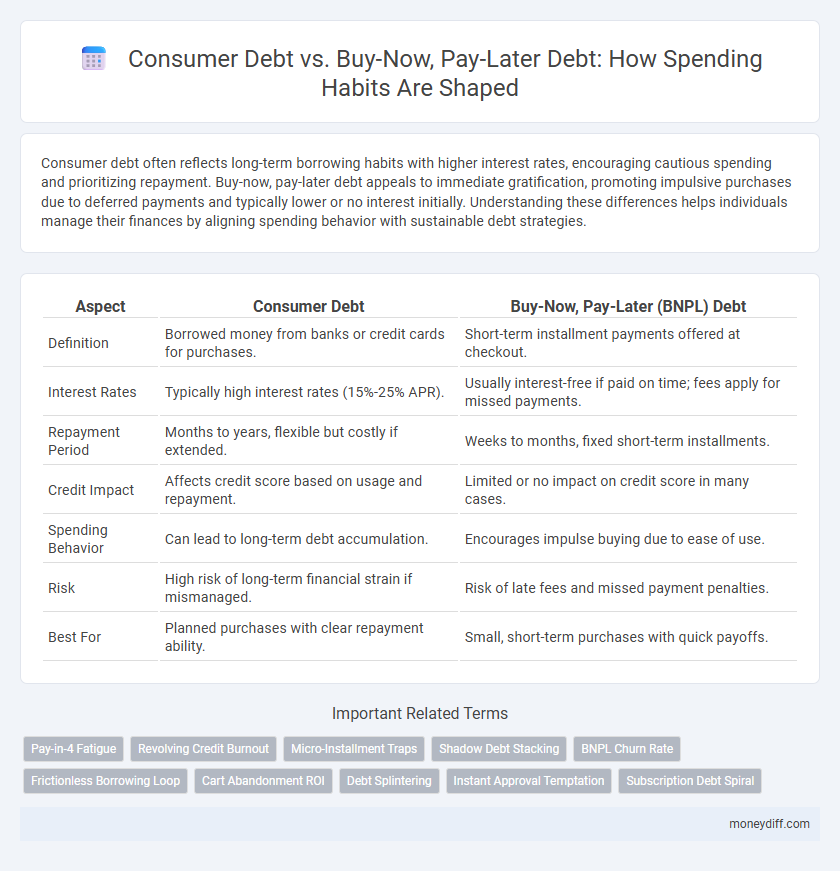

Consumer debt often reflects long-term borrowing habits with higher interest rates, encouraging cautious spending and prioritizing repayment. Buy-now, pay-later debt appeals to immediate gratification, promoting impulsive purchases due to deferred payments and typically lower or no interest initially. Understanding these differences helps individuals manage their finances by aligning spending behavior with sustainable debt strategies.

Table of Comparison

| Aspect | Consumer Debt | Buy-Now, Pay-Later (BNPL) Debt |

|---|---|---|

| Definition | Borrowed money from banks or credit cards for purchases. | Short-term installment payments offered at checkout. |

| Interest Rates | Typically high interest rates (15%-25% APR). | Usually interest-free if paid on time; fees apply for missed payments. |

| Repayment Period | Months to years, flexible but costly if extended. | Weeks to months, fixed short-term installments. |

| Credit Impact | Affects credit score based on usage and repayment. | Limited or no impact on credit score in many cases. |

| Spending Behavior | Can lead to long-term debt accumulation. | Encourages impulse buying due to ease of use. |

| Risk | High risk of long-term financial strain if mismanaged. | Risk of late fees and missed payment penalties. |

| Best For | Planned purchases with clear repayment ability. | Small, short-term purchases with quick payoffs. |

Understanding Consumer Debt and Buy-Now, Pay-Later Debt

Understanding consumer debt involves recognizing traditional credit card balances and personal loans, which often carry higher interest rates and impact long-term credit scores. Buy-Now, Pay-Later (BNPL) debt offers short-term, interest-free installment payments but can encourage overspending and lead to missed payments affecting creditworthiness. Analyzing spending habits reveals that BNPL services drive impulsive purchases, while consumer debt reflects more planned or necessity-driven borrowing.

