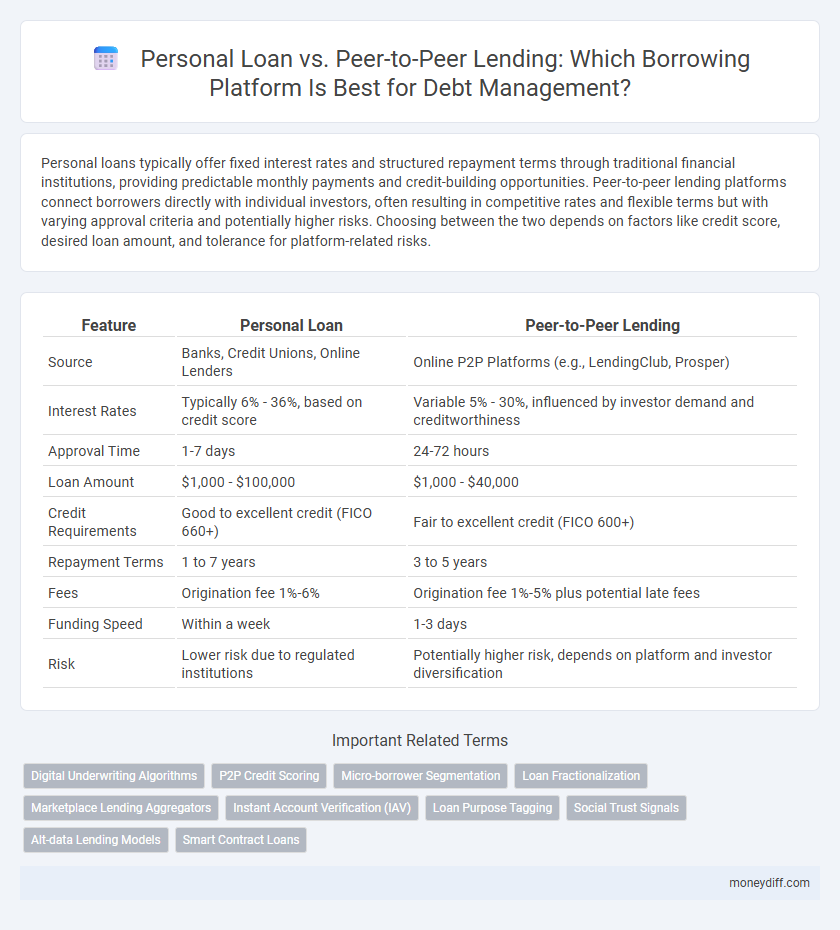

Personal loans typically offer fixed interest rates and structured repayment terms through traditional financial institutions, providing predictable monthly payments and credit-building opportunities. Peer-to-peer lending platforms connect borrowers directly with individual investors, often resulting in competitive rates and flexible terms but with varying approval criteria and potentially higher risks. Choosing between the two depends on factors like credit score, desired loan amount, and tolerance for platform-related risks.

Table of Comparison

| Feature | Personal Loan | Peer-to-Peer Lending |

|---|---|---|

| Source | Banks, Credit Unions, Online Lenders | Online P2P Platforms (e.g., LendingClub, Prosper) |

| Interest Rates | Typically 6% - 36%, based on credit score | Variable 5% - 30%, influenced by investor demand and creditworthiness |

| Approval Time | 1-7 days | 24-72 hours |

| Loan Amount | $1,000 - $100,000 | $1,000 - $40,000 |

| Credit Requirements | Good to excellent credit (FICO 660+) | Fair to excellent credit (FICO 600+) |

| Repayment Terms | 1 to 7 years | 3 to 5 years |

| Fees | Origination fee 1%-6% | Origination fee 1%-5% plus potential late fees |

| Funding Speed | Within a week | 1-3 days |

| Risk | Lower risk due to regulated institutions | Potentially higher risk, depends on platform and investor diversification |

Understanding Personal Loans: Traditional Borrowing Explained

Personal loans are unsecured loans offered by banks and credit unions, typically featuring fixed interest rates and repayment terms ranging from one to seven years. Borrowers undergo credit evaluation to determine eligibility and interest rates, making personal loans suitable for individuals with established credit histories seeking predictable repayment plans. Unlike peer-to-peer lending platforms that connect borrowers directly with investors, personal loans involve a financial institution acting as the intermediary, ensuring regulated lending processes and consumer protections.

