if the borrower defaults. Common examples include mortgages, auto loans, and secured personal loans, where the asset reduces lending risk and often results in lower interest rates. Understanding secured debt is crucial for developing a borrowing strategy that balances risk, interest costs, and asset protection.

Unsecured Debt: Key Features and Common Types

Unsecured debt lacks collateral, making it riskier for lenders but more accessible for borrowers without assets to pledge. Common types of unsecured debt include credit cards, personal loans, and medical bills, each carrying higher interest rates due to increased lender risk. Choosing unsecured debt can offer flexibility but demands careful management to avoid higher financial costs and potential impact on credit scores.

Risk Factors: Secured vs Unsecured Borrowing

Secured debt carries lower risk for lenders due to the collateral backing, often resulting in lower interest rates for borrowers but poses the risk of asset loss if repayment fails. Unsecured debt has no collateral requirement, increasing lender risk and typically leading to higher interest rates, while borrowers retain assets but face stricter qualification criteria. Evaluating creditworthiness and potential asset exposure is crucial in choosing between secured and unsecured borrowing strategies.

Interest Rates Comparison: Which Is More Cost-Effective?

Secured debt typically offers lower interest rates due to collateral reducing lender risk, making it more cost-effective for borrowers with eligible assets. Unsecured debt carries higher interest rates, reflecting increased lender risk and accounting for the lack of collateral. Evaluating interest rate differentials alongside personal asset availability helps determine the optimal borrowing strategy between secured and unsecured debt.

Collateral Requirements in Secured Debt Explained

Secured debt requires collateral, such as property or assets, which reduces the lender's risk and often results in lower interest rates for the borrower. In contrast, unsecured debt does not involve collateral, leading to higher interest rates due to increased lender risk. Understanding collateral requirements in secured debt is crucial for borrowers aiming to optimize their borrowing strategy by potentially securing better terms and credit access.

Impact on Credit Score: Secured vs Unsecured Debt

Secured debt, backed by collateral, generally has a more favorable impact on credit scores due to lower default risk and potential for on-time payments to boost credit history. Unsecured debt, lacking collateral, carries higher risk and interest rates, making missed payments more damaging to credit scores. Borrowers should manage secured debt carefully to build credit, while cautious use of unsecured debt can prevent score deterioration.

Repayment Terms and Flexibility Compared

Secured debt typically offers lower interest rates and longer repayment terms due to collateral backing, providing more structured and predictable payment schedules. Unsecured debt generally comes with higher interest rates and shorter repayment periods, offering less flexibility but faster payoff opportunities. Borrowers seeking repayment adaptability may prefer secured debt for its negotiated terms, while those prioritizing speed might opt for unsecured options despite stricter conditions.

Consequences of Default: What Borrowers Need to Know

Defaulting on secured debt often results in the lender repossessing the collateral, such as a home or vehicle, leading to significant asset loss for the borrower. In contrast, default on unsecured debt, including credit cards or personal loans, can severely damage the borrower's credit score and lead to aggressive collection actions but does not involve collateral seizure. Understanding these consequences helps borrowers strategically manage risk and prioritize repayments to protect both financial assets and creditworthiness.

Optimal Borrowing Scenarios for Secured and Unsecured Debt

Optimal borrowing strategies distinguish secured debt, which leverages collateral to secure lower interest rates and higher loan amounts, from unsecured debt that offers flexibility without asset risk but at higher costs. Borrowers seeking large sums for assets like homes or vehicles benefit from secured debt, minimizing interest expenses and maximizing borrowing capacity. Conversely, unsecured debt suits short-term, smaller needs such as credit cards or personal loans, where speed and convenience outweigh the cost and risk of higher rates.

