Revolving debt allows borrowers to access a credit limit repeatedly, making it ideal for ongoing expenses and flexible repayment schedules. Installment debt involves fixed monthly payments over a set term, which helps in systematically reducing the principal and interest. Choosing between revolving and installment debt depends on financial goals, spending habits, and the need for predictable budgeting versus flexibility.

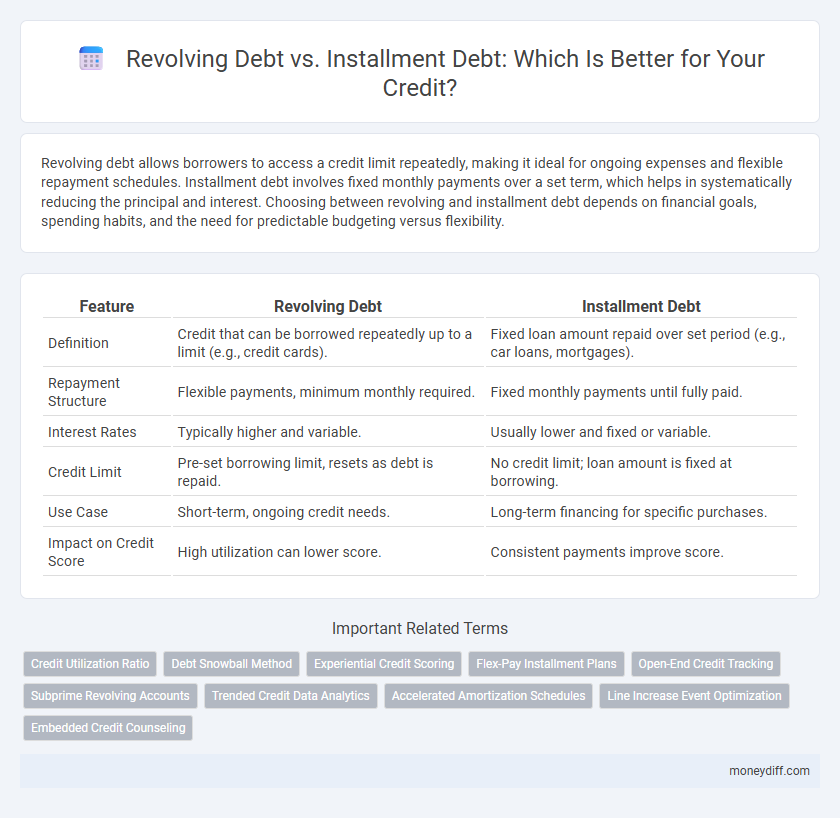

Table of Comparison

| Feature | Revolving Debt | Installment Debt |

|---|---|---|

| Definition | Credit that can be borrowed repeatedly up to a limit (e.g., credit cards). | Fixed loan amount repaid over set period (e.g., car loans, mortgages). |

| Repayment Structure | Flexible payments, minimum monthly required. | Fixed monthly payments until fully paid. |

| Interest Rates | Typically higher and variable. | Usually lower and fixed or variable. |

| Credit Limit | Pre-set borrowing limit, resets as debt is repaid. | No credit limit; loan amount is fixed at borrowing. |

| Use Case | Short-term, ongoing credit needs. | Long-term financing for specific purchases. |

| Impact on Credit Score | High utilization can lower score. | Consistent payments improve score. |

Understanding Revolving Debt and Installment Debt

Revolving debt allows borrowers to access credit up to a set limit with flexible repayments, commonly seen in credit cards where balances can vary monthly. Installment debt involves fixed payments over a specified term, typical of loans like mortgages or auto financing, providing predictable repayment schedules. Understanding these differences helps manage credit decisions and impacts credit scores based on payment consistency and utilization rates.

Key Differences Between Revolving and Installment Debt

Revolving debt, such as credit cards, allows borrowers to carry a balance with variable monthly payments and often fluctuating interest rates, providing flexibility in borrowing and repayment. Installment debt, including mortgages and auto loans, involves fixed payments over a set period with a predetermined interest rate, promoting predictable budgeting and consistent payoff schedules. Key differences lie in payment structure, interest variability, and term duration, which impact credit utilization and debt management strategies.

How Revolving Debt Impacts Your Credit Score

Revolving debt, such as credit card balances, directly affects credit utilization ratio, a key factor in credit score calculations, with higher utilization potentially lowering your score. Consistently high revolving debt indicates greater credit risk to lenders, impacting creditworthiness negatively. Responsible management of revolving accounts by maintaining low balances and timely payments supports a positive credit score trajectory.

The Effect of Installment Debt on Credit Reports

Installment debt typically has a positive effect on credit reports by demonstrating consistent payment history and lowering credit utilization ratios, which can boost credit scores. Unlike revolving debt, installment loans have fixed payments and a set payoff timeline, reducing the risk of accumulating high balances that negatively affect creditworthiness. Timely payments on installment debt signal financial responsibility to credit bureaus, leading to improved credit profiles over time.

Interest Rates: Revolving vs Installment Debt

Revolving debt typically carries higher interest rates compared to installment debt due to its flexible repayment terms and the increased risk for lenders. Installment debt, such as personal loans or auto loans, often offers lower interest rates because of fixed terms and predictable payment schedules. Understanding these differences helps borrowers manage credit costs and optimize repayment strategies.