Key Differences Between Consumer Debt and BNPL Debt

Consumer debt typically involves traditional credit forms such as credit cards and personal loans, which accrue interest over time and impact credit scores based on payment history. Buy-now, pay-later (BNPL) debt offers short-term installment plans without immediate interest, appealing to consumers seeking flexible payment options but often lacking stringent credit checks. The key difference lies in BNPL's emphasis on frictionless, interest-free purchases versus consumer debt's structured repayment schedules and long-term credit implications.

How Spending Habits Influence Debt Choices

Spending habits directly impact the preference between consumer debt and buy-now, pay-later (BNPL) options, with impulsive buyers often leaning towards BNPL due to its immediate gratification and deferred payments. Consumers with disciplined budgeting are more likely to use traditional consumer debt, such as credit cards or personal loans, to manage larger, planned expenses. The ease of BNPL services encourages increased spending frequency, leading to higher overall debt accumulation compared to conventional consumer credit methods.

Psychological Triggers: BNPL vs Traditional Credit

Buy-now, pay-later (BNPL) debt exploits psychological triggers like instant gratification and perceived affordability, encouraging impulsive spending by minimizing immediate financial impact. Traditional consumer debt, such as credit cards, often involves awareness of interest accumulation and debt limits, which can lead to more cautious spending behaviors. The streamlined approval process and simplified repayment structure of BNPL reduce friction, amplifying the tendency for overconsumption compared to traditional credit mechanisms.

The Hidden Costs of BNPL for Consumers

Buy-now, pay-later (BNPL) services often appear to offer interest-free short-term credit, but consumers face hidden costs such as late fees, increased impulsive spending, and potential damage to credit scores. Unlike traditional consumer debt, BNPL can encourage overspending due to minimal upfront payments and lack of clear interest rates, leading to accumulating balances that are difficult to track. These hidden financial burdens can ultimately worsen long-term financial health, undermining the perceived benefits of BNPL compared to conventional credit options.

Long-Term Financial Impact of Consumer Debt

Consumer debt typically carries higher interest rates and can accumulate rapidly, leading to long-term financial strain and hindered credit scores. Buy-now, pay-later debt often promotes impulsive spending, increasing the risk of missed payments and escalating unpaid balances over time. Both forms of debt, when mismanaged, contribute to prolonged repayment periods and diminished financial flexibility.

Debt Accumulation: Pitfalls of Easy Credit Access

Consumer debt typically accumulates through traditional credit cards and personal loans, often incurring high interest rates that compound over time. Buy-now, pay-later debt enables immediate purchases without upfront costs but risks rapid accumulation due to minimal initial payments and lack of stringent credit checks. Both forms of debt contribute to financial strain when spending habits prioritize short-term gratification over long-term fiscal responsibility.

Responsible Borrowing: Setting Spending Boundaries

Responsible borrowing requires setting clear spending boundaries to avoid the pitfalls of consumer debt and buy-now, pay-later debt. Consumers should evaluate their monthly income against outstanding balances to maintain manageable repayment schedules and prevent escalating interest charges. Establishing and adhering to a budget helps optimize credit utilization and fosters disciplined financial habits essential for long-term debt management.

Building Healthy Money Management Skills

Consumer debt often involves credit cards and personal loans with variable interest rates, encouraging disciplined budgeting and credit score awareness. Buy-now, pay-later debt offers short-term financing for immediate purchases but can promote impulsive spending without clear repayment plans. Developing healthy money management skills requires understanding the cost implications of each debt type and prioritizing timely payments to avoid financial strain.

Strategies to Avoid Debt Traps in Everyday Spending

Consumer debt often involves revolving credit with high interest rates, while buy-now, pay-later (BNPL) services offer short-term installment plans that can lead to overspending due to delayed payment awareness. To avoid debt traps, budgeting strategies such as tracking expenses, setting spending limits, and prioritizing full debt repayment before taking on new obligations are essential. Utilizing financial tools like automatic payments and credit monitoring can help maintain control over both consumer debt and BNPL commitments, promoting responsible spending habits.