What is Peer-to-Peer (P2P) Lending?

Peer-to-peer (P2P) lending is an online platform that connects individual borrowers directly with investors, bypassing traditional banks to offer potentially lower interest rates and faster approval processes. This decentralized lending model uses technology to match loan requests with available funds, allowing borrowers to access personal loans without stringent banking requirements. P2P lending platforms often provide transparent terms and flexible repayment options, making them an attractive alternative to conventional personal loan products.

Eligibility Requirements: Personal Loans vs P2P Lending

Personal loans typically require a strong credit score, stable income, and proof of employment, making them accessible primarily to borrowers with established financial histories. Peer-to-peer lending platforms often have more flexible eligibility criteria, allowing borrowers with lower credit scores or limited credit history to secure loans through investor funding. While personal loans are issued by traditional banks and credit unions with stringent underwriting, P2P lending leverages technology to assess risk more dynamically, expanding access to diverse borrower profiles.

Interest Rates Comparison: Personal Loan vs P2P Lending

Personal loans typically offer fixed interest rates ranging from 6% to 36%, depending on credit score and lender policies, providing predictable repayment schedules. Peer-to-peer (P2P) lending platforms often have variable interest rates averaging between 5% and 30%, influenced by individual borrower risk profiles and market demand. Comparing interest rates, P2P lending can be more cost-effective for borrowers with strong credit, while personal loans may provide greater stability and regulatory protections.

Application and Approval Process Differences

Personal loans from traditional banks typically require a detailed application, credit checks, and a longer approval timeline, often several days to weeks. Peer-to-peer lending platforms offer a faster, more streamlined online application process with approval driven by investor interest and less stringent credit requirements. These differences highlight how peer-to-peer lending can provide quicker access to funds, while personal loans offer potentially lower interest rates based on creditworthiness.

Flexibility and Loan Terms: Which Option Is Better?

Personal loans typically offer fixed interest rates and structured repayment schedules, providing predictable monthly payments over a set term, which appeals to borrowers seeking stability and clear timelines. Peer-to-peer (P2P) lending platforms often provide more flexible loan terms, including variable interest rates and customized repayment plans tailored by individual lenders, enabling borrowers to negotiate terms that fit their specific financial situations. For those prioritizing guaranteed repayment amounts and lower risk, personal loans are preferable, whereas borrowers valuing adaptable conditions and potential cost savings might benefit from the dynamic nature of P2P lending.

Risks and Consumer Protections in Borrowing Platforms

Personal loans from traditional lenders typically offer stronger consumer protections regulated by federal laws, including clear disclosures and dispute resolution mechanisms, while peer-to-peer lending platforms may expose borrowers to higher default risks and less regulatory oversight. Peer-to-peer loans often come with variable interest rates and limited recourse in cases of fraud or mismanagement, increasing potential financial vulnerability. Evaluating the risk profile and understanding platform-specific protections are crucial for informed borrowing decisions.

Fees and Charges: Hidden Costs in Personal Loans vs P2P Lending

Personal loans often come with hidden fees such as origination charges, prepayment penalties, and high late payment fees that can significantly increase the total borrowing cost. Peer-to-peer lending platforms generally offer more transparent fee structures, typically including a flat origination fee and lower interest rates due to direct borrower-lender connections. Understanding these fees and charges is crucial for borrowers to compare the true cost of financing and avoid unexpected expenses in personal loans versus P2P lending.

Impact on Credit Score: How Each Platform Affects Borrowers

Personal loans typically involve traditional lenders who report borrowers' payment history to major credit bureaus, positively impacting credit scores when payments are made on time. Peer-to-peer lending platforms may also report to credit agencies, but this varies by lender, causing inconsistent effects on a borrower's credit profile. Both types of borrowing require timely repayments to maintain or improve credit scores, while missed payments can significantly damage creditworthiness.

Which Borrowing Platform Is Right for You?

