The debt snowball method prioritizes paying off the smallest debts first to build momentum and motivation, while the debt avalanche focuses on tackling debts with the highest interest rates to minimize overall cost. Choosing between these repayment strategies depends on whether you value psychological motivation or financial efficiency. Both methods require consistent payments and discipline to achieve debt freedom effectively.

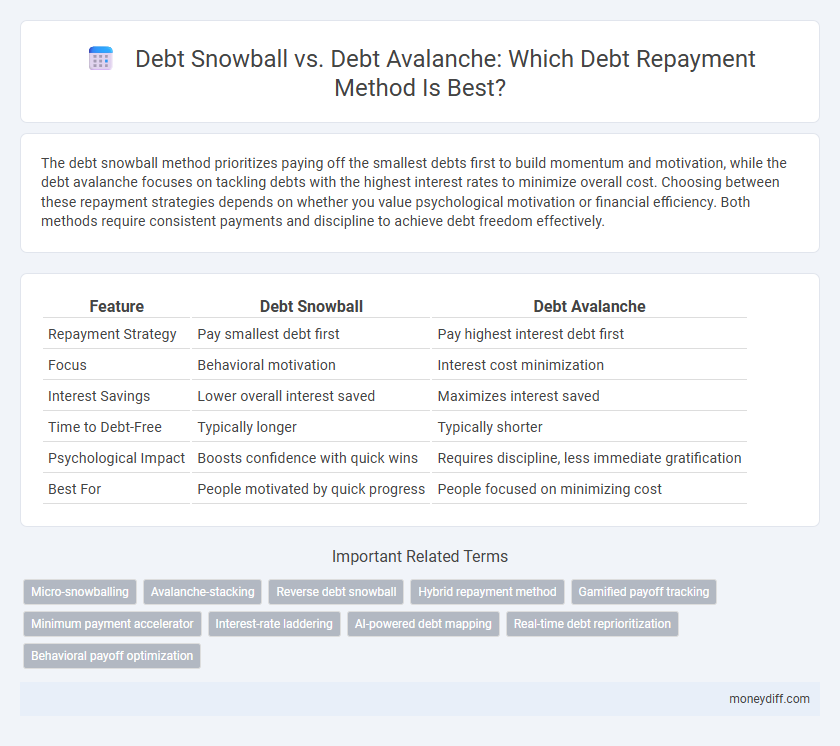

Table of Comparison

| Feature | Debt Snowball | Debt Avalanche |

|---|---|---|

| Repayment Strategy | Pay smallest debt first | Pay highest interest debt first |

| Focus | Behavioral motivation | Interest cost minimization |

| Interest Savings | Lower overall interest saved | Maximizes interest saved |

| Time to Debt-Free | Typically longer | Typically shorter |

| Psychological Impact | Boosts confidence with quick wins | Requires discipline, less immediate gratification |

| Best For | People motivated by quick progress | People focused on minimizing cost |

Understanding the Debt Snowball Method

The Debt Snowball Method prioritizes repaying the smallest debts first, creating quick wins that boost motivation and maintain consistent momentum toward financial freedom. By targeting smaller balances, this strategy encourages steady progress and reduces the psychological burden of debt. While it may not minimize total interest paid compared to other methods, it effectively builds discipline and confidence for long-term debt elimination.

What is the Debt Avalanche Approach?

The Debt Avalanche approach prioritizes paying off debts with the highest interest rates first, which minimizes overall interest payments and reduces repayment time. By targeting high-cost debts, this method accelerates savings on interest compared to other strategies. It is especially effective for borrowers aiming to save money and become debt-free faster.

Key Differences Between Snowball and Avalanche

The Debt Snowball method prioritizes paying off the smallest debts first to build motivation, whereas the Debt Avalanche targets debts with the highest interest rates to minimize overall interest paid. Snowball offers psychological benefits by providing quick wins, while Avalanche is financially more efficient for long-term savings. Choosing between them depends on whether the focus is on motivation or interest cost reduction.

Pros and Cons of Debt Snowball

The debt snowball method prioritizes paying off the smallest debts first, which provides quick psychological wins and increased motivation to continue repayment. Its main drawback is potentially higher interest costs over time, as larger debts with higher rates remain unpaid longer. This approach suits individuals needing momentum and confidence boosts, despite possibly not being the most cost-effective strategy compared to the debt avalanche method.

Advantages and Disadvantages of Debt Avalanche

Debt avalanche accelerates debt repayment by targeting high-interest debts first, minimizing total interest paid and reducing repayment time significantly. This method requires strong discipline, as lower-interest debts remain unpaid longer, which can be demotivating for some individuals. While it is cost-efficient, its complexity and delayed psychological rewards may lead to lower adherence compared to simpler methods like the debt snowball.

Which Method Saves More on Interest?

The debt avalanche method saves more money on interest compared to the debt snowball by prioritizing payments on debts with the highest interest rates first. This approach reduces the total interest accrued over time, leading to faster overall debt repayment. While the debt snowball method boosts motivation through quick wins, the avalanche method is more cost-effective for minimizing interest payments.

