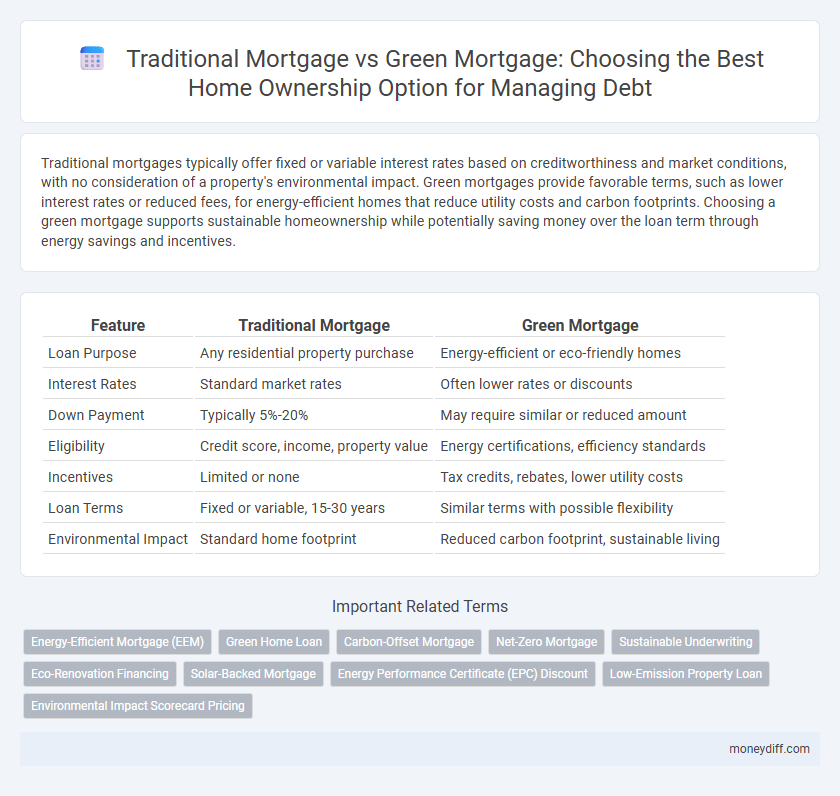

Traditional mortgages typically offer fixed or variable interest rates based on creditworthiness and market conditions, with no consideration of a property's environmental impact. Green mortgages provide favorable terms, such as lower interest rates or reduced fees, for energy-efficient homes that reduce utility costs and carbon footprints. Choosing a green mortgage supports sustainable homeownership while potentially saving money over the loan term through energy savings and incentives.

Table of Comparison

| Feature | Traditional Mortgage | Green Mortgage |

|---|---|---|

| Loan Purpose | Any residential property purchase | Energy-efficient or eco-friendly homes |

| Interest Rates | Standard market rates | Often lower rates or discounts |

| Down Payment | Typically 5%-20% | May require similar or reduced amount |

| Eligibility | Credit score, income, property value | Energy certifications, efficiency standards |

| Incentives | Limited or none | Tax credits, rebates, lower utility costs |

| Loan Terms | Fixed or variable, 15-30 years | Similar terms with possible flexibility |

| Environmental Impact | Standard home footprint | Reduced carbon footprint, sustainable living |

Understanding Traditional Mortgages: Key Features

Traditional mortgages typically involve fixed or adjustable interest rates with terms ranging from 15 to 30 years, requiring borrowers to have a standard credit score and steady income. These loans focus primarily on the borrower's financial history and property value without emphasizing energy efficiency or environmental impact. Repayment structures often include principal and interest payments, with potential for private mortgage insurance if the down payment is below 20%.

Introduction to Green Mortgages: What Sets Them Apart

Green mortgages offer homeowners lower interest rates and financial incentives by promoting energy-efficient, environmentally-friendly property improvements. Unlike traditional mortgages, green mortgages assess a home's sustainable features, such as solar panels or advanced insulation, as part of the loan approval process. This approach reduces overall debt costs while encouraging reduced carbon footprints and long-term savings on utility bills.

Qualifying Criteria: Traditional vs Green Mortgage

Traditional mortgage qualifying criteria primarily rely on credit score, income stability, and debt-to-income ratio, with less emphasis on property efficiency. Green mortgages require similar financial benchmarks but also mandate verification of a home's energy-efficient features or certification, such as Energy Star or LEED. Borrowers with homes demonstrating sustainable qualities may qualify for higher loan amounts or better interest rates under green mortgage programs.

Interest Rates Comparison: Which Mortgage Saves More?

Traditional mortgages typically offer fixed or variable interest rates that average around 3-5%, depending on market conditions and borrower creditworthiness. Green mortgages often provide lower interest rates or additional financial incentives to encourage energy-efficient home improvements, potentially reducing overall borrowing costs by 0.25% to 1% compared to traditional loans. Borrowers focused on long-term savings should analyze these rate differences alongside potential energy savings to determine which mortgage better supports affordable homeownership.

Upfront Costs and Long-Term Savings: A Financial Analysis

Traditional mortgages typically require higher upfront costs, including larger down payments and standard closing fees, which can strain initial finances. Green mortgages often feature incentives such as reduced interest rates or down payment assistance for energy-efficient homes, lowering initial expenses and encouraging sustainable investment. Over time, green mortgages can generate significant long-term savings through reduced utility bills and potential tax credits, offsetting any marginally higher costs compared to traditional loans.

Environmental Benefits: Green Mortgage Incentives

Green mortgages offer significant environmental benefits by providing lower interest rates and financial incentives for energy-efficient home improvements, encouraging sustainable building practices. Traditional mortgages typically lack these targeted incentives, resulting in fewer benefits tied to environmental performance. By prioritizing energy efficiency and reduced carbon footprints, green mortgages contribute to long-term environmental sustainability and help homeowners reduce utility costs.

