Traditional debt typically involves intermediaries such as banks or financial institutions that enforce strict credit requirements and prolonged approval processes. Decentralized finance (DeFi) debt leverages blockchain technology to enable peer-to-peer lending, offering greater accessibility, transparency, and faster transactions without the need for centralized approval. Borrowing platforms in DeFi reduce barriers by using smart contracts to automate loan execution and collateral management, minimizing reliance on credit scores and increasing user autonomy.

Table of Comparison

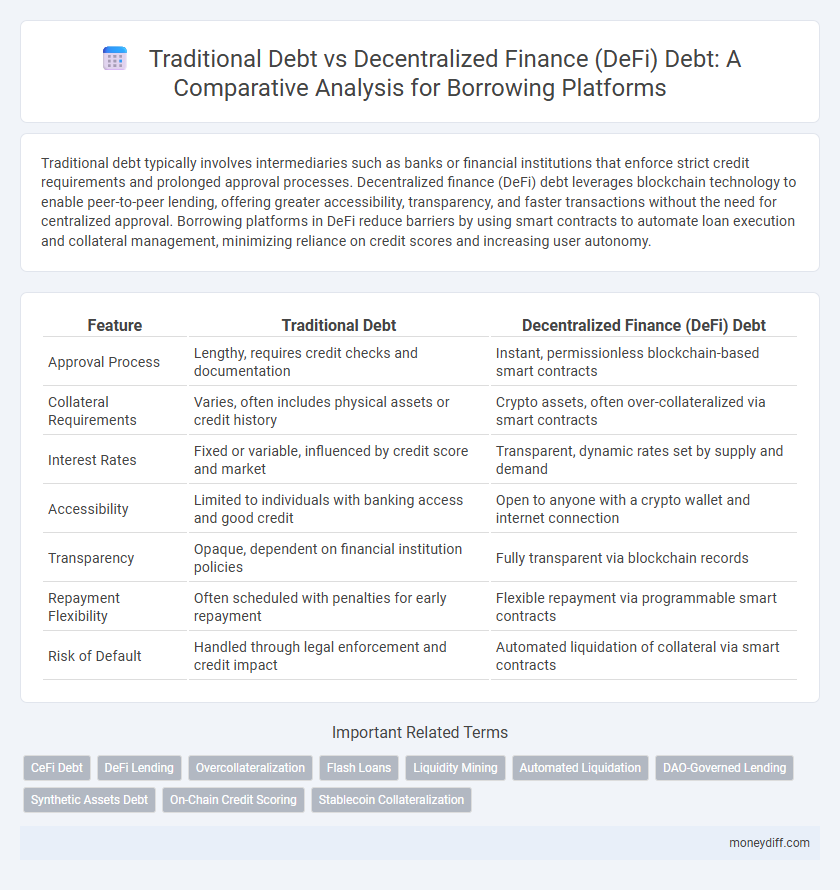

| Feature | Traditional Debt | Decentralized Finance (DeFi) Debt |

|---|---|---|

| Approval Process | Lengthy, requires credit checks and documentation | Instant, permissionless blockchain-based smart contracts |

| Collateral Requirements | Varies, often includes physical assets or credit history | Crypto assets, often over-collateralized via smart contracts |

| Interest Rates | Fixed or variable, influenced by credit score and market | Transparent, dynamic rates set by supply and demand |

| Accessibility | Limited to individuals with banking access and good credit | Open to anyone with a crypto wallet and internet connection |

| Transparency | Opaque, dependent on financial institution policies | Fully transparent via blockchain records |

| Repayment Flexibility | Often scheduled with penalties for early repayment | Flexible repayment via programmable smart contracts |

| Risk of Default | Handled through legal enforcement and credit impact | Automated liquidation of collateral via smart contracts |

Introduction: Understanding Borrowing in Traditional vs DeFi Platforms

Traditional debt borrowing relies on centralized institutions like banks to approve loans based on credit scores and financial history, often involving detailed paperwork and lengthy approval times. Decentralized finance (DeFi) platforms use blockchain technology to offer peer-to-peer lending without intermediaries, enabling faster access to funds through smart contracts and collateralization. DeFi borrowing enhances transparency and accessibility but requires users to understand digital asset management and the risks of volatile collateral.

