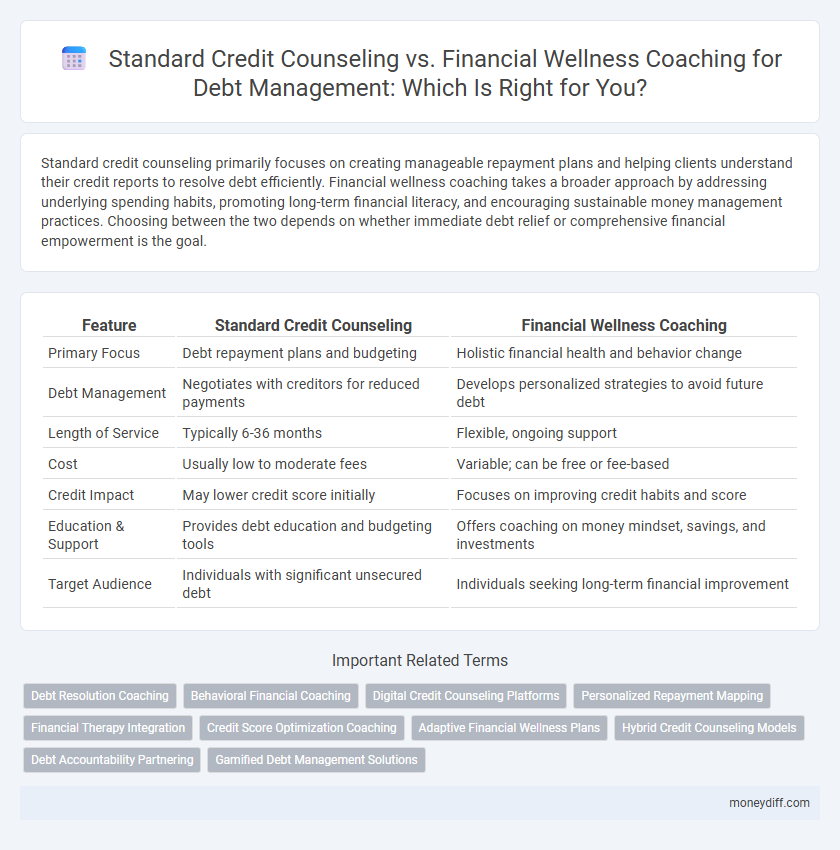

Standard credit counseling primarily focuses on creating manageable repayment plans and helping clients understand their credit reports to resolve debt efficiently. Financial wellness coaching takes a broader approach by addressing underlying spending habits, promoting long-term financial literacy, and encouraging sustainable money management practices. Choosing between the two depends on whether immediate debt relief or comprehensive financial empowerment is the goal.

Table of Comparison

| Feature | Standard Credit Counseling | Financial Wellness Coaching |

|---|---|---|

| Primary Focus | Debt repayment plans and budgeting | Holistic financial health and behavior change |

| Debt Management | Negotiates with creditors for reduced payments | Develops personalized strategies to avoid future debt |

| Length of Service | Typically 6-36 months | Flexible, ongoing support |

| Cost | Usually low to moderate fees | Variable; can be free or fee-based |

| Credit Impact | May lower credit score initially | Focuses on improving credit habits and score |

| Education & Support | Provides debt education and budgeting tools | Offers coaching on money mindset, savings, and investments |

| Target Audience | Individuals with significant unsecured debt | Individuals seeking long-term financial improvement |

Understanding Standard Credit Counseling

Standard credit counseling provides structured debt management plans tailored to individuals struggling with credit card debt and loan repayments, often involving negotiations with creditors to reduce interest rates and fees. Certified credit counselors analyze a client's financial situation, create realistic budgets, and offer guidance on improving credit scores while protecting against debt escalation. This approach emphasizes accountability and long-term financial stability through personalized counseling sessions and debt repayment strategies.

What is Financial Wellness Coaching?

Financial wellness coaching guides individuals through personalized strategies to improve financial health by addressing debt management, budgeting, and long-term financial goals. Unlike standard credit counseling, which primarily focuses on negotiating debt repayment plans and credit issues, financial wellness coaching emphasizes behavioral change and financial literacy to foster sustainable money habits. This approach supports overall financial empowerment, helping clients develop confidence in managing income, expenses, and debt reduction effectively.

Key Differences Between Credit Counseling and Financial Wellness Coaching

Standard credit counseling primarily focuses on creating debt management plans, negotiating with creditors, and providing education on credit repair techniques. Financial wellness coaching offers a broader approach by addressing overall financial habits, goal setting, budgeting, and long-term behavioral changes to improve financial health. Key differences include the scope of services, with credit counseling targeting immediate debt reduction and financial coaching emphasizing sustainable financial empowerment.

Approach to Debt Assessment and Planning

Standard credit counseling typically involves a structured evaluation of a client's debt, income, and expenses to develop a debt management plan aimed at repayment over time. Financial wellness coaching adopts a holistic approach, assessing not only debt but also overall financial behaviors, goals, and emotional factors to create a personalized roadmap for financial health. This coaching emphasizes sustainable habits and long-term financial stability beyond immediate debt resolution.

Educational Focus: Budgeting, Spending, and Saving

Standard credit counseling provides structured guidance on budgeting, spending, and saving by analyzing current debt and developing a personalized repayment plan, often emphasizing practical debt reduction strategies. Financial wellness coaching offers a broader educational focus that includes behavioral changes, long-term financial goal setting, and improving money management habits to promote sustainable financial health. Both approaches aim to enhance financial literacy but differ in scope, with credit counseling targeting immediate debt resolution and wellness coaching fostering ongoing financial empowerment.