Government Support and Tax Credits for Green Home Buyers

Green mortgages often come with government support and tax credits designed to encourage energy-efficient homeownership, reducing overall borrowing costs and increasing affordability. Traditional mortgages typically lack these specific incentives, making green loans more attractive for eco-conscious buyers seeking financial benefits tied to sustainable living. Tax credits and rebates tied to green home purchases can significantly offset initial costs, promoting widespread adoption of environmentally friendly housing.

Loan Repayment Terms: Flexibility and Risks

Traditional mortgages typically offer fixed or adjustable interest rate options with standard loan terms ranging from 15 to 30 years, providing predictable repayment schedules but limited flexibility in refinancing without penalties. Green mortgages often include incentives such as reduced interest rates or extended terms to encourage energy-efficient home purchases or upgrades, though these benefits may come with stricter qualification criteria and potentially higher risk if energy savings do not meet projections. Borrowers should evaluate how repayment flexibility, interest savings, and risk tolerance align with their long-term financial goals when choosing between traditional and green mortgage options.

Impact on Property Value and Marketability

Green mortgages often enhance property value by incentivizing energy-efficient upgrades and appealing to eco-conscious buyers, leading to faster sales and higher marketability. Traditional mortgages may not directly influence property value or attract niche markets interested in sustainability. Energy-efficient homes financed through green mortgages typically command premium prices and demonstrate greater long-term appreciation in the real estate market.

Choosing the Right Mortgage: Aligning with Your Financial Goals

Choosing the right mortgage involves evaluating traditional mortgages and green mortgages based on your financial goals and long-term savings potential. Traditional mortgages typically offer stable interest rates and predictable payments, while green mortgages provide incentives such as lower interest rates or rebates for energy-efficient home improvements, reducing overall debt burden. Prioritizing sustainable investments through green mortgages can enhance property value and lower utility costs, aligning debt management with eco-friendly financial planning.

Related Important Terms

Energy-Efficient Mortgage (EEM)

Energy-Efficient Mortgages (EEMs) enable homebuyers to finance energy-saving improvements within their mortgage, reducing utility costs and increasing property value compared to traditional mortgages. EEMs often offer lower interest rates or increased borrowing limits to incentivize investment in energy-efficient homes, making sustainable homeownership more affordable.

Green Home Loan

Green home loans offer lower interest rates and incentives for energy-efficient home improvements, reducing overall debt burden while promoting eco-friendly living. Traditional mortgages typically lack these benefits, resulting in higher long-term costs without supporting sustainability goals.

Carbon-Offset Mortgage

Traditional mortgages often have fixed or variable interest rates without incentives for energy efficiency, while green mortgages, particularly carbon-offset mortgages, provide borrowers with lower rates or rebates tied to a home's reduced carbon footprint, encouraging sustainable homeownership. Carbon-offset mortgages integrate environmental impact assessments into loan qualification, rewarding energy-efficient upgrades and renewable energy installations that decrease overall greenhouse gas emissions.

Net-Zero Mortgage

Traditional mortgages typically offer standard interest rates without incentives for energy efficiency, whereas Green mortgages, such as Net-Zero Mortgages, provide lower interest rates and financial benefits tied to purchasing or upgrading homes to achieve net-zero energy consumption. Net-Zero Mortgages promote sustainable homeownership by reducing long-term energy costs and supporting environmental goals through energy-efficient construction and renewable energy integration.

Sustainable Underwriting

Traditional mortgages assess borrower creditworthiness and property value using standard financial metrics, whereas green mortgages incorporate sustainable underwriting by evaluating energy efficiency, environmental impact, and potential utility savings, promoting eco-friendly home ownership. This sustainable underwriting approach may offer lower interest rates and incentives, reducing long-term costs and supporting environmentally responsible debt management.

Eco-Renovation Financing

Traditional mortgages typically offer standard interest rates without incentives for energy-efficient improvements, while green mortgages provide lower rates or additional funds specifically for eco-renovation financing, promoting sustainable homeownership. Eco-renovation financing through green mortgages supports homeowners in upgrading insulation, installing solar panels, and adopting energy-efficient systems, reducing long-term utility costs and increasing property value.

Solar-Backed Mortgage

Solar-backed mortgages integrate renewable energy incentives into traditional home financing, reducing overall debt by leveraging solar panel installation credits and energy savings. These green mortgages offer lower interest rates and increased home value, making them a financially viable alternative to conventional mortgages while promoting sustainable energy consumption.

Energy Performance Certificate (EPC) Discount

Green mortgages offer reduced interest rates linked to the home's Energy Performance Certificate (EPC) rating, incentivizing energy-efficient properties and lowering borrowing costs. Traditional mortgages lack EPC-based discounts, often resulting in higher long-term expenses due to inefficient energy use and missed opportunities for financial savings.

Low-Emission Property Loan

Low-Emission Property Loans, commonly known as Green Mortgages, offer reduced interest rates and incentives for financing energy-efficient homes compared to traditional mortgages. These loans promote sustainable home ownership by supporting properties with lower environmental impact and reduced carbon emissions.

Environmental Impact Scorecard Pricing

Traditional mortgages typically feature standard interest rates without incentives, often neglecting the borrower's environmental impact, while green mortgages incorporate Environmental Impact Scorecard Pricing, offering lower rates and financial benefits for energy-efficient homes. This scorecard evaluates property sustainability factors such as energy consumption, carbon footprint, and renewable energy integration, directly influencing loan affordability and promoting eco-friendly homeownership.

Traditional mortgage vs Green mortgage for home ownership. Infographic

moneydiff.com

moneydiff.com