Secured loans require collateral, offering lower interest rates and higher borrowing limits due to reduced lender risk, making them ideal for borrowers with valuable assets. Unsecured peer-to-peer lending relies on individual creditworthiness without asset backing, often featuring more flexible approval criteria but higher interest rates to offset increased lender risk. Choosing between secured loans and unsecured peer-to-peer lending depends on the borrower's asset availability, credit profile, and willingness to accept potential risks or costs.

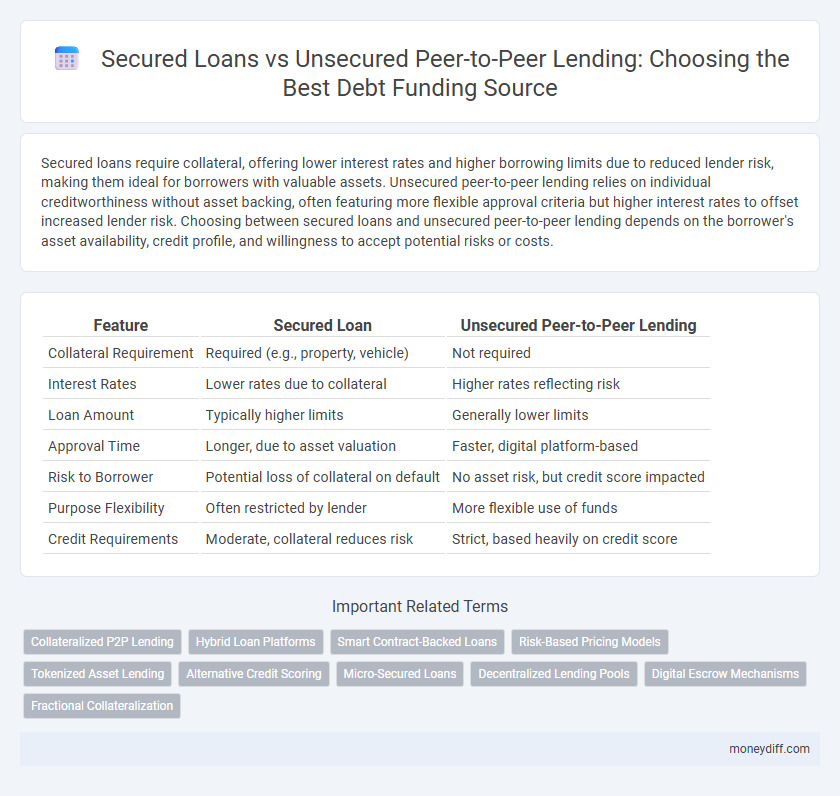

Table of Comparison

| Feature | Secured Loan | Unsecured Peer-to-Peer Lending |

|---|---|---|

| Collateral Requirement | Required (e.g., property, vehicle) | Not required |

| Interest Rates | Lower rates due to collateral | Higher rates reflecting risk |

| Loan Amount | Typically higher limits | Generally lower limits |

| Approval Time | Longer, due to asset valuation | Faster, digital platform-based |

| Risk to Borrower | Potential loss of collateral on default | No asset risk, but credit score impacted |

| Purpose Flexibility | Often restricted by lender | More flexible use of funds |

| Credit Requirements | Moderate, collateral reduces risk | Strict, based heavily on credit score |

Understanding Secured Loans: Key Features and Benefits

Secured loans require collateral, such as property or assets, which reduces risk for lenders and often results in lower interest rates for borrowers. These loans typically have higher borrowing limits and longer repayment terms compared to unsecured options, making them suitable for significant funding needs. The key benefit of secured loans is the increased approval likelihood due to collateral backing, offering borrowers access to larger amounts at competitive rates.

What Is Unsecured Peer-to-Peer Lending?

Unsecured peer-to-peer lending is a method of borrowing funds directly from individual investors through online platforms without requiring collateral, distinguishing it from secured loans that mandate assets as security. This type of lending typically involves higher interest rates due to increased risk for lenders, but it offers faster approval and greater accessibility for borrowers with limited credit history. The absence of asset-backed guarantees places emphasis on the borrower's creditworthiness and platform underwriting standards in evaluating loan eligibility.

Interest Rate Comparison: Secured vs P2P Loans

Secured loans typically offer lower interest rates due to collateral reducing lender risk, with average rates ranging from 4% to 8%. Unsecured peer-to-peer (P2P) loans have higher interest rates, often between 7% and 15%, reflecting increased risk for investors without asset backing. Borrowers seeking cost-effective funding usually find secured loans more affordable, while P2P loans provide easier access but at the expense of higher interest costs.

Eligibility Requirements: Secured Loans vs P2P Lending

Secured loans require borrowers to provide collateral such as property or assets, often leading to stricter eligibility criteria including higher credit scores and verified income. Peer-to-peer lending platforms generally have more flexible eligibility requirements, focusing primarily on creditworthiness and repayment history without the need for collateral. This accessibility makes P2P lending an attractive option for borrowers with limited assets or lower credit scores.

Risk Analysis: Asset Backing vs Trust-Based Lending

Secured loans involve asset backing, significantly reducing lender risk by providing collateral that can be seized if the borrower defaults, offering greater protection and typically lower interest rates. Unsecured peer-to-peer lending relies on trust and borrower creditworthiness without collateral, increasing the risk for lenders and often resulting in higher interest rates to compensate for potential defaults. Risk analysis shows secured loans prioritize tangible asset security, while unsecured peer-to-peer lending depends heavily on borrower reputation and platform credit assessment models.

Speed and Accessibility: Which Option Is Faster?

Secured loans typically require collateral and involve thorough credit checks, resulting in longer approval times but often lower interest rates. Unsecured peer-to-peer lending platforms offer faster access to funds by minimizing documentation and relying on online verification, making them more accessible for borrowers with varied credit profiles. For immediate funding needs, peer-to-peer lending generally provides quicker disbursement compared to traditional secured loans.