Emotional and Behavioral Support in Debt Management

Standard credit counseling primarily offers structured debt repayment plans and financial education, focusing on practical steps to reduce debt. Financial wellness coaching provides personalized emotional and behavioral support, helping individuals develop healthier money habits and address underlying psychological factors related to debt. This holistic approach enhances long-term debt management by fostering motivation, resilience, and improved financial decision-making skills.

Accessibility and Cost Comparison

Standard credit counseling typically offers free or low-cost services funded by non-profit organizations, making it highly accessible for individuals seeking debt management assistance. Financial wellness coaching often involves personalized, ongoing sessions with fees that vary widely, potentially limiting accessibility due to higher costs. Comparing both, credit counseling provides immediate, affordable access to debt solutions, while financial coaching delivers tailored guidance at a greater financial investment.

Long-term Outcomes: Credit Counseling vs. Financial Wellness Coaching

Standard credit counseling primarily addresses immediate debt relief through budgeting and repayment plans, offering structured solutions to reduce outstanding balances. Financial wellness coaching emphasizes long-term behavioral changes by fostering financial literacy, goal setting, and personalized strategies to prevent future debt cycles. Studies show clients engaged in wellness coaching often achieve sustained financial stability and improved credit scores over time compared to those relying solely on credit counseling.

Choosing the Right Debt Management Solution

Standard credit counseling provides structured plans designed to reduce debt through negotiated payment arrangements with creditors, often suited for individuals facing significant financial distress. Financial wellness coaching emphasizes personalized budgeting, spending habits, and long-term financial education to build sustainable money management skills. Selecting the right debt management solution depends on immediate debt relief needs versus long-term financial behavior improvement, balancing debt reduction strategies with ongoing financial literacy.

Frequently Asked Questions on Debt Management Services

Standard credit counseling typically offers budget assessment, debt management plans, and creditor negotiations to help reduce debt efficiently. Financial wellness coaching emphasizes personalized strategies for long-term financial health, including spending habits, saving goals, and credit score improvement. Many clients ask how each service impacts debt repayment timelines and credit scores, with counseling focusing on immediate solutions and coaching promoting sustainable financial behavior.

Related Important Terms

Debt Resolution Coaching

Debt resolution coaching provides personalized strategies to negotiate with creditors, aiming to reduce overall debt balances and improve repayment terms, unlike standard credit counseling which primarily offers budgeting advice and credit education. Financial wellness coaching encompasses broader financial habits and long-term goals, but debt resolution coaching specifically targets actionable solutions to manage and resolve existing debt efficiently.

Behavioral Financial Coaching

Standard credit counseling typically emphasizes debt repayment plans and managing creditor payments, while financial wellness coaching, especially behavioral financial coaching, focuses on transforming spending habits and underlying money behaviors to foster long-term financial stability. Behavioral financial coaching integrates psychological insights and personalized strategies to help individuals build sustainable money management skills beyond immediate debt reduction.

Digital Credit Counseling Platforms

Digital credit counseling platforms provide structured debt management plans, focusing on negotiating with creditors and consolidating payments to reduce debt efficiently. Financial wellness coaching emphasizes personalized budgeting strategies and behavioral changes, leveraging digital tools to build long-term financial resilience beyond immediate debt reduction.

Personalized Repayment Mapping

Standard credit counseling provides structured debt management plans focusing on negotiating with creditors, while financial wellness coaching offers personalized repayment mapping tailored to individual financial goals and behaviors. This customized approach enhances debt reduction strategies by aligning repayment schedules with income patterns and spending habits, improving long-term financial stability.

Financial Therapy Integration

Standard credit counseling primarily addresses debt repayment strategies and budgeting, while financial wellness coaching integrates financial therapy to tackle emotional attitudes and behaviors related to money, promoting sustainable debt management. This holistic approach helps individuals develop healthier financial habits by combining practical guidance with psychological support.

Credit Score Optimization Coaching

Standard credit counseling typically focuses on creating debt management plans and negotiating with creditors to lower interest rates, while financial wellness coaching emphasizes Credit Score Optimization Coaching by guiding clients to improve credit utilization, payment history, and overall financial behavior. Credit Score Optimization Coaching helps individuals strategically build and maintain credit profiles, directly impacting creditworthiness and access to better lending options.

Adaptive Financial Wellness Plans

Standard credit counseling typically offers fixed debt repayment strategies focused on budgeting and creditor negotiations, while financial wellness coaching provides adaptive financial wellness plans tailored to individual spending habits, income changes, and long-term goals. Adaptive plans emphasize personalized guidance, ongoing adjustments, and holistic financial health improvement, making them more effective for sustainable debt management.

Hybrid Credit Counseling Models

Hybrid credit counseling models combine the structured guidance of standard credit counseling with the personalized strategies of financial wellness coaching, enhancing debt management effectiveness for clients. This integrated approach addresses both immediate debt reduction and long-term financial behavior change, improving credit scores and overall financial stability.

Debt Accountability Partnering

Standard credit counseling offers structured debt repayment plans and budget assessments, while financial wellness coaching emphasizes personalized strategies and behavioral changes for long-term financial health. Debt accountability partnering in financial wellness coaching fosters ongoing support and motivation, enhancing commitment to debt reduction goals more effectively than traditional credit counseling methods.

Gamified Debt Management Solutions

Standard credit counseling offers structured debt repayment plans and budgeting advice, while financial wellness coaching emphasizes personalized behavior change and goal-setting for long-term financial health; integrating gamified debt management solutions enhances user engagement and motivation through interactive challenges and rewards. These gamification strategies increase adherence to debt reduction plans and improve financial literacy by making the debt management process more engaging and accessible.

Standard credit counseling vs financial wellness coaching for debt management. Infographic

moneydiff.com

moneydiff.com