Managing Payments: Revolving vs Installment Accounts

Managing payments on revolving debt involves variable monthly amounts based on outstanding balances, requiring careful monitoring to avoid high interest charges and potential credit score impacts. Installment debt features fixed payment schedules with consistent amounts over a set term, promoting predictable budgeting and steady credit improvement. Effective handling of both types supports overall credit health and reduces the risk of default or financial strain.

Pros and Cons of Revolving Debt for Credit Health

Revolving debt offers flexibility in repayment, allowing borrowers to carry a balance while making minimum payments, which can help build a positive credit history if managed responsibly. However, high interest rates and the temptation to overspend may lead to increased debt levels and negatively impact credit scores due to high credit utilization ratios. Consistently maintaining low balances and making timely payments on revolving debt is crucial for sustaining good credit health.

Advantages and Disadvantages of Installment Debt

Installment debt offers the advantage of predictable monthly payments, which simplifies budgeting and financial planning. It typically comes with lower interest rates compared to revolving debt, reducing overall borrowing costs and promoting disciplined repayment. However, installment debt lacks flexibility since borrowers must adhere to fixed payment schedules, and early repayment may sometimes incur penalties.

Strategies for Balancing Revolving and Installment Debt

Balancing revolving debt, such as credit card balances, with installment debt like auto loans requires strategic allocation of payments to minimize interest costs and maintain a healthy credit score. Prioritizing higher-interest revolving debts while consistently meeting installment loan payments prevents late fees and improves your debt-to-income ratio. Regularly monitoring credit utilization and adjusting payment amounts can optimize creditworthiness and support long-term financial stability.

Choosing the Right Debt Type for Better Money Management

Revolving debt, such as credit cards, offers flexible borrowing with variable payments and interest rates, ideal for managing ongoing expenses. Installment debt, including personal loans and mortgages, involves fixed payments over a set period, providing predictable monthly budgeting and long-term financial planning. Choosing the right debt type depends on your spending habits, repayment ability, and financial goals to optimize credit scores and maintain healthy money management.

Related Important Terms

Credit Utilization Ratio

Revolving debt, such as credit card balances, directly impacts the credit utilization ratio by fluctuating monthly and often representing a higher percentage of credit limits, thereby influencing credit scores more significantly. Installment debt, including mortgages or auto loans, does not affect credit utilization ratio since it involves fixed payments and does not revolve around available credit limits.

Debt Snowball Method

Revolving debt, such as credit card balances, allows flexible payments and can fluctuate based on usage, while installment debt involves fixed monthly payments for loans like mortgages or auto financing. The Debt Snowball Method targets paying off smaller installment debts first to build momentum, then applies freed-up funds to larger revolving debts, optimizing credit reduction and boosting credit scores.

Experiential Credit Scoring

Experiential credit scoring leverages transactional and behavioral data to differentiate revolving debt, which requires ongoing balance management, from installment debt characterized by fixed monthly payments. This nuanced analysis enhances predictive accuracy by assessing payment patterns and credit utilization, improving risk evaluation in credit decisioning.

Flex-Pay Installment Plans

Flex-Pay Installment Plans offer a structured repayment schedule with fixed monthly payments, making it easier to manage installment debt compared to revolving debt, which involves fluctuating balances and interest rates. These plans improve credit predictability and can lower overall interest costs by encouraging timely payments and reducing reliance on continuous borrowing.

Open-End Credit Tracking

Revolving debt allows borrowers to access credit repeatedly up to a set limit, with balances tracked as open-end credit, affecting credit utilization ratios and credit scores. Installment debt involves fixed payments over a set period, typically tracked as closed-end credit, impacting credit history differently by demonstrating consistent repayment behavior.

Subprime Revolving Accounts

Subprime revolving accounts often carry higher interest rates and variable balances, increasing financial risk compared to installment debt, which features fixed payments and set terms that help manage repayment predictability. Lenders assess subprime revolving debt carefully due to its impact on credit utilization ratios and potential for accumulating unpredictable, revolving balances.

Trended Credit Data Analytics

Revolving debt, such as credit card balances, fluctuates based on credit usage and impacts credit scores dynamically, while installment debt involves fixed monthly payments that demonstrate consistent repayment patterns. Trended Credit Data Analytics leverages longitudinal data on both debt types to provide lenders with deeper insights into borrower behavior and credit risk, improving predictive accuracy beyond traditional credit scoring models.

Accelerated Amortization Schedules

Revolving debt, such as credit cards, typically features flexible repayment amounts without a fixed amortization schedule, leading to potentially prolonged debt periods and increased interest costs. Installment debt, including personal loans or auto loans, employs accelerated amortization schedules with fixed monthly payments that systematically reduce principal and interest, enabling faster debt payoff and improved credit profiles.

Line Increase Event Optimization

Revolving debt, such as credit cards, offers flexible spending up to a credit limit with variable payments, enabling consumers to manage sudden expenses or optimize credit utilization during a Line Increase Event. Installment debt involves fixed monthly payments over a set term, making it less adaptable to credit line increases but providing predictable repayment schedules that can improve credit scores when managed properly.

Embedded Credit Counseling

Embedded credit counseling within revolving debt frameworks empowers borrowers to manage credit utilization effectively while mitigating the risk of accumulating high-interest balances. In contrast, installment debt typically incorporates structured payment plans with integrated counseling options, promoting disciplined repayment and enhancing overall credit health.

Revolving debt vs Installment debt for credit. Infographic

moneydiff.com

moneydiff.com