Personal loans offer fixed interest rates and repayment terms typically from banks or credit unions, providing predictable monthly payments and often requiring a strong credit score. Peer-to-peer lending platforms connect borrowers directly with individual investors, potentially offering lower rates and more flexible credit requirements but with variable approval standards. Evaluating your credit profile, desired loan amount, and repayment flexibility helps determine whether a traditional personal loan or peer-to-peer lending better suits your borrowing needs.

Related Important Terms

Digital Underwriting Algorithms

Personal loan platforms utilize advanced digital underwriting algorithms to analyze credit scores, income stability, and debt-to-income ratios, enabling faster and more accurate risk assessments. Peer-to-peer lending platforms leverage these algorithms alongside social data and alternative credit metrics to match borrowers with individual investors, often offering more flexible qualifying criteria and interest rates.

P2P Credit Scoring

Peer-to-peer lending platforms utilize advanced credit scoring algorithms that analyze diverse data points beyond traditional credit scores, enabling more accurate risk assessment and often offering lower interest rates compared to personal loans from banks. This innovative P2P credit scoring enhances borrower accessibility while providing lenders with tailored risk profiles, improving overall loan performance and reducing default rates.

Micro-borrower Segmentation

Personal loans from traditional financial institutions typically offer fixed interest rates and established credit evaluation, benefiting creditworthy micro-borrowers seeking predictable repayment terms. Peer-to-peer lending platforms provide flexible borrowing options with varying interest rates, appealing to underserved micro-borrowers lacking access to conventional credit but willing to engage in community-based lending environments.

Loan Fractionalization

Personal loans offer fixed amounts from traditional lenders, whereas peer-to-peer lending platforms utilize loan fractionalization, allowing multiple investors to fund portions of a single loan, reducing risk exposure and increasing access to capital. Loan fractionalization enhances liquidity and diversification for investors while providing borrowers with potentially lower interest rates due to competitive funding sources.

Marketplace Lending Aggregators

Marketplace Lending Aggregators streamline access to both personal loans and peer-to-peer lending by comparing multiple borrowing platforms in real-time, enabling borrowers to find competitive rates and flexible terms tailored to their credit profiles. These aggregators leverage data-driven algorithms to match users with optimal loan options, enhancing transparency and efficiency in the digital lending ecosystem.

Instant Account Verification (IAV)

Personal loans typically require traditional bank credit checks, while peer-to-peer lending platforms leverage Instant Account Verification (IAV) to expedite borrower identity and asset verification, reducing approval times significantly. IAV technology enhances security and accuracy by directly accessing bank account data, enabling faster fund disbursement compared to conventional loan processing methods.

Loan Purpose Tagging

Loan purpose tagging in personal loans enables precise categorization for credit risk assessment and tailored interest rates, while peer-to-peer lending platforms utilize loan purpose data to match borrowers with investors aligned to specific funding categories, enhancing transparency and trust. Both methods improve the borrower experience by streamlining application processes and enabling better loan performance monitoring through semantic analysis of loan intent.

Social Trust Signals

Peer-to-peer lending platforms leverage social trust signals such as borrower ratings, verified profiles, and community endorsements to enhance transparency and reduce default risk compared to traditional personal loans. These social trust mechanisms foster accountability and provide lenders with real-time feedback, improving the overall borrowing experience and trustworthiness of the platform.

Alt-data Lending Models

Personal loan platforms traditionally rely on credit scores and income verification, while peer-to-peer lending incorporates alternative data such as social behavior, employment patterns, and transaction history to assess borrower creditworthiness. Alt-data lending models enhance risk assessment accuracy and expand access to credit for individuals with limited credit histories through decentralized peer funding mechanisms.

Smart Contract Loans

Personal loan platforms typically rely on traditional credit evaluations and fixed interest rates, while peer-to-peer lending with smart contract loans uses blockchain technology to automate lending agreements, reduce intermediaries, and enhance transparency. Smart contracts enable secure, programmable loans that execute repayments and collateral management automatically, optimizing efficiency and lowering default risks in peer-to-peer borrowing.

Personal loan vs Peer-to-peer lending for borrowing platforms Infographic

moneydiff.com

moneydiff.com