Loan Amounts and Flexibility: How Much Can You Borrow?

Secured loans typically offer higher loan amounts due to collateral backing, enabling borrowers to access substantial funds for significant expenses or investments. Unsecured peer-to-peer lending provides more flexible borrowing limits, often ranging from a few thousand to tens of thousands of dollars, catering to smaller, short-term financial needs without collateral requirements. Borrowers seeking large sums with asset security may favor secured loans, while those valuing speed and lower qualification barriers might choose unsecured P2P lending.

Impact on Credit Score: Secured Loans vs P2P Platforms

Secured loans typically have a more predictable impact on credit scores because they involve collateral, reducing lender risk and often resulting in lower interest rates and timely repayments that build positive credit history. Unsecured peer-to-peer (P2P) lending platforms may lead to higher interest rates and stricter repayment terms, with missed payments potentially causing significant damage to credit scores due to the lack of collateral. Both funding sources affect credit reports through payment history and credit utilization, but secured loans tend to be viewed more favorably by credit scoring models because of their secured nature.

Repayment Terms: Comparing Flexibility and Penalties

Secured loans typically offer lower interest rates with fixed repayment terms tied to collateral, providing predictable monthly payments but risking asset forfeiture upon default. Unsecured peer-to-peer lending features more flexible repayment schedules, often customizable to borrower needs, yet carries higher penalties and interest rates due to increased lender risk. Borrowers must weigh the strict collateral-backed obligations of secured loans against the adaptable but costlier terms of unsecured P2P loans when planning repayment strategies.

Choosing the Right Funding Source: Factors to Consider

Interest rates, collateral requirements, and creditworthiness significantly impact the decision between secured loans and unsecured peer-to-peer lending. Secured loans typically offer lower interest rates due to the backing of assets, while unsecured peer-to-peer loans provide faster approval but at higher rates and elevated risk. Assessing one's financial stability, repayment capacity, and asset availability ensures selecting the optimal funding source for debt management.

Related Important Terms

Collateralized P2P Lending

Collateralized peer-to-peer lending offers borrowers lower interest rates and higher borrowing limits compared to unsecured loans by requiring tangible assets as collateral, reducing lender risk. This form of secured P2P funding provides more flexible repayment terms and faster approval processes, making it an attractive alternative to traditional secured loans from banks.

Hybrid Loan Platforms

Hybrid loan platforms combine the benefits of secured loans and unsecured peer-to-peer lending by offering collateral-backed options with accessible, individualized funding terms through online marketplaces. These platforms enhance borrower security and lender trust, optimizing funding efficiency and risk management in alternative debt financing markets.

Smart Contract-Backed Loans

Smart contract-backed loans in peer-to-peer lending offer enhanced security and transparency by automating loan terms and collateral management without intermediaries, reducing default risk compared to traditional unsecured peer-to-peer loans. Secured loans typically involve tangible assets as collateral, but smart contracts enable decentralized enforcement, creating a more efficient and trustless system for both lenders and borrowers.

Risk-Based Pricing Models

Secured loans use collateral to minimize lender risk, leading to lower interest rates through risk-based pricing models that directly assess asset value. Unsecured peer-to-peer lending relies on borrower creditworthiness and risk scores, resulting in higher rates to compensate for absence of collateral and increased default risk.

Tokenized Asset Lending

Secured loans backed by tokenized assets offer lower interest rates and reduced default risk by leveraging blockchain-based collateral, whereas unsecured peer-to-peer lending relies on creditworthiness without physical or digital asset backing, resulting in higher risk and interest costs. Tokenized asset lending enhances transparency and liquidity in secured loan markets, providing investors with verifiable digital ownership and instant asset transferability compared to traditional unsecured peer-to-peer platforms.

Alternative Credit Scoring

Secured loans rely on collateral and traditional credit scoring models, while unsecured peer-to-peer lending increasingly utilizes alternative credit scoring methods, analyzing non-traditional data such as social media activity, payment history on utilities, and employment stability to assess borrower risk. This innovative approach allows lenders to evaluate creditworthiness beyond FICO scores, expanding access to funding for individuals with limited credit history.

Micro-Secured Loans

Micro-secured loans offer a lower interest rate and greater borrowing limits compared to unsecured peer-to-peer lending, thanks to collateral backing that reduces lender risk. These loans provide micro-entrepreneurs with faster access to capital, enhanced credit-building opportunities, and more flexible repayment terms aligned with business cash flow.

Decentralized Lending Pools

Decentralized lending pools in peer-to-peer lending offer unsecured loans by matching borrowers and lenders directly without traditional collateral requirements, leveraging blockchain technology for transparency and security. In contrast, secured loans require collateral, often limiting access but reducing lender risk, while decentralized lending pools democratize funding access by pooling collective liquidity and using smart contracts for automated loan management.

Digital Escrow Mechanisms

Digital escrow mechanisms enhance the security of unsecured peer-to-peer lending by holding funds until both parties fulfill the loan terms, reducing default risks without requiring collateral. In contrast, secured loans rely on tangible assets as collateral, providing lenders with direct recovery options but often involving more stringent approval processes and longer disbursal times.

Fractional Collateralization

Fractional collateralization in secured loans enhances borrower credibility by backing a portion of the loan with tangible assets, reducing lender risk and potentially securing lower interest rates. In contrast, unsecured peer-to-peer lending relies primarily on creditworthiness without collateral, increasing risk exposure and often resulting in higher interest rates due to the absence of asset-backed security.

Secured Loan vs Unsecured Peer-to-Peer Lending for funding sources. Infographic

moneydiff.com

moneydiff.com