Choosing a Borrowing Strategy: Factors to Consider

Secured debt involves borrowing money backed by collateral, which typically offers lower interest rates and higher borrowing limits, making it suitable for long-term investments like mortgages or auto loans. Unsecured debt, without collateral requirements, generally carries higher interest rates and is often used for short-term needs or when collateral is unavailable, such as credit cards or personal loans. When choosing a borrowing strategy, factors to consider include interest rates, repayment terms, risk tolerance, and the borrower's asset availability to optimize financial outcomes.

Related Important Terms

Asset-Backed Lending Optimization

Secured debt leverages collateral such as property or equipment to reduce lender risk and often grants borrowers lower interest rates and higher credit limits, optimizing asset-backed lending strategies. Unsecured debt, lacking collateral, typically carries higher costs and stricter terms, making it less efficient for businesses aiming to maximize borrowing capacity while minimizing financing expenses.

Unsecured Credit Layering

Unsecured credit layering involves strategically combining multiple unsecured loans or credit lines to optimize borrowing capacity without risking collateral, enhancing financial flexibility while managing interest costs. This approach contrasts with secured debt, which uses assets as collateral, often leading to lower rates but higher risk of asset loss.

Collateralization Gap Analysis

Secured debt requires collateral, reducing lender risk and often resulting in lower interest rates, while unsecured debt lacks collateral, leading to higher borrowing costs. Collateralization gap analysis evaluates the difference between the loan value and the collateral's market value, guiding optimal borrowing strategies by balancing risk exposure and capital efficiency.

Debt Stacking Hybridization

Debt stacking hybridization optimizes borrowing strategy by combining secured debt, which offers lower interest rates due to collateral, with unsecured debt that provides greater flexibility but often at higher costs. Structuring repayments to prioritize high-interest unsecured debt while leveraging secured debt's lower rates enhances cash flow management and reduces overall borrowing expenses.

Secured-to-Unsecured Ratio Tuning

Optimizing borrowing strategy requires carefully adjusting the secured-to-unsecured debt ratio to balance risk and cost, where higher secured debt typically lowers interest rates but increases collateral risk. Maintaining a strategic ratio improves creditworthiness, enhances borrowing capacity, and minimizes overall financing expenses.

Convertible Security Loans

Convertible security loans blend the features of secured debt and equity, offering lenders collateral alongside the option to convert debt into equity, reducing risk and enhancing borrower appeal. This hybrid structure optimizes borrowing strategy by balancing asset protection with potential ownership upside, contrasting with traditional unsecured loans that lack collateral and carry higher interest rates.

Risk-Weighted Borrowing Models

Secured debt, backed by collateral, typically carries lower interest rates and reduced risk weights in borrowing models, making it a strategic choice for minimizing capital costs and enhancing creditworthiness. Unsecured debt, lacking asset backing, incurs higher risk weights and interest rates, demanding careful assessment within risk-weighted borrowing frameworks to balance financing needs against potential default exposure.

Dynamic Re-collateralization

Dynamic re-collateralization enhances secured debt by allowing borrowers to adjust collateral levels in response to market fluctuations, reducing default risk and optimizing borrowing capacity. Unsecured debt lacks this flexibility, increasing risk exposure and often resulting in higher interest rates due to the absence of asset-backed protection.

Tranche Prioritization Strategy

Secured debt holds priority in tranche structuring by offering lenders collateral rights, reducing risk and potentially lowering borrowing costs compared to unsecured debt, which lacks asset backing and ranks lower in repayment hierarchy. Implementing a tranche prioritization strategy enables optimal capital allocation by sequencing secured debt first to enhance creditworthiness, followed by unsecured debt to balance funding flexibility and risk exposure.

Flexible Lien Structuring

Secured debt offers flexible lien structuring that allows borrowers to prioritize collateral claims, optimizing borrowing capacity and reducing interest rates by leveraging specific assets. Unsecured debt lacks collateral, resulting in higher risk for lenders and increased costs for borrowers, limiting strategic flexibility in lien arrangements.

Secured debt vs unsecured debt for borrowing strategy. Infographic

moneydiff.com

moneydiff.com