Related Important Terms

Pay-in-4 Fatigue

Consumer debt typically involves revolving credit with interest, leading to long-term financial strain, whereas buy-now, pay-later (BNPL) debt like Pay-in-4 introduces short-term, interest-free installments that encourage impulsive spending. Pay-in-4 fatigue emerges as consumers face multiple overlapping BNPL payments, causing budgeting challenges and increasing the risk of missed payments and credit score declines.

Revolving Credit Burnout

Revolving credit burnout occurs when consumers relying heavily on credit cards for ongoing expenses accumulate excessive consumer debt, leading to increased financial stress and reduced credit limits. Buy-now, pay-later debt often exacerbates spending habits by encouraging impulse purchases without immediate payment, but its structured repayment plans can mitigate revolving credit burnout by preventing unchecked credit card usage.

Micro-Installment Traps

Consumer debt often accumulates through traditional credit cards and personal loans, whereas buy-now, pay-later (BNPL) debt leverages micro-installments that can disguise the total cost, increasing impulsive spending and financial strain. Micro-installment traps embedded in BNPL services obscure repayment timelines and fees, leading to underestimated debt burdens and a higher risk of default compared to conventional consumer credit.

Shadow Debt Stacking

Consumer debt typically accumulates through traditional credit cards and personal loans, often manifesting as clear monthly obligations, while buy-now, pay-later (BNPL) debt fragments purchases into smaller, seemingly manageable payments that contribute to shadow debt stacking. This hidden layering of BNPL commitments alongside existing consumer debt can obscure the total financial burden, leading to increased risk of overextension and difficulty in tracking true spending habits.

BNPL Churn Rate

Buy-Now, Pay-Later (BNPL) debt often exhibits a higher churn rate than traditional consumer debt due to shorter repayment terms and frequent usage for discretionary purchases, leading to recurring cycles of borrowing and repayment. This elevated BNPL churn influences spending habits by encouraging impulsive buying and reliance on revolving credit, which can strain personal finances and affect overall debt management strategies.

Frictionless Borrowing Loop

Consumer debt typically involves higher interest rates and long-term repayment plans, influencing cautious spending habits, while buy-now, pay-later (BNPL) debt offers frictionless borrowing with minimal upfront costs, encouraging impulsive purchases and frequent use. The frictionless borrowing loop in BNPL services reduces the psychological barrier to spending, often leading to increased overall consumer debt and potentially impaired financial discipline.

Cart Abandonment ROI

Consumer debt, including credit card balances, often carries higher interest rates and long-term financial risks compared to buy-now, pay-later (BNPL) options, which tend to encourage immediate purchases but can lead to overspending if unmanaged. BNPL services reduce cart abandonment rates by offering flexible payment plans, increasing conversion rates and improving return on investment (ROI) for retailers through enhanced customer acquisition and retention.

Debt Splintering

Debt splintering reveals how consumers divide expenses between traditional credit cards and buy-now, pay-later plans, often leading to fragmented repayments that complicate budgeting and increase the risk of missed payments. This fragmentation intensifies financial strain by dispersing obligations across multiple platforms, undermining overall debt management and increasing cumulative interest and penalty fees.

Instant Approval Temptation

Consumer debt often involves revolving credit with higher interest rates, promoting long-term financial obligations, while buy-now, pay-later (BNPL) debt offers instant approval, enticing consumers to make impulsive purchases without immediate financial consequences. The instant approval temptation of BNPL services can accelerate spending habits, leading to increased debt accumulation and potential credit difficulties.

Subscription Debt Spiral

Consumer debt often stems from credit cards and loans that accumulate interest over time, while buy-now, pay-later (BNPL) debt promotes immediate spending with deferred payments, frequently lacking interest but encouraging excessive purchases. Subscription debt spirals exacerbate financial strain as recurring charges from multiple services accumulate unnoticed, leading to higher overall debt burden and reduced financial flexibility.

Consumer debt vs buy-now, pay-later debt for spending habits. Infographic

moneydiff.com

moneydiff.com