Core Principles: How Traditional and DeFi Debt Systems Work

Traditional debt systems operate through centralized institutions such as banks and credit unions, where lenders assess borrower creditworthiness and enforce repayment schedules based on fixed interest rates and collateral requirements. Decentralized finance (DeFi) debt platforms leverage blockchain technology and smart contracts to enable peer-to-peer lending without intermediaries, using algorithmic risk assessment and over-collateralization to manage credit risk and automate loan issuance and repayment. Both systems aim to provide capital access but differ fundamentally in transparency, trust dependencies, and operational efficiency driven by their underlying technological infrastructures.

Accessibility and Entry Barriers: Comparing Borrower Requirements

Traditional debt platforms often require extensive credit history, collateral, and rigorous approval processes, limiting accessibility for many borrowers. Decentralized finance (DeFi) debt platforms reduce entry barriers by enabling permissionless borrowing without credit checks or intermediaries, utilizing smart contracts and collateral in cryptocurrency assets. This shift enhances financial inclusion by offering broader access to capital for users globally, regardless of their credit background.

Collateralization: Securing Loans in Traditional vs DeFi Environments

Traditional debt relies heavily on credit scores and collateral such as real estate or physical assets to secure loans, often involving lengthy approval processes with centralized intermediaries. DeFi debt platforms use blockchain technology to enable over-collateralization with digital assets like cryptocurrencies, ensuring transparency and instant loan issuance without centralized control. Collateralization in DeFi reduces counterparty risk through smart contracts, automating loan terms and liquidation triggers in a secure, immutable environment.

Interest Rates: Fixed, Variable, and Algorithmic Approaches

Traditional debt platforms typically offer fixed or variable interest rates determined by centralized financial institutions, reflecting creditworthiness and market conditions. Decentralized finance (DeFi) debt platforms utilize algorithmic interest rates that dynamically adjust based on supply and demand, liquidity, and borrower risk metrics encoded in smart contracts. Algorithmic approaches in DeFi enable real-time rate optimization, potentially lowering costs for borrowers compared to the more rigid traditional models.

Transparency and Trust: Middlemen vs Smart Contracts

Traditional debt borrowing platforms rely on middlemen such as banks or financial institutions, leading to less transparency due to opaque processes and potential conflicts of interest. Decentralized finance (DeFi) debt platforms use smart contracts that execute automatically and transparently on blockchain networks, allowing borrowers and lenders to verify terms and transactions in real-time. This reliance on trustless algorithms reduces the risk of manipulation and fosters greater trust by eliminating intermediaries and enhancing accountability.

Speed and Efficiency: Loan Approval and Disbursement Processes

Traditional debt platforms often involve lengthy loan approval times due to extensive credit checks and manual underwriting, resulting in slower disbursement processes. Decentralized finance (DeFi) debt leverages smart contracts and blockchain technology to automate approvals, enabling near-instant loan disbursement with reduced intermediary costs. The increased efficiency of DeFi borrowing platforms offers borrowers faster access to funds while maintaining transparent and secure transaction records.

Risk Factors: Default, Liquidation, and Security Concerns

Traditional debt platforms face risk factors like credit default due to borrower insolvency and legal enforcement challenges during liquidation, often relying on collateral appraisal and regulatory oversight for security. Decentralized finance (DeFi) debt introduces smart contract vulnerabilities, automatic liquidation triggered by price volatility, and the risk of platform hacks, while providing transparency and non-custodial asset management. Both systems entail different risk profiles where traditional debt depends on centralized credit assessments and legal frameworks, whereas DeFi leverages blockchain automation but requires robust cybersecurity measures to minimize default and liquidation risks.

Regulatory Oversight: Legal Protections and Compliance

Traditional debt platforms operate under strict regulatory oversight with established legal protections, ensuring borrower and lender rights through compliance with financial laws and centralized institutional governance. In contrast, decentralized finance (DeFi) borrowing platforms function without centralized regulatory bodies, relying on smart contracts for enforcement and often lacking comprehensive legal recourse for disputes or defaults. The absence of standardized compliance in DeFi introduces higher risk levels, as regulatory frameworks are still evolving to address consumer protection and fraud prevention in decentralized lending.

Choosing the Right Platform: Matching Debt Solutions to Borrower Needs

Traditional debt platforms typically rely on credit scores, collateral, and rigid approval processes, limiting access for many borrowers. Decentralized finance (DeFi) debt platforms offer permissionless access, transparent smart contracts, and flexible terms, attracting users seeking speed and inclusivity. Matching borrower needs with the appropriate platform requires assessing creditworthiness, risk tolerance, and desired borrowing conditions to optimize cost and convenience.