Psychological Benefits of Each Repayment Strategy

Debt snowball repayment offers psychological benefits by creating quick wins through paying off smaller debts first, boosting motivation and confidence. Debt avalanche focuses on minimizing interest costs, providing satisfaction from saving money and accelerating overall repayment. Both methods enhance debt management mindset by catering to different emotional drivers--momentum for snowball and financial efficiency for avalanche.

Who Should Choose Debt Snowball?

Individuals with low motivation or those who benefit from quick wins should choose the debt snowball method for repayment. This strategy prioritizes paying off the smallest debts first, creating a sense of progress and boosting confidence. People struggling with impulse control or needing emotional reinforcement find the debt snowball approach more effective than the debt avalanche method.

Who Benefits Most from Debt Avalanche?

The debt avalanche method benefits individuals with high-interest debts by prioritizing repayments on those balances first, minimizing overall interest payments and shortening the repayment timeline. People with multiple high-interest credit cards or loans find this method most effective, as it targets costly debts more aggressively than the debt snowball approach. Those committed to long-term savings and reducing total debt cost typically gain the greatest financial advantage from the debt avalanche strategy.

Making the Best Choice for Your Debt Repayment

Choosing between the Debt Snowball and Debt Avalanche methods depends on your financial goals and psychological preferences; the Debt Snowball focuses on paying off the smallest debts first to build momentum, while the Debt Avalanche targets high-interest debts to minimize overall interest paid. Assess your debt portfolio, interest rates, and motivation levels to decide which strategy aligns best with your repayment capacity and long-term financial health. Optimizing repayment methods by balancing immediate wins with interest cost savings can accelerate debt freedom efficiently.

Related Important Terms

Micro-snowballing

Micro-snowballing accelerates debt repayment by targeting small outstanding balances first, creating psychological wins that increase motivation and cash flow for larger debts, aligning with the behavioral benefits emphasized in the debt snowball method. This strategy contrasts with the debt avalanche approach, which prioritizes high-interest debts to minimize overall interest but may delay emotional satisfaction gained from quick payoff milestones.

Avalanche-stacking

The Debt Avalanche method prioritizes paying off debts with the highest interest rates first, minimizing total interest paid and accelerating debt freedom. Stacking payments by allocating extra funds to the highest-interest debt maximizes savings and shortens repayment duration compared to the Debt Snowball approach.

Reverse debt snowball

The reverse debt snowball repayment method focuses on paying off larger debts first to reduce overall interest costs faster, contrasting with the traditional debt snowball that targets smaller balances initially. This approach accelerates total debt reduction by prioritizing high-interest accounts, optimizing financial efficiency and minimizing the total repayment period.

Hybrid repayment method

The hybrid repayment method combines the key strategies of the debt snowball and debt avalanche approaches, targeting smaller balances first to build momentum while prioritizing high-interest debts to minimize overall interest costs. This balanced technique accelerates debt elimination by boosting motivation through quick wins and simultaneously reducing the total repayment amount through interest optimization.

Gamified payoff tracking

Debt snowball emphasizes rapid motivation by paying off smaller debts first, while debt avalanche targets minimizing interest by attacking high-interest balances; gamified payoff tracking enhances engagement and accountability through progress visualization, rewards, and interactive challenges tailored to each method's strategy. Integrating game mechanics like leaderboards, badges, and milestone celebrations can boost user commitment and accelerate debt repayment regardless of the chosen approach.

Minimum payment accelerator

The Debt Snowball method prioritizes paying off the smallest debts first to accelerate minimum payment reductions and build momentum, while the Debt Avalanche targets high-interest debts to minimize total interest paid. Leveraging minimum payment accelerators in the Debt Snowball approach rapidly frees up cash flow by eliminating smaller balances, enabling faster overall debt repayment.

Interest-rate laddering

Debt snowball targets smallest balances first to build momentum, while debt avalanche prioritizes highest interest rates, minimizing total interest paid. Interest-rate laddering in the avalanche method accelerates debt reduction by focusing payments on high-interest debts, optimizing financial efficiency.

AI-powered debt mapping

AI-powered debt mapping enhances both Debt Snowball and Debt Avalanche methods by analyzing individual spending patterns, interest rates, and payment behavior to recommend the most efficient repayment strategy. This technology enables dynamic prioritization of debts, accelerating payoff timelines and minimizing total interest paid by tailoring the sequence of repayments to personalized financial data.

Real-time debt reprioritization

Debt snowball prioritizes smaller balances first to accelerate psychological wins, while debt avalanche targets highest interest debts to minimize total interest paid. Real-time debt reprioritization enables dynamic adjustment of payment strategies, shifting focus based on evolving balances and interest rates for optimized repayment efficiency.

Behavioral payoff optimization

The debt snowball method accelerates behavioral payoff by prioritizing smaller debts first, creating quick wins that boost motivation and commitment to repayment. In contrast, the debt avalanche targets higher-interest debts to minimize total interest paid, but may delay psychological rewards, impacting adherence for some borrowers.

Debt snowball vs Debt avalanche for repayment method Infographic

moneydiff.com

moneydiff.com