Related Important Terms

CeFi Debt

Traditional debt in borrowing platforms relies on centralized finance (CeFi) institutions that enforce credit checks, collateral requirements, and fixed interest rates, limiting accessibility for underbanked users. CeFi debt provides structured regulation and predictable repayment terms, contrasting with decentralized finance (DeFi) debt's permissionless, transparent protocols that offer greater flexibility and lower entry barriers but higher systemic risk.

DeFi Lending

Traditional debt relies on centralized institutions like banks that impose strict credit checks, collateral requirements, and lengthy approval processes, limiting accessibility and transparency for borrowers. DeFi lending platforms leverage blockchain technology to offer decentralized, permissionless loans with automated smart contracts, reduced intermediaries, and greater liquidity, enabling faster, borderless borrowing with programmable terms and enhanced transparency.

Overcollateralization

Traditional debt platforms require borrowers to provide overcollateralization, often exceeding 150% of the loan value, to mitigate lender risk and ensure loan repayment. In contrast, decentralized finance (DeFi) borrowing platforms utilize smart contracts for automatic overcollateralization, enforcing real-time collateral liquidation when asset values drop below predefined thresholds, enhancing security and transparency.

Flash Loans

Traditional debt relies on intermediaries such as banks to approve loans based on credit history and collateral, whereas decentralized finance (DeFi) platforms enable instant, permissionless borrowing through mechanisms like flash loans that require no collateral but must be repaid within one transaction block. Flash loans leverage smart contracts on blockchain networks to provide uncollateralized liquidity for arbitrage, refinancing, or liquidation without credit risk, revolutionizing access to capital compared to conventional debt instruments.

Liquidity Mining

Traditional debt platforms rely on centralized institutions to provide liquidity, often resulting in slower access and higher collateral requirements, whereas decentralized finance (DeFi) debt leverages liquidity mining to incentivize users with token rewards, enhancing capital availability and reducing borrowing costs. Liquidity mining programs in DeFi create dynamic markets where users supply assets to liquidity pools, increasing borrowing efficiency and fostering greater financial inclusion without intermediary constraints.

Automated Liquidation

Traditional debt platforms rely on manual foreclosure processes that are often slow and costly, while decentralized finance (DeFi) debt utilizes automated liquidation mechanisms triggered by smart contracts to instantly sell collateral when loan-to-value ratios fall below predefined thresholds. This automation reduces default risks, enhances transparency, and maintains liquidity, fundamentally transforming borrowing efficiency and asset recovery in DeFi ecosystems.

DAO-Governed Lending

DAO-governed lending platforms leverage decentralized finance (DeFi) protocols to offer transparent, permissionless borrowing options with reduced intermediaries and programmable smart contracts. Traditional debt models rely on centralized institutions, rigid credit checks, and slower approval processes, while DAO-based lending enhances collateral management and community-driven risk assessment through decentralized governance mechanisms.

Synthetic Assets Debt

Synthetic assets debt in decentralized finance platforms offers programmable, transparent, and borderless borrowing solutions compared to traditional debt, which relies on centralized intermediaries and often faces regulatory constraints and slower settlement times. The creation and management of synthetic assets on blockchain enable more efficient collateralization and real-time liquidity, reducing counterparty risk inherent in conventional debt markets.

On-Chain Credit Scoring

Traditional debt relies heavily on centralized credit bureaus and historical financial data, limiting access and inclusivity for many borrowers. On-chain credit scoring in decentralized finance debt leverages transparent blockchain transaction history and smart contract automation to provide real-time, permissionless credit assessments, enhancing borrowing accessibility and efficiency on DeFi platforms.

Stablecoin Collateralization

Traditional debt relies on credit scores and centralized approval processes, often requiring substantial collateral and lengthy approval times, whereas decentralized finance (DeFi) debt uses stablecoin collateralization to enable instant, permissionless borrowing without intermediaries. Stablecoin collateral in DeFi platforms minimizes volatility risks and increases liquidity, enhancing transparency and accessibility compared to conventional loans secured by physical assets or fiat currency.

Traditional debt vs decentralized finance debt for borrowing platforms. Infographic

moneydiff.com

